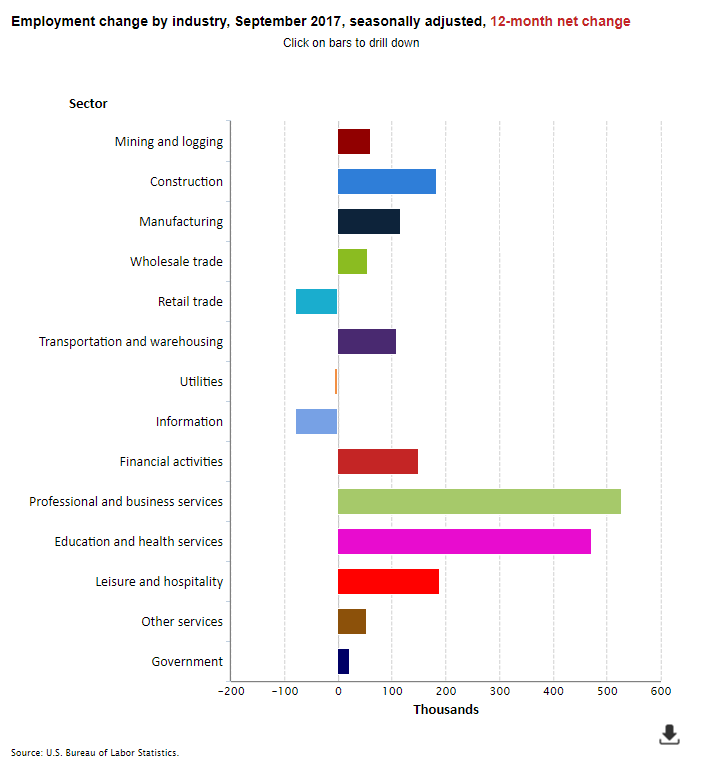

The effects of Hurricanes Harvey and Irma were seen in the September employment report issued by the Labor Department last Friday. The report showed that there was a loss of 33,000 jobs in September, significantly worse that then consensus forecast of a gain of 90,000. Hardest hit was the restaurant sector which had a loss of 105,000 jobs. The sector normally generates a gain of 30,000 jobs in any given month. It is likely that this month’s data will be viewed by the Federal Reserve as storm-related and little policy change will ensue.

The Federal Reserve has stated that it will continue to gradually normalize interest rates and that it is slowly unwinding its $4.5 trillion balance sheet of bonds and other asset holdings from the bloated levels created under Quantitative Easing (QE). In recent statements, the Fed has indicated that another rate hike is anticipated for 2017 to bring the Fed Funds rate—the interest rate that the Fed directly manages—to 1.40% by year end. Three additional quarter-point increases are planned for 2018, two in 2019, and one in 2020, with the goal of increasing the Fed Funds rate to 2.90% by year-end 2020. The Fed has raised rates by a quarter percentage point four times since late 2015, and most recently to a range between 1.0% and 1.25% in June of this year, after keeping them near zero for seven years.

That said, there remains a significant amount of uncertainty as a backdrop to the economic outlook. This uncertainty includes the upcoming and repeated challenge of raising the debt ceiling (this deadline was originally scheduled for early September, but got pushed out until December); enacting a federal government budget for fiscal year 2018 (the fiscal year began October 1st, but Congress extended last year’s budget until December); and engaging in the first significant discussion of tax reform in 30 years.

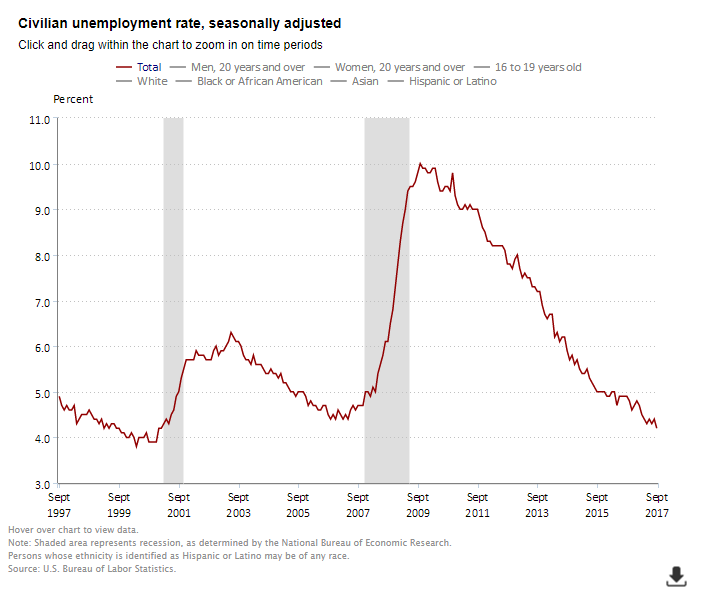

The BLS report also indicated that the unemployment rate fell to a new 16-year low of 4.2% in September, down from 4.4% in August. A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—fell to 8.3% from 8.6% in August and 9.7% a year ago.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work increased to 63.1%, up from 62.9%. This was its highest level in 3 ½ years. This measure has generally been very low by historic standards, reflecting the effects of retiring baby boomers.

Average hourly earnings for all employees on private nonfarm payrolls by 2.9% in September. This is up from the 2.6% average in 2016. In 2015 this figure was 2.3% and in 2014, it was 2.1%.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace