A NIC report developed to provide timely insights from owners and C-suite operators and executives on the pulse of seniors housing and skilled nursing sectors

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

This Wave 10 survey sample includes responses collected July 20-August 2, 2020 from owners and executives of 73 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 10 Summary of Insights and Findings

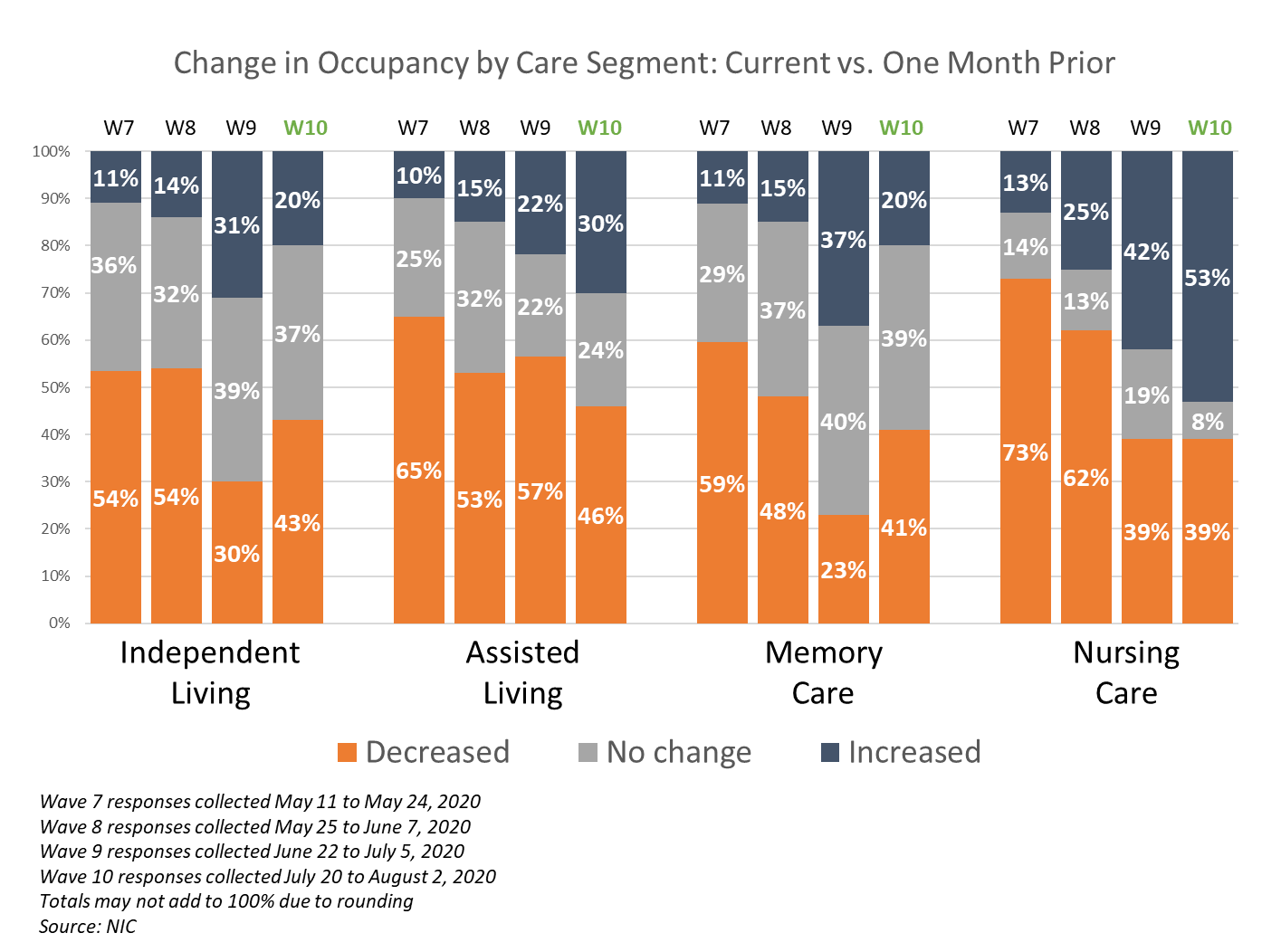

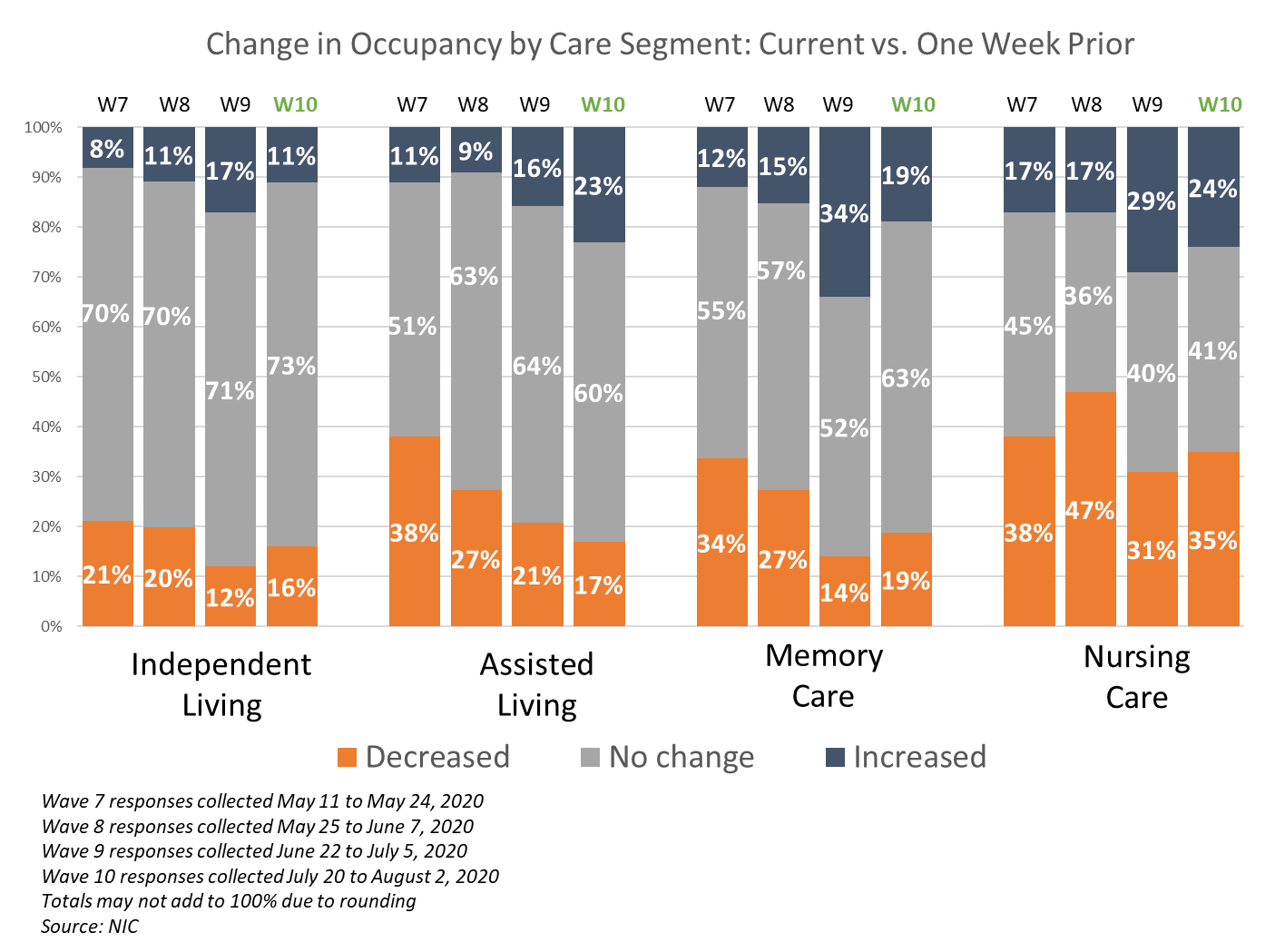

The Wave 10 survey revealed a slight deterioration in the pace of move-ins, specifically in the independent living and memory care segments, resulting in downward changes in occupancy rates month-over-month and week-over-week for these care segments—likely because of an increase in COVID-19 cases in certain areas of the country. However, the assisted living and nursing care segments continued to improve in Wave 10 in terms of the market fundamentals, with both segments seeing the highest shares of organizations reporting an acceleration in move-ins and upward movement in occupancy rate changes since the survey began. The Wave 9 survey results (June 22-July 5, 2020) showed that larger shares of organizations reported month-over-month and week-over-week improvements in occupancy rates than in all prior waves of the survey. This was likely due to pent-up demand from resident/family members and the easing of COVID-19 related move-in restrictions.

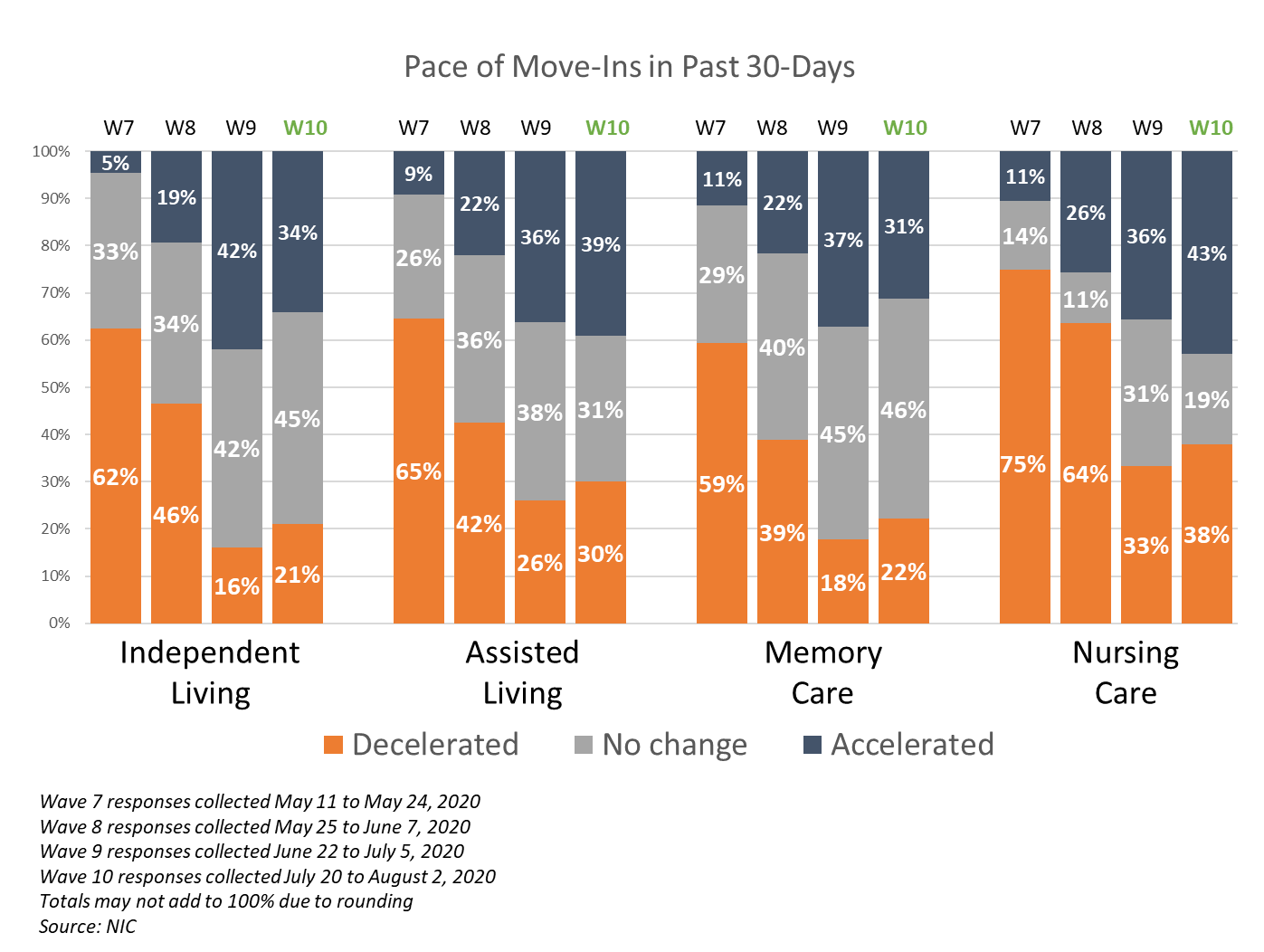

- In Wave 10 of the survey, 43% of organizations with nursing care beds and 39% of organizations with assisted living units noted a continuing upward trend in move-ins in the past 30-days—the highest shares achieved by these segments in the survey time series. However, fewer organizations with independent living and memory care units reported an acceleration in move-ins than in Wave 9 of the survey.

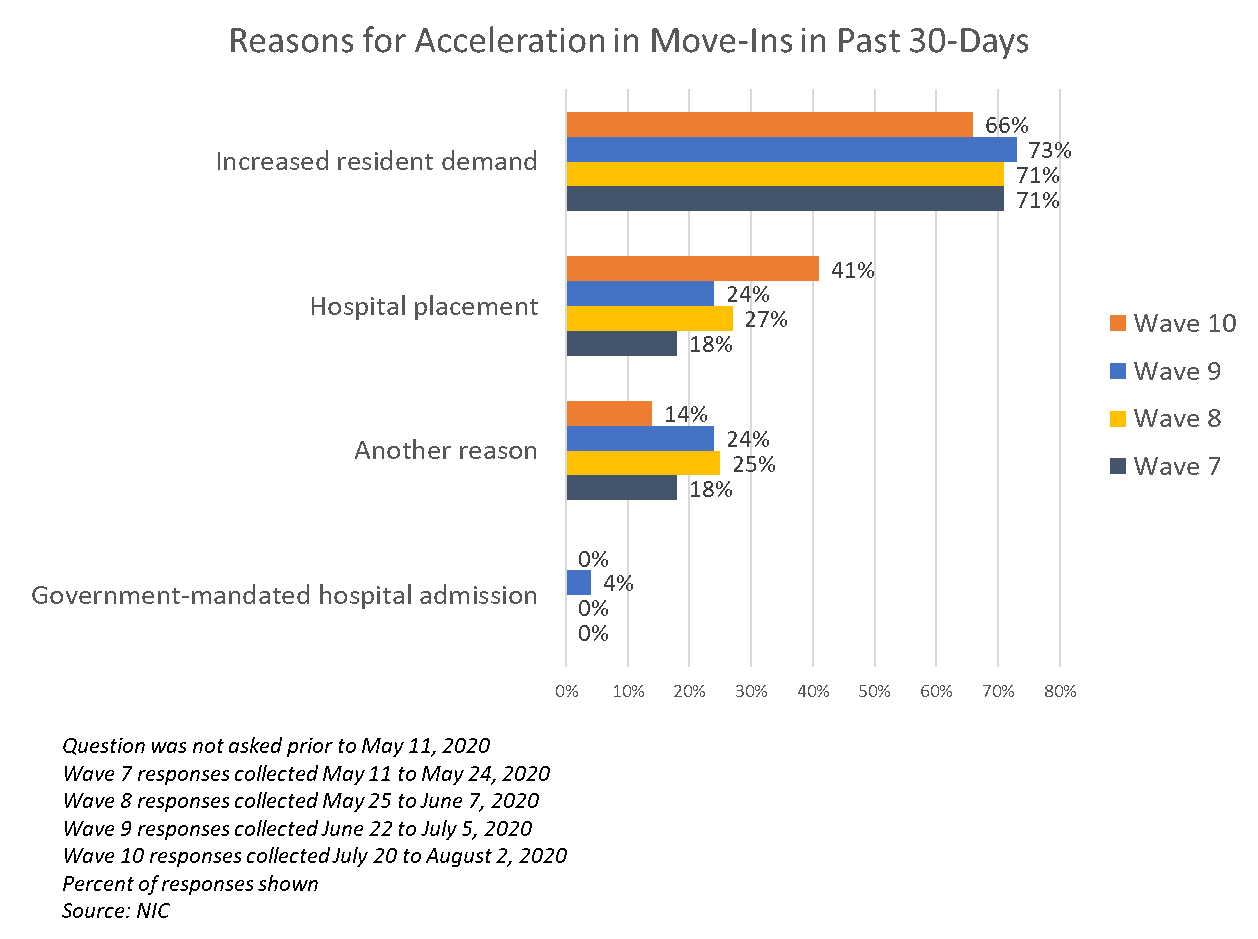

- In each of the past four waves of the survey, roughly two-thirds to three-quarters of organizations cited increased resident demand (many due to pre-COVID-19 planned move-ins resuming) as a reason for acceleration in move-ins. Additionally, organizations with any nursing care beds cited hospital placement more frequently than in the prior three waves of the survey. Other reasons cited for an acceleration in move-ins included properties being re-opened for tours, current and new residents feeling more comfortable about moving-in, and seniors in the lead pipelines ready to move-in.

- Regarding reasons for a deceleration in move-ins, most organizations continued to cite a slowdown in leads conversions/sales, while considerably more in Wave 10 than in Wave 9 cited resident or family member concerns (60% in Wave 10 vs. 38% in Wave 9), presumably due to the increase of COVID-19 cases in many areas of the country since June and July.

- At this point in the pandemic, most organizations are easing move-in restrictions, but others are increasing move-in restrictions. About half of organizations with more than one property in Wave 10 of the survey are easing move in restrictions in some or all geographies (53%), while about one in five are increasing move-in restrictions in some or all geographies (21%). Among single-site organizations, most (42%) are easing move-in restrictions, while about a quarter (26%) are increasing move-in restrictions at this time.

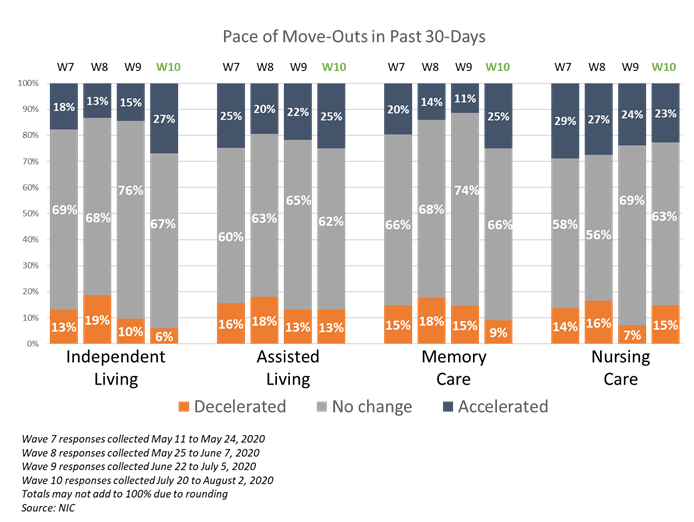

- In Wave 10 of the survey, roughly two-thirds of organizations (62% to 67%) note no change in the pace of move-outs in the past 30-days across all four care segments, while about one quarter (23% to 27%) report an acceleration in move-outs. Primary reasons for move-outs included deaths and residents moving to higher levels of care. Compared to the Wave 9 survey, the shares of organizations reporting an acceleration in the pace of move-outs for the independent living and memory care segments increased in Wave 10 survey, while the assisted living and nursing care segments remained relatively unchanged.

- The nursing care segment continued to have the largest shares of organizations with increasing occupancy rates. In Wave 10, approximately half (53%) reported an upward change in month-over-month occupancy—the highest in the survey time series for the nursing care segment—likely a result of more hospitals around the country resuming greater amounts of elective surgeries that require post-acute care rehabilitation, and/or seniors housing residents moving to higher levels of care.

- As a result of the slight pullback in move-in rates for the independent living and memory care segments, the Wave 10 survey shows a slight decline in the shares of organizations reporting increasing occupancy from a week prior. Slightly more organizations with assisted living units report an increase in week-over-week occupancy, while slightly more organizations with nursing care report a decrease.

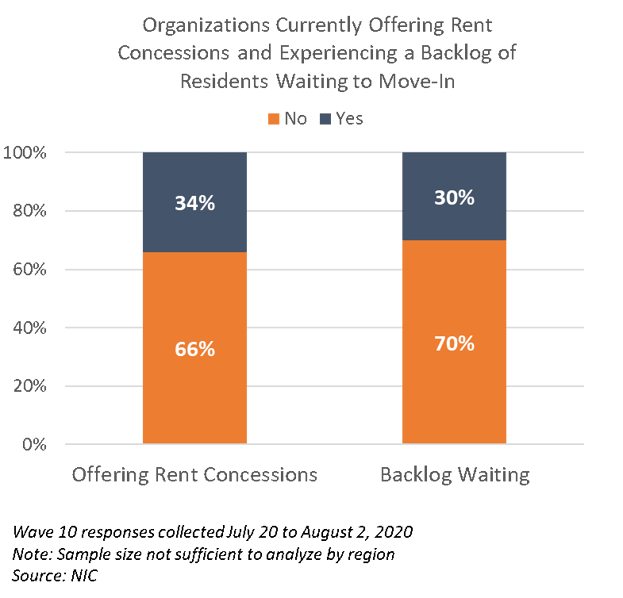

- As of Wave 10, about two-thirds of organizations report they are not currently offering rent concessions to attract new residents. Similarly, 70% indicate they do not have a backlog of new residents waiting to move in.

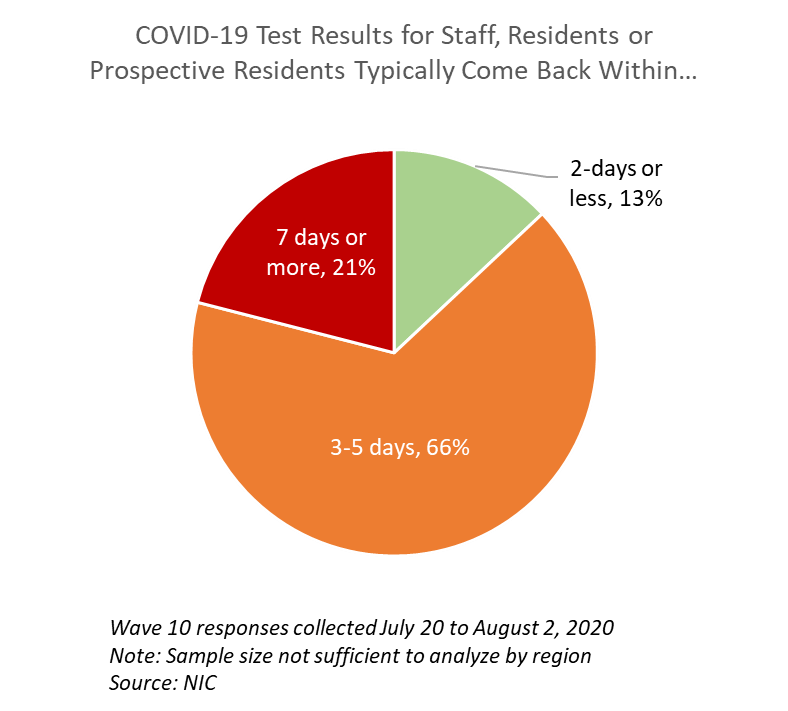

- Regarding the availability of PPE and COVID-19 testing kits, and the time it takes to receive test results back, more than one-quarter of organizations (29%) report that it is still very difficult to obtain enough COVID-19 testing kits in most markets, and 17% report difficulty accessing PPE—up from Wave 9 but similar to Wave 8.

- Two-thirds of organizations reported that COVID-19 test results for staff, residents or prospective residents are typically available in 3-5 days (66%). However, one in five say it is taking 7 or more days to receive results (21%).

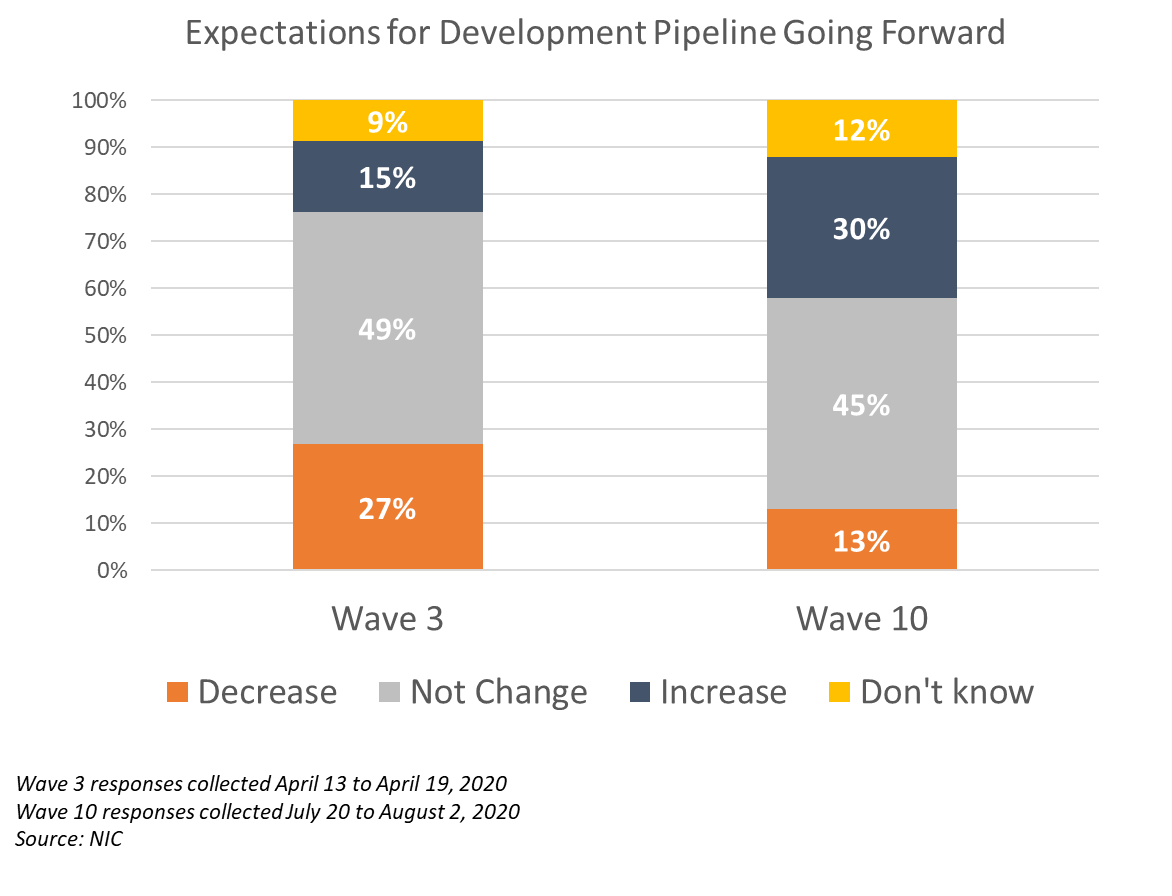

- More respondents in the Wave 10 survey (July 20-August 2, 2020) compared to the Wave 3 survey (April 13-19, 2020) expect an increase in their development pipelines going forward (30% vs. 15%).

- Many respondents in Wave 10 offered comments about how their organizations are supporting staff as the pandemic emergency continues for employees and their families, with most citing pay incentives. Additionally, more are supporting staff with flexible work hours, but fewer are currently offering additional paid sick leave. Organizations offering overtime hours to mitigate labor shortages has remained steady at 85% and 84% from Wave 10 compared to Wave 3. However, slightly more report tapping agency or temp staff (42% vs. 36%) to fill staffing vacancies.

Wave 10 Survey Demographics

- Responses were collected July 20-August 2, 2020 from owners and executives of 73 seniors housing and skilled nursing operators from across the nation.

- Roughly half of respondents are exclusively for-profit providers (52%), more than one-third (39%) are exclusively nonprofit providers, and 9% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 77% of the sample. Operators with 11 to 25 properties make up 10% while operators with 26 properties or more make up 13% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 73% of the organizations operate seniors housing properties (IL, AL, MC), 39% operate nursing care properties, and 34% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

-

- The shares of organizations reporting deceleration in move-ins—across each of the care segments—ticked up slightly between Wave 9 and Wave 10 of the survey. In Wave 10 of the survey, between 21% and 30% of organizations with independent living, assisted living and/or memory care segments, and 38% of organizations with nursing care beds indicated that the pace of move-ins decelerated in the past 30-days. Comparatively in Wave 9, between 16% and 26% of organizations with independent living, assisted living and memory care segments and 33% of organizations with nursing care beds reported a deceleration in move-ins.

- Conversely in Wave 10, between 31% and 43% of organizations reporting on their independent living, assisted living, memory care, and nursing care segments indicated that the pace of move-ins accelerated in the past 30-days, compared to between 36% and 42% respectively in Wave 9.

- While the shares of organizations with independent living units reporting an acceleration in move-ins in the past 30-days retreated slightly, the assisted living and nursing care segments continued to increase shares to their highest levels in the survey time series (39% and 43%, respectively).

Reasons for Acceleration/Deceleration in Move-Ins

Respondents were asked: “The acceleration/deceleration in move-ins is due to…”

-

- In Wave 10 of the survey—hospital placement was cited most frequently as a reason for an acceleration in move-ins in the past 30-days (41%) among organizations with any nursing care beds—significantly higher than in the prior three waves of the survey.

- In each of the past four waves of the survey, roughly two-thirds to three-quarters of organizations cited increased resident demand (many due to pre-COVID-19 planned move-ins resuming) as a reason for the acceleration in move-ins.

-

-

- Regarding reasons for a deceleration in move-ins, most organizations continued to cite a slowdown in leads conversions/sales, while considerably more in Wave 10 than in Wave 9 cited resident or family member concerns (60% vs. 38%), presumably due to new spikes of COVID-19 cases in many areas of the country.

Organizations Easing or Increasing Move-In Restrictions

Respondents were asked: “At this point in the pandemic, my organization is…”

-

- Given the resurgence of COVID-19 cases across the country in June and July, organizations with more than one-property were asked to describe whether they were easing or increasing move-in restrictions in some or all geographies. In Wave 10 of the survey, while roughly half (53%) were easing move in restrictions in some or all geographies, about one in five organizations (21%) were increasing move-in restrictions in some or all geographies.

- Among single-site organizations, most (42%) are easing move-in restrictions at this time, while about a quarter (26%) are increasing move-in restrictions.

Organizations Currently Offering Rent Concessions to Attract New Residents and Organizations Experiencing a Backlog of Residents Waiting to Move-In

Respondents were asked: “My organization is currently offering rent concessions to attract new residents,” and “My organization is experiencing a backlog of residents waiting to move-in”

-

- As of Wave 10, about one-third of organizations report they are currently offering rent concessions to attract new residents and/or have a waitlist of new residents waiting to move-in.

Move-Outs

-

-

- Roughly two-thirds of organizations (62% to 67%) in Wave 10 of the survey note no change in the pace of move-outs in the past 30-days across all four care segments, while about one quarter (23% to 27%) report an acceleration in move-outs.

- Compared to the Wave 9 survey, the shares of organizations reporting an acceleration in the pace of move-outs for the independent living and memory care segments increased in the Wave 10 survey, while the assisted living and nursing care segments remained relatively unchanged.

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

-

- In Wave 9, the largest shares of survey respondents reported occupancy improvement across all care segments since the survey began. However, in Wave 10, more organizations with independent living and memory care units note a month-over-month decline in occupancy, while organizations with assisted living report a month-over-month increase in occupancy—the highest in the survey time series (March 24 to August 2, 2020).

- The nursing care segment continued to have the largest shares of organizations with increasing month-over-month occupancy. In Wave 10, approximately half (53%) reported an upward change in occupancy from the month prior (also the highest in the survey time series for the nursing care segment).

-

-

- Regarding the change in occupancy from one week ago—while each of the care segments in the Wave 9 survey showed the smallest shares of organizations reporting occupancy declines since the survey began—the Wave 10 survey shows a slight decline in the shares of organizations reporting increasing occupancy from a week prior for the independent living, memory care, and nursing care segments. Slightly more organizations with assisted living units report an increase in week-over-week occupancy.

Improvement in Access to PPE and COVID-19 Testing Kits

Respondents were asked: “Considering access to PPE (personal protective equipment) and COVID-19 testing kits, my organization has experienced that access has improved… Very little, it is still difficult to obtain enough PPE/testing kits in most markets/Somewhat, in some markets it is easier to obtain PPE/testing kits than in others/Considerably, we typically have no difficulty obtaining PPE/testing kits, regardless of market”

-

- In the Wave 10 survey (late July to early August), similar to Wave 8 (late May to early June), more than one-quarter of organizations (29%) report that it is still very difficult to obtain enough COVID-19 testing kits in most markets, and 17% report difficulty accessing PPE.

Time Frames for Receiving Back COVID-19 Test Results

Respondents were asked: “Regarding COVID-19 test results (either for staff, residents or prospective residents) results typically come back within…”

-

-

- Two-thirds of organizations reported that COVID-19 test results for staff, residents or prospective residents are typically available in 3-5 days. However, one in five say it is taking 7 or more days to receive results.

Supporting Property Staff

Respondents were asked: “My organization is supporting property staff who may be experiencing challenges by providing… (Choose all that apply)” Note: this question has not been asked since Wave 3.

-

- More organizations in Wave 10 (July 20-August 2) than earlier in the pandemic in Wave 3 (April 13-April 19) report offering staff flexible work hours, while fewer report offering additional paid sick leave.

-

-

- With regard to mitigating labor shortages, the proportion of organizations offering overtime hours has remained steady at 85% and 84% (Wave 10 compared to Wave 3, respectively). However, slightly more report tapping agency or temp staff to fill staffing vacancies (42% vs. 36%). Many are supporting staff with pay incentives.

Development Pipeline Considerations

Respondents were asked: “My organization’s projected development pipeline going forward is expected to… (Choose all that apply)” Note: this question has not been asked since Wave 3.

-

- More respondents in the Wave 10 survey (July 20-August 2, 2020) compared to the Wave 3 survey (April 13-19, 2020) expect an increase in their development pipelines going forward (30% vs. 15%).

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. NIC also thanks both ASHA and Argentum for their support in encouraging participation in the Executive Survey Insights: COVID-19 survey. The results of our joint efforts to provide timely and informative data to the market in this challenging time have been significant and noteworthy. The Executive Survey Insights: COVID-19 survey is now open. To respond to the survey, please click here.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the upcoming Executive Survey: Market Fundamentals (which will start again on Monday, August 17), please send a message to insight@nic.org to be added to the email distribution list.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck