"The pace of move-ins has slowed as the COVID-19 delta variant spreads primarily among the unvaccinated. In Wave 32, about one-quarter of organizations with assisted living apartments and/or nursing care beds, and about one in five with memory care units reported a deceleration in the pace of move-ins across their portfolio of properties in the past 30-days. Nursing care occupancy has taken a jolt with nearly 40% of organizations indicating that occupancy declined.Respondents to the Wave 32 survey want prospective residents and their family members to know that senior living is safe. Much has been learned over course of the pandemic and operating with COVID-19 has become routine. Operators want the media to know that they are better equipped to care for residents than last when little was known about the virus—and infection mitigation protocols are working. Indeed, according to NIC data analyst Omar Zahraoui in a recent blog post, overall case counts within skilled nursing facilities relative to cases among the general population on August 1 remained low.”

--Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space as market conditions continue to change. This Wave 32 survey includes responses collected August 9 to September 6, 2021, from owners and executives of 92 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 32 Summary of Insights and Findings

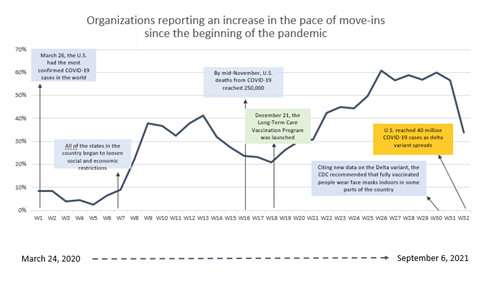

- As shown in the timeline below, across the survey time series from March 24, 2020 to September 6, 2021, NIC’s Executive Survey Insights results have shown clear trends that have corresponded with the broad incidence of COVID-19 infection cases in the United States. By Wave 18 (in the latter half of December), the COVID-19 vaccine had begun to be distributed across the country through the Long-Term Care Vaccination Program and more and more respondents noted that the pace of move-ins accelerated in Waves 19 through 31. In Wave 32, the shares of organizations reporting an acceleration in the pace of move-ins in the past 30-days dropped notably, presumably due to the spread of the COVID-19 delta variant primarily among the unvaccinated.

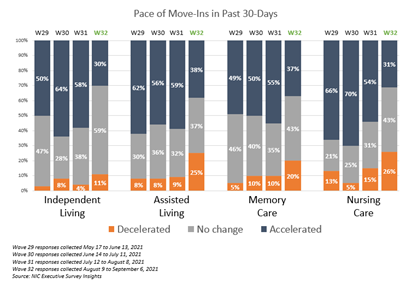

- Between roughly 30% and 40% of organizations report that the pace of move-ins accelerated in the past 30-days—compared to roughly 55% and 60% in Wave 31. Of note, about one-quarter of organizations with assisted living apartments and/or nursing care beds, and about one in five with memory care units reported a deceleration in the pace of move-ins. However, more than half (59%) of organizations with independent living residences reported no change in the pace of move-ins.

- Currently, about 20% of respondents note that their organization has a backlog of residents waiting to move in, up from about 10% in Wave 28 (5/3-5/16, 2021), but down from about 35% in Wave 16 (11/9-11/22, 2020). Furthermore, one-third of organizations reported a decline in lead volume in the past 30-days specifically due to COVID-19 and new variants (32%).

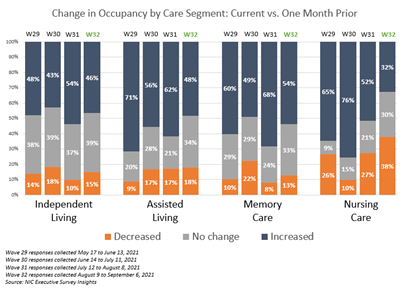

- In Wave 32 between roughly 45% and 55% of organizations with independent living, assisted living and/or memory care units reported an increase in occupancy across their portfolios of properties in the past 30-days. However, only about one-third (32%) saw an increase in nursing care occupancy. This is down significantly from Wave 30 (6/14-7/11) when three-quarters of organizations with nursing care beds saw occupancy increases in the 30-days prior (76%).

- Indeed, of each of the four care segments, nursing care occupancy has taken a jolt with nearly 40% of organizations indicating that occupancy declined across their portfolios of properties in Wave 32 (and about 20% reported a decline in occupancy of 3-percentage points or more).

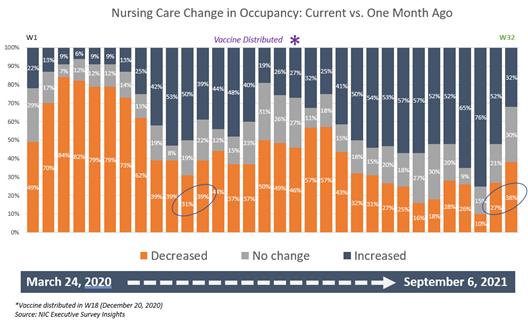

- The chart below shows the shares of organizations with nursing care beds that saw an increase, decrease or no change in occupancy, across their portfolio of properties in the past 30-days, across 32 waves of survey data since near the beginning of the pandemic.

- The shares of organizations with nursing care occupancy declines in the Waves 31 and 32 surveys show a similar trend compared to Waves 11 and 12 (8/17-9/27, 2020) leading up to the Fall surge in COVID-19 cases across the country. Whether or not the pattern of declining occupancy rates will continue to trend is uncertain until the delta variant spread is muted by increasing vaccinations and natural immunity from prior infection.

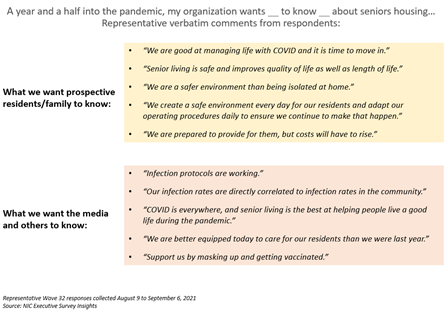

- A new question was asked in Wave 32: “A year and a half into the pandemic, my organization wants (a) prospective residents/family and (b) the media and others to know ___ about seniors housing…” Regarding what operators want prospective residents/family to know, most respondents cited senior living is safe/being better than being isolated at home. Most respondents want the media to know that they are better equipped to care for residents than they were last year, and infection protocols are working. Some select quotes from respondents are shown below:

Wave 32 Survey Demographics

- Responses were collected between August 9 and September 6, 2021, from owners and executives of 92 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise roughly two-thirds (63%) of the sample. Operators with 11 to 25 and 26 properties or more make up 20% and 16% of the sample, respectively.

- Approximately one-half of respondents are exclusively for-profit providers (51%); more than one-third operate not-for-profit (37%) and 12% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 66% of the organizations operate seniors housing properties (IL, AL, MC), 23% operate nursing care properties, and 37% operate CCRCs (aka Life Plan Communities).

Referenced by The Wall Street Journal on August 31 — Senior Housing Industry Faces Higher Costs as It Plays Lead Role in Vaccine Mandates — NIC's Executive Survey Insights continues to be closely watched by the media, and we ask for your continued support.

The current survey is available and takes under ten minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please contact Lana Peck at lpeck@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and create a comprehensive and honest narrative in the seniors housing and care space at a time when trends are continuing to change in our sector.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck