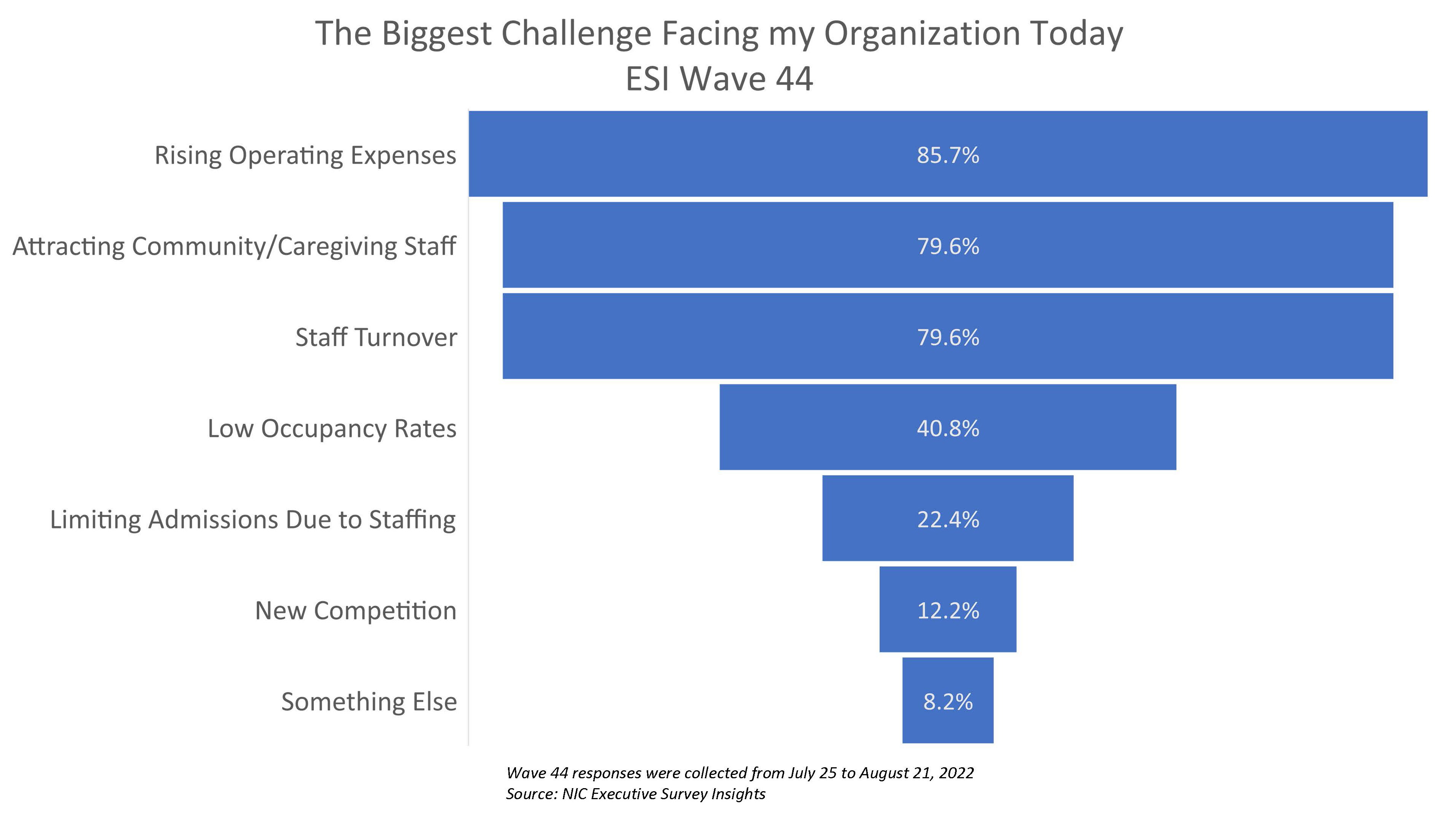

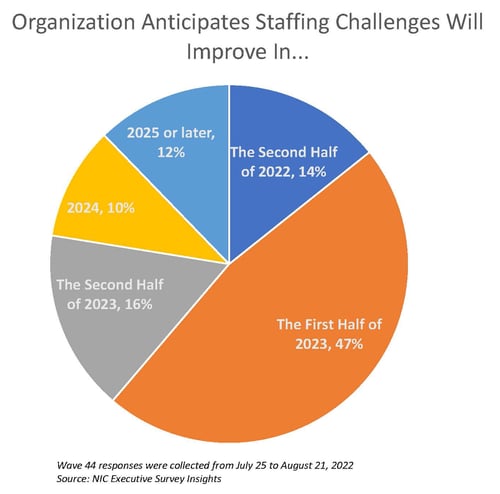

Rising operating expenses now surpass staffing challenges as the most frequently cited response to the question from Wave 44 which asks about “the biggest challenge facing my organization today.” Employee turnover and attracting community and caregiving staff (which have traditionally been cited as the top challenges among survey respondents) are now coming in as the 2nd and 3rd biggest challenges organizations are confronted with. That said, a promising sign of relief to the long-standing labor market issues may be that 15% of responding organizations anticipate their staffing challenges will improve in the second half of 2022 and half of respondents (47%) anticipate their staffing challenges will improve in the first half of 2023.

--Ryan Brooks, Senior Principal, NIC

NIC’s Executive Survey of senior housing and skilled nursing operators was implemented in March 2020 to deliver real-time insights into the impact of the pandemic and the pace of recovery. In its third year, the “ESI” has transitioned away from the COVID-19 crisis to focus on timely industry topics. While some standard questions will remain for tracking purposes, in each new survey wave, new questions are added.

This Wave 44 survey includes responses from July 25 to August 21, 2022, from owners and executives of 55 small, medium, and large senior housing and skilled nursing operators across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolio of properties. More detailed reports for each wave of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

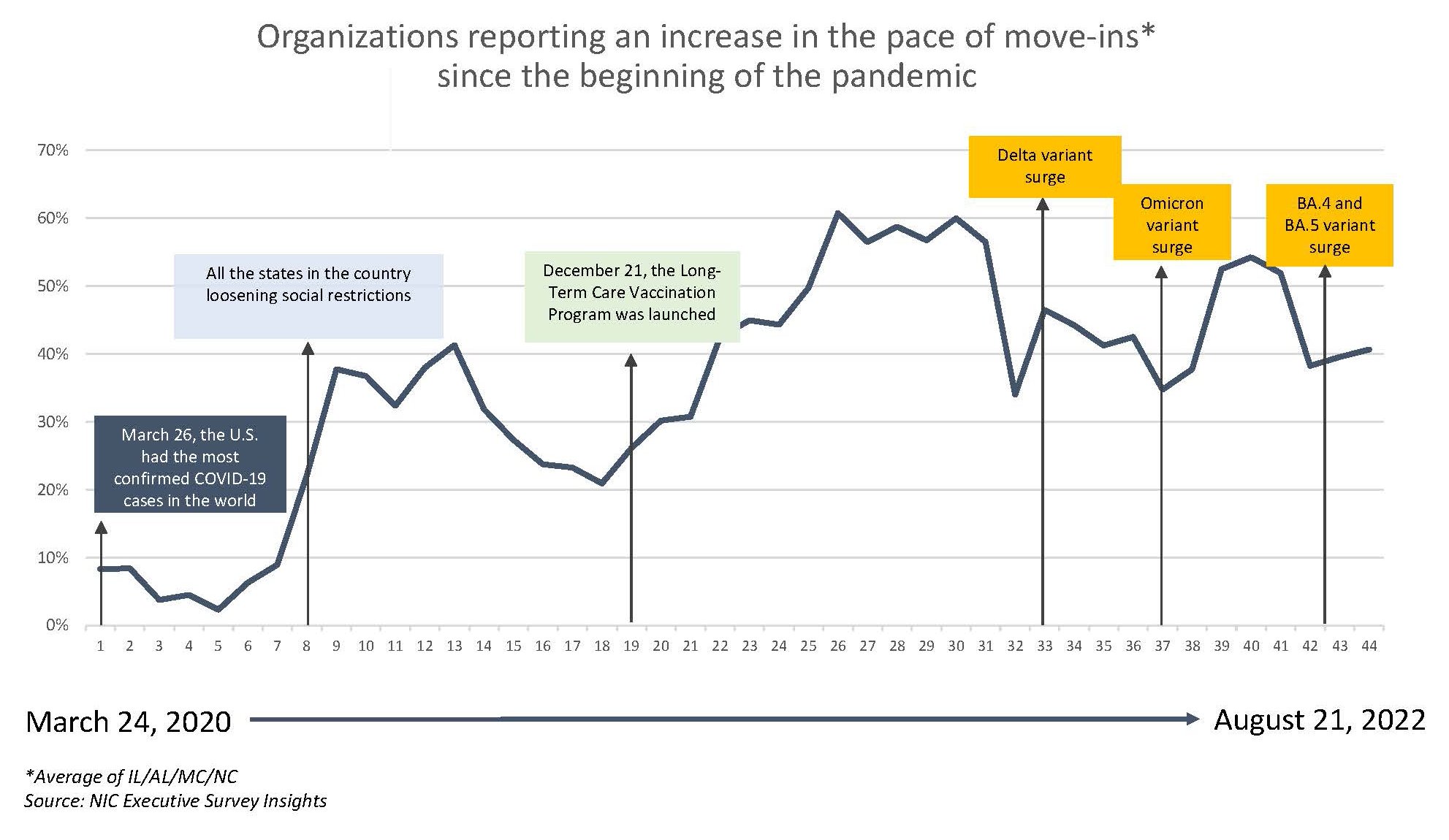

The timeline below, demonstrating the share of organizations reporting an increase in the pace of move-ins during the prior 30-days, shows that the share of organizations reporting an increase has remained close to 40% since Wave 42 conducted in June 2022.

Rising operator expenses are now the top-cited challenge of survey respondents. Eighty-six percent of respondents cite rising operating expenses as the biggest challenge currently facing their organization. This is an increase from the Wave 41 survey, conducted in May 2022, where 80% of responding organizations claimed rising operating expenses as the biggest challenge.

Rising operator expenses are now the top-cited challenge of survey respondents. Eighty-six percent of respondents cite rising operating expenses as the biggest challenge currently facing their organization. This is an increase from the Wave 41 survey, conducted in May 2022, where 80% of responding organizations claimed rising operating expenses as the biggest challenge.

Staffing challenges – turnover and attracting community and caregiving staff – remain among operators’ most significant challenges, but nearly three-quarters of respondents are optimistic that improvements are on the horizon. Since July 2021, nearly all operators (96% – 100%) responding to NIC’s Executive Survey Insights have reported staff shortages. Although no longer the top-cited challenge, employee turnover and attracting community and caregiving staff remain as significant challenges for survey respondents (80%).

When asked about backfilling staff shortages, nearly all respondents (96%) reported paying overtime hours in Wave 44, and three out of four respondents are currently tapping agency or temp staff (74%). Of those organizations, about one-half (55%) do not expect their reliance on agency or temp staff to change in the remaining months of 2022; however, 37% anticipate it will decrease.

When asked about backfilling staff shortages, nearly all respondents (96%) reported paying overtime hours in Wave 44, and three out of four respondents are currently tapping agency or temp staff (74%). Of those organizations, about one-half (55%) do not expect their reliance on agency or temp staff to change in the remaining months of 2022; however, 37% anticipate it will decrease.

A promising sign of relief to the long-standing labor market challenges may be that 14% expect staffing challenges to improve in the second half of this year. Approximately one-half believe labor markets will ease in the first half of 2023, 16% believe staffing challenges will improve in the second half of 2023, and one in four anticipate it will take until 2024 or beyond before staffing challenges ease.

Wave 44 Survey Demographics

- Responses were collected between July 25 and August 21, 2022, from owners and executives of 55 senior housing and skilled nursing operators across the nation. Owners/operators with 1 to 10 properties comprise roughly two-thirds (62%) of the sample. Operators with 11 to 25 properties account for 25%, and operators with 26 properties or more make up the rest of the sample with 13%.

- Three-fifths of respondents are exclusively for-profit providers (58%), approximately one-third operate not-for-profit seniors housing and care properties (36%), and 5% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 76% of the organizations operate seniors housing properties (IL, AL, MC), 33% operate nursing care properties, and 27% operate CCRCs – also known as life plan communities.

Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please contact Ryan Brooks at rbrooks@nic.org to be added to the list of recipients.

NIC wishes to thank respondents for their valuable input and continuing support for this effort to provide the broader market with a sense of the evolving landscape as we recover from the pandemic. This is your survey! Please take the Wave 45 survey and suggest new questions for Wave 46.

About Ryan Brooks

Senior Principal Ryan Brooks works with the research team in providing research, analysis, and contributions in the areas of healthcare collaboration and partnerships, telemedicine implementation, EHR optimization, and value-based care transition. Prior to joining NIC, he served as Clinical Administrator for multiple service lines within the Johns Hopkins Health System, where he focused on patient throughput strategies, regulatory compliance, and lean deployment throughout the organization. Brooks received his Bachelor’s in Health Services Administration from James Madison University and his Master’s in Business Administration from the University of Maryland.

Connect with Ryan Brooks

Read More by Ryan Brooks