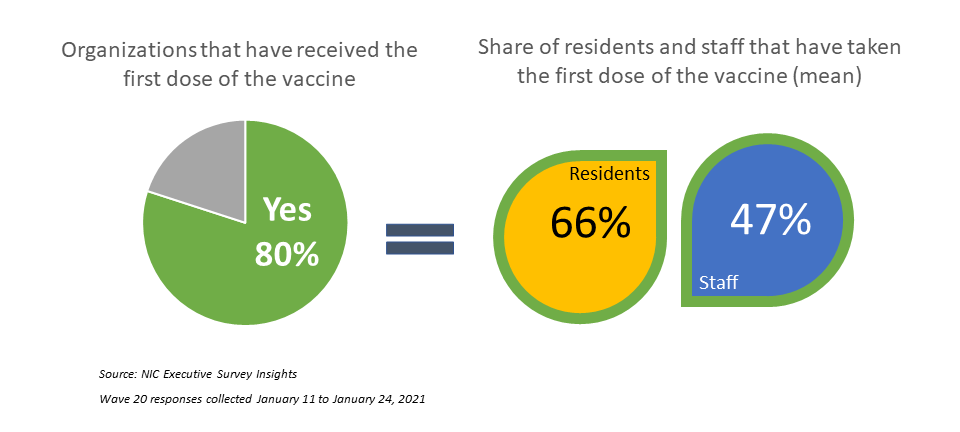

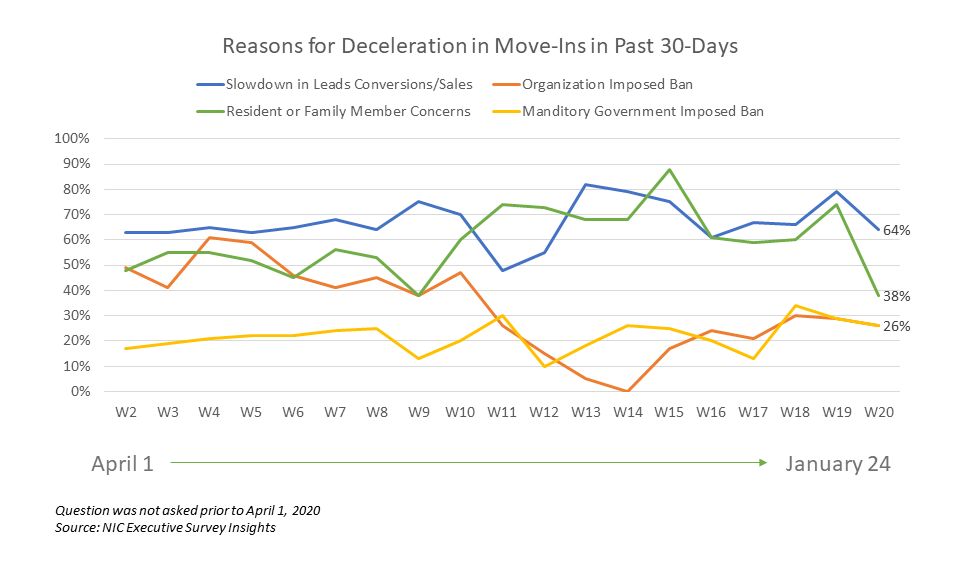

“A compelling departure from recent surveys, significantly fewer respondents in the Wave 20 survey cited resident or family member concerns as a reason for slower pace of move-ins and/or faster pace of move-outs the past 30-days—and notably fewer survey respondents cited a slowdown in leads conversions/sales. The CDC reports that more than 2.7 million doses of the COVID-19 vaccine had been administered as of January 26 to residents in nursing care, assisted living communities, and other senior living settings. According to Wave 20 survey respondents, four out of five organizations have had their first clinic. Of those organizations, on average, two-thirds of residents (66%) and nearly one-half of staff (47%) have received the first dose of the vaccine, and nine out of ten respondents anticipate that all residents willing to take the vaccine will be vaccinated within two months. More consumers having access to the vaccine in an environment where infection mitigation is the highest priority may encourage prospective residents to move in and improve future occupancy rates.”

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change. This Wave 20 survey includes responses collected January 11 to January 24, 2021 from owners and executives of 92 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Additionally, the full range of time series data for each wave of the survey by care segment for move-ins, move-outs and occupancy rate changes can be found HERE.

Wave 20 Summary of Insights and Findings

- Long-anticipated as a game-changer with regard to improving occupancy, seniors housing and care operators are currently holding vaccination clinics for their residents and staff. In December, the CDC prioritized skilled nursing and assisted living residents and staff members in phase 1a of the COVID-19 vaccine distribution. According to Wave 20 survey respondents, four out of five organizations have had their first clinic. On average, two-thirds of residents (66%) and nearly one-half of staff (47%) have received the first dose of the vaccine, and nine out of ten respondents anticipate that all residents willing to take the vaccine will be vaccinated within two months.

- A few survey respondents shared caveats regarding vaccine availability and percentage of residents and staff who received their first dose of the vaccine. Due to varied local vaccine allocations on phases 1a and 1b, or only being able to vaccinate nursing care residents while independent living residents were still waiting for vaccination dates, some said their responses were skewed lower compared to total population.

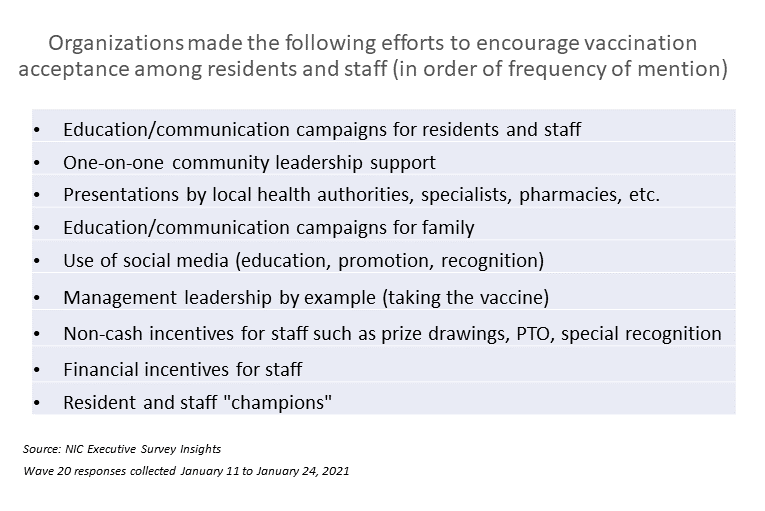

- Four out of five respondents indicated that educating and motivating staff to take the vaccine was a challenge in distributing the vaccine. To mitigate these challenges, operators are implementing a variety of strategies to encourage and improve vaccine acceptance.

- Mentioned most frequently, early and continued education and robust communication campaigns including print, digital and social media to residents, staff and families about the benefits and risks of the vaccine were strategies noted by all respondents. Other approaches included one-on-one, open-door discussions with community and corporate leadership to answer questions and allay concerns, hosting webinars and holding virtual and town hall discussions with local health authorities and pharmacy partners, management leading by example by taking the vaccine publicly, financial incentives and non-cash prizes for special recognition, utilizing testimonials from resident and staff “champions” of the benefits (and lack of side effects) of the vaccine, and paring up vaccination “buddies” to encourage clinic participation. [Detail on measures some communities are taking to encourage vaccine acceptance among staff can be found in the NIC Notes Blog.]

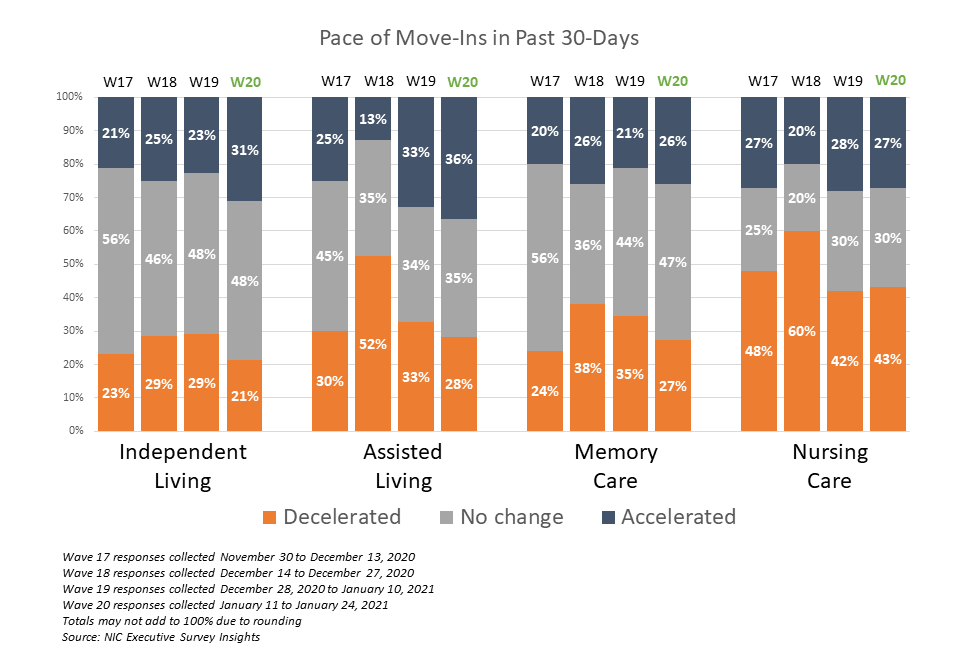

- In the Wave 20 survey, there was some improvement in the pace of move-ins for each of the care segments except the nursing care segment. The shares of organizations reporting an acceleration in the pace of move-ins in the past 30-days is higher than the portion of organizations reporting decelerations for independent living and assisted living (an improvement for these two care segments since the Wave 14 and 15 surveys conducted in October, reflecting operator experiences in early Fall), but equal for memory care. More organizations with nursing care beds have reported decelerations than accelerations in move-ins for the past seven waves of the survey. The full range of time-series data can be viewed here.

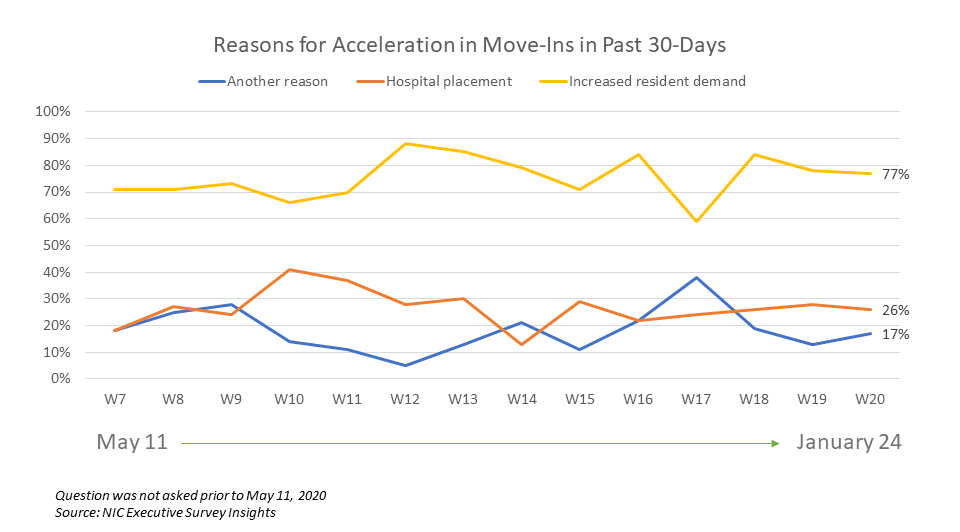

- The share of organizations citing increased resident demand as a reason for acceleration in the pace of move-ins remained high (77%) in the Wave 20 survey but down from a recent high of 86% in the Wave 16 survey, conducted in mid-November. Presumably for various reasons including anecdotal reports of more hospital discharges of patients to home health, and elective surgeries on hold in some locales hard hit by the coronavirus, hospital placement cited as a reason for acceleration in the pace of move-ins (26%) continued to lag the survey time series high of 41% reached in Wave 10, conducted in late July. Other reasons for faster pace of move-ins mentioned by respondents included admissions restrictions being lifted and COVID-19 vaccination clinics having been started.

- Significantly fewer respondents in the Wave 20 survey cited resident or family member concerns than in the Wave 19 survey (38% vs. 74%), and notably fewer cited a slowdown in leads conversions/sales (64% vs. 79%) as reasons for deceleration in move-ins in the past 30-days.

- Approximately one-third of respondents (31%) noted that their organizations had a backlog of residents waiting to move-in. This is just below the high point (34%) reached in the Wave 16 survey conducted in mid-November, and higher than Waves 17 and 19 conducted in December and early January (26%).

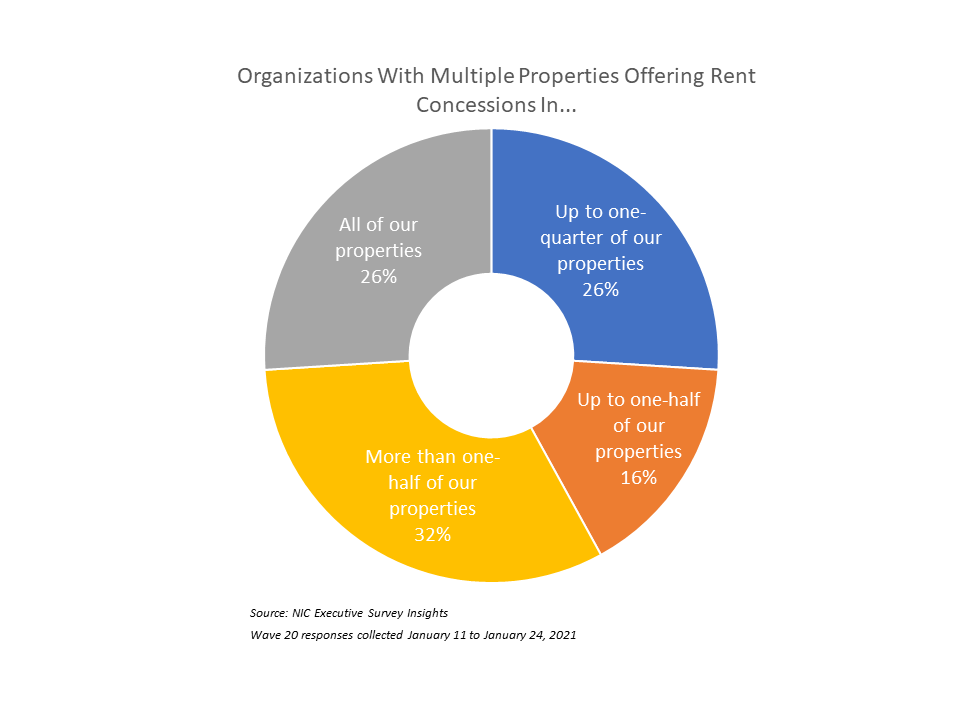

- Between 50% to 60% of survey respondents have consistently reported offering rent concessions to attract new residents since the Wave 13 survey conducted in late-September to early-October. Among organizations with multiple properties that were offering rent concessions in the Wave 20 survey, one in three (32%) were offering rent concessions in more than one-half of their properties, and one in four (26%) were offering rent concessions in all of their properties.

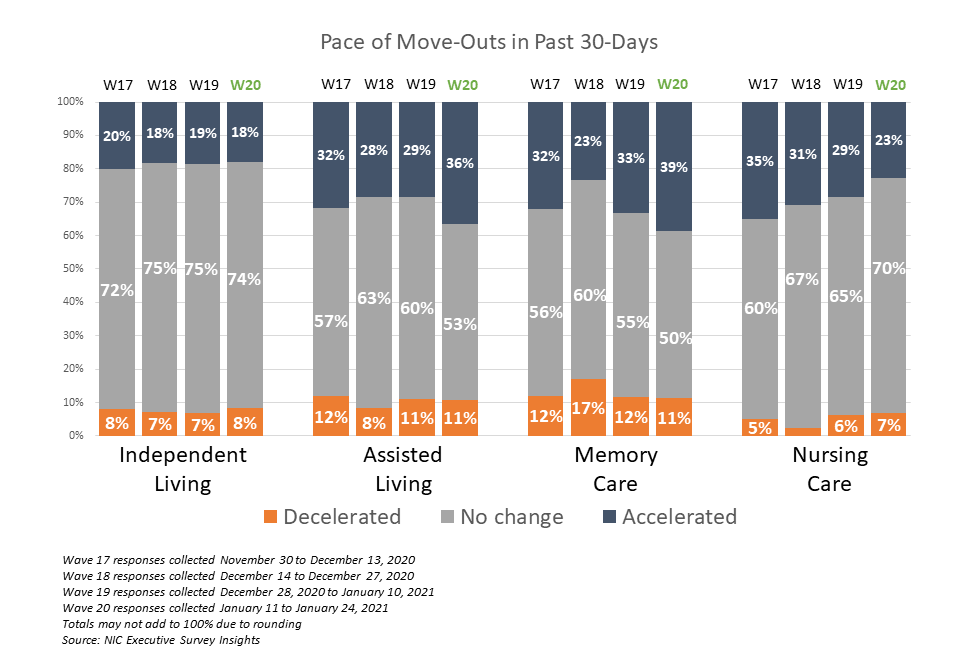

- As shown in the chart below, more organizations with assisted living and/or memory care units in the Wave 20 survey than at any other time in the survey time series reported accelerations in the pace of move-outs in the past 30-days. That said, fewer organizations with nursing care beds noted acceleration in the pace of move-outs than in the past five waves of the survey dating back to Wave 15 conducted late-October to early November. Presumably in part due to operator innovations in infection mitigation and creative visitation protocols which have gained acceptance from many residents and families, respondents citing resident or family member concerns as a reason for acceleration in move-outs is at the lowest level in the survey time series (23%). The full range of time-series data can be viewed here.

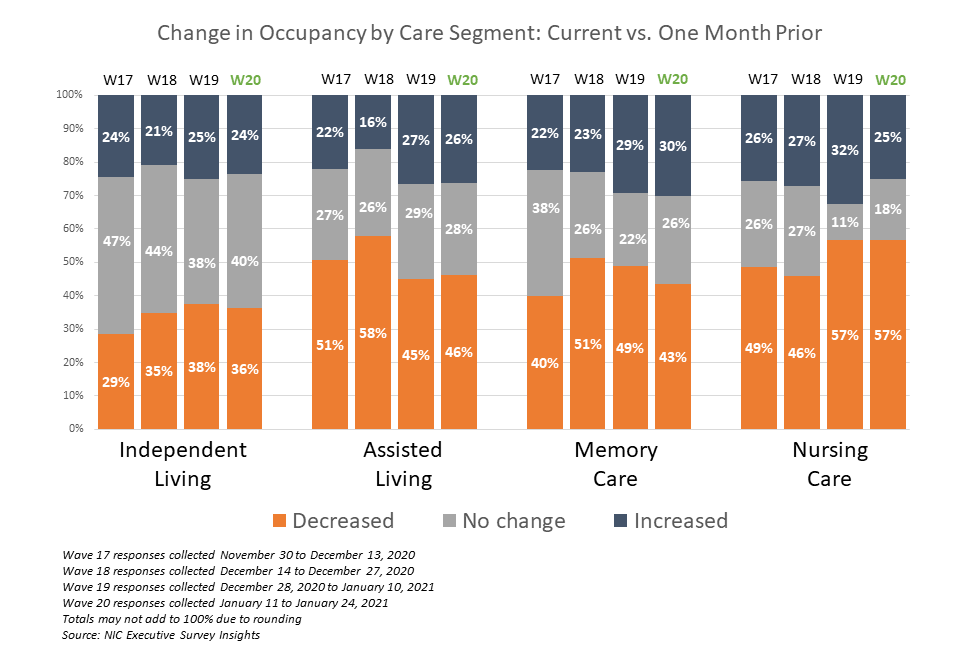

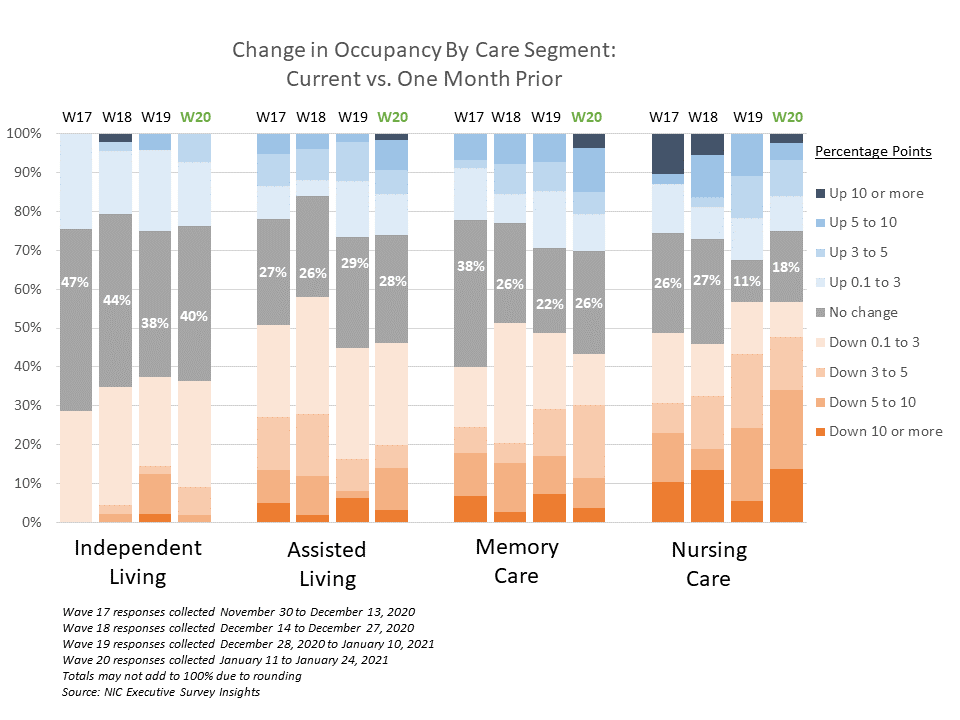

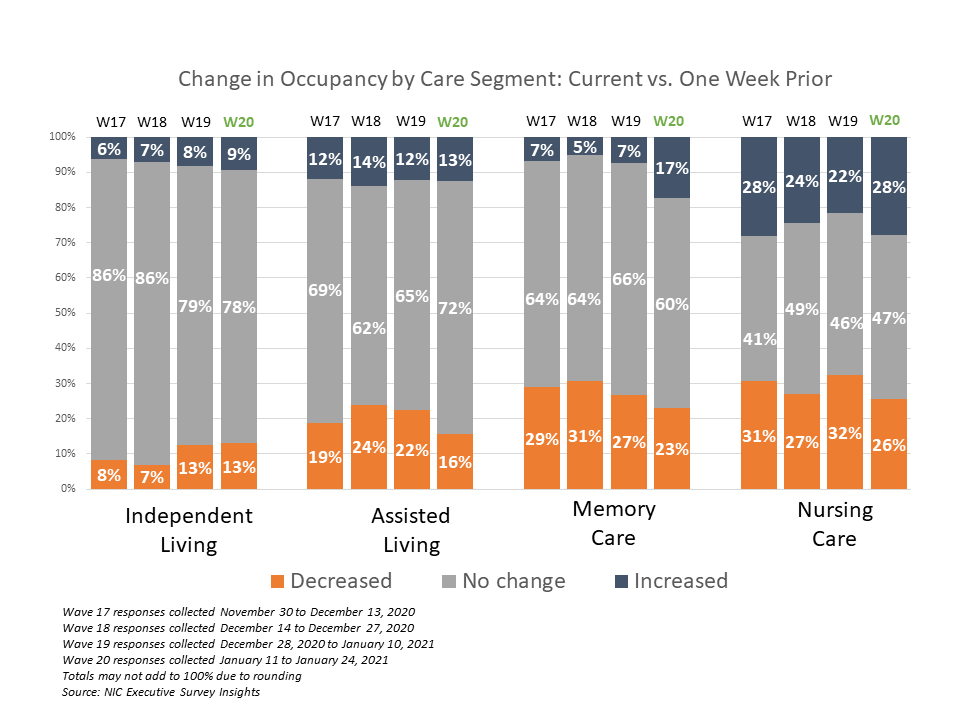

- For each of the care segments, the shares of organizations reporting occupancy declines continued to outpace those reporting higher occupancy. Considering recent survey data, this trend began in the Wave 16 survey conducted in mid-November (reflecting experiences that occurred during the beginning of the Fall surge in coronavirus cases in October). Essentially unchanged from the Wave 19 survey, between 46% and 57% of organizations with assisted living units, memory care units and/or nursing care beds, and 36% with independent living units, reported declines in occupancy in the past 30-days. The full range of time-series data can be viewed here.

- The chart above shows that in Waves 19 and 20, an equal proportion of operators with nursing care beds (57%) reported declines in occupancy rates. The chart below describes the degree of those occupancy rate changes and illustrates that more organizations with nursing care beds in Wave 20 reported deeper declines than in Wave 19. (The blue and orange-hued stacked bars correspond to the solid bars in the chart above indicating the degree of change by the saturation of color.) In the Wave 19 survey, more than one-third of respondents (38%) reported occupancy decreases of between three and ten percentage points. However, in the Wave 20 survey, nearly one-half had reported the same (48%).

- Similar to past surveys, differences in week-over-week occupancy rates typically result in little change. However, the memory care and nursing care segments show higher shares of respondents reporting occupancy rate increases from one week prior in Wave 20 compared to Wave 19 (17% vs. 7% and 28% vs. 22%, respectively).

Wave 20 Survey Demographics

- Responses were collected between January 11 and January 24, 2021 from owners and executives of 92 seniors housing and skilled nursing operators from across the nation. Just over half of respondents are exclusively for-profit providers (56%), one-third are nonprofit providers (32%), and 12% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise just over half of the sample (58%). Operators with 11 to 25 properties make up about one-quarter of the sample (22%), while operators with 26 properties or more make up 20% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 65% of the organizations operate seniors housing properties (IL, AL, MC), 31% operate nursing care properties, and 36% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By providing real-time insights to the longest running pulse of the industry survey you can help ensure the narrative on the seniors housing and care sector is accurate. By demonstrating transparency, you can help build trust.

“…a closely watched Covid-19-related weekly survey of…operators

conducted by the National Investment Center for Seniors Housing & Care…”

The Wall Street Journal | June 30, 2020

The Wave 21 survey is available and takes 5-10 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck