“On one hand, the market fundamentals continue to show signals of progress due to the availability and widespread distribution of the COVID-19 vaccine among America’s seniors—on the other hand, staffing challenges and wage pressures are continuing to put strain on NOI for many operators. These data from the Wave 25 survey support trending improvement in the pace of move-ins and in occupancy rates across each of the care segments. However, staffing shortages that were experienced by many operators prior to and exacerbated by the pandemic persist. Currently, two-thirds of organizations report staffing shortages within their portfolio of properties. Adding to the challenge, nearly all respondents to the Wave 25 survey were paying staff overtime hours, and four out of five organizations were tapping agency/temp staff. The Wave 26 survey currently collecting data will explore strategies operators are implementing to attract staff.”

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space as market conditions continue to change. This Wave 25 survey includes responses collected March 22 to April 4, 2021 from owners and executives of 64 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 25 Summary of Insights and Findings

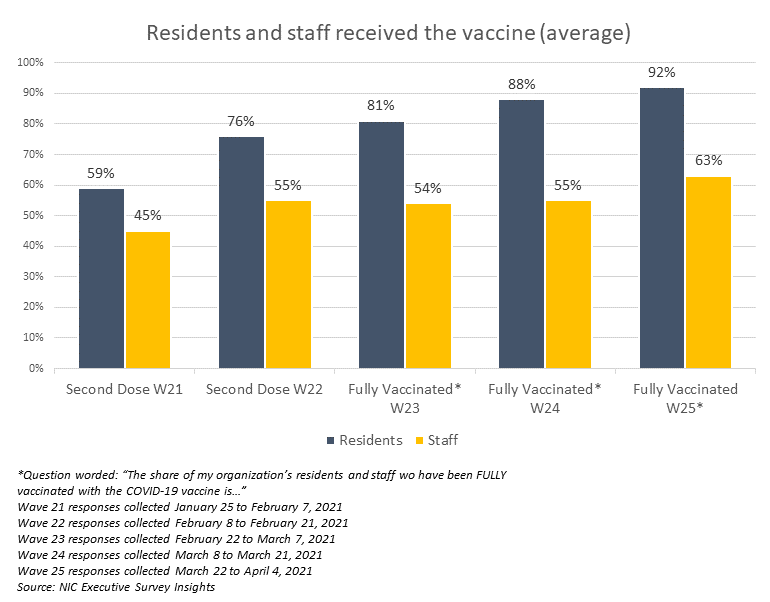

- According to Wave 25 seniors housing and care survey respondents, on average, nine out of ten residents (92%) of their respective properties—including all care segments across their portfolios—have been fully vaccinated. From late January to the present, resident uptake of the vaccine has steadily increased. Staff uptake of the vaccine, however, leveled off between Waves 22 and 24 and has just recently increased slightly from over half (55%) to nearly two-thirds (63%) of staff.

- As a result of the vaccination rates, one-half of organizations are currently testing staff at least once a week for COVID-19, and one-half are testing residents only if symptomatic. Notwithstanding the need to test staff more frequently, and the costs associated with testing, one-half of respondent organizations indicate they probably will not or definitely will not make the COVID-19 vaccine mandatory for staff (53%); however, one-quarter probably will or definitely will (27%). The share of organizations considering making the vaccine mandatory for staff has increased since Wave 22 (11%).

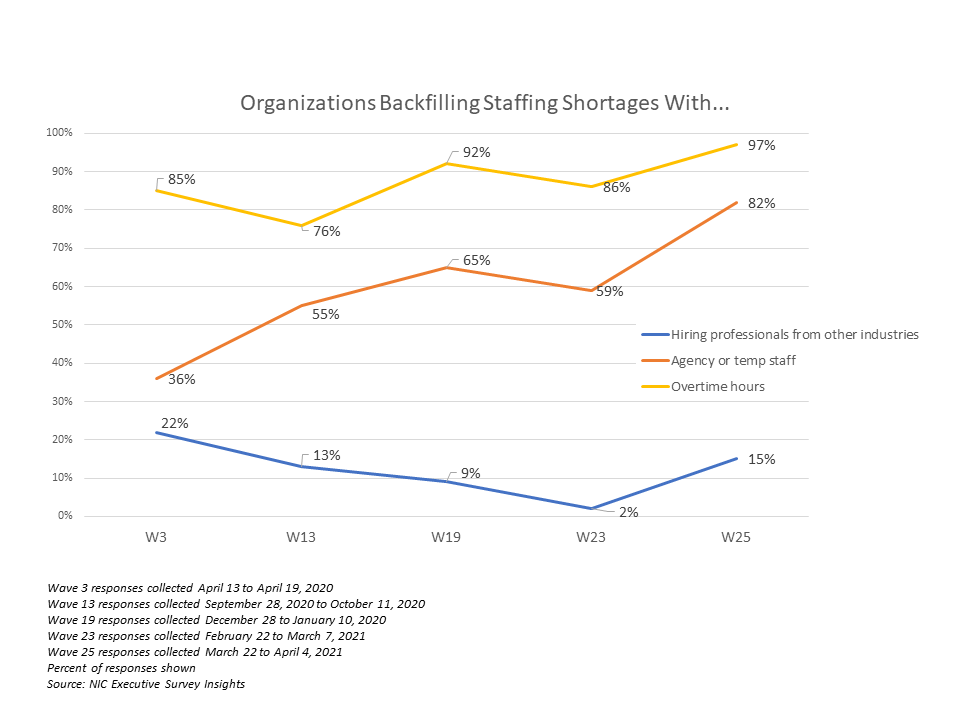

- Staffing shortages that were experienced by many operators prior to and exacerbated by the pandemic persist in Wave 25. Currently, two-thirds of organizations report staffing shortages within their portfolio of properties (68%). And NOI continues to be pressured. Nearly all respondents to the Wave 25 survey are paying staff overtime hours (97%), up from a prior peak of 92% in the Wave 19 survey conducted December 28 to January 10. Furthermore, four out of five organizations are currently tapping agency/temp staff (82%). Both factors are at a time series high.

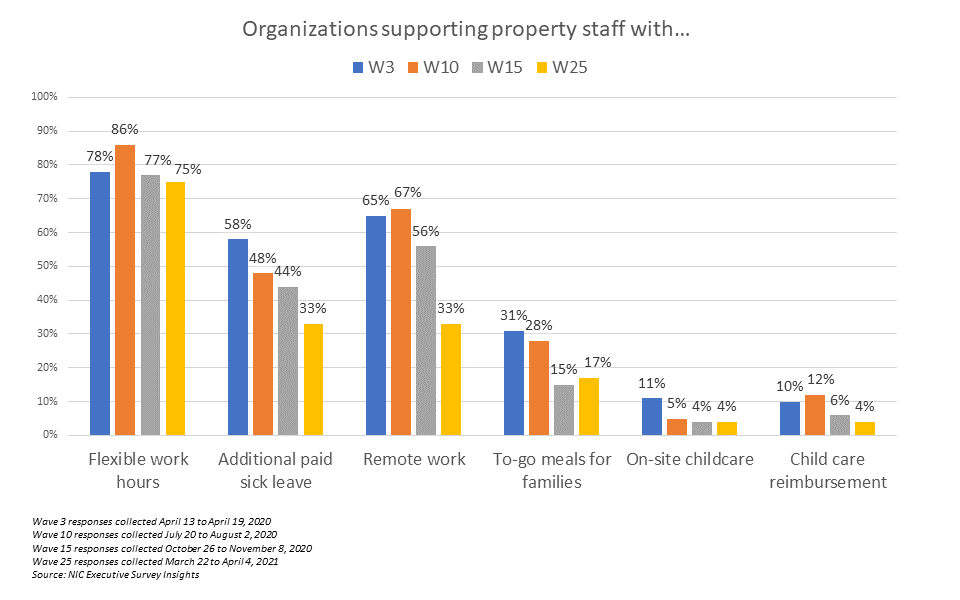

- The Wave 25 survey revisited the ways organizations are supporting property staff and their families to see what changes, if any, have occurred since early in the pandemic. As shown in the chart below, substantially fewer organizations are still offering additional paid sick leave and remote work. However, flexibility in work schedules is enduring: three-quarters of respondents (75%) are still offering staff flexible work hours.

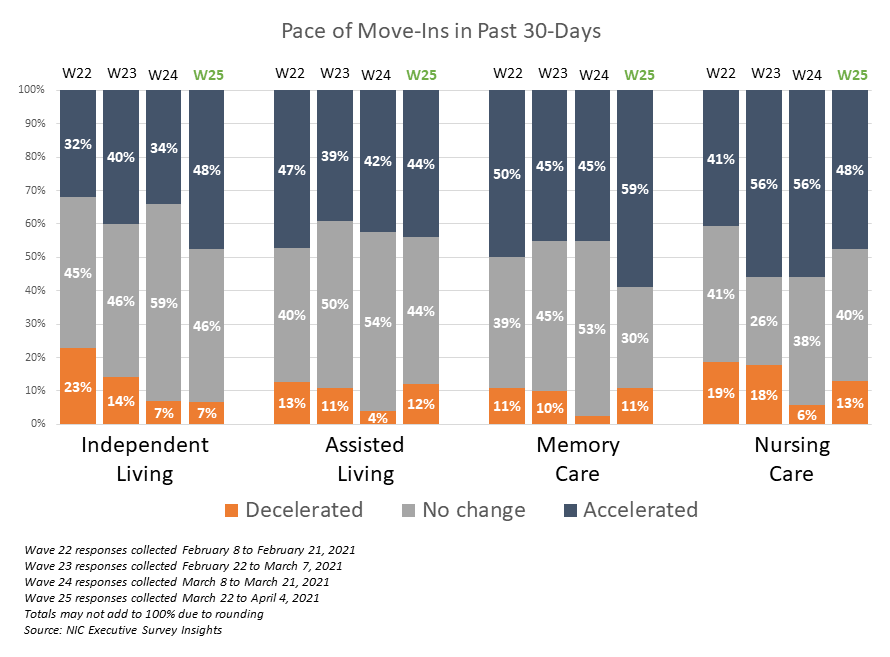

- The shares of organizations reporting acceleration in the pace of move-ins has increased for independent living, assisted living and memory care since Wave 23, and reports of acceleration in move-ins in independent living is at the highest point in the time series. It is encouraging to see the pace of move-ins increasing in independent living, now, after lagging the higher levels of care that presumably saw earlier penetration of the vaccine due to the generally higher age and more acute health care needs of residents in assisted living, memory care and nursing care.

- Many operators have been eagerly anticipating a boost in occupancy due to the COVID-19 vaccine availability, and these survey data from Wave 25 support continued trends in improvement in the pace of move-ins and upward changes in occupancy rates across each of the care segments. More than one-half of organizations responding to the Wave 25 survey noted an increase in prospect interest specifically related to the vaccine (56%)—up from 25% in Wave 21. A similar proportion of survey respondents (57%) expect their organizations’ occupancy rates to recover to pre-pandemic levels sometime in 2022.

- Increased resident demand was cited by nine out of ten respondents (90%) as a reason for acceleration in move-ins in the past 30-days (the highest point in the survey time series), and about one-quarter of respondents in the Wave 25 survey reported that their organizations had a backlog of residents waiting to move-in (23%). The share of organizations currently offering rent concessions remains around 50% since the Wave 12 survey, conducted mid- to late-September.

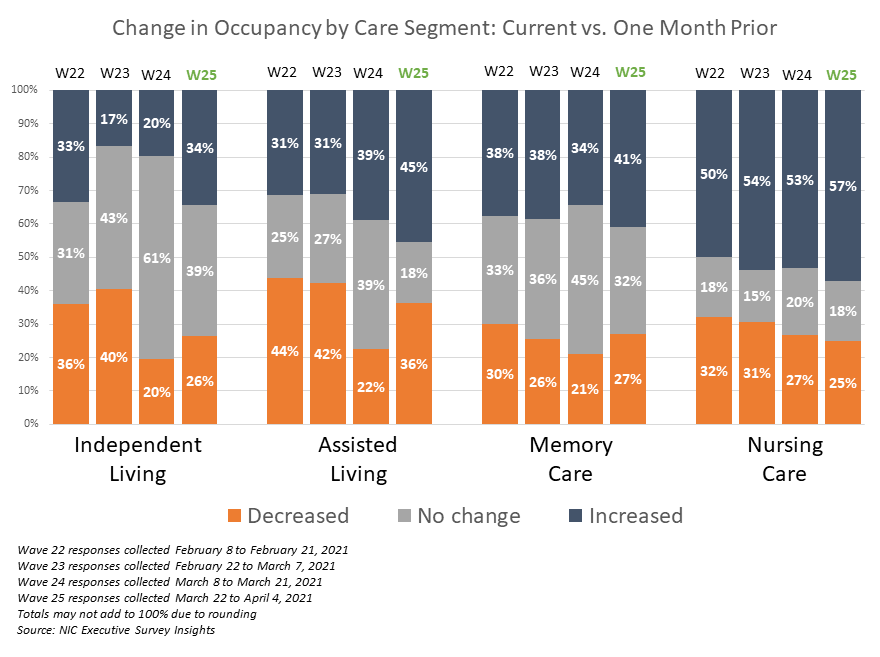

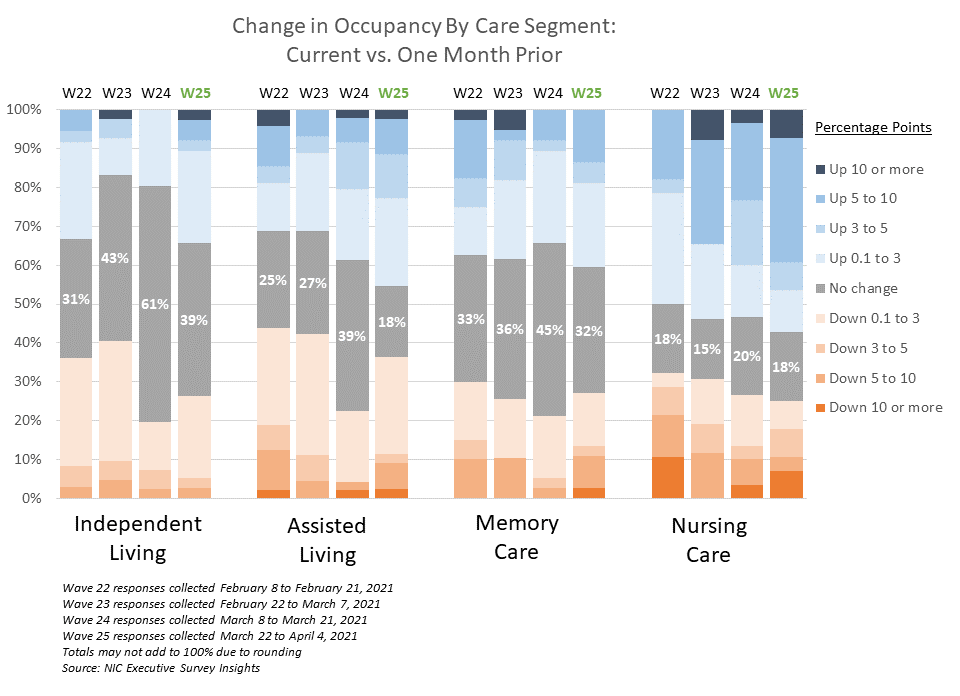

- The Wave 25 survey data continue to show a trend in the shares of organizations noting an increase in occupancy across all four care segments, and each of the care segments are at or near the respective time series high points in terms of reports of occupancy increases.

- However, the degrees of occupancy increases vary. As shown in the chart below, the largest degrees of upward changes in occupancy rates were reported in the nursing care segment with 32% reporting upward changes of 5 to 10 percentage points. Reports of occupancy increases in organizations with independent living residents is at the time series peak, but the degree of change is weaker than the other care segments with one-quarter reporting increases of 0.1 to 3.0 percentage points.

Wave 25 Survey Demographics

- Responses were collected between March 22 and April 4, 2021 from owners and executives of 64 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise one-half of the sample (52%). Operators with 11 to 25 and 26 properties or more make up about one-quarter of the sample (25% and 23%, respectively).

- One-half of respondents are exclusively for-profit providers (54%), just over one-quarter (28%) are nonprofit providers, and 18% operate both for-profit and nonprofit seniors housing and care organizations.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 79% of the organizations operate seniors housing properties (IL, AL, MC), 33% operate nursing care properties, and 39% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By demonstrating transparency, you can help build trust. The survey results and analysis are frequently referenced in media reports on the sector including in McKnight’s publications, Mortgage Professional America Magazine, Senior Housing News, Multi-Housing News, Provider Magazine,, and other industry-watching media outlets. The surveys’ findings have also been mentioned in stories by Kaiser Health News, CNN, the Wall Street Journal, and other major news outlets across the U.S.

The Wave 26 survey is available and takes 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck