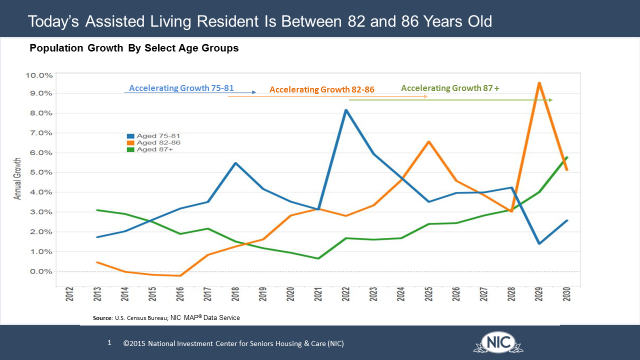

We frequently receive questions about the relationships between demographic trends and seniors housing demand at NIC and this commentary briefly addresses the topic. The chart below depicts the annual growth rates of three U.S. population age cohorts—(1) persons aged 75 - 81, (2) persons aged 82 – 86 and (3) persons aged 87 plus for the period beginning in 2012 and ending in 2030. The chart uses data from the U.S. Census Bureau’s 2012 Middle Series projections for the growth rates of these three cohorts.

We chose these cohorts intentionally, especially the 82-86 cohort. While we don’t have an official and exact statistic on the average age of a person when they move into seniors housing, we believe, from anecdotal evidence that it is between 82-84 years of age. We also know from the 2014 State of Seniors Housing Survey (SOSH), that the median length of stay of a resident in a seniors housing property is roughly 2 to 3 years (longer for IL than AL), implying that the typical age of a resident in seniors housing is likely between 82 and 86. Hence, we created the 82-86 population age cohort, depicted in the chart below by the orange line.

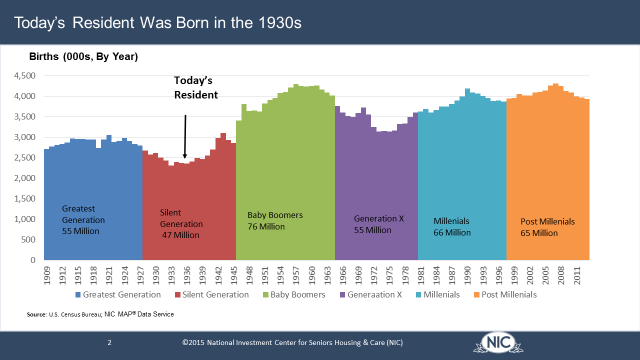

As the chart shows, the growth in the 82-86 cohort started to decelerate in 2013 and is projected to actually become nominally negative in 2015 and 2016. This deceleration in growth largely reflects the effects of the Great Depression when fertility rates fell sharply causing births to hit a low point in 1933 (see live births chart above). If you add 82 years to 1933, those born in 1933 are 82 today, the lower age of the cohort residing in seniors housing.

This suggests that there will be a demographic slowdown in this age cohort which could impact demand for seniors housing this year and next. By 2017, the 82-86 cohort will start to accelerate again and will generally continue to do so until 2025, providing a nice demographic driver for seniors housing. Between 2017 and 2025, this cohort will increase in size by 1.5 million persons, or 29% from 5.1 million to 6.6 million. This cohort’s share of the U.S. population will grow from 1.6% to 1.9% over this period.

The green line shows the pattern of growth for the 87-plus cohort. This population age group decelerates in growth through 2021 and then accelerates. Again, this reflects the births of the 1930s, which accelerated after 1933. In 2021, those persons aged 87 were born in 1935. Note that while growth decelerates, it remains positive, allowing this cohort to grow in absolute numbers by 800,000 or 17% between 2015 and 2025.

The blue line depicts the growth rate for the 75 to 81 cohort. Growth in this group accelerates through 2018 and then slows a bit in through 2021. After that, the baby boomers start to affect this cohort, with the first baby boomer born in 1946 turning 75 in 2021. Note, the first baby boomer will not turn 82 until 2028.

For operators and capital providers of seniors housing, these demographic trends have many implications. Among these are the following:

- The 82-86 age group, a significant cohort residing in today’s senior housing properties, slows in growth through 2016, after which it will accelerate from annual gains of 42,000 persons aged 82-86 in 2017 to 400,000 in 2026. Hence, near-term demographic demand drivers for seniors living may be less of a demand driver than broad economic conditions. By 2017, growth in the 82-86 age cohort will become an ever larger influencer on demand.

- The growth in the 82-86 age group as well the accelerating growth in the 87-plus cohort beyond 2021 has important implications for demand for memory care services. Dementia, Alzheimer’s disease and other memory impairment issues become more prevalent with age. According to research from both the Centers for Disease Control and Prevention and the National Institutes of Health (NIH) the risk of developing Alzheimer’s disease, for example, doubles every 5 years starting at age 65. By age 85 years and older, between 25% and 50% of people typically exhibit signs of Alzheimer's disease.

- The growth of the 75-81 cohort through 2018 is an opportunity for those skilled nursing operators who are catering to the rehabilitation needs of baby boomers who often require reintegration services as they recover from knee and hip replacement surgeries.

- The combined growth of these three cohorts presents opportunities for post-acute care coordination between hospitals, skilled nursing properties, assisted living properties and independent living properties since the prevalence of hospital care and service needs rise with age. Opportunities will be created by those businesses that can best align themselves in the accountable-care environment (ACOs), where costs can be optimized between the post-acute care and acute worlds of hospitals, skilled nursing facilities, and seniors housing properties. Moreover, those operators that can effectively and efficiently integrate systems and big data that measure outcomes and reduce costs stand to benefit.

- The growth of the 75-81 cohort through 2018 is also an opportunity for the development of new types of alternative active seniors housing options.

- While not shown directly on this chart, baby boomers (born between 1946 and 1964) are currently between the ages of 51 and 69. This cohort is large, with an estimated 76 million Americans labeled as such. While much of this cohort currently acts as the adult child decision maker for today’s residents in seniors housing, this cohort will soon be seeking housing options for themselves that offer enticing social environments, active life styles and low home maintenance.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace