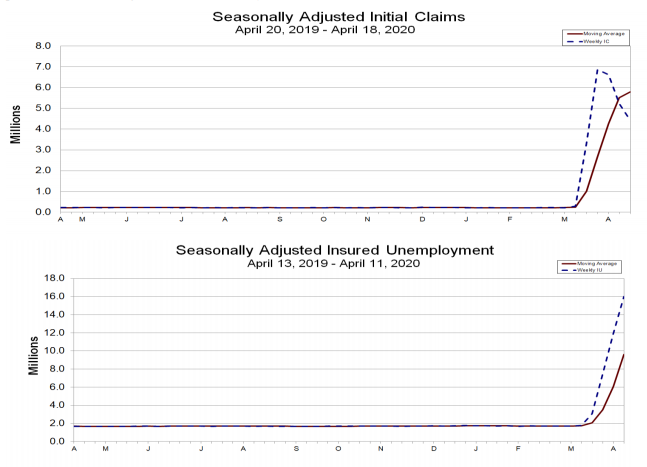

The Department of Labor reported that 4.4 million Americans filed for unemployment insurance benefits in the week ending April 18, 2020 as the COVID-19 pandemic continues to cause businesses to lay off or temporarily furlough workers due to lock down across much of the country. This was a decline of 810,000 from the previous week’s upwardly revised level of 5.2 million. The speed and scale of the job losses is unprecedented. In the past five weeks, more than 26 million people have filed claims. By comparison, 9 million jobs were lost over the course of the 2007-2009 recession.

Continuing claims for regular benefits, which are reported with an extra week’s lag, rose 4.0 million to 16 million. This marks an all-time high in the data series. This measure, which accounts for people who are continuing to receive benefits, will keep climbing as jobs continue to disappear. This has also pushed the insured unemployment rate (the share of the labor force that claims unemployment benefits) higher. The insured unemployment rate was 11.0% in the week ending April 11, an increase of 2.8 percentage points from the prior week and up from 1.2% pre-COVID-19. This marks the highest level of the rate in the history of the data series.

Jobless claims are laid-off workers’ applications for unemployment insurance payments. Gig-economy workers, self-employed people and those seeking part-time work are now eligible to apply for benefits in an expanded unemployment assistance program recently created in response to the pandemic. Further, as of last Monday, more than 40 states were paying recipients an additional $600 a week in enhanced unemployment benefits on top of the usual payments.

The largest increases in initial claims for the week ending April 11 were in Colorado, New York, Missouri, Florida and North Carolina.

This week’s increase in unemployment claims marks the fifth consecutive week of surging jobless claims and indicates just how quickly and sharply the economy has collapsed. An 11-percentage point jump in the official BLS jobless rate to as much as 15% to 20% by April is likely and could exceed 20% in May, according to Capital Economics. This would be the highest rate since the 1930s. As recently as February, the unemployment rate was at a 50-year low of 3.5%. In March, the rate had already increased to 4.4%.

In response to the coronavirus crisis, the Federal Reserve has pushed interest rates to zero and enacted nine new lending programs in recent weeks. These include open-ended asset purchases of $1.2 trillion of Treasury securities in just four weeks and the announcement of a series of new lending facilities aimed at households and non-financial businesses, worth up to $2.3 trillion. The FOMC meets next week and may announce further plans to buy more Treasury securities and create new or expand existing loan programs. The Fed’s actions in recent weeks are unprecedented and indicate how troubled the economy is indeed.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace