Analysts, operators and capital providers often pay close attention to the employment data release issued by the Labor Department on the first Friday of the month. This report provides near-real time information about the state of the economy and the U.S. labor market. And with labor representing up to 60% of a typical operator’s expense load, indicators regarding labor availability and its cost are critically important. Additionally, the Federal Reserve pays close attention to the jobs report since it provides clues about the state of the economy as well as wage and inflation pressures. And in today’s economic environment, these data points in turn will help the Fed decide whether it will continue to normalize interest rates and nudge rates higher.

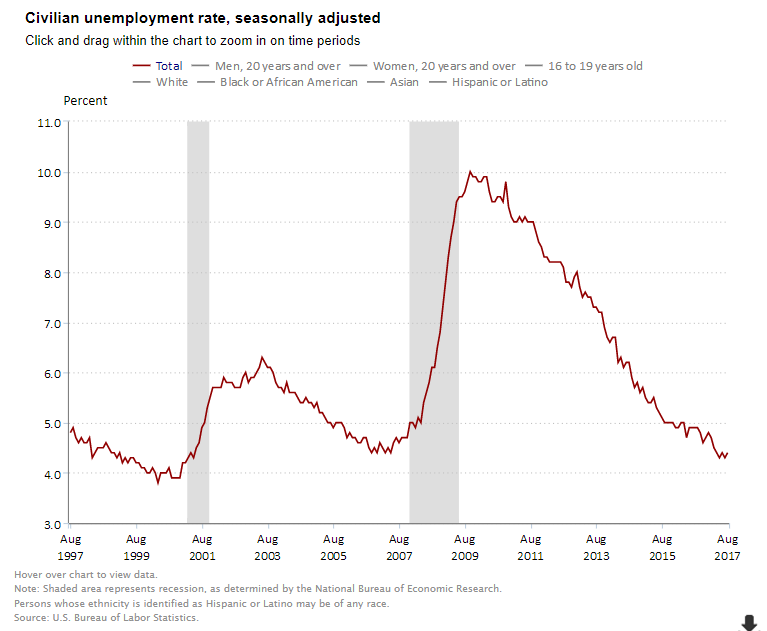

Specifically, today’s employment report indicated that jobs rose by 156,000 in August, less than the downwardly revised July estimate of 189,000 and less than the estimate of 180,000 projected by many analysts. In addition, revisions for the prior two months subtracted 41,000 jobs, while the jobless rate increased 10 basis points to 4.4% from 4.3% in July. A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—was flat at 8.6% in August, down from 9.7% a year ago.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work was flat at 62.9%. It is very low by historic standards and in part reflects the effects of retiring baby boomers.

Average hourly earnings for all employees on private nonfarm payrolls increased by three cents to $26.39 in August. Over the year, average hourly earnings have risen by 65 cents or 2.5%. This is down slightly the 2.6% average in 2016. In 2015 this figure was 2.3% and in 2014, it was 2.1%.

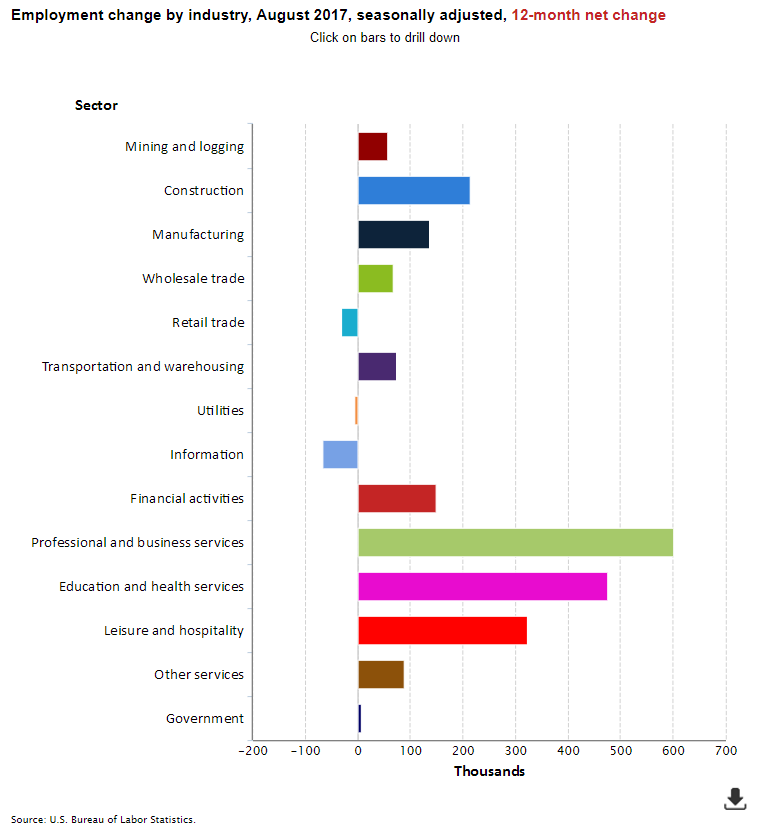

Employment in health care rose by 20,000 in August and has added 328,000 jobs over the past year.

The Labor Department indicated that Hurricane Harvey had no effect on the August report since the survey data collection was completed prior to the storm. However, the September figures may be affected by Hurricane Harvey, which suggests that the next good gauge of employment may be with the October data release in early November.

The relatively weak growth in annualized hourly earnings, along with the weak inflation report, issued by the Commerce Department yesterday may cause the Fed to wait to further increase interest rates. Yesterday’s report showed the price index for personal-consumption expenditures, which is the Fed’s preferred inflation gauge, remained at 1.4% in July on an annualized basis. This was down from 2.2% earlier this year and below the Fed’s 2% annual target.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace