This blog features the NIC Analytics Demand Pulse Metric (DPM) for third quarter 2021 (3Q2021), a measure that examines senior housing demand (occupied units) for the NIC MAP® 31 Primary Markets and provides a window into the strength of a market based on occupied stock trends. The demand pulse metric pinpoints when 3Q2021 demand levels were last seen before the pandemic began to influence the senior housing sector in 1Q2020 and tracks demand growth and progress across the 31 Primary Markets.

Aggregate Market Demand Pulse

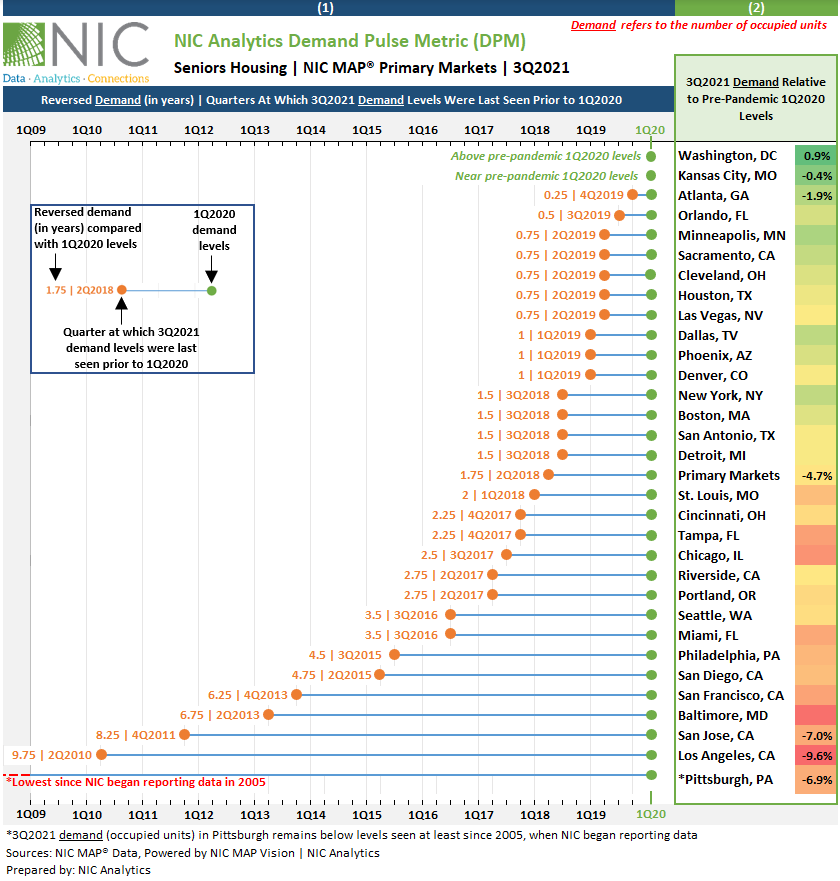

Third quarter 2021 NIC MAP® data, powered by NIC MAP Vision, showed the largest improvement in demand in a single quarter since NIC MAP® began to report the data in 2005. For the 31 Primary Markets, 12,318 units were absorbed on a net basis, a 2.3% increase from the prior quarter. This pushed occupied units back to their 2Q2018 level. Said another way, it was 1.75 years (7 quarters) ago – counting back from pre-pandemic 1Q2020 levels - that occupied units equaled the level achieved in 3Q2021. Prior to the 3Q2021 jump in net absorption, occupied units had only recovered to their 2Q2017 levels (2.75 years or 11 quarters, counting back from pre-pandemic 1Q2020 levels). And while a very welcomed improvement, 3Q2021 occupied stock was still 4.7% below pre-pandemic 1Q2020 levels.

The DPM Exhibit below provides a visual of these metrics for the Primary Markets as well as the individual metropolitan markets that comprise the aggregate measure.

Market-Specific Demand Pulse

Based on the positive momentum in net absorption patterns in 3Q2021, the level of occupied units in both Washington, D.C. and Kansas City had returned to 1Q2020 pre-pandemic levels. In fact, the level of occupied units in Washington exceeded pre-pandemic levels by 0.9%, while demand in Kansas City was near 1Q2020 levels and fell short by only 55 units, equivalent to a gap of merely 0.4% compared with 1Q2020 levels.

There were 10 markets where occupied units in 3Q2021 were at levels seen as recently as one year ago or less compared with 1Q2020 levels. This includes Atlanta (3Q2021 demand was the same as in 4Q2019 and remains 1.9% below 1Q2020 levels), Orlando (same as 3Q2019); Minneapolis, Sacramento, Cleveland, Houston and Las Vegas (same as 2Q2019); Dallas, Phoenix and Denver (same as 1Q2019).

Despite the recent improvements in demand across all the 31 Primary Markets, the level of occupied units in 3Q 2021 remains far below 1Q2020 levels. This is the case for Pittsburgh, where the number of occupied units remains below levels reported since at least 2005, when NIC began reporting data. Similarly, the number of occupied units in Los Angeles remains below 1Q2020 levels by almost 10 years and is now at levels seen in 2Q2010, and San Jose remains eight years below 1Q2020 levels and is now at levels seen in 4Q2011. Notably, 3Q2021 demand relative to 1Q2020 levels in Los Angeles stood at negative 9.6%, while 3Q2021 demand in San Jose and Pittsburgh remains 7.0% and 6.9% below 1Q2020 levels, respectively.

This analysis suggests that factors that influence demand are stronger in some markets than in others and that there will be some markets that will return to pre-pandemic demand levels sooner while others will take longer. Separately, and not surprisingly, a recent analysis by NIC Analytics looked at the share of same-store properties within individual metropolitan markets that had reached their pre-pandemic occupied unit levels and found that the demand recovery paths and timelines for properties also varied significantly. Hence as property performance goes, so goes broader metropolitan area performance.

In summary, positive senior housing demand momentum was evident in both the 2Q2021 and 3Q2021 NIC MAP® data after four consecutive quarters of pandemic-related weak demand. The upcoming 4Q2021 NIC MAP® Quarterly Data Release on January 6, 2022, will showcase if the demand recovery continued to expand or slowed down, and which other markets have fully returned to pre-pandemic 1Q2020 demand levels and which ones continued to lag.

Exhibit: 3Q2021 NIC Analytics Demand Pulse Metric

Interested in learning more about NIC MAP data? To learn more about NIC MAP data, powered by NIC MAP Vision, schedule a meeting with a product expert today.

data? To learn more about NIC MAP data, powered by NIC MAP Vision, schedule a meeting with a product expert today.

About Beth Mace and Omar Zahraoui

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Omar Zahraoui, Principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing research professional with expertise in providing quantitative analysis and insights on seniors housing & care market data; building new products and reporting capabilities, including dashboards and proformas for clients and internal stakeholders; and implementing new processes and data solutions. Prior to his current role, Omar worked as a data analyst, at Calpine Corporation, supporting the development of new-business strategy initiatives, analyzing sales and financial data, and developing statistical modeling of consumers’ behaviors to drive business performance. Omar holds a Bachelor’s degree in Business Administration with concentrations in Finance and Management, a Master in Corporate Finance from IAE Lyon School of Management at Jean Moulin Lyon III University in France, and a Master of Science in Management Information Systems and Data Analytics from Pace University.

Connect with Beth Mace and Omar Zahraoui

Read More by Beth Mace and Omar Zahraoui