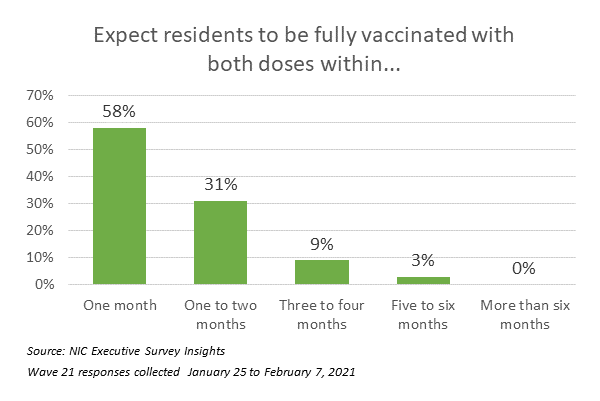

“Significant headway is being made to vaccinate residents and staff in seniors housing and care communities. According to 84 small, medium, and large seniors housing and skilled nursing operators from across the country—ranging in size from single-building operators to operators with hundreds of buildings across their portfolios of properties—considering all care segments, approximately 80% of residents and 50% of staff have received their first dose of the COVID-19 vaccine on average, and about 60% of residents and 45% of staff have received their second dose. While educating and motivating staff to be vaccinated continues to be cited as a challenge, the majority of organizations have not made the vaccine mandatory. Although one-quarter of respondents noted an increase in prospect interest specifically related to the availability of the vaccine, the survey data has yet to show an upward trend in occupancy. It will be interesting to see when the trend begins to reverse with greater penetration of the COVID-19 vaccine in the coming weeks and months.”

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space as market conditions continue to change. This Wave 21 survey includes responses collected from January 25 to February 7, 2021, from owners and executives of 84 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Additionally, the full range of time series data for each wave of the survey by care segment for move-ins, move-outs, and occupancy rate changes can be found HERE.

Wave 21 Summary of Insights and Findings

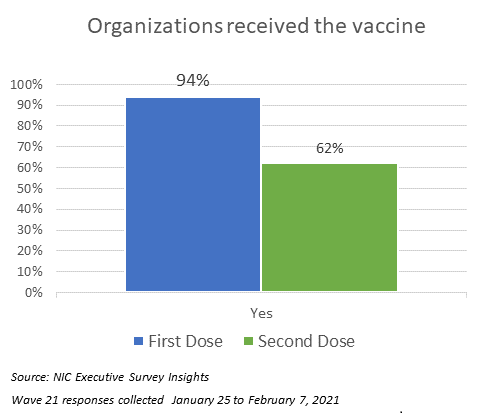

- Most organizations that responded to the Wave 21 survey, which ended on February 7, had already finished their first COVID-19 vaccine clinics, and many, but not all, have started their second clinics. Nine out of ten have had their first clinic (94%), while two out of three (62%) have had their second clinic. Among those organizations that have received the second dose and have more than three properties in their portfolios, over half (57%) have received it in up to 25% of their properties, and one-third (32%) have received the second dose in 50% to 75% of their properties.

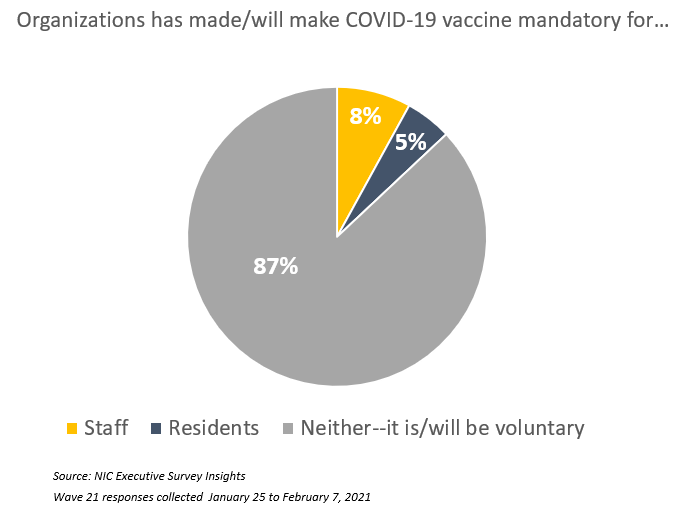

- Four out of five organizations in Waves 20 and 21 indicated that educating and motivating staff to take the vaccine was a challenge (the Wave 20 survey report detailed strategies by operators to encourage and improve vaccine acceptance; Wave 21 measures those strategies for change). The majority of organizations have not made the COVID-19 vaccine mandatory for residents and/or staff (87%). Whether or not the vaccine remains voluntary for most organizations will continue to be monitored in Wave 22 of the survey as anecdotal comments by some operators suggest that unless staff vaccination rates improve, mandatory vaccination may be considered.

- According to Wave 21 survey respondents, approximately 80% of residents and 50% of staff of seniors housing and care properties—considering all care segments across their portfolios of properties—have received their first dose of the COVID-19 vaccine on average, and about 60% of residents and 45% of staff have received their second dose. This CDC report offers comparison data regarding vaccine coverage among more than 11,000 skilled nursing facilities in their first clinic conducted during the first month of the CDC Pharmacy Partnership for Long-Term Care Program.

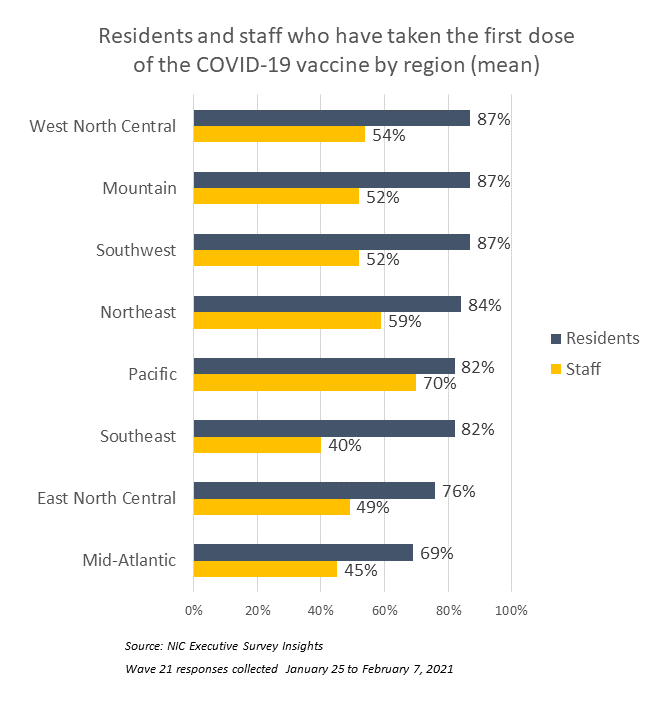

- The chart below shows the average of survey respondents’ residents and staff that have taken the first dose of the COVID-19 vaccine, by region. The East North Central and Mid-Atlantic regions were the lowest for residents—averaging 76% and 69%, respectively. The Southeast and Mid-Atlantic regions were the lowest for staff—averaging 45% and 40%, respectively. It is important to note that vaccine distribution rates depend on a variety of factors including but not limited to supply and demand, acceptance, and vaccination administration logistics.

- Vaccination administration logistics was a challenge for roughly 40% of organizations in Waves 20 and 21. Many operators indicated that their organizations have experienced varying levels of disorganization, confusion, and delays in terms of the pharmacy program in vaccinating residents. Some organizations mentioned that they are working to provide resources and information for their independent living residents on where they can get the vaccine on their own in some states, including Florida and California.

- Many operators have been eagerly anticipating a boost in occupancy due to the COVID-19 vaccine availability. Although about one-quarter of organizations responding to the Wave 21 survey note an increase in prospect interest specifically related to the vaccine, most (67%) do not, suggesting other influential factors. For example, the share of organizations citing increased resident demand (86%) as a reason for acceleration in the pace of move-ins in the past 30-days is at the highest level since the Wave 12 survey. Additionally, respondents citing resident or family member concerns as a reason for acceleration in move-outs continues to trend at its lowest level (20%) due in part to operator innovations in infection mitigation and creative visitation protocols which have gained acceptance from many residents and families, quelling move-outs due to the virus. (Some organizations have branded programs to the marketplace highlighting their commitment to safety and health protocols).

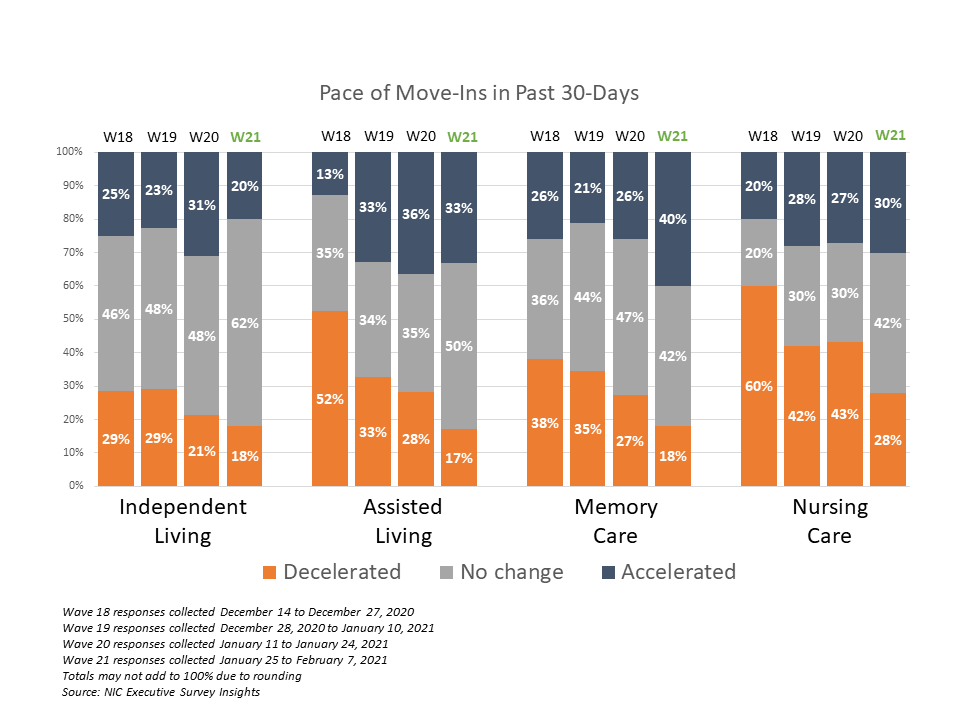

- In Wave 21, the shares of organizations reporting acceleration in the pace of move-ins is higher than the portion of organizations reporting deceleration for each of the care segments. Furthermore, organizations reporting deceleration in the pace of move-ins has shrunk across each of the care segments over the past three waves of the survey.

- While the independent living care segment saw the least change in the pace of move-ins, with 62% of organizations noting no change, more organizations with memory care units reported acceleration in the past 30 days (40%) than in eight prior waves of the survey (reflecting operators’ experiences in mid to late August).

- Substantially fewer respondents in Wave 21 noted that their organizations had a backlog of residents waiting to move in (15%)—lower than at any time since the question was first asked in late July, and down from approximately one-third of respondents in the prior survey. Possible reasons may include typical seasonality experienced during the winter months and fewer organizations offering rent concessions to support sales. In the Wave 21 survey, the fewest respondents reported offering rent concessions to attract new residents (45%) since mid to late August. Another possible reason may include less turnover of inventory. The pace of move-outs slowed in the Wave 21 survey. Between 75% and 82% of organizations noted no change or deceleration in the pace of move-outs in the past 30-days for each of the care segments.

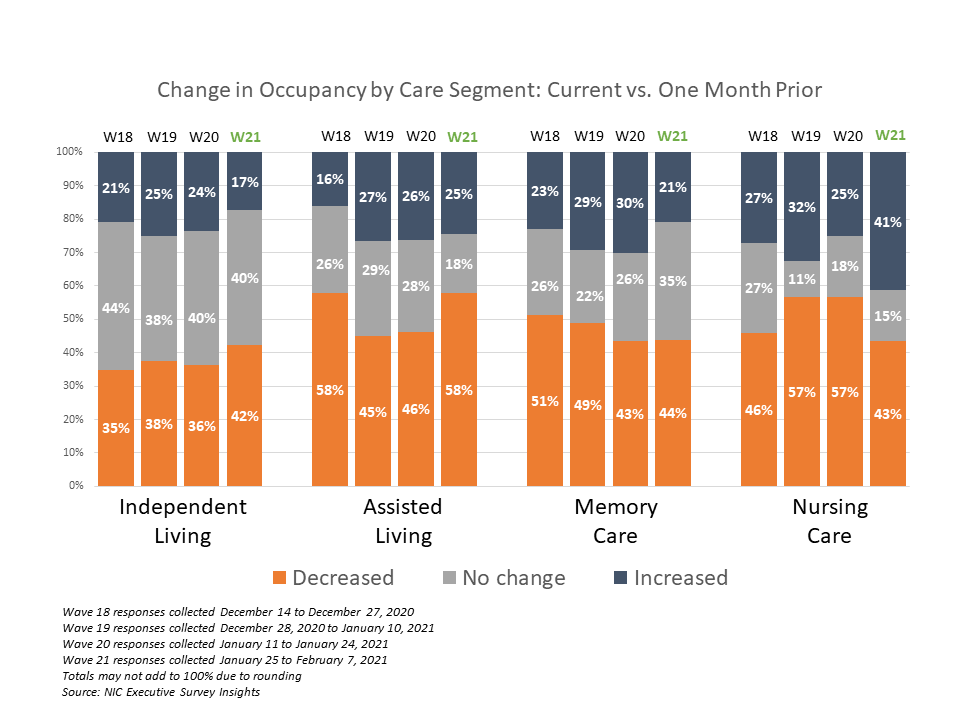

- Reflecting operators experiences at the end of 2020, the Wave 21 survey data has yet to show an upward trend in occupancy. For each of the care segments, the shares of organizations reporting occupancy declines in the past 30-days (across their portfolios of properties) continued to outpace those reporting higher occupancy. It will be interesting to see if the data that has been trending this way since the Fall surge of the coronavirus begins to reverse with greater penetration of the COVID-19 vaccine in the coming weeks and months.

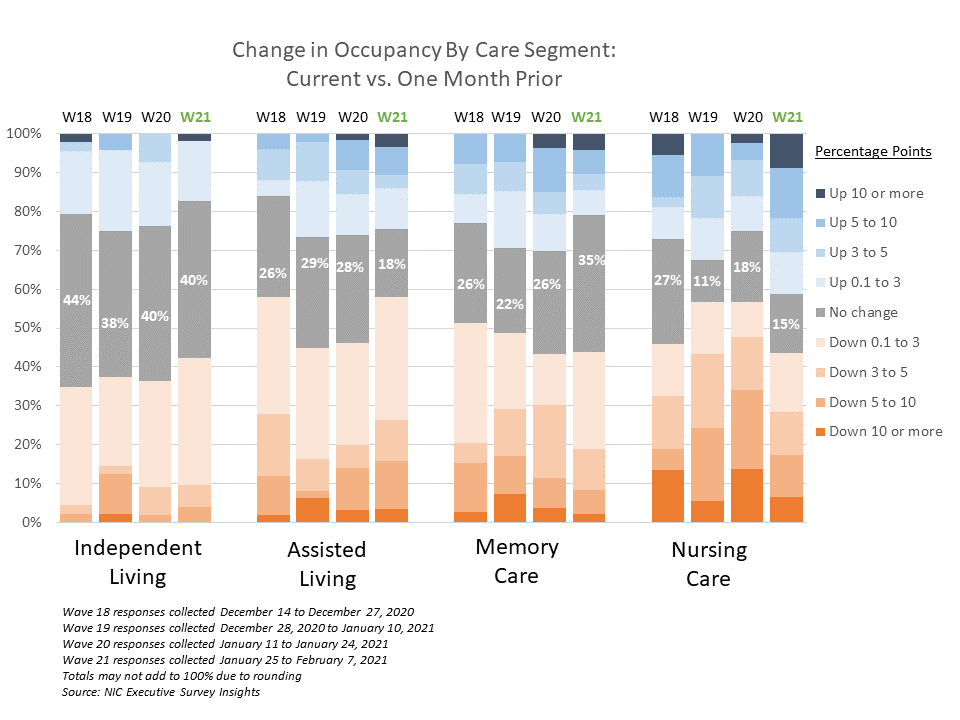

- The chart above shows that in Wave 21, 41% of organizations with nursing care beds reported increasing occupancy rates. The chart below describes the degree of those occupancy rate changes and illustrates that more organizations with nursing care beds in Wave 21 reported stronger increases than in the prior three waves of the survey. (The blue and orange-hued stacked bars correspond to the solid bars in the chart above indicating the degree of change by the saturation of color.) In the Wave 21 survey, about one-third of respondents with nursing care beds (31%) reported occupancy increases of three percentage points or more. However, in the Wave 20 survey, fewer than one-fifth had reported the same (16%).

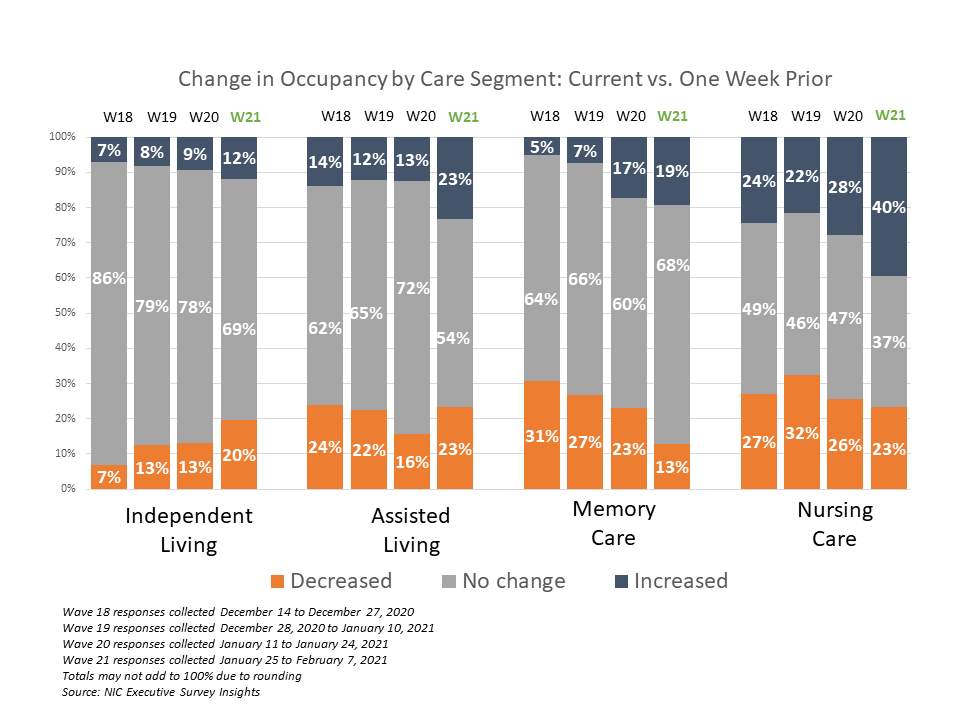

- Similar to past surveys, differences in week-over-week occupancy rates typically result in little change. However, the assisted living and nursing care segments show higher shares of respondents reporting occupancy rate increases from one week prior in Wave 21 compared to Wave 20 (23% vs 13% and 40% vs. 28%, respectively).

Wave 21 Survey Demographics

- Responses were collected between January 25 and February 7, 2021 from owners and executives of 84 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise just over half of the sample (58%). Operators with 11 to 25 properties make up about one-quarter of the sample (26%), while operators with 26 properties or more make up 15% of the sample.

- About one-half of respondents are exclusively for-profit providers (47%), two out of five (41%) are nonprofit providers, and 12% operate both for-profit and nonprofit seniors housing and care organizations.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 68% of the organizations operate seniors housing properties (IL, AL, MC), 36% operate nursing care properties, and 45% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By demonstrating transparency, you can help build trust. The survey results and analysis are frequently referenced in media reports on the sector including in McKnight’s publications, Mortgage Professional America Magazine, Senior Housing News, Multi-Housing News, and other industry-watching media outlets. The surveys’ findings have also been mentioned in stories by Kaiser Health News, CNN, the Wall Street Journal, and other major news outlets across the U.S.

The Wave 22 survey is available and takes 5-10 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck