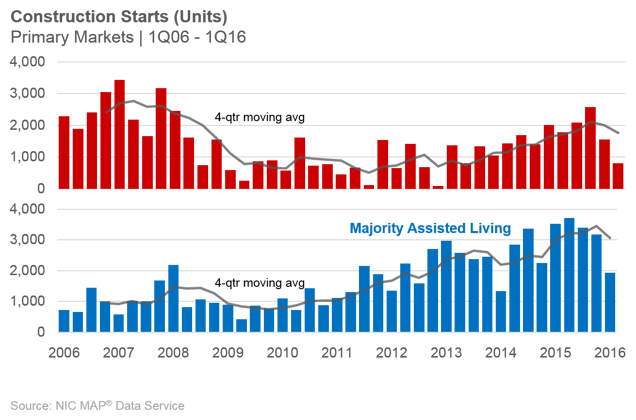

For the second consecutive quarter, new development activity for seniors housing showed a marked slowdown. Indeed, seniors housing construction starts totaled 2,737 units in the first-quarter of 2016, comprised of 802 independent living units and 1,935 assisted living units. On a four-quarter basis, a slowdown also was evident, as starts totaled 19,243 units, the weakest pace in a year. The decline in starts may suggest that the market is responding to well-publicized concerns about supply. Data for the second and third quarter will further illuminate this possibility. Anecdotally, some properties scheduled to break ground in the first quarter failed to do so because of higher construction costs or the discovery of new competition in the area, or because they were waiting on final financing approval.

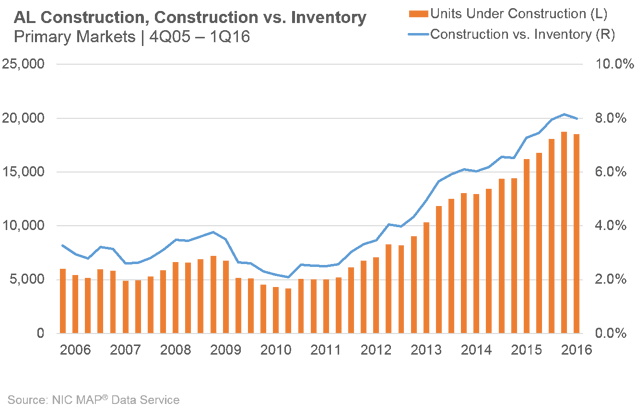

In addition to looking at starts, another way to evaluate construction activity is to examine the number of units under construction throughout all phases of construction, from groundbreaking (starts) up until the time of completion. The following chart illustrates that measure of development activity. This first chart shows both the unit count, as measured on the left axis, and units under construction as a share of inventory, as measured on the right axis. It indicates that with 18,500 units under development, construction is at a near record high for assisted living, by either unit count or as a share of inventory (8%). However, the slowdown in starts in assisted living effectively has caused this data series to level off in the first quarter.

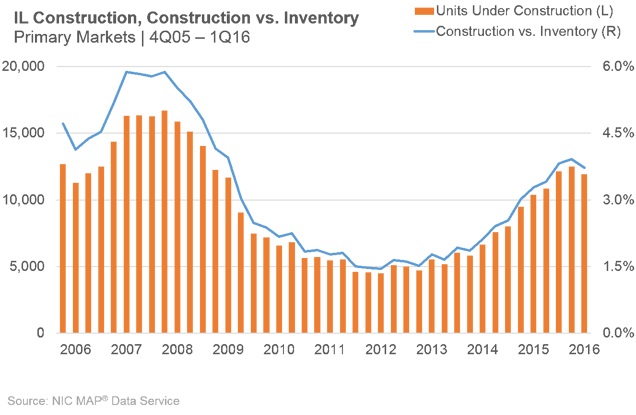

The third chart shows the same data concepts for independent living and the same pattern emerges. It is notable, however, that as a share of inventory, construction activity for independent living is half that of assisted living, although it is ramping up.

Construction Remains Concentrated in a Handful of Markets

Construction continues to be concentrated in a handful of markets. In fact, while not necessarily in the same metro areas, roughly 50% of construction within the NIC 31 Primary markets is situated in six geographies.

For assisted living, these markets include Chicago, Dallas, Minneapolis, Atlanta, Sacramento, and Denver.

These six markets comprise 47% of all construction activity among the Primary 31 markets. The top ten markets equal two-thirds of all activity. Rounding off the top ten are Miami, Washington DC, Phoenix, and Detroit.

For independent living, these markets include Atlanta, Houston, Dallas, Seattle, Miami, and San Antonio.

These markets comprise 48% of all construction activity among the Primary 31 markets. The top ten markets equal a bit more than two-thirds of all activity. Rounding off the top ten are New York, Chicago, Orlando, and Detroit. Atlanta, Dallas and Chicago, Miami and Detroit rank among the top 10 for both majority property types.

It is notable that several of these markets also saw strong absorption over the past year. These include Dallas, Denver, Houston, and Orlando.

If You Build It, Do They Come?

This raises the question of “If you build it, will they come?” Analysis conducted last year by Senior Housing Analytics and NIC showed that after 24–36 months, two-thirds of all newly constructed assisted living and independent living properties were more than 90% occupied, while 10% were less than 80% occupied and did not stabilize. Conditions affecting specific property-level outcomes may include location, operator, competition, and local market conditions. This suggests that in assessing an opportunity, it is important to carefully review all of these considerations.

Download the 1Q16 NIC MAP Data Release Abridged Presentation:

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace