The NIC MAP® Data Service recently released national monthly data through June 2019 for actual rates and leasing velocity. The NIC Actual Rates initiative is driven by the need to continually increase transparency in the seniors housing sector and achieve greater parity to data that is available in other real estate asset types. Having access to accurate data on the monthly rates that a seniors housing resident pays as compared to asking rates helps NIC achieve this goal.

Key takeaways from the 2Q2019 Seniors Housing Actual Rates Report include:

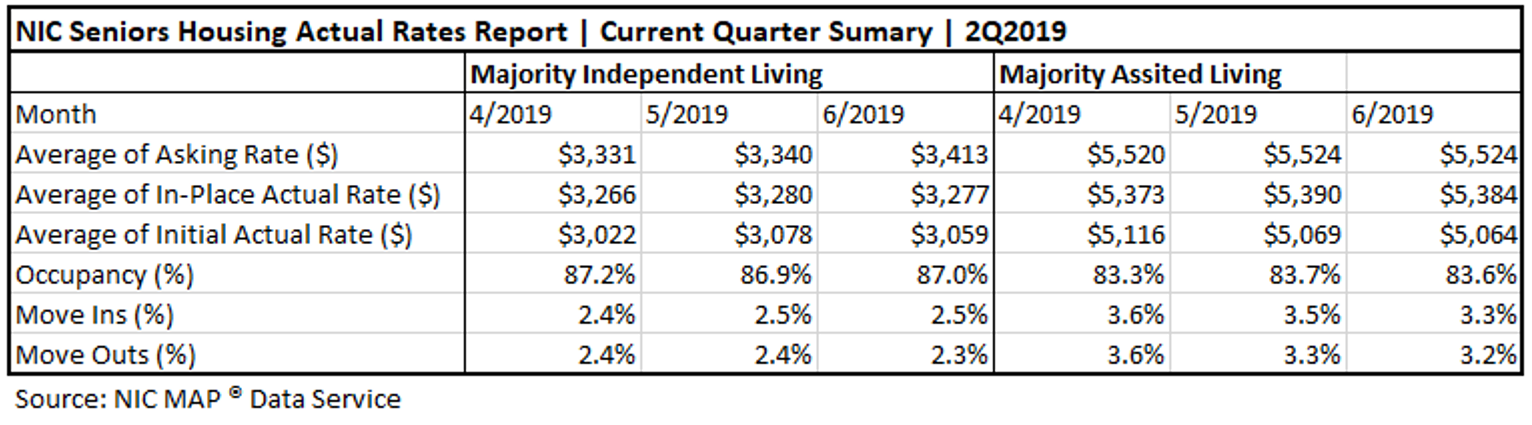

- Average initial rates for residents moving in were below average asking rates for both majority independent living and majority assisted living properties, with monthly spreads generally larger for majority assisted living properties dating back to April 2015.

- As of June 2019, initial rates for majority assisted living properties averaged 8.3% below their average asking rate, which equates to an average initial rate discount of 1.0 months on an annualized basis, the same as in May and back to the December discount.

- The average discount for majority independent living properties was larger at the equivalent of 1.2 months, which was as high as it has been since NIC began reporting the data in April 2015. This was also notable because the discount has been smaller for independent living than assisted living for nearly the entire time series that began in April 2015. The larger independent living discount began in January 2019.

- Average asking rates for majority independent living properties have exceeded in-place rates since May 2018 and the gap between these rates reached a new high in June 2019 of 4.2% or $136.

- For majority assisted living properties, average asking rates have consistently exceeded average in-place rates.

- In June, the average majority independent living asking rate was 4.9% above its year-earlier level, more than in June 2018 (3.2%), but less than in December 2018 (5.8%). The annual pace of growth for majority independent living in-place rates was less at 1.4% from year-earlier levels, while initial rates fell 1.0% from year-earlier levels, marking the first decline since April 2018.

- For majority assisted living properties, annual growth was strongest for initial rates as of June 2019, at 3.6%. This compares with 3.1% for in-place rates and 2.7% for asking rates.

- The rate of move-ins has exceeded the rate of move-outs for five of the past twelve months for both majority assisted living and majority independent living.

This Seniors Housing Actual Rates Report provides aggregate national data from approximately 300,000 units within more than 2,500 properties across the U.S. operated by 25 to 30 seniors housing providers. Note that this monthly time series is comprised of end-of-month data for each respective month. The operators included in the current sample tend to be larger, professionally managed, and investment-grade operators as we currently require participating operators to manage 5 or more properties.

While these trends are certainly interesting aggregated across the states, actual rate data will be even more useful when it is available at the CBSA level. As NIC continues to work towards growing the sample size to be large enough to release data at the CBSA level, partnering with leading software providers like Yardi and MatrixCare makes it easier for operators to contribute data to the Actual Rates initiative. NIC appreciates our partnerships with software providers and our data contributors and their work in achieving standardized data reporting.

If you are an operator or a software provider interested in how you can contribute to the Actual Rates initiative, please contact Brian Connolly at bconnolly@nic.org.

About NIC

The National Investment Center for Seniors Housing & Care (NIC) is a nonprofit 501(c)(3) organization whose mission is to support access and choice for America’s seniors by providing data, analytics, and connections that bring together investors and providers.

Connect with NIC

Read More by NIC