The Labor Department reported that nonfarm payrolls increased by only 38,000 positions in May, much less than the 160,000 positions consensus projection. Over the past 3 months, monthly job increases have averaged 116,000, down sharply from the average gain of 240,000 over the past two years. The weakness in May’s payrolls was broad-based. Employment fell in information services, temporary services, manufacturing, construction, and mining, but increased in government, leisure and hospitality, financial services, and retail. The 34,000-job loss in information largely reflected the effects of the Verizon strike, which occurred during the reporting period. Workers returned to work this week.

In May, health care employment rose by 46,000. Over the year, health care employment has increased by 487,000. Increases occurred in ambulatory health care services (24,000), hospitals (17,000), and nursing care facilities (5,000).

The unemployment rate fell 30 basis points to 4.7% in May from 5.0% in April. The unemployment rate is derived from a separate survey from the payroll employment number sited above. The number of unemployed persons declined by 484,000 to 7.4 million.

The wider measure of unemployment, the U-6 measure, remained flat at 9.7% in May. This measure of unemployment includes those workers in part-time positions or too discouraged to look for work. The number of long-term unemployed (those jobless for 27 weeks or more) declined by 178,000 to 1.9 million in May and accounted for 25.1% of the unemployed.

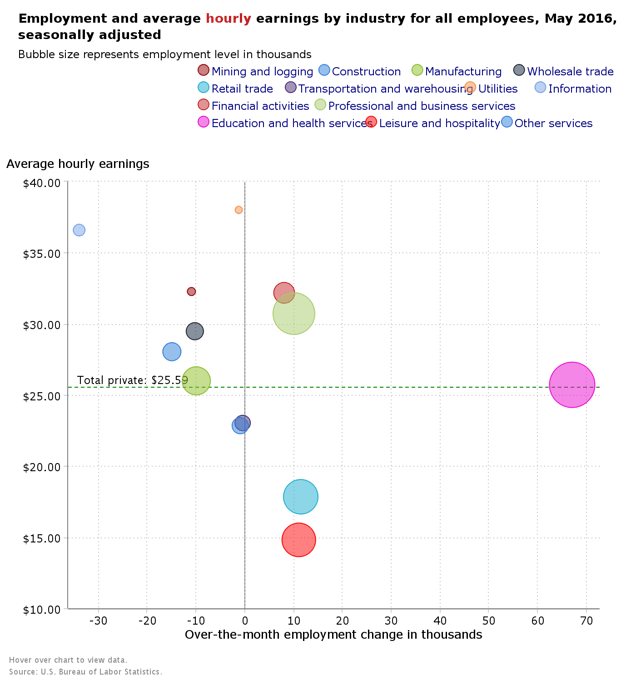

Average hourly earnings for all employees on private nonfarm payrolls increased by 5 cents to $25.59 in May, following a 9-cent increase in April. Over the year, average hourly earnings have risen by 2.5%. This measure of wage growth is starting to rise. In all of 2015, it averaged 2.3% and in 2014, it averaged 2.1%.

This report will give pause to the Fed and will likely cause it to delay raising the Fed Funds rate at its upcoming June 14-15th FOMC meeting. Nevertheless, a rate hike may still be in the cards at its late July meeting, since there will be two more employment reports to provide further information to the Fed on the strength of the economy. In the past few months, the Fed has indicated its intention to raise interest rates once the economy shows consistent and steady strength, especially the labor market. Other indicators, such as GDP, appear to be strengthening. Janet Yellen is scheduled to speak this coming Monday and may provide further insights at that time.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace