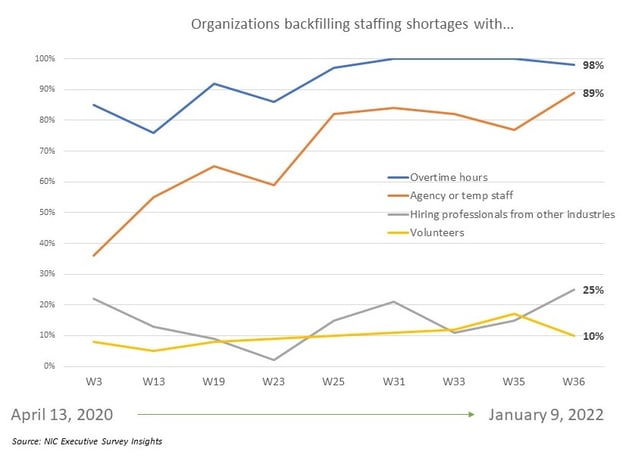

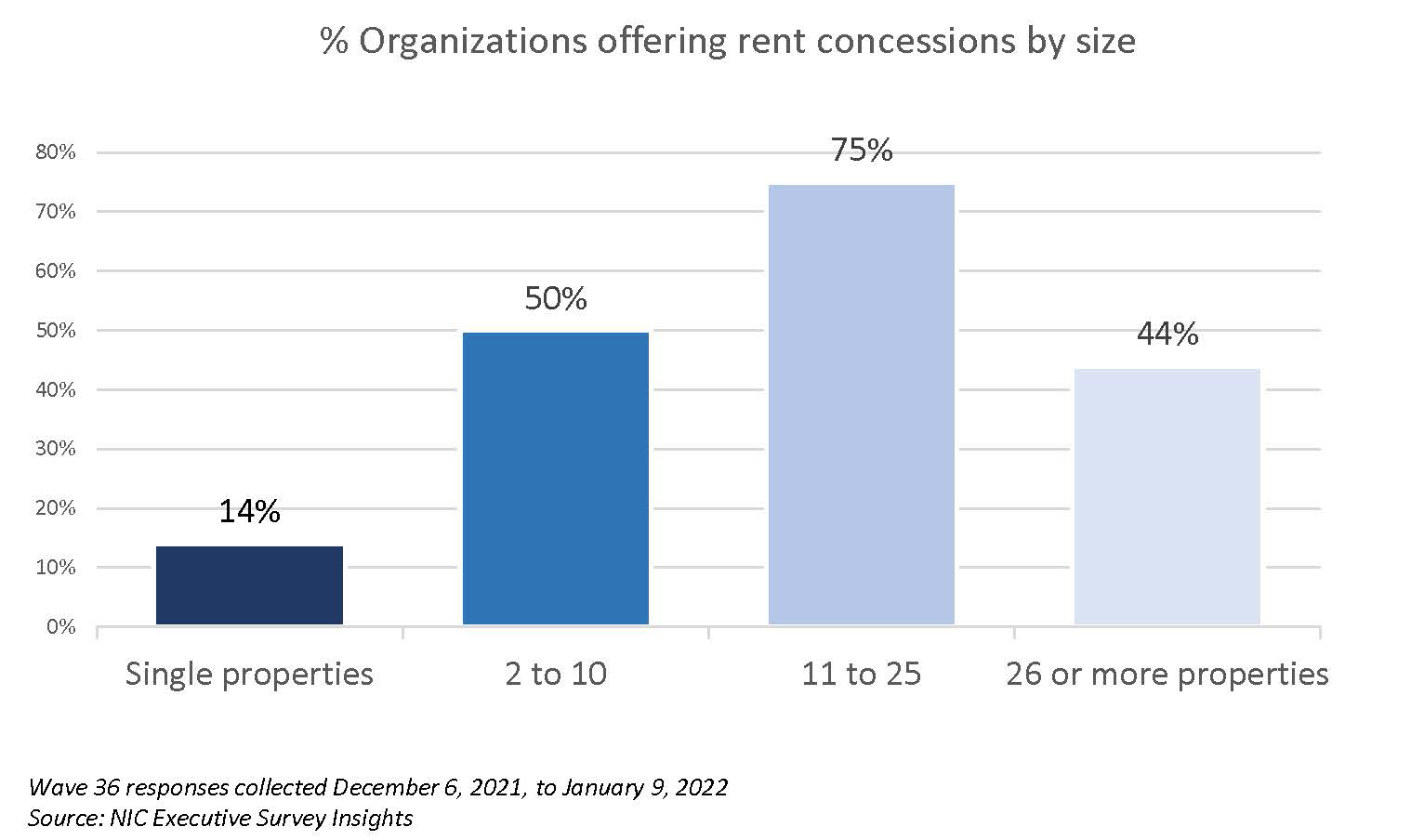

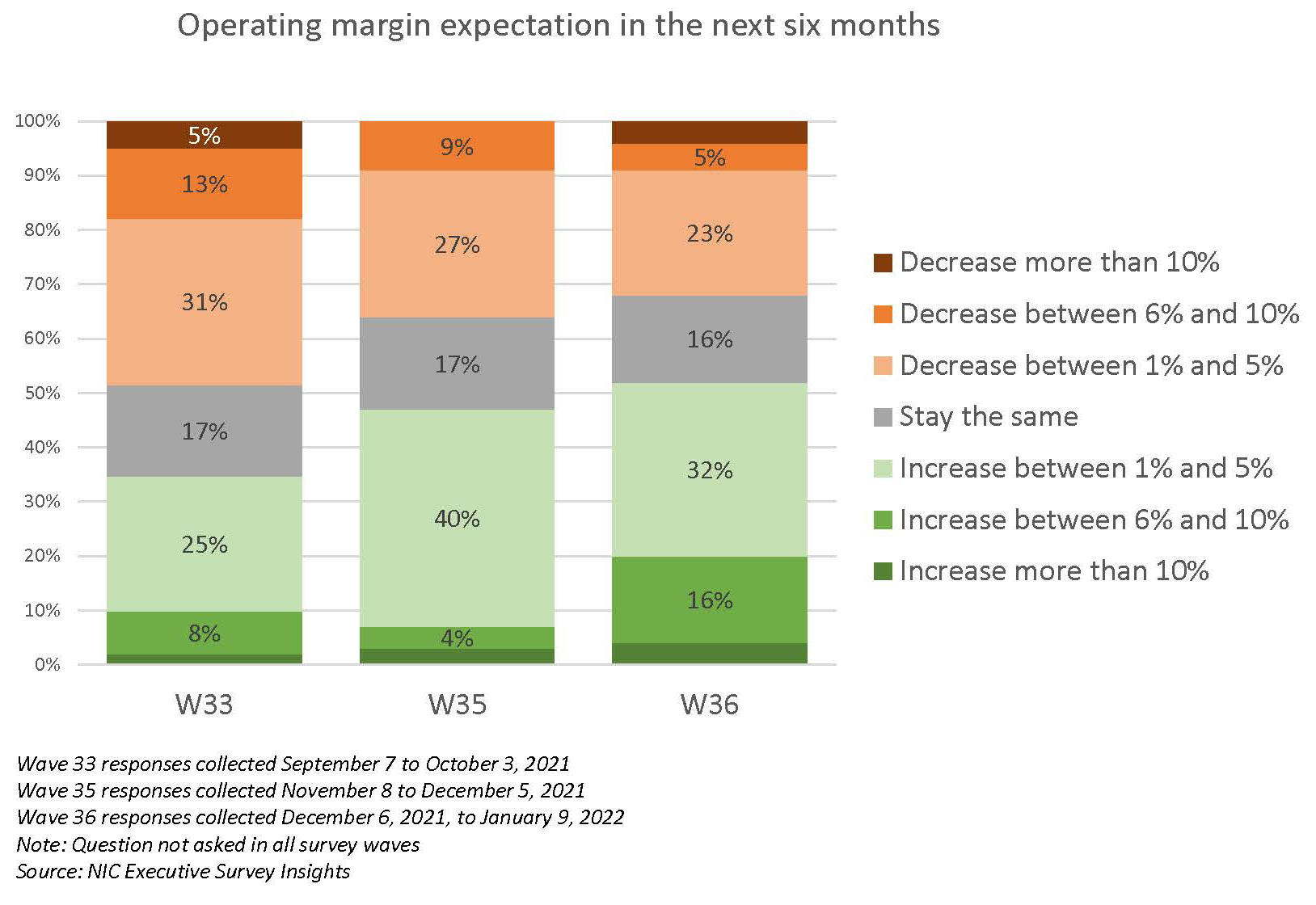

One-half of respondents (52%) in Wave 36 anticipate their organization’s operating margins will improve in the next six months. One-third (32%) expect a 1% to 5% increase, and an increasing share (16%) anticipates growth between 6% and 10%. However, labor costs will continue to be a mitigating factor. Nearly all respondents since July have been paying staff overtime, and the use of expensive agency/temp staff is growing, with nine out of ten organizations (89%) now tapping agency/temp staff. The ability to hire from outside of the seniors housing and care industry has grown modestly from 11% to 25% since the Wave 33 survey Factors supporting NOI growth going forward include anecdotal reports of operators beginning to implement rate increases to counterbalance pandemic and recovery-related cost pressures. About one-half (47%) of respondents are currently offering rent concessions (most frequently in the form of rent discounts and free rent for a specific period of time). Single site operators are significantly less likely to offer rent concessions than their larger competitors.

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space as market conditions continue to change. This Wave 36 survey includes responses from December 6, 2021, to January 9, 2022, from owners and executives of 66 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 36 Summary of Insights and Findings

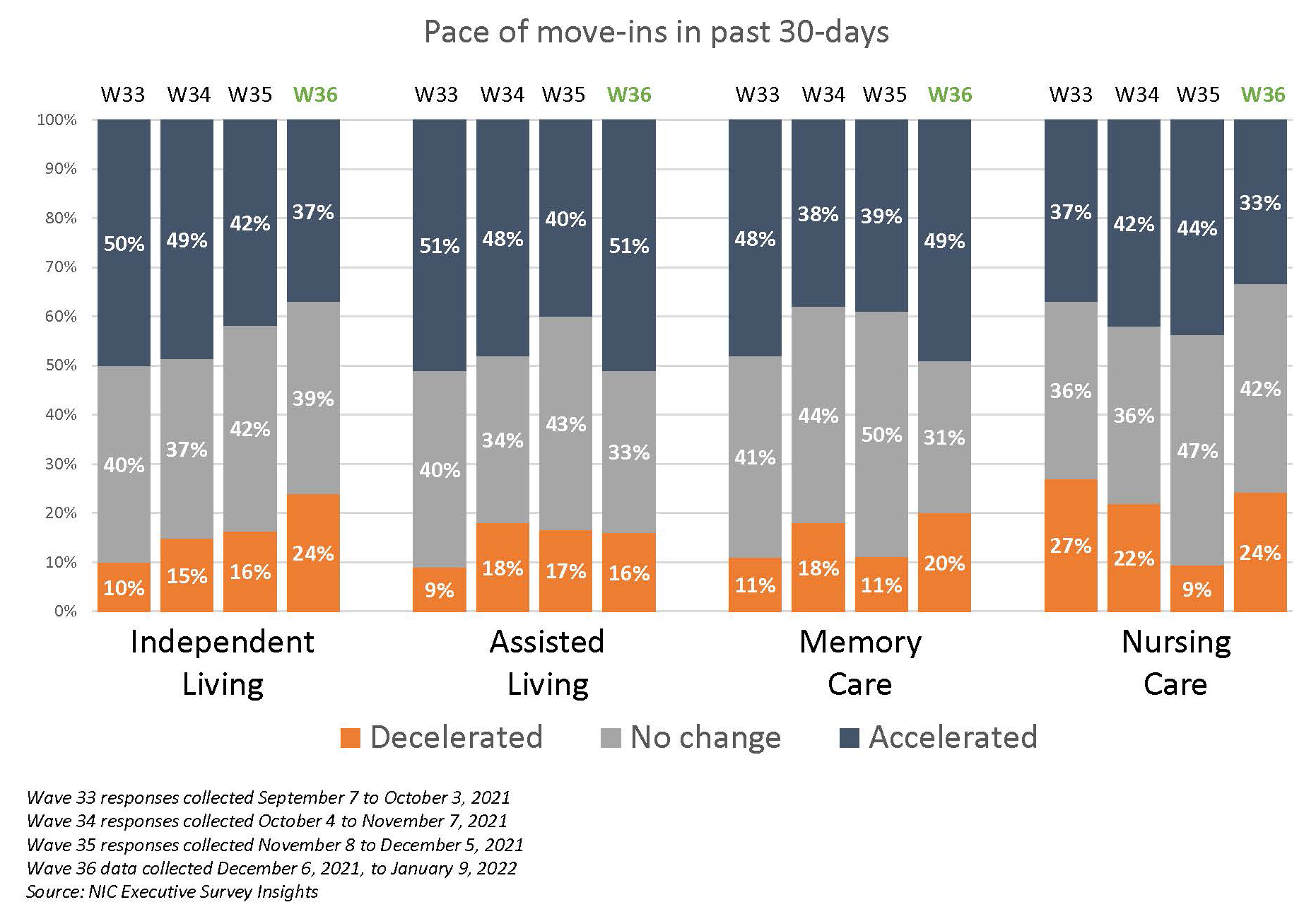

- The pace of move-ins in independent living declined over the past four waves of survey data, while the pace picked up in assisted living and memory care, suggesting a slight slowdown for choice-based seniors housing and an increase in needs-based moves. (The slowdown in independent living may be due to typical patterns of seasonality). Roughly one-half of organizations with assisted living and/or memory care units reported an acceleration in the pace of move-ins (51% and 49%), compared to just over one-third with independent living units (37%). Fewer organizations with nursing care beds reported an acceleration in the pace of move-ins since the previous survey (33% vs. 44%).

- Considering the pace of move-outs in the past 30-days, no change was reported by the majority of organizations across care segments (65% to 68%). More organizations with assisted living units have seen a deceleration in the pace of move-outs than in recent surveys. However, roughly one-quarter of organizations with nursing care beds and/or memory care units reported an acceleration in the pace of move-outs typically due to discharges, natural attrition, and moves to higher levels of care.

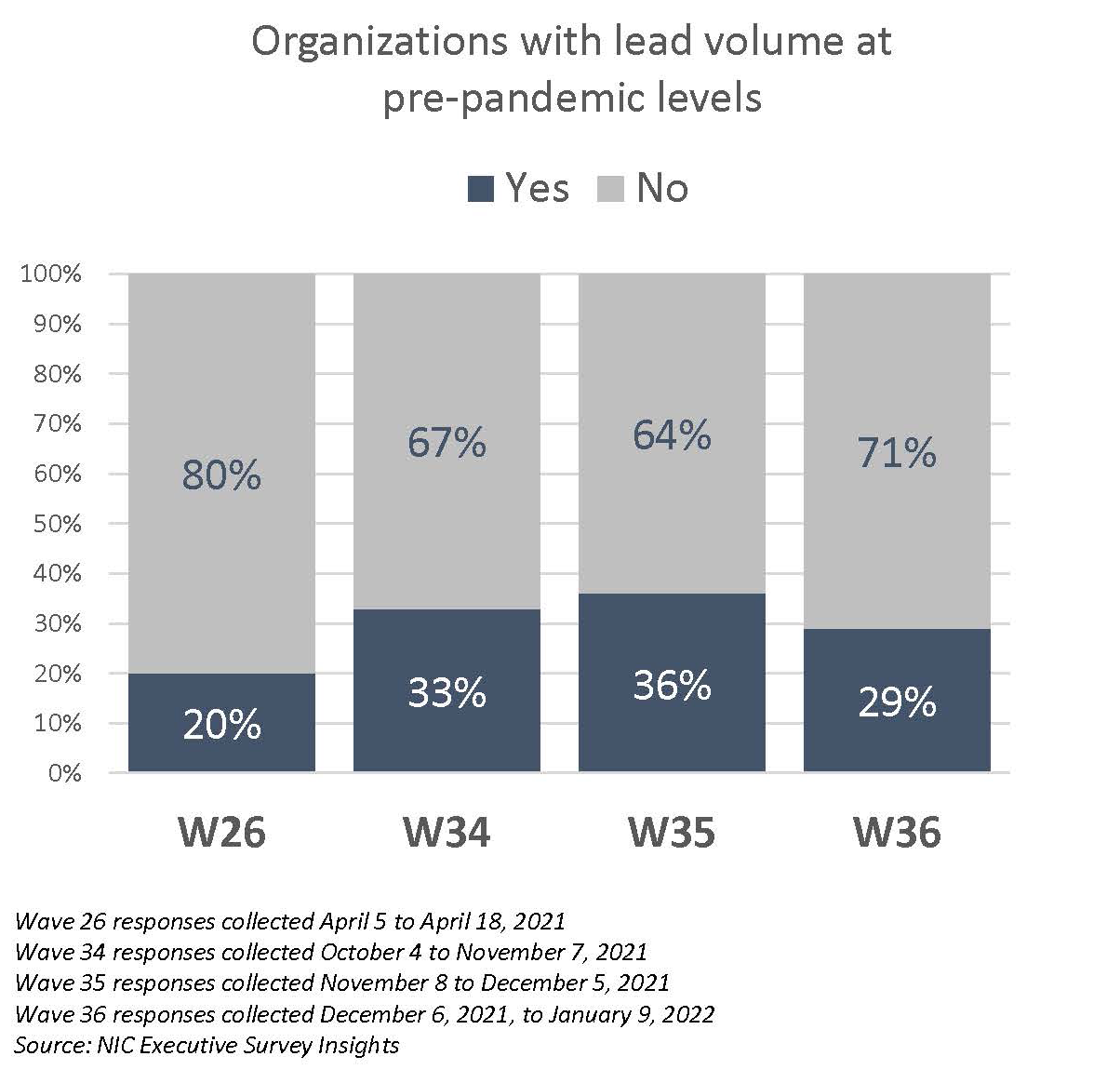

- Although the pace of move-ins across care segments was brisk during the past two quarters, and occupancy rates as reported by NIC MAP Vision improved, only around one-third of organizations (29%) indicated that their leads volume were at pre-pandemic levels in Wave 36–down from 36% in the prior survey, but higher than 20% in Wave 26 conducted April 5 to April 18, 2021.

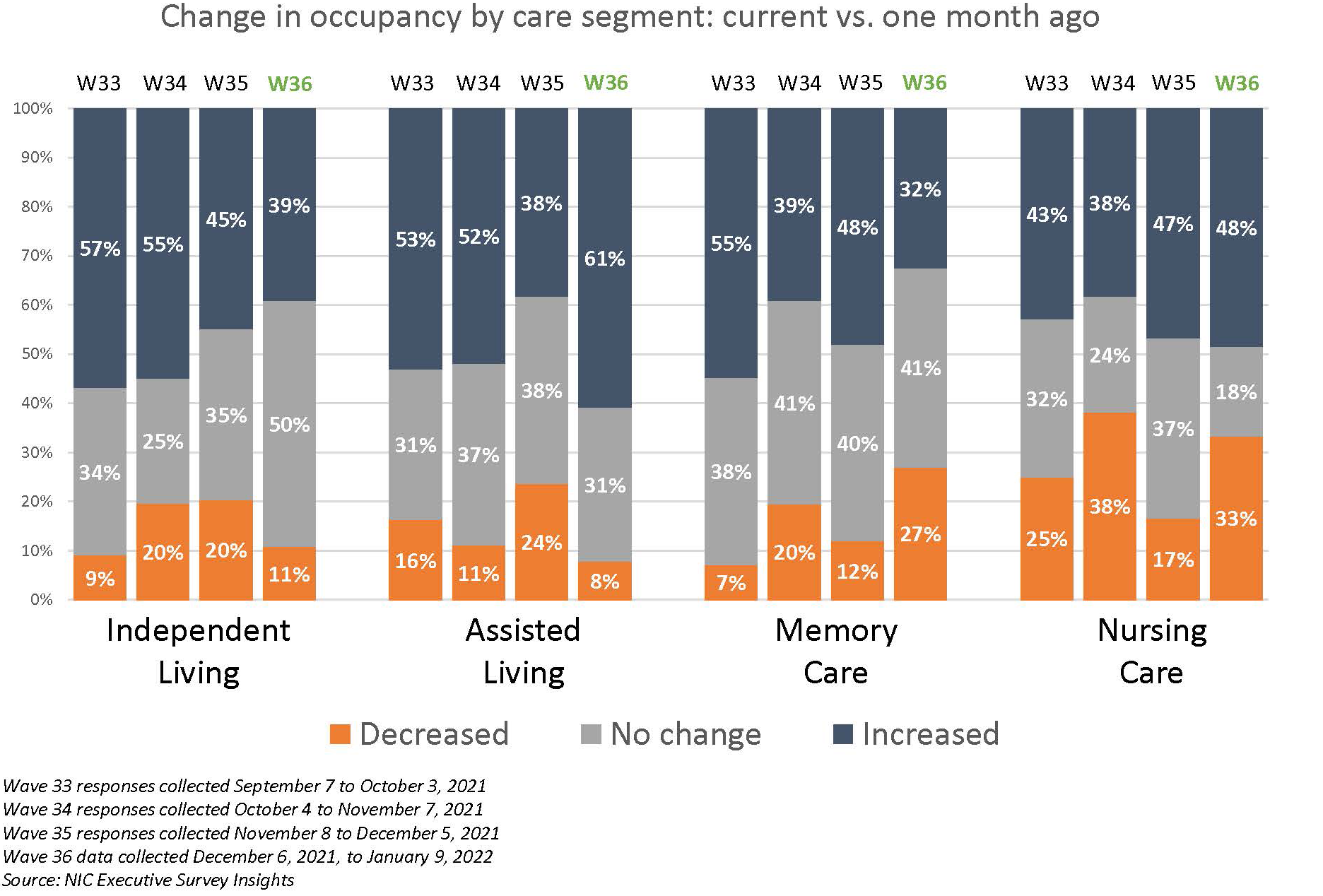

- In Wave 36, nearly two-thirds of organizations (61%) with assisted living units reported increases in occupancy from prior surveys, and nearly one-half (47%) of organizations with nursing care beds saw recent improvement. However, about one-third (32%) of organizations with memory care units noted declining occupancy—down from roughly one-half in Waves 35 and 33 (48% and 55%, respectively).

- Similar to the pattern shown for the pace of move-ins for the independent living segment, the share of organizations reporting occupancy increases in independent living declined over the past four survey waves from roughly 60% to roughly 40%.

- Although one-half (50%) of organizations with independent living units noted no change in occupancy compared to one month ago, between one-quarter and one-third (27% and 33%) of organizations with memory care units and/or nursing care beds reported declining occupancy in Wave 36.

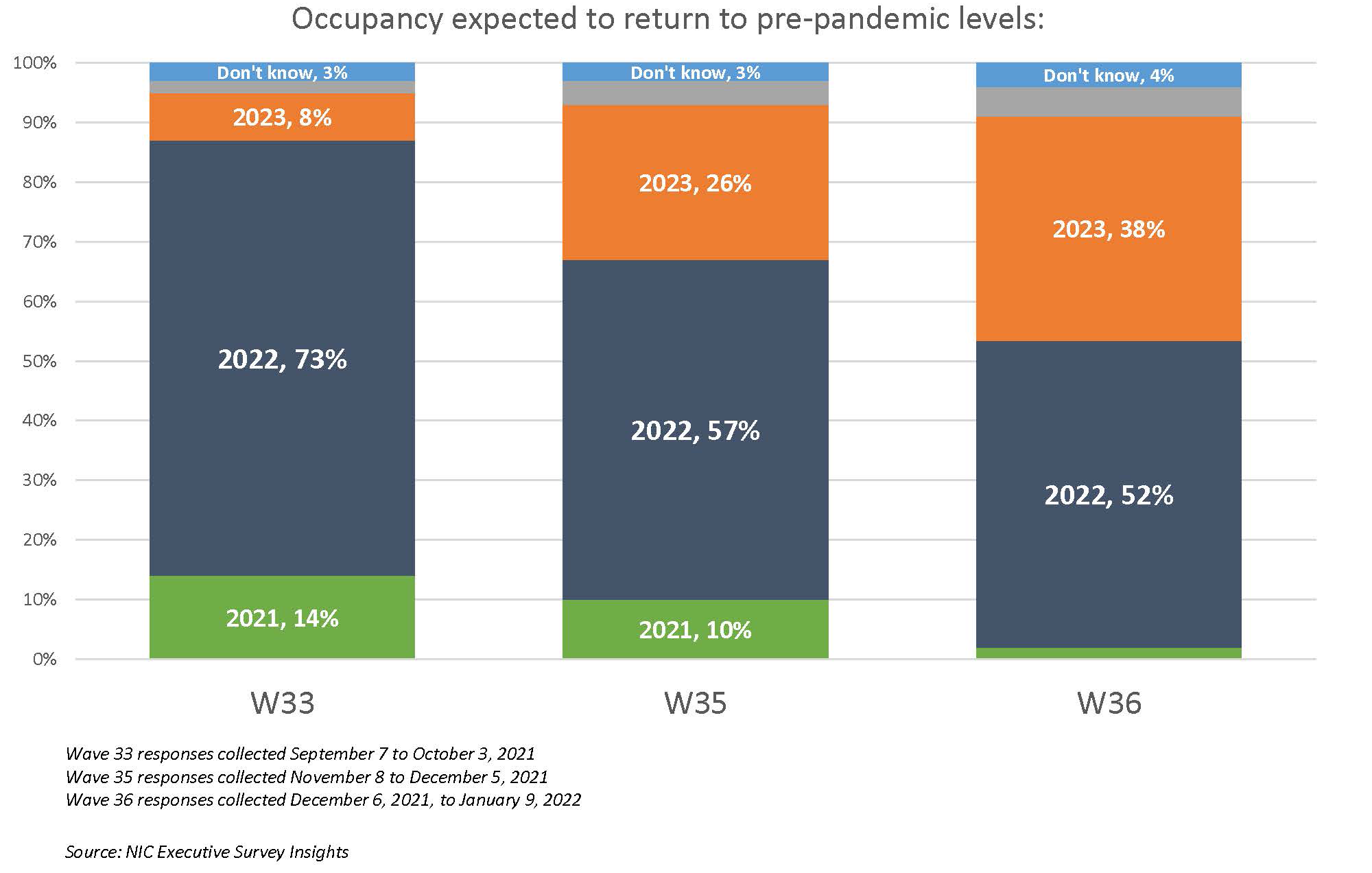

- The expected timeframes for occupancy recovery have lengthened among operators. In Wave 36, one-half of respondents expect their organization’s occupancy to return to pre-pandemic levels in 2022 (52% down from 73% in Wave 33), and just over one-third now believe it will recover by 2023 (38% up from 8% in Wave 33).

- Nearly all operators responding to NIC’s Executive Survey Insights conducted since July (98% – 100%) reported staff shortages. In the Wave 36 survey, four out of five organizations with multiple sites (83%) reported staff shortages in more than half of their properties—up from roughly one-half (46%) in the Wave 24 survey conducted mid-March. Attracting community/caregiving staff and employee turnover remain significant challenges for survey respondents.

- When asked how they are backfilling staffing shortages, 97% – 100% of respondents cited overtime hours since Wave 25 (data collected between March 22, 2021, and January 9, 2022). And the use of expensive agency/temp staff is growing. Currently, 89% of organizations are tapping agency or temp staff—up from 77% in the prior survey. In Wave 36, approximately one-quarter (25%) indicated that their use of agency/temp staff increased more than 75% in 2021.

- While the use of volunteers remains relatively low, the ability to hire from outside of the seniors housing and care industry has grown from 11% to 25% since the Wave 33 survey.

- Offering rent concessions to new residents often helps drive increases in occupancy. Currently, about one-half (47%) of respondents are offering rent concessions to attract new residents. Of those offering rent concessions, three-quarters are offering rent discounts (76%) and more than two-thirds are offering free rent for a specific period of time (69%).

- The chart below breaks out the 47% of responding organizations currently offering rent concessions by the size of the organization. Single site operators are significantly less likely to offer rent concessions than larger organizations. In Wave 36 only 14% of single-site providers were offering rent concessions.

- In Wave 36, one-half of respondents (52%) anticipate their organization’s operating margins will increase—up from one-third (35%) in the Wave 33 survey conducted in September. One-third (32%) expect margins to increase 1% to 5%, and a growing share of organizations anticipate growth between 6% and 10%.

Wave 36 Survey Demographics

- Responses were collected between December 6, 2021, and January 9, 2022 from owners and executives of 66 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise roughly one-half (47%) of the sample. Operators with 11 to 25 and 26 properties or more make up the other half of the sample (31% and 26%, respectively).

- Approximately one-half of respondents are exclusively for-profit providers (54%), one-third operate not-for-profit seniors housing and care organizations (33%,) and 13% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 75% of the organizations operate seniors housing properties (IL, AL, MC), 28% operate nursing care properties, and 33% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance.

The current survey is available and takes 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please contact Lana Peck at lpeck@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and create a comprehensive and honest narrative in the seniors housing and care space at a time when trends are continuing to change in our sector.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck