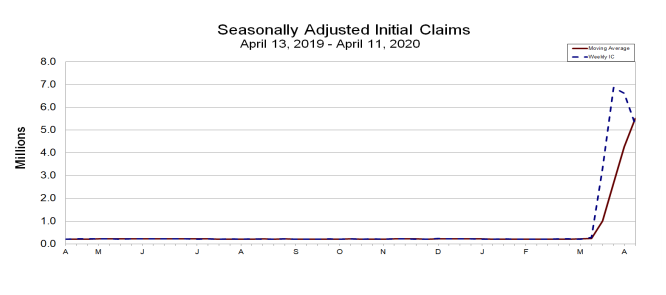

The Department of Labor reported that 5,245,000 Americans filed for unemployment insurance benefits in the week ending April 11, 2020 as the COVID-19 pandemic continues to cause businesses to reduce or furlough their workforces as sales plummet. This was a decline of 1,370,000 from the previous week’s upwardly revised level of 6,615,000. The speed and scale of the job losses is unprecedented. In the past four weeks, more than 22 million people have filed claims. For perspective, there were about 21.5 million jobs generated during the employment expansion that began in October 2010 or said another way, it took four weeks to lose the jobs it took 9.5 years to generate.

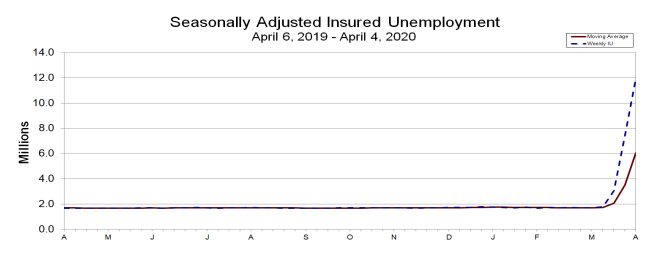

Continuing claims for regular benefits, which are reported with an extra week’s lag, rose 4.5 million to 12 million. This marks an all-time high in the data series. This measure, which accounts for people who are continuing to receive benefits, will keep climbing as jobs continue to disappear. This will push the insured unemployment rate (the share of the labor force that claims unemployment benefits) higher. The insured unemployment rate was 8.2% in the week ending April 4, an increase of 3.1 percentage points from the prior week and up from 1.2% pre-COVID-19. This marks the highest level of the rate in the history of the data series. The previous high was 7.0% in May 1975.

The largest increases in initial claims for the week ending April 4 were in Georgia, Michigan, Arizona, Texas and Virginia.

This week’s increase in unemployment claims marks the fourth consecutive week of surging jobless claims and provides a window into the magnitude of the economic downturn into which we are solidly moving. A 11-percentage point surge in the jobless rate to as much as 15% by April is likely, according to a Bloomberg commentary. As recently as February, it was at a 50-year low of 3.5%. In March, the rate had already increased to 4.4%.

Separately, on Wednesday, the Commerce Department reported the steepest monthly drop in retail sales on record going back 30 years and the Federal Reserve said industrial production fell the most since 1946.

Projections of real GDP growth continue to darken, with JPMorgan economists now predicting an annualized rate decline of 40% in the second quarter of 2020. Earlier, the expectation had been a decline of 25%.

The International Monetary Fund (IMF) is also pessimistic, with an expectation of a global contraction of 3% in 2020. This compares with a 0.1% contraction in 2009, the worst year of the previous recession. This amounts to about $2.7 trillion of global losses for the roughly $90 trillion global economy. Such a decline would be unmatched by anything aside from the Great Depression, IMF’s chief economist said. The IMF projects that the U.S. economy will shrink by 5.9% for the year, more than twice as severe as the 2.5% decline in 2009.

In response to the expected sharp slowdown in the economy, the President signed into law a $2 trillion economic stimulus rescue package that broadly expands unemployment benefits. Independent contractors and self-employed individuals are now eligible, at least in some cases. More fiscal stimulus packages are expected to be enacted in the coming months to further blunt the economic fallout of the COVID-19 pandemic.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace