The NIC MAP® Data Service recently released national monthly data through September 2020 for actual rates and leasing velocity. In this release, NIC also provided data on three metropolitan areas for which there is enough data to report: Atlanta, Philadelphia, and Phoenix.

U.S. National Trends—Memory Care Segment—3Q20

A few of the key takeaways from the 3Q2020 Seniors Housing Actual Rates Report are listed below. Full access to the reports and other takeaways is available to NIC MAP® Data Service clients.

-

- Average initial rates for residents moving into independent living, assisted living and memory care segments were below average asking rates, with monthly spreads generally largest for memory care. Care segments refer to the levels of care and services provided to a resident living in an assisted living, memory care or independent living unit.

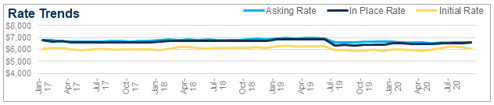

- The average discount for the memory care segment was the largest of the three care segments in September 2020 and averaged 8.4% below average asking rates. This equates to an average initial rate discount of 1.0 month on an annualized basis, more than in June, July, or August, but less than in September 2019 (1.2 months).

- For the assisted living segment, average in-place rates were consistently below average asking rates since reporting began in January 2017. However, the monthly gap between these two rates is shrinking and was only 0.4% or $18 in September 2020. One year ago, it was 3.4% or $170.

-

- The rate of move-outs has exceeded or equaled the rate of move-ins for each of the prior twelve months for both the independent living and assisted living segments, and for seven of the last twelve months for the memory care segment as of September 2020. The difference between the pace of move-outs and move-ins was widest in the immediate aftermath of the pandemic in the March, April, and May period.

- There was monthly variation in initial rate discounts by geography and care segment during the third quarter of 2020. Of the three metropolitan markets currently being reported by the NIC MAP® Data Service (Atlanta, Philadelphia, and Phoenix), Philadelphia’s independent living segment had the largest discount in initial rates relative to asking rates, with a discount equivalent to 2.4 months at an annualized basis in September 2020.

- Atlanta’s assisted living segment had a large initial rates discount relative to asking rates at 1.9 months (annualized) in September 2020. In contrast, Phoenix had no discount and Philadelphia offered 0.5-month discount. This compares with 0.7 month for the assisted living segment at the national level.

The NIC Actual Rates Initiative is driven by the need to continually increase transparency in the seniors housing sector and achieve greater parity to data that is available in other real estate asset types. Now, more than ever, in the world of the COVID-19 pandemic, having access to accurate data on the actual monthly rates that a seniors housing resident pays as compared to property level asking rates helps NIC achieve this goal.

The Seniors Housing Actual Rates Report available in NIC MAP provides aggregate national data from approximately 300,000 units within more than 2,500 properties across the U.S. operated by 25 to 30 seniors housing providers. The operators included in the current sample tend to be larger, professionally managed, and investment-grade operators as we currently require participating operators to manage 5 or more properties. Note that this monthly time series is comprised of end-of-month data for each respective month.

Note that the data reported here is on care segment, where care segment type refers to each part or section of a property that provides a specific level of service, i.e., independent living, assisted living or memory care. NIC also has this data for majority property type, where majority property type refers to which care segment comprises the largest share of inventory. In addition, care segment actual rates data is also available for the Atlanta, Phoenix and Philadelphia CBSAs.

While these trends are certainly interesting aggregated across the states, actual rate data is even more useful at the CBSA level. As NIC continues to work toward growing the sample size to be large enough to release more data at the CBSA level, partnering with leading software providers like Yardi, PointClickCare, Alis, and MatrixCare makes it easier for operators to contribute data to the Actual Rates Initiative. NIC appreciates our partnerships with software providers and our data contributors and their work in achieving standardized data reporting.

If you are an operator or a software provider interested in how you can contribute to the Actual Rates Initiative, please visit nic.org/actual-rates.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace