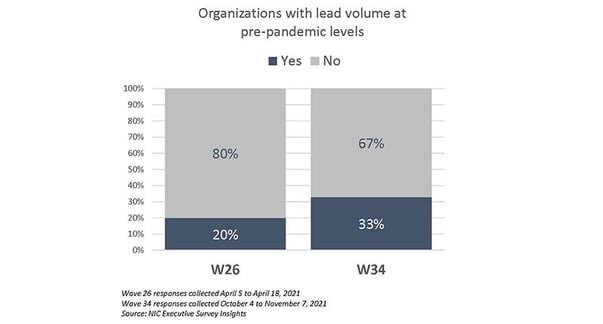

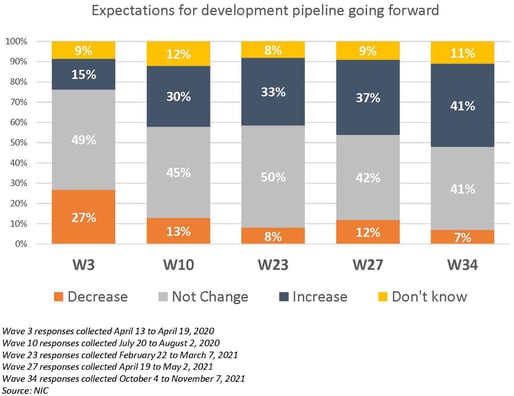

“Lead volumes are improving. In Wave 34 of the survey, one-third of organizations report lead volumes reaching pre-pandemic levels (33%), up from just one-fifth back in April 2021 (20%). During the pandemic new construction lending had slowed sharply. A recent increase in construction lending is reflected in the Wave 34 survey where 41% of respondent organizations now expect their development pipelines to increase. However, challenges to the practicality of new construction and timelines persist due to labor and key materials shortages and relatively high costs. Future surveys will help shed light on whether pent-up demand for senior housing as supported by an historically high rate of net absorption reported by NIC MAP Vision in 3Q 2021 will continue to usher in occupancy to fill pandemic vacancies or will the effects of normal seasonal impacts on admissions come into play.”

--Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in senior housing and skilled nursing is designed to deliver transparency into market fundamentals in the senior housing and care space as market conditions continue to change. This Wave 34 survey includes responses collected October 4 to November 7, 2021, from owners and executives of 74 small, medium, and large senior housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 34 Summary of Insights and Findings

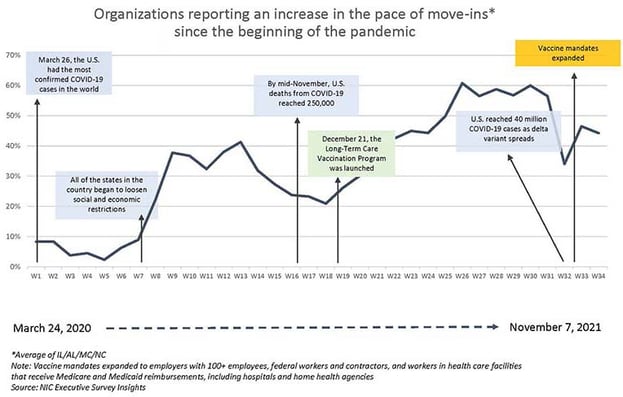

- Through the 34 Waves of the NIC Executive Survey Insights report — that started at the beginning of the pandemic in March 24, 2020 and has continued through the current survey date of November 7, 2021 — the results have closely corresponded with the broad incidence of COVID-19 infection cases in the United States. This is demonstrated in the timeline below that shows the share of organizations reporting an increase in the pace of move-ins during the prior 30-days. For example, the Wave 19 survey (which collected responses from December 28, 2020 to January 10, 2021) showed that when the COVID-19 vaccine had begun to be distributed across the country through the Long-Term Care Vaccination Program, the pace of move-ins began to accelerate and continued to do so through Wave 31. However, in Wave 32, the shares of organizations reporting an acceleration in the pace of move-ins in the past 30-days dropped notably, presumably due to the spread of the COVID-19 Delta variant primarily among the unvaccinated. In the Wave 33 survey (representing operator experience in the month of August) respondents reported a notable increase in move-ins compared with the Wave 32 survey as Delta variant infections waned and vaccinations ticked up. The most recent survey results were largely similar to Wave 33.

- Lead volumes are improving. In Wave 34, one-third of organizations had lead volume at pre-pandemic levels (33%), up from just one out of five back in April 2021 (20%).

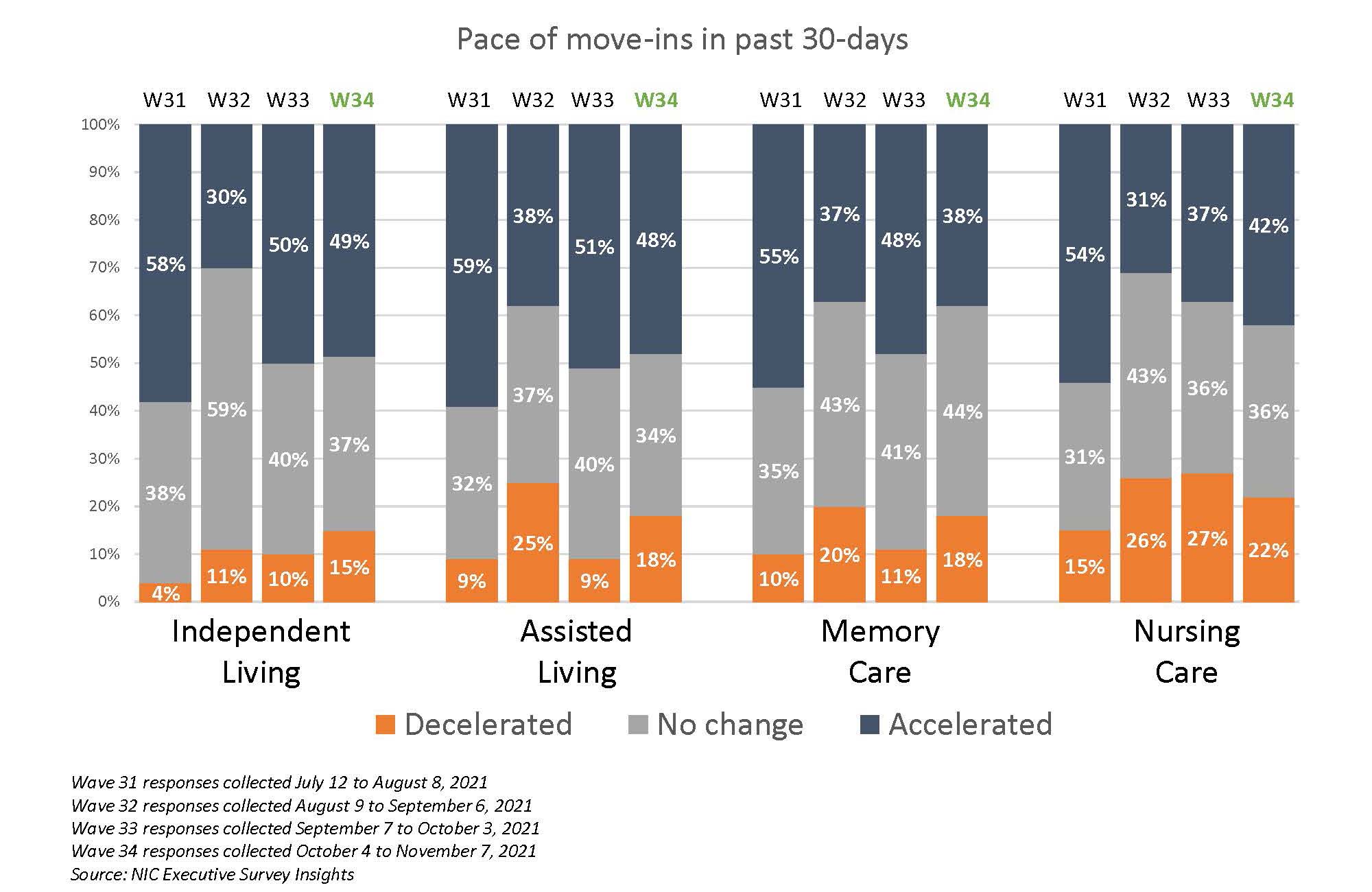

- By care segment, roughly 50% of Wave 34 respondents with independent living and/or assisted living units reported that the pace of move-ins accelerated in the past 30-days (similar to the previous, Wave 33, survey). However, the memory care and nursing care segments did not see the same pace of acceleration. While slightly more organizations with nursing care beds saw an acceleration in the pace of move-ins from the previous survey (42% up from 37%), 22% to 27% of organizations with nursing care beds have reported deceleration in the pace of move-ins since the Wave 32 survey.

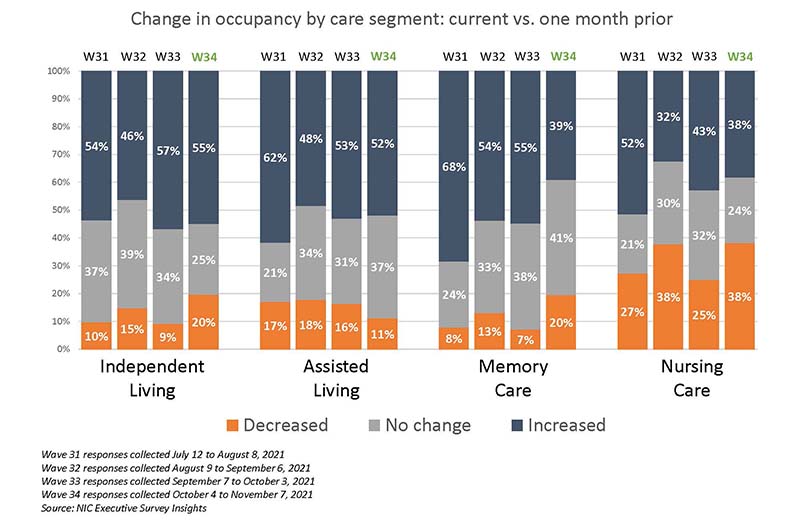

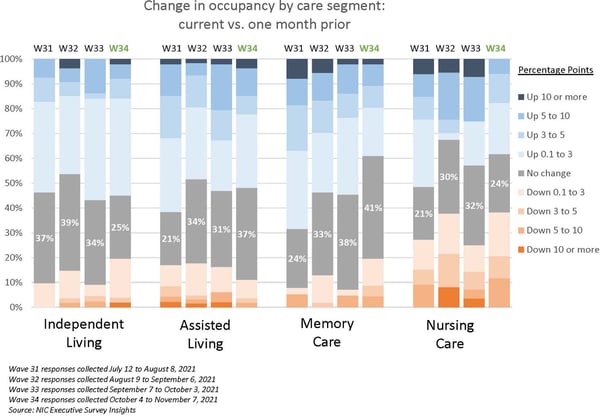

- As shown in the chart above, fewer organizations with memory care units saw an acceleration in move-ins since the Wave 33 survey (38% vs. 48%), and shown in the chart below, notably more saw no change or a decline in occupancy during the same timeframe.

- In Wave 34, roughly 50% of organizations with independent living and/or assisted living units reported higher occupancy rates. Organizations with nursing care beds reported equal levels of increases and decreases in occupancy (38%, respectively).

- As shown in the chart below, most occupancy increases were between 0.1 and 3 percentage points. Of note however, approximately 20% of organizations with assisted living and/or memory care units saw occupancy increase three percentage points or more.

- The NIC Executive Survey Insights has asked organizations about their development plans since near the beginning of the pandemic. In Wave 3 (April 13 – 19, 2020), only 15% of operators expected their development pipelines to increase, primarily due to projects already underway. During the pandemic, new construction lending had slowed sharply. NIC Analytics recently released the second quarter 2021 NIC Lending Trends Report, which notes that newly closed senior housing construction loans increased by 46.7% on a same-store, quarter-over-quarter basis—the highest recorded quarterly increase since the fourth quarter of 2017. The recent uptick in construction lending is reflected in the Wave 34 survey where 41% now expect their development pipelines to increase. However, challenges to new construction continue due to labor and key materials shortages and higher costs largely associated with supply chain disruptions, tariffs in some instances and rising energy prices.

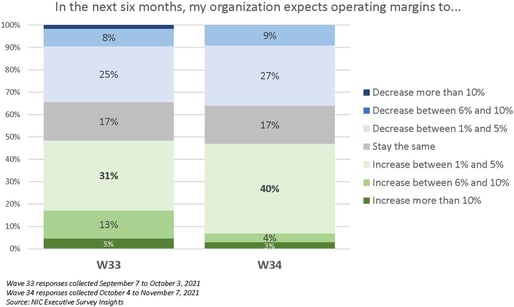

- NOI has been pressured for many operators due to the impact of labor shortages and higher wages on expenses, the pandemic-related decline in occupancy rates, and the inability to grow rents. In the current and prior survey, respondents were asked how much they expect their operating margins to increase or decrease in the next six months. Roughly half of respondents (49% and 47%) indicated they expect operating margins to increase. However, slightly more operators in Wave 34 anticipate smaller increases than in Wave 33 (40% between 1% and 5%).

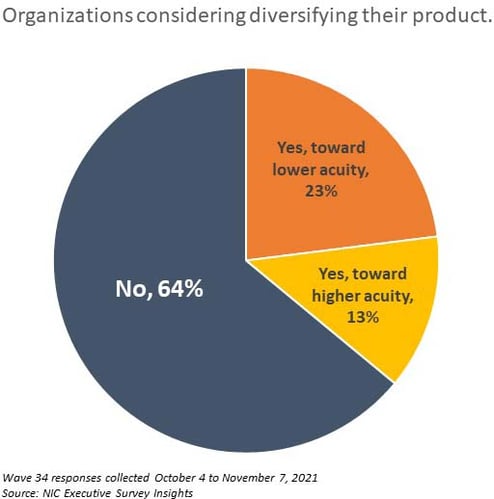

- A new question was added to the Wave 34 survey to gauge operator interest in diversifying their products to serve a different resident. While roughly two-thirds of organizations stated that they were not considering changing their product mix (64%), nearly one-quarter (23%) reported considering expanding their offerings toward lower acuity settings.

Featured Survey Comments

At the end of each survey, several respondents offer detailed comments that add informative detail to their responses. The following set of quotes is an abbreviated selection of the Wave 34 comments:

- “Our independent living is thriving, with the duplex home expansion filling up more quickly than anticipated. We intend to add more IL units in the next couple of years, once that project is complete. Staffing concerns have led us to hold admissions at times in our assisted living facilities, hurting our already poor occupancy there. At the beginning of October, we put a very substantial wage increase into effect to try to aid our recruitment and retention efforts. We believe it's beginning to pay some dividends, but somewhat slowly.”

- “Regarding SNF census, our percentage occupied is not a result of lack of inquiries, but a direct result of lack of labor.”

- “It appears deaths due to COVID-19 may have attenuated a modest amount of available high acuity seniors requiring AL/MC. Normal annual move outs in the 40 - 45 percentage range has resumed due to typical death and discharge(s) to skilled nursing. Admissions, while vastly improved since spring, are slow to recover to pre-COVID populations. It may be that our years of continuous wait list may only recover by the end of 2022 to 88 - 90 % stabilization.”

Wave 34 Survey Demographic

Responses were collected between October 4 and November 7, 2021, from owners and executives of 74 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise over one-half of the sample (58%). Operators with 11 to 25 and 26 properties or more make up 26% and 16% of the sample, respectively

- One-half of respondents are exclusively for-profit providers (51%); about one-third operate not-for-profit (36%) and 13% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 73% of the organizations operate seniors housing properties (IL, AL, MC), 30% operate nursing care properties, and 37% operate Life Plan Communities (aka CCRCs).

Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance.

The current survey is available and takes under ten minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please contact Lana Peck at lpeck@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and create a comprehensive and honest narrative in the seniors housing and care space at a time when trends are continuing to change in our sector.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck