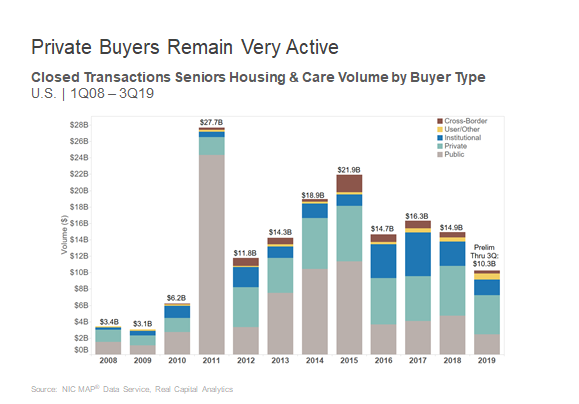

The U.S. seniors housing and care transactions market saw a slight drop in dollar volume in the third quarter of 2019 from the previous quarter. However, measured by the number of transactions closed year-to-date in 2019, the market seems to be very active on a relative basis. Judging by interest from investors, especially from the private buyers (discussed further below), this trend is likely to continue in the short-term barring any liquidity or economic shocks.

When comparing the number of transactions closed, the first three quarters of 2018 lagged that of the same period in 2019, with 391 and 441 transactions closed, respectively. That represents a 13% increase year-over-year. Given that transaction volume is relatively strong, in terms of the number of deals closed, the activity is another testament of the continued plentiful liquidity in the seniors housing and care market. Nearing the close of 2019, we should expect strong activity in the fourth quarter, barring any capital market disruptions, as there is typically a push to close deals that have been in the pipeline before year-end.

The number of closed transactions in the third quarter alone was 140, up slightly from the third quarter of 2018 when 138 transactions closed. Private buyers are driving this activity, providing a relatively significant amount of liquidity to the market. Private buyers represented $1.6 billion of the $3.2 billion total of closed transactions in the third quarter of 2019, or 49% of the total volume. This has been a consistent theme throughout 2019 as private buyers have represented 47% of volume through the third quarter 2019, registering $4.8 billion of the $10.3 billion closed so far in 2019. The consistency has been notable as the private buyers continue to register over $1 billion in closed transaction volume each quarter with only one quarter dipping below $1 billion since the third quarter of 2013. More recently, since the beginning of 2016, the first year public buyers started to slow down with their activity, private buyers have averaged $1.5 billion in volume per quarter. This compares to institutional and public buyers which averaged $947 million and $1 billion, respectively.

Public buyers represented $2.5 billion of the $10.3 billion of total dollar volume thus far in 2019, or 25% of total volume. Institutional buyers only represented $1.9 billion of the total dollar volume through the third quarter of 2019. The institutional buyers which include many of the private equity companies that manage institutional funds such as pension and endowment money, have raised lots of capital but anecdotal evidence suggests they are having a hard time putting the capital to work in a meaningful way due to competition and high property prices, in addition to lower expected returns.

As activity overall has been strong, so has the price per unit in seniors housing. In fact, the price per unit increased in the third quarter, and interestingly enough, the seniors housing rolling four-quarter price per unit has reached a time-series high going back to 2008. It currently stands at $185,600 per unit, an increase of 10% from the second quarter which had a price per unit of $168,800. The price per unit in the third quarter of 2019 is up 18% from the third quarter of 2018 when it averaged 156,800.

Nursing care pricing also increased in the third quarter of 2019. It now stands at $78,000 per bed, which represents a 13.5% increase from the prior quarter. The price per bed in the third quarter 2019 is up 7.4% from the third quarter of 2018 when it was $72,600.

As a closing note, when analyzing this pricing data, it should be pointed out that some higher priced, or lower priced, outliers can skew the averages. In the third quarter, for example, Riverview SNF Realty LLC bought from Eastern Blvd Real Estate LLC at a price per bed of $140,000, which represents a much higher price per bed than the rolling four-quarter average. The same holds true for seniors housing. In a third quarter 2019 deal, GFH Financial Group bought from Harbert Management Corp. at a price per unit of more than $300,000, again representing a much higher figure than the average.

About Bill Kauffman

Senior Principal Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

Connect with Bill Kauffman

Read More by Bill Kauffman