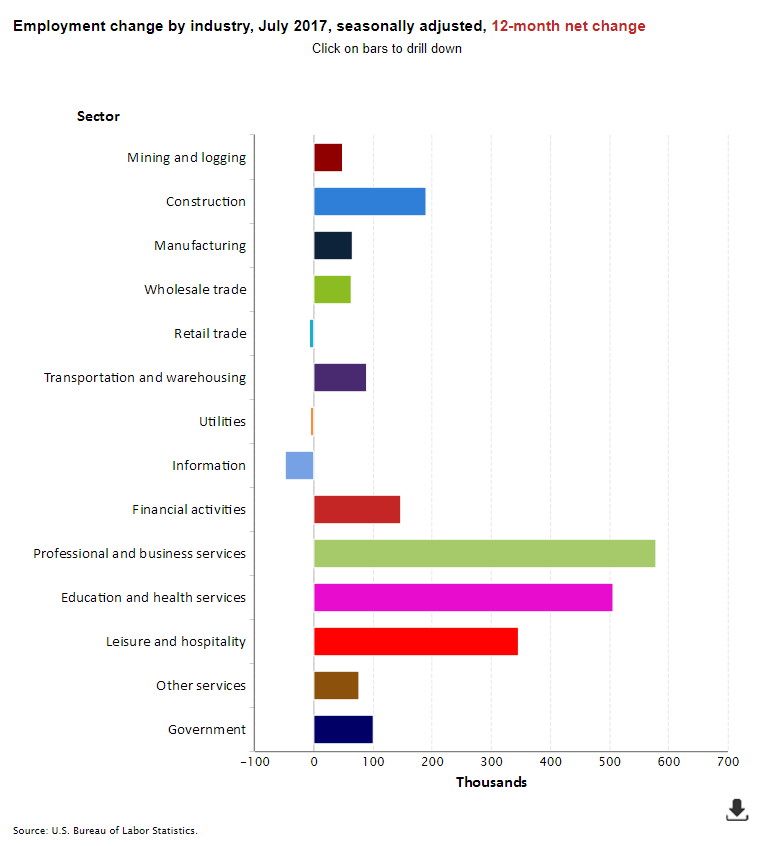

The Labor Department reported on Friday that nonfarm payrolls increased by a seasonally-adjusted 209,000 positions in July, above the consensus 180,000 estimate. This followed gains of 231,000 in June, originally reported as 222,000, and 145,000 in May, originally reported as 152,000. Monthly revisions result from additional reports received from businesses since the last published estimates and from the recalculation of seasonal factors. Over the past 7 months, job gains have averaged 187,000 per month, similar to the average monthly gain of 187,000 in 2016. The economy has generated jobs every month since October 2010.

Employment in health care rose by 39,000 in June. Health care has added 327,000 jobs over the past year.

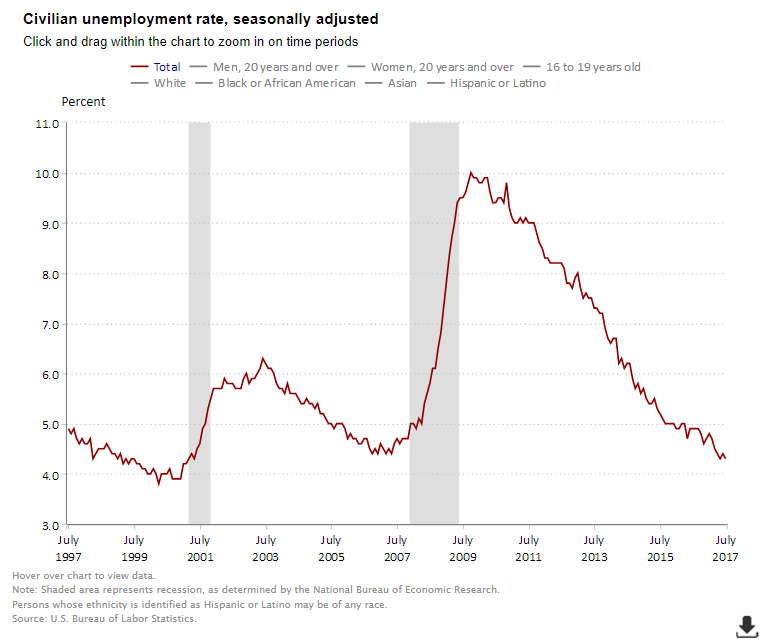

The unemployment rate fell 10 basis points to 4.3% in July, matching the 16-year low unemployment rate of 4.3% in May. The unemployment rate is derived from a separate survey than the payroll employment number sited above. The Labor Department has two surveys, one of businesses and one of households. The unemployment data is based on the household survey, while the hiring employment data is based on the business survey. A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—was flat at 8.6% in July, up 20 basis points from 8.4% in May when it stood at a 10-year low. The number of long-term unemployed (those jobless for 27 weeks or more) was estimated at 1.8 million in July and accounted for 25.9% of the unemployed. The employment-population ratio was 60.2% and was up by 40 basis points over the year.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work increased 10 basis points to 62.9%. It is very low by historic standards and in part reflects the effects of retiring baby boomers.

Average hourly earnings for all employees on private nonfarm payrolls increased by nine cents to $26.36 in July. Over the year, average hourly earnings have risen by 65 cents or 2.5%. This is down slightly the 2.6% average in 2016. In 2015 this figure was 2.3% and in 2014, it was 2.1%. Increases in minimum wage rates in many states and tightening labor markets June start to put further pressure on this measure of earnings.

Additional downward pressure on the unemployment rate is likely to occur in the coming months as job growth exceeds labor force growth. This will put the official unemployment rate further below the full-employment or natural equilibrium level; indeed, the official estimate by the Federal Reserve of the full-employment level of the jobless rate is 4.7%. A rate much below this rate is believed to fuel inflation through upward pressure on wage rates. The low July jobless rate, as well as other evidence of labor shortages, will provide further support for the Federal Reserve to pursue at least one more rate hike this year. In recent statements, officials have indicated that another rate hike is anticipated for 2017 to bring the Fed Funds rate to 1.4% by year end and that three more quarter-point increases are planned for 2018, with the eventual goal of increasing the federal funds rate—the interest rate that the Fed directly manages—to 2.9% by year-end 2019.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace