NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the sector.

This Wave 11 survey sample includes responses collected August 17-30, 2020 from owners and executives of 56 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 11 Summary of Insights and Findings

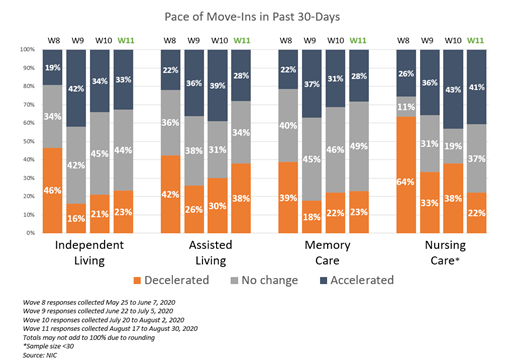

Over the summer months, much of the southern and western portions of the nation experienced a surge in COVID-19 outbreaks. More recently, this has been followed by a flattening in the number of new cases reported daily. Although some areas of the country are seeing increasing cases of COVID-19, many seniors housing and care organizations are continuing to ease move-in restrictions. The Wave 11 survey revealed generally little change in the pace of move-ins and move-outs in the past 30-days from Wave 10, and greater shares of organizations with higher levels of acuity in their properties—nursing care beds and memory care units—reporting month-over-month and week-over-week improvements in occupancy rates. About half (48%) of organizations with independent living units and 40% with assisted living units report no change in month-over-month occupancy. More organizations with assisted living units note a deceleration in the pace of move-ins and slower increase in occupancy rates than in Wave 10.

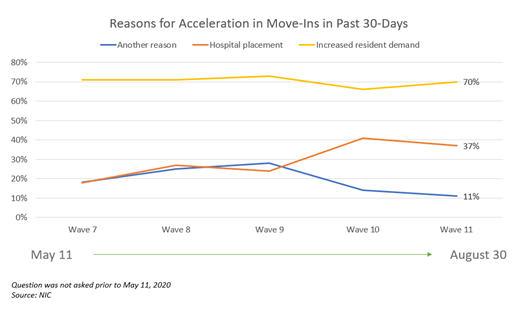

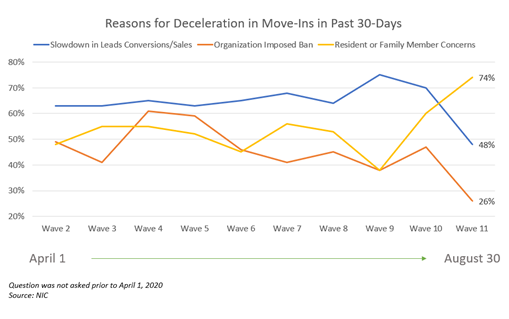

- In Wave 11 of the survey, increased resident demand continued to be cited as the primary reason for accelerations in move-ins in the past 30-days (70%), and notably fewer organizations in Wave 11 than in Wave 10 cited a slowdown in leads conversions/sales (48% vs. 70%). Hospital placement (due to more elective surgeries and rehabilitation therapies resuming) has grown considerably since Wave 9 (responses collected June 22 to July 5, 2020). However, notably more organizations in Wave 11 than in all of the prior waves of the survey cited resident or family member concerns (74%), presumably due to new spikes of COVID-19 cases in many areas of the country or possibly due to restrictions on family member visitation rules imposed by some states.

- The shares of organizations reporting acceleration in move-ins in Wave 11 of the survey remained similar to Wave 10 for the independent living, memory care and nursing care segments. However, fewer organizations with assisted living in Wave 11 than in the prior two waves of the survey report an acceleration in the pace of move-ins, and more than one-third (38%) note a deceleration.

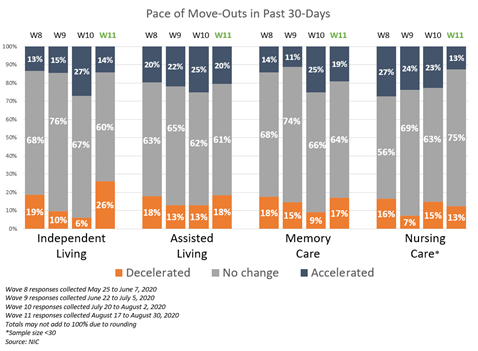

- Compared to the Wave 10 survey (and all prior waves, as well), the shares of organizations reporting a deceleration in the pace of move-outs for the independent living care segment increased to the highest level in the Wave 11 survey. Most organizations with independent living, assisted living and/or memory care segments (60% to 64%) note no change in the pace of move-outs in the past 30-days, while about three-quarters with nursing care beds (75%) report no change.

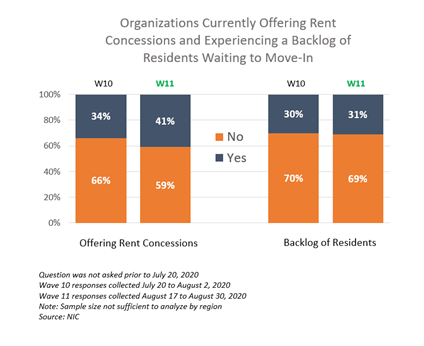

- Most organizations are not currently offering rent concessions to attract new residents (59%). That said, more organizations report offering rent concessions in Wave 11 than in the prior survey (41% vs. 34%). While, one-third of organizations report a backlog of residents waiting to move in, the majority of organizations—about seven in ten—do not.

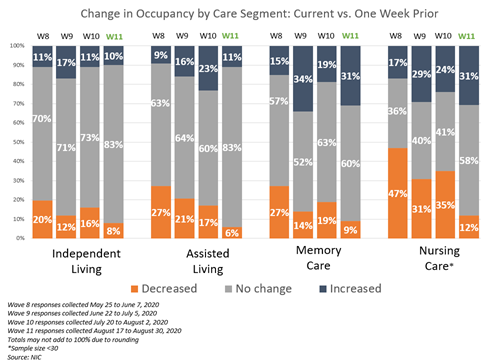

- Larger shares of organizations with memory care units and/or nursing care beds in their properties report increasing occupancy from one week prior (31%, respectively)—an improvement from Wave 10 but similar to Wave 9. However, four out of five organizations with independent living and/or assisted living care units (83%, respectively) report no change in week-over-week occupancy.

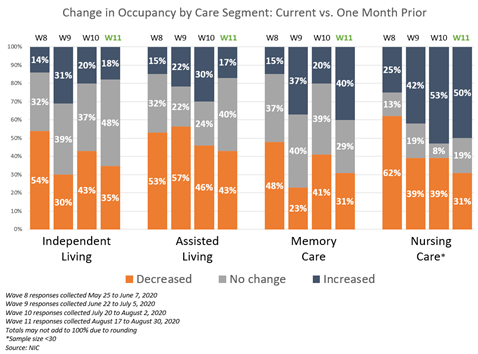

- Organizations with nursing care beds continue to report the largest shares of increasing occupancy on a month-over-month basis. In Wave 11, half (50%) report an upward change in occupancy from the month prior, similar to Wave 10 (53%). Additionally, more organizations with memory care units note increases in occupancy (40% vs. 20%).

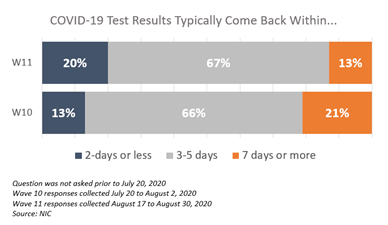

- Two-thirds of organizations in Waves 10 and 11 reported that COVID-19 test results for staff, residents or prospective residents are typically available in 3-5 days (67%). However, one in five (20%) received test results in as few as 2-days—an improvement since Wave 10 (13%).

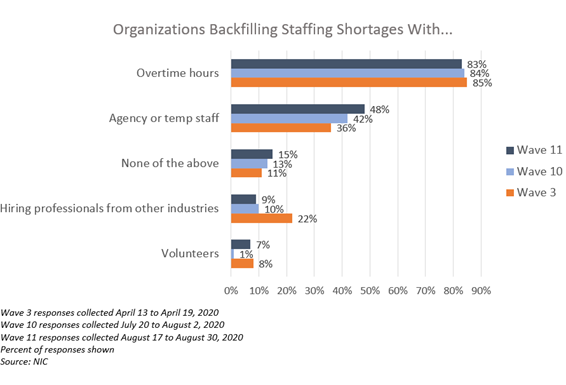

- Due to the pandemic most organizations (83%-85%) have bolstered staffing deficiencies with additional overtime hours. Additionally, a growing percentage of survey respondents report tapping agency or temp staff (48% in Wave 11 vs. 36% in Wave 3) adding to increasing costs since the pandemic began.

Wave 11 Survey Demographics

- Responses were collected August 17-30, 2020 from owners and executives of 56 seniors housing and skilled nursing operators from across the nation. Roughly half of respondents are exclusively for-profit providers (56%), about one-third (33%) are exclusively nonprofit providers, and 11% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 59% of the sample. Operators with 11 to 25 properties make up 18% while operators with 26 properties or more make up 23% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 72% of the organizations operate seniors housing properties (IL, AL, MC), 24% operate nursing care properties, and 39% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

- In Wave 11, fewer organizations with assisted living reported an acceleration in the pace of move-ins than in Waves 9 and 10. More than one-third (38%) noted a deceleration.

- However, the shares of organizations reporting acceleration in move-ins in Wave 11 of the survey remained similar to Wave 10 for the independent living, memory care and nursing care segments. In Wave 11, between 33% and 41% of organizations with these care segments indicated that the pace of move-ins accelerated in the past 30-days.

Reasons for Acceleration/Deceleration in Move-Ins

Respondents were asked: “The acceleration/deceleration in move-ins is due to…”

- Increased resident demand continued to be cited most frequently as a reason for an acceleration in move-ins in the past 30-days (70%). Hospital placement cited as a reason for acceleration in move-ins has grown since Wave 9 (responses collected June 22-July 5, 2020).

- Regarding reasons for a deceleration in move-ins, resident or family member concerns reached the highest level in the time series. While notably fewer organizations in Wave 11 than in Wave 10 cited a slowdown in leads conversions/sales (48% vs. 70%), considerably more organizations in Wave 11 than in all of the prior waves of the survey cited resident or family member concerns (74%).

Organizations Easing or Increasing Move-In Restrictions

Respondents were asked to describe whether they were easing or increasing move-in restrictions in some or all of the geographies in which they operate.

- Roughly two-thirds (63%) of organizations with multiple properties in their portfolios were easing move in restrictions in some or all of their geographies in Wave 11, compared to roughly half in Wave 10. About one-third (33%) were neither increasing nor easing move-in restrictions. However, fewer than one in ten (8%) indicated they were increasing move-in restrictions in all of their geographies. Among single-site organizations, roughly half were easing move-in restrictions (47%), but none were increasing move-in restrictions.

Organizations Currently Offering Rent Concessions to Attract New Residents and Organizations Experiencing a Backlog of Residents Waiting to Move-In

Respondents were asked: “My organization is currently offering rent concessions to attract new residents,” and “My organization is experiencing a backlog of residents waiting to move-in”

- Most organizations are not currently offering rent concessions to attract new residents (59%). However, more organizations report offering rent concessions in Wave 11 than in the prior survey (41% vs. 34%). The majority of organizations—about seven in ten—do not currently have a backlog of residents waiting to move in.

Move-Outs

- Roughly two-thirds of organizations with independent living, assisted living and/or memory care segments (60% to 64%) in Wave 11 of the survey note no change in the pace of move-outs in the past 30-days, while about three-quarters with nursing care beds (75%) report no change. This has been largely consistent since the survey began in March.

- Compared to the Wave 10 survey (and all prior waves, as well), the shares of organizations reporting a deceleration in the pace of move-outs for the independent living care segment increased to the highest level in the Wave 11 survey.

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

- Many organizations continue to report improvements in occupancy rates since the beginning of the survey in March. The nursing care segment had the largest shares of organizations with increasing month-over-month occupancy. In Wave 11, half (50%) report an upward change in occupancy from the month prior, similar to Wave 10 (53%) and the most since NIC began conducting this survey.

- In Wave 11, about half (48%) of organizations with independent living and 40% with assisted living report no change in month-over-month occupancy.

- Fewer organizations with assisted living units in Wave 11 than in Wave 10 report increases in occupancy rates (17% vs. 30%), however, more organizations with memory care units note increases in occupancy (40% vs. 20%).

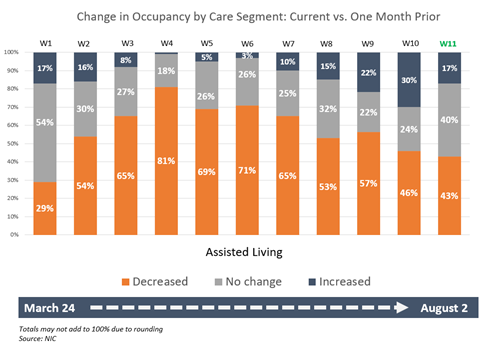

- The chart below shows the entire time series of assisted living care segment month-over-month occupancy change data for each wave of the survey between March 24 and August 30, 2020. The data is illustrative of effects of the pandemic on seniors housing occupancy rates during the pandemic and the trend is similar to the NIC MAP® Intra-Quarterly Snapshot data reported beginning in March.

- Indeed, the new Intra-Quarterly database shows that the largest decline in assisted living stabilized occupancy occurred early during the second quarter in the April reporting period, the first full month of the COVID-19 pandemic in the US. In the April reporting period (defined as the February-March-April rolling period), occupancy for assisted living for the Primary Markets fell 1.8 percentage points to 86.0%. The decline in May was less at 0.8 percentage point (to 85.2%), and the decline in June was even less at 0.6 percentage point (to 84.6%). However, in July, the drop in occupancy accelerated to a full 1.7 percentage points to push the overall rate to 82.9%. Total occupancy was even lower at 80.5%, a new record low. This decline, after two months of seemingly better occupancy patterns, likely reflects the recent growth in COVID-19 cases in many parts of the country.

- In Wave 4 of the survey (responses collected April 20-April 26, 2020) four out of five of organizations reported occupancy declines from one month prior (81%). Occupancy rates began to improve in Wave 8 (responses collected May 25-June 7, 2020), with the highest shares of organizations reporting increases in occupancy in Wave 10 than at any other time during the survey (30%).

- In Wave 11, the largest share of organizations with assisted living report no change in month-over-month occupancy (40%) since Wave 1 of the survey when about half indicated no change (54%).

- Regarding the change in occupancy from one week ago—about four out of five organizations with independent living and assisted living care segments (83%, respectively) report no change in week-over-week occupancy. However, larger shares of organizations with memory care units and/or nursing care beds in their properties report increasing occupancy from one week prior (31%, respectively)—an improvement from Wave 10 but similar to Wave 9.

Time Frames for Receiving COVID-19 Test Results

Respondents were asked: “Regarding COVID-19 test results (either for staff, residents or prospective residents) results typically come back within…”

- Two-thirds of organizations continue to report that COVID-19 test results for staff, residents or prospective residents are typically available in 3-5 days, however, more organizations in Wave 11 received test results within 2 days than in Wave 10 (20% vs. 13%).

Labor and Staffing

Respondents were asked: “My organization is backfilling property staffing shortages by utilizing … (Choose all that apply)”

Note: this question was asked in Wave 3, Wave 10 and Wave 11.

- Respondents offering overtime hours has remained steady (between 83% and 85%) with regard to backfilling staffing shortages since the beginning of the pandemic. However, organizations are increasingly using agency or temp staff to fill staffing vacancies. In Wave 11, roughly half of respondents are tapping agency or temp staff to mitigate staffing shortages.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. The results of our joint efforts to provide timely and informative data to the market in this challenging time have been significant and noteworthy.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the upcoming Executive Survey: Market Fundamentals, please send a message to insight@nic.org to be added to the email distribution list.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck