Key Takeaways from the 2017 NREI/ NIC Senior Housing Market Study

The National Investment Center for Seniors Housing & Care (NIC) and the National Real Estate Investor (NREI) recently conducted the fourth annual NREI/NIC Seniors Housing Market Study from June 28-July 17. The goal of the online survey was to gauge attitudes and opinions regarding the state of the seniors housing sector. There were 153 respondents. Penton Research conducted the research and the methodology conforms to accepted marketing research methods, practices and procedures. Results of the survey are summarized below:

- Respondents favored seniors housing over other commercial real estate asset types for investment for the fourth year in a row. Following seniors housing were apartments, industrial, office and hotels. Retail continued to be the laggard asset type for investment choice.

Seniors Housing Market Fundamentals

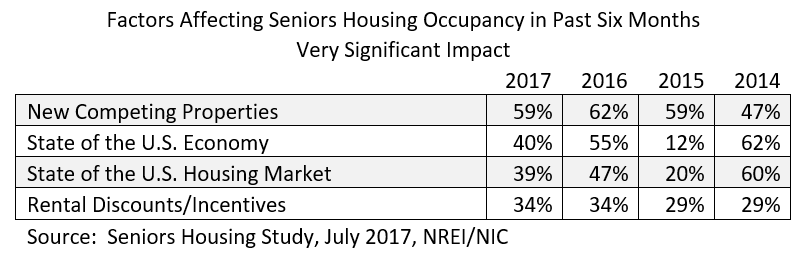

- Survey respondents viewed new competing properties as more of a threat to occupancy than the state of the U.S. economy, the U.S. housing market or rental discounts and incentives. It’s interesting to note that in 2014, the state of the S. economy and its housing markets were viewed as greater threats.

- Roughly 59% of respondents expect to see an increase in seniors housing construction starts over the next 12 months. This compares with 45% in 2016, 69% in 2015 and 72% in 2014. Of the 2017 respondents that expect to see an increase in starts, 20% expect new construction to result in overbuilding.

- A little more than 65% of respondents anticipate occupancy rates to rise in the coming 12 months versus 56% in 2016 survey.

- Nearly 78% of the survey respondents expect rents to rise by roughly 1 percentage point, nearly the same as in 2016.

- The West and South continue to be favored regions for investing in seniors housing. Most respondents were “neutral” with regard to the East and Midwest.

- Most respondents thought the market was in a recovery /expansion phase, although nearly one in five thought the market was at its peak.

Capital Markets and Transactions

- REITs, HUD and institutional lenders were considered to be the most significant sources of debt capital in 2017 among the survey respondents. This compares with HUD, Fannie/Freddie and local/regional banks in 2016.

- Debt market conditions are projected to be tighter in 2017 than in 2016.

- Transaction volumes in 2017 are anticipated to be the same as in 2016, with the time it takes to close a deal unchanged.

- More respondents anticipate buying properties than selling properties.

- A cap rate increase of 15 basis points is anticipated by the 52% of respondents that anticipate higher cap rates; this compares to 11 basis points in 2016 survey.

- Few respondents anticipated a decrease in the risk premium for investing in seniors housing (i.e., the spread between the risk-free 10-year Treasury yield and seniors housing cap rates).

In wrapping up, seniors housing continues to be a favored property type among investors. Generally positive perspectives surround questions related to improving market fundamentals, access to capital and the transactions pipeline. Development and new supply remain concerns among industry participants, however.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace