The Labor Department reported that there were 134,000 jobs created in the U.S. economy in September, well below the consensus expectation of 180,000. However, revisions added 87,000 to the prior two months as August was revised to 270,000 from 201,000 and July to 165,000 from 147,000. The September figure may have been negatively affected by Hurricane Florence. Payrolls have averaged 190,000 per month for the last three months, up from 182,000 last year.

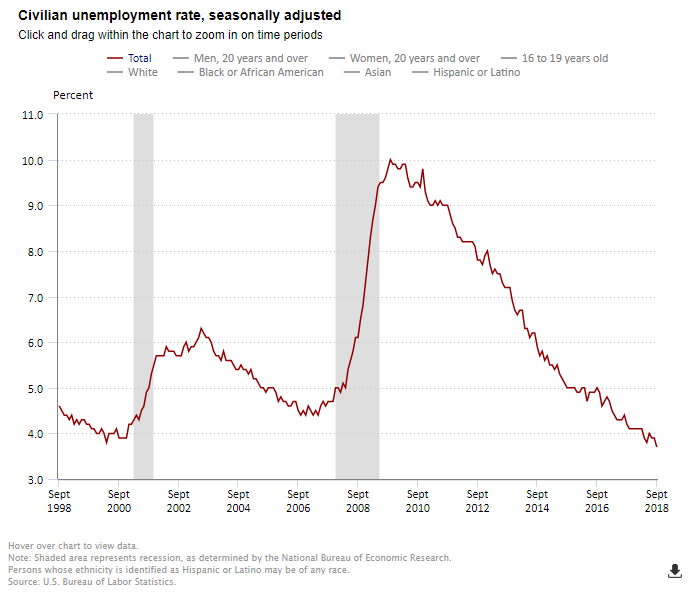

The unemployment rate declined to 3.7% in September from 3.9% in August and was at the lowest rate since December 1969. The jobless rate remains well below the rate of what is generally believed to be the “natural rate of unemployment” of 4.5% and continues to suggest that there will be growing upward pressure on wage rates. The jobless rate is calculated from a different survey than the survey used to calculate the number of new jobs (the household versus the establishment survey, respectively).

A broader measure of unemployment, which includes those who are working part-time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—rose to 7.5% from 7.4% in August, but was down from 8.3% a year ago.

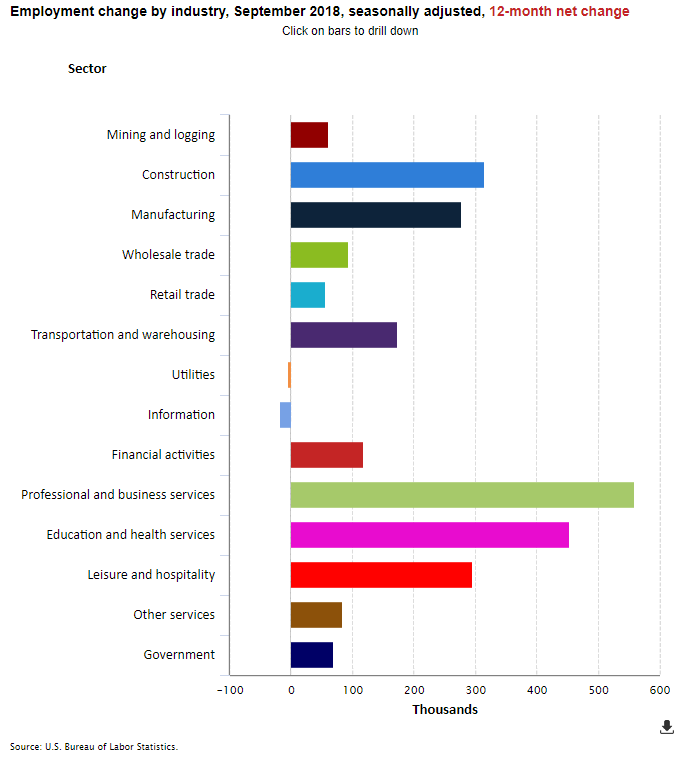

In September, employment in health care rose by 26,000. In the past year, health care has added 302,000 jobs.

The labor force participation rate, which is a measure of the share of working-age people who are employed or looking for work was unchanged at 62.7%, near its cyclical low of 62.5% in October 2015. The low rate at least partially reflecting the effects of an aging population.

Average hourly earnings for all employees on private nonfarm payrolls rose in September by eight cents to $27.24. Over the past 12 months, average hourly earnings have increased by 73 cents, or 2.8%. Last year, they averaged 2.6%.

The September jobs report and the annual increase in average hourly earnings will provide further support for increases in interest rates through 2018 by the Federal Reserve. As widely expected, the Fed increased the fed funds rate by 25 basis points at its September FOMC meeting, the third increase in 2018. The Fed has raised rates by a quarter percentage point eight times since late 2015, and most recently to a range between 2.00% and 2.25% after keeping them near zero for seven years. It is widely expected that the Fed will raise rates at the next FOMC meeting to be held in December, with another three rate hikes anticipated in 2019, pushing rates toward 3.4% by 2020.

For consumers who save, higher rates are good news as their returns on CDs and money market accounts will grow at a faster pace. But for borrowers—both consumers and businesses--higher rates are not good news as their borrowing costs will be higher.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace