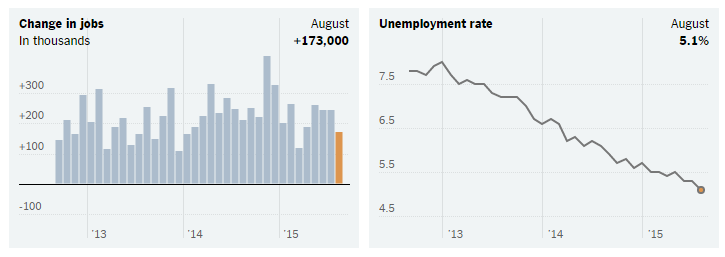

At 173,000, August's job gains are below market expectations and make a September rate hike by the Fed less certain

The first Friday of the month at 8:30 EDT is widely anticipated by market participants as the Labor Department presents a fresh gauge of the most recent economic performance in its release of the labor report for the prior month. Today’s number was even more closely watched since it will be the most up to date information on the labor market that the Federal Reserve has prior to its upcoming September meetings where it will assess the state of the economy and determine whether or not it should raise its benchmark interest rate which has been near zero since the depths of the recession in late 2008.

For August, a 173,000 job gain was reported, below market expectations (217,000), but the prior two months were upwardly revised by a combined 44,000 jobs. The unemployment rate slipped back to 5.1%, the lowest level since April 2008 and near, if not at, the level considered to be “full employment”. The wider measure of unemployment, the U-6 measure, fell to 10.3%. Wage growth remained relatively benign in this data release, with average hourly earnings rising at a 2.2% pace from year-earlier levels. Anecdotal evidence from seniors housing operators suggest wage pressures are mounting, however.

The report suggests that the economy continues to strengthen. However, the data are not emphatically strong and makes a move by the Fed on September 16th and 17th less than certain. The wide swings in the stock market in recent weeks, as well as weakening expectations on global economic growth adds to the uncertainty and gives the Fed plenty of things to think about before they pull the trigger and start to normalize monetary policy.

Source: Bureau of Labor Statistics, NY Times

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace