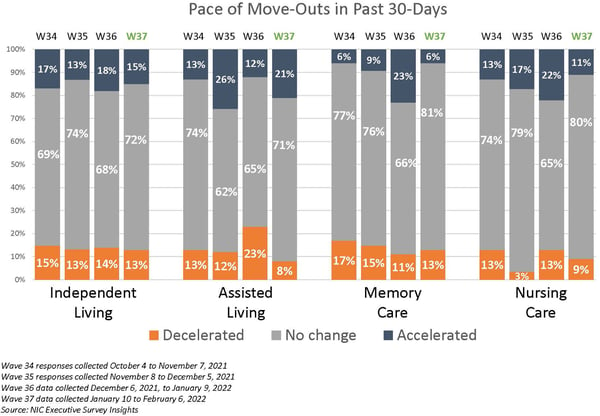

The spread of the COVID-19 Omicron variant (and seasonality) had a moderate impact on the pace of move-ins. While the pace of move-ins slowed during the Omicron surge, residents were not leaving out the back door of communities at the same rates that they did earlier in the pandemic. Respondents with nursing care beds cited lack of available staff, fewer hospital discharges due to COVID-19, and the holidays as reasons for a deceleration in the pace of move-ins. Notably, between 70% and 80% of organizations reported no change in the pace of move-outs, indicating that most residents have remained in their communities. Of the respondents that noted an increase in the pace of move-outs, three-quarters (75%) indicated that residents were moving to receive higher levels of care. Staffing continues to be operators’ most significant challenge. Roughly four out of five respondents (79%) report that their organizations currently use agency or temp staff to backfill labor shortages. One-half (50%) employ agency or temp staff to supplement nurse aides and about 40% tap agency nurses. Anticipated increases in operating margins in the near term have moderated. Currently, roughly one-half (48%) of organizations expect margins to increase between 1% and 5% in the next six months.

--Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of senior housing and skilled nursing operators is designed to deliver transparency into the market fundamentals as conditions change. Since March 2020, at the beginning of the pandemic, NIC Analytics has received more than 3,200 completed questionnaires with insights on thousands of properties across the nation and by property type. These survey responses have allowed NIC to provide real-time insights into the impact of the pandemic and the pace of recovery. The Executive Survey Insights 2022 questionnaire has been streamlined from prior surveys as we continue to recover from the pandemic. Both standard questions and new, monthly questions track and examine the pulse of the industry—informed by the leadership of seniors housing and care properties.

The “ESI” is the longest-running industry survey offering time-series data on specific market fundamentals and trends influencing our sector. This Wave 37 survey includes responses from January 10 to February 6, 2022, from owners and executives of 78 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

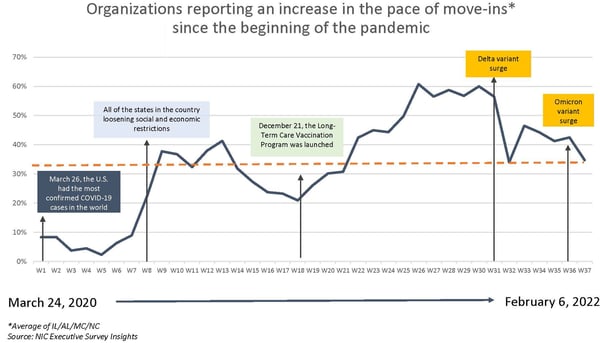

Across 37 Waves of the ESI, the pace of move-ins has closely corresponded with the broad incidence of COVID-19 infection cases in the United States. This is demonstrated in the timeline below that shows the share of organizations reporting an increase in the pace of move-ins during the prior 30-days. Between survey Waves 32 and 37 (conducted August 9, 2021, to February 6, 2022), the shares of organizations reporting an acceleration in the pace of move-ins trended lower overall, largely due to the spread of the COVID-19 Delta variant and, more recently, the Omicron variant.

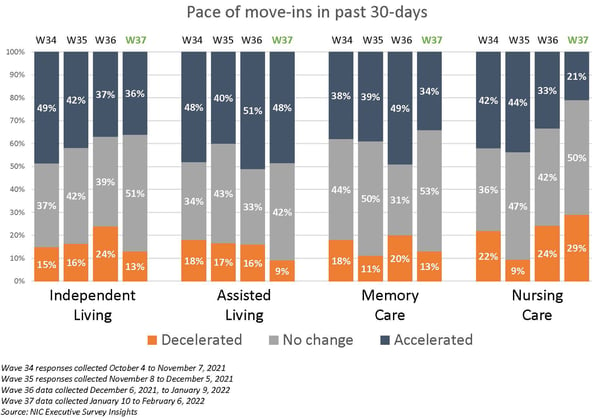

Move-Ins slowed notably in the higher levels of care in Wave 37. Presumably due to the Omicron variant surge in many parts of the country, fewer organizations with memory care units and/or nursing care beds reported an acceleration in the pace of move-ins since the previous survey (21% vs. 33% for the nursing care segment and 34% vs. 49% for the memory care segment). However, one-half of the organizations with these care segments (and independent living units) reported no change in the pace of move-ins. Respondents with nursing care beds cited lack of available staff, fewer hospital discharges due to COVID-19, and the holidays as reasons for the slowdown in the pace of move-ins.

Most reported no change in the pace of move-outs. Between 70% and 80% of organizations reported no change in the pace of move-outs suggesting that although the current pace of move-ins may have been affected by the Omicron variant, most residents have remained in their communities. Of the respondents that cited an acceleration in the pace of move-outs, three-quarters (75%) indicated that residents were moving to receive higher levels of care. And unlike earlier in the pandemic, only one respondent cited resident or family member concerns.

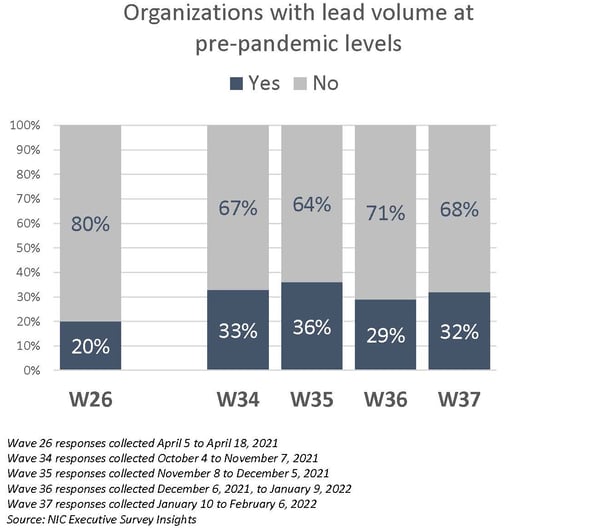

Few organizations have regained their pre-pandemic lead volumes. Given pent-up demand coming out of the pandemic and questions about the sustainability of historic and near-historic absorption rates during the third and fourth quarters of 2021 per NIC MAP® data, powered by NIC MAP Vision, this measure in the ESI may be a leading indicator to watch with regards to occupancy recovery. As shown in the chart below, the question of lead volume was benchmarked in Wave 26, with data collected at the beginning of the second quarter of 2021. Contrary to anecdotal reports suggesting a more robust return of leads, only one-third of respondents (32%) indicate that their leads volume is currently at pre-pandemic levels in Wave 37.

Staffing remains the operators’ most significant challenge. Since last July, nearly all operators (98% - 100%) responding to NIC’s Executive Survey Insights have reported staff shortages. In the Wave 37 survey, four out of five organizations with multiple sites (81%) reported staff shortages in more than half of their properties—up from roughly one-half (46%) in the Wave 24 survey conducted mid-March 2021. Attracting community/caregiving staff and employee turnover remain significant challenges for survey respondents. When asked about backfilling staffing shortages, 97% - 100% of respondents cited overtime hours since Wave 25 (data collected between March 22, 2021, and January 9, 2022). And more than three-quarters of respondents are currently tapping agency or temp staff (79%).

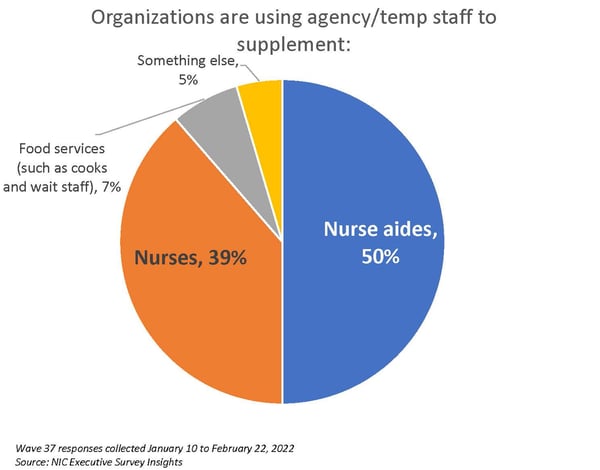

One-half of organizations use agency or temp staff to supplement nurse aides. Respondents who indicated that their organization currently utilizes agency and temp staff were asked to describe the jobs being filled. One-half of organizations use agency or temp staff to supplement nurse aides, and roughly 40% are backfilling nurses. In the Wave 37 survey, under 10% of respondents sought temp staff to fill food services positions. No respondents sought temp staff in plant operations (such as housekeeping, maintenance, and transportation staff), community administration, or corporate support.

Considering CMS data, for the week ending January 23, 2022, approximately 30% of nursing care properties reported shortages of nurse aides, 28% reported nursing staff shortages, and 18% reported shortages of other staff. This data, including vaccination rates among residents and staff of skilled nursing facilities reported to CMS, time-series trends in COVID-19 cases, fatalities, and occupancy with the ability to sort by geographic location, can be viewed by accessing the NIC Skilled Nursing COVID-19 Tracker.

A question was added to the Wave 38 survey (currently in data collection) to understand the degree of operators’ support for a federal investigation of anticompetitive practices by nursing and other direct care staffing agencies. According to the Bureau of Labor Statistics (BLS), nursing and residential care facilities employed three million people in July, down 380,000 workers from February 2020. The American Health Care Association and National Center for Assisted Living (AHCA/NCAL) with the American Hospital Association (AHA), sent a joint letter to the White House’s COVID-19 Response Team Coordinator at the end of January, requesting assistance due to reports of anticompetitive practices by nursing and other direct care staffing agencies. AHCA/NCAL asked that the White House “urgently devote” the federal government’s attention to these practices. (Both organizations are still waiting on a response from the Federal Trade Commission after writing to the agency to investigate the matter last October.)

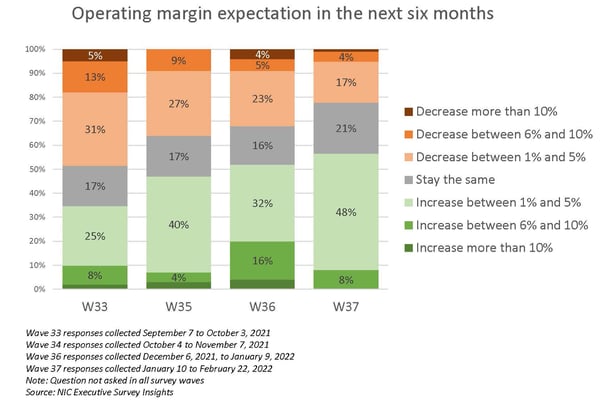

Anticipated increases in operating margins in the near term have moderated since last September. Just over one-half of respondents (56%) in Wave 37 anticipate their organization’s operating margins will improve in the next six months. Just under one-half (48%) expect a 1% to 5% increase. While rising wages, insurance premiums, and maintaining infection control measures will continue to be mitigating factors, other factors supporting NOI growth going forward are related to rising occupancy rates and census counts and possibly higher rates, as evidenced by anecdotal comments by some operators that they are implementing rate increases to counterbalance pandemic and recovery-related cost pressures.

Wave 37 Survey Demographics

- Responses were collected between January 10 and February 6, 2022, from owners and executives of 78 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise roughly one-half (47%) of the sample. Operators with 11 to 25 and 26 properties or more make up the other half of the sample (31% and 26%, respectively).

- One-half of respondents are exclusively for-profit providers (50%), more than one-third operate not-for-profit seniors housing and care organizations (37%), and 13% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 72% of the organizations operate seniors housing properties (IL, AL, MC), 30% operate nursing care properties, and 36% operate CCRCs (aka Life Plan Communities).

This is your survey! Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. The ESI 2022 questionnaire has been shortened from prior surveys. While some standard questions will remain for tracking purposes, in each new survey "wave," a new question or two will be added as per respondents' suggestions.

Wave 38 of the ESI is now collecting data. The current survey is available and takes five minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please get in touch with Lana Peck at lpeck@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to provide the broader market with a sense of the evolving landscape as we recover from the pandemic.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck