“Single-site operators and those with between two and nine properties were more likely to be considering product diversification, with single-site operators favoring lower acuity settings (36%) and those with between two and nine properties equally considering lower acuity (20%) and higher acuity settings (20%).

With regards to expected changes to various care segments in their portfolio of properties, approximately half of respondents expect to increase the active adult (age 55+) and independent living care segments, while just under one-half (45% and 41%) anticipate increases in their assisted living and memory care segments.

When asked about the contributing factors to the acceleration of move-outs, operators cite residents moving to higher levels of care as the leading cause (45%), followed by deaths (35%), resident and family member concerns (10%), natural disasters (5%), and current economic conditions (5%).”

--Ryan Brooks, Senior Principal, NIC

This Wave 47 survey includes responses from October 17 to November 13, 2022, from owners and executives of 46 small, medium, and large senior housing and skilled nursing operators across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

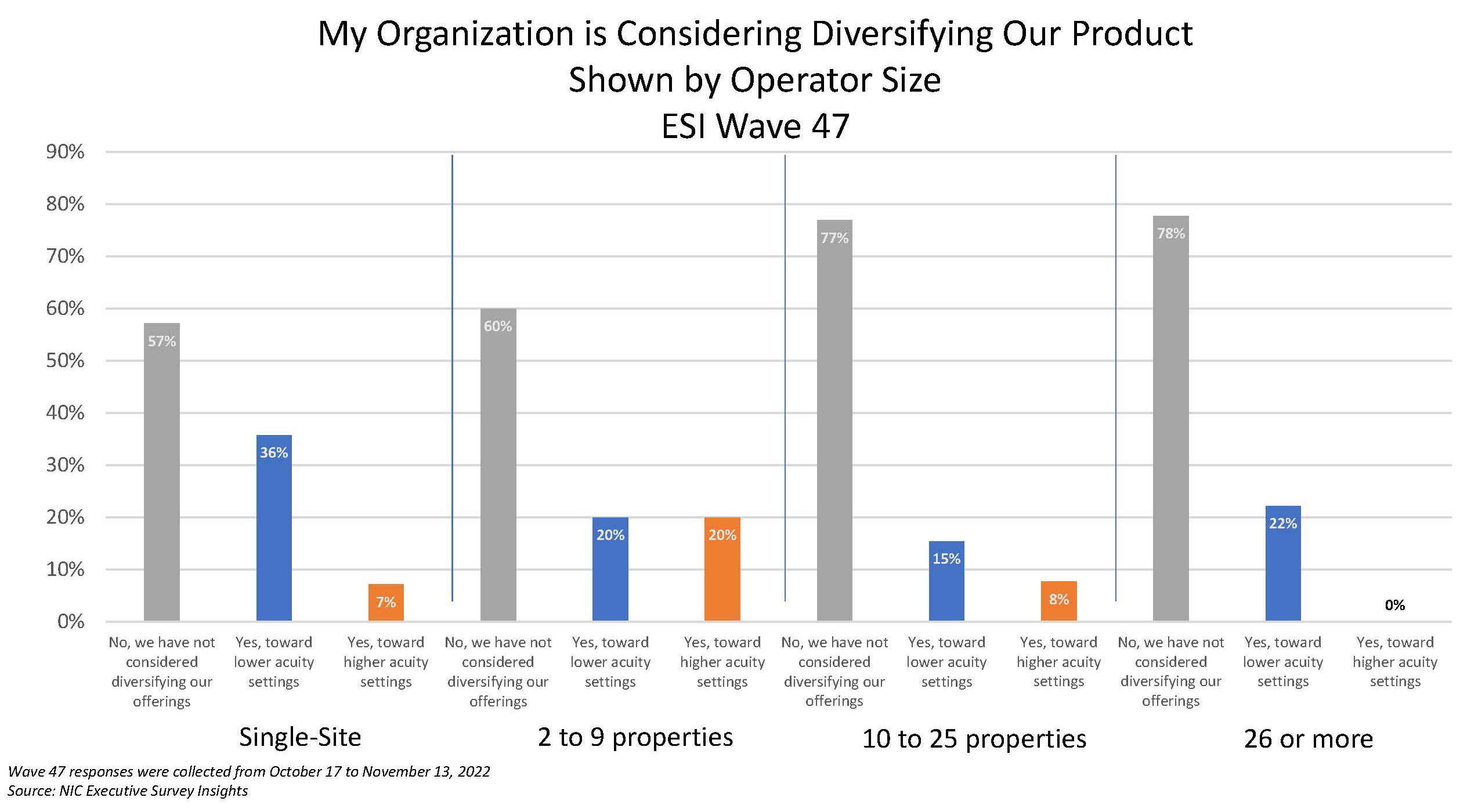

In the Wave 47 survey, reflecting operator experiences in October and November 2022, survey respondents were asked about their considerations on diversifying and expanding their product offering into higher acuity or lower acuity settings. Single-site operators and those with between two and nine properties were more likely to be considering product diversification, with single-site operators favoring lower acuity settings (36%) and those with between two and nine properties equally considering lower acuity (20%) and higher acuity settings (20%).

Larger operators were less likely to be considering product diversification, as three-quarters of those with 10 to 25 properties (77%) and those with 26 or more properties (78%) were not considering diversifying their offerings.

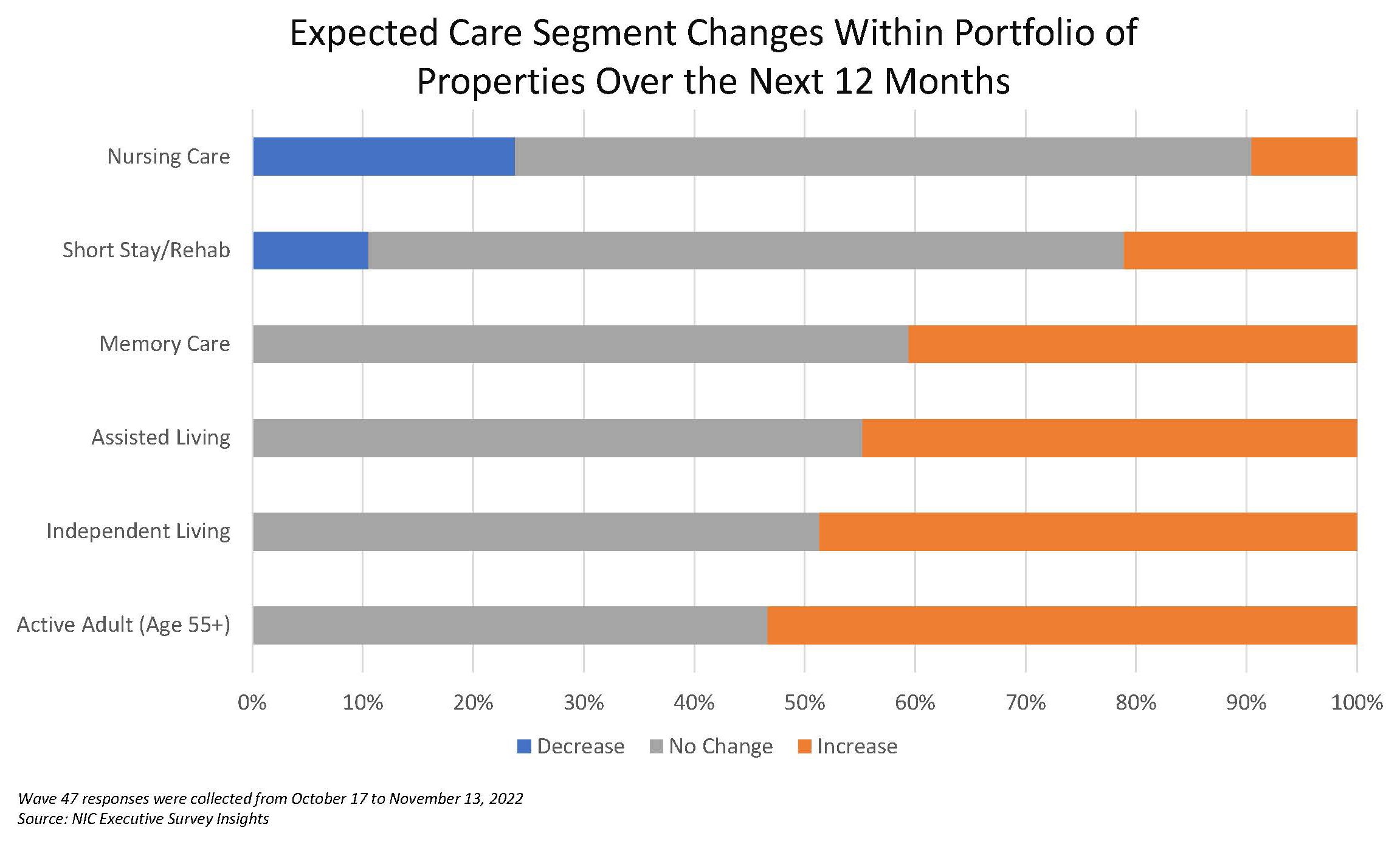

Respondents were also asked whether their organization expected to increase or decrease specific care segments in their portfolio of properties over the next 12 months. Approximately half (53% and 49%) of respondents expect to increase the active adult (age 55+) and independent living care segments, while just under one-half (45% and 41%) anticipate increases in their assisted living and memory care segments.

Short stay/rehab and nursing care were the only care segments with survey respondents reporting expected decreases in their portfolio of properties over the next 12 months. One-quarter (24%) of respondents anticipate decreasing nursing care and one-tenth (11%) anticipate decreasing short stay/rehab within their portfolio of properties.

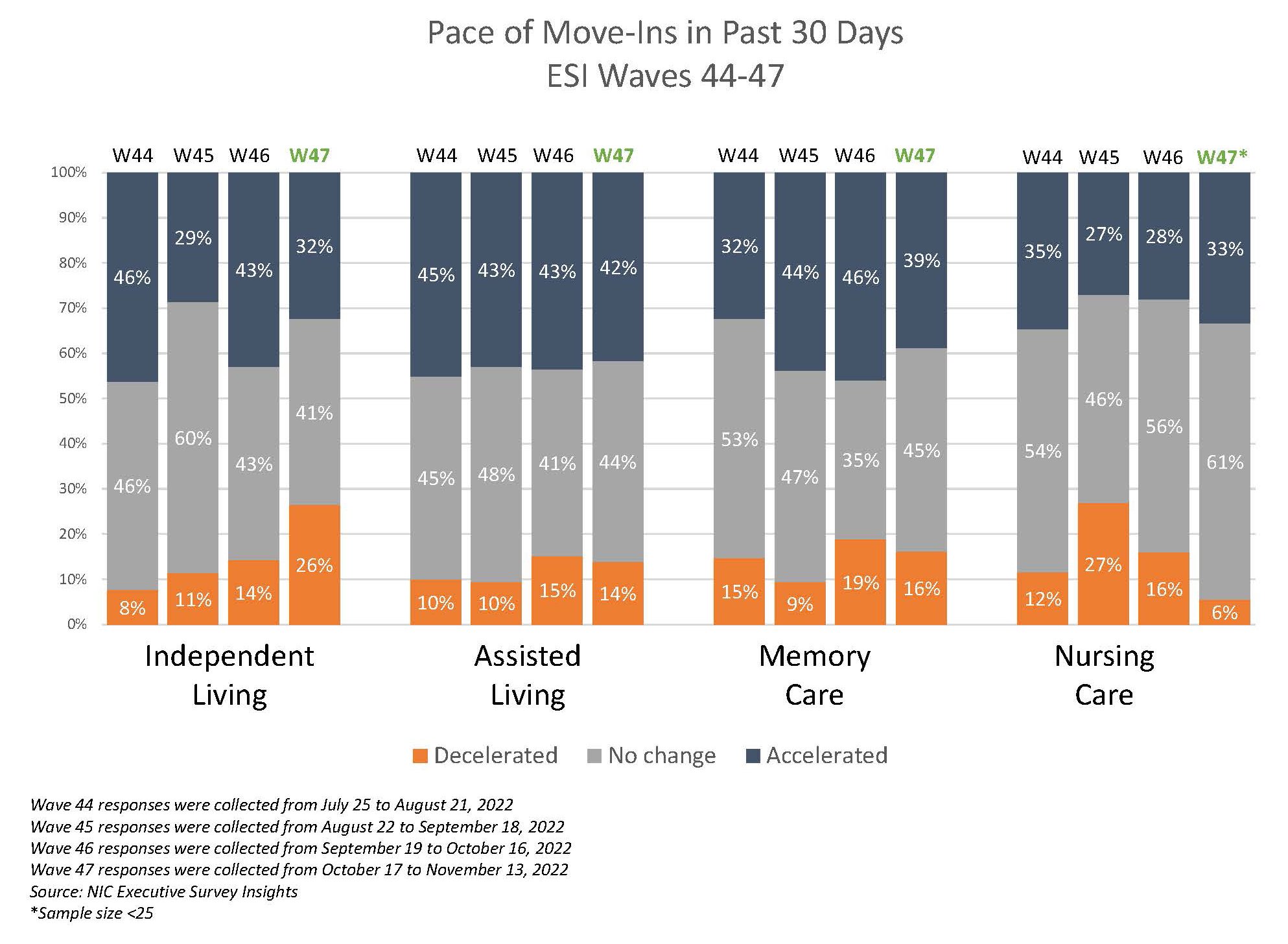

The share of operators reporting a deceleration in the pace of move-ins in the past 30 days went up for independent living operators (26%) but fell for nursing care operators (6%). This marks the fifth consecutive wave with an increase in independent living operators reporting a deceleration in the pace of move-ins. For nursing care, it is the third consecutive wave with a decline in the rate of operators reporting a deceleration in the pace of move-ins. The share of assisted living (14%) and memory care operators (16%) reporting a deceleration in the pace of move-ins remained stable compared to the previous wave.

Of respondents indicating a deceleration in the pace of move-ins, 80% indicate the deceleration is a result of a slowdown in leads conversions or sales. Accounting for the remaining 20% are resident or family member concerns, routine seasonality, and natural disasters.

Wave 47 Survey Demographics

- Responses were collected between October 17 and November 13, 2022, from owners and executives of 46 senior housing and skilled nursing operators across the nation.

- Owners/operators with 1 to 10 properties comprise roughly one-half of the sample (52%). Operators with 11 to 25 properties account for 28%, and operators with 26 properties or more make up the rest of the sample with 20%.

- More than one-half of respondents are exclusively for-profit providers (59%), one-third operate not-for-profit seniors housing and care properties (37%), and 4% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, three-quarters (74%) of the organizations operate seniors housing properties (IL, AL, MC), 17% operate nursing care properties, and 30% operate CCRCs – also known as life plan communities.

This is your survey! Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. The ESI 2022 questionnaire has been shortened from prior surveys. While some standard questions will remain for tracking purposes, in each new survey wave, new questions can be added based on respondents' suggestions.

Wave 48 of the ESI is now live and new questions have been added. The current survey is available and takes 12 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please contact Ryan Brooks at rbrooks@nic.org to be added to the list of recipients.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to provide the broader market with a sense of the evolving landscape as we recover from the pandemic.

About Ryan Brooks

Senior Principal Ryan Brooks works with the research team in providing research, analysis, and contributions in the areas of healthcare collaboration and partnerships, telemedicine implementation, EHR optimization, and value-based care transition. Prior to joining NIC, he served as Clinical Administrator for multiple service lines within the Johns Hopkins Health System, where he focused on patient throughput strategies, regulatory compliance, and lean deployment throughout the organization. Brooks received his Bachelor’s in Health Services Administration from James Madison University and his Master’s in Business Administration from the University of Maryland.

Connect with Ryan Brooks

Read More by Ryan Brooks