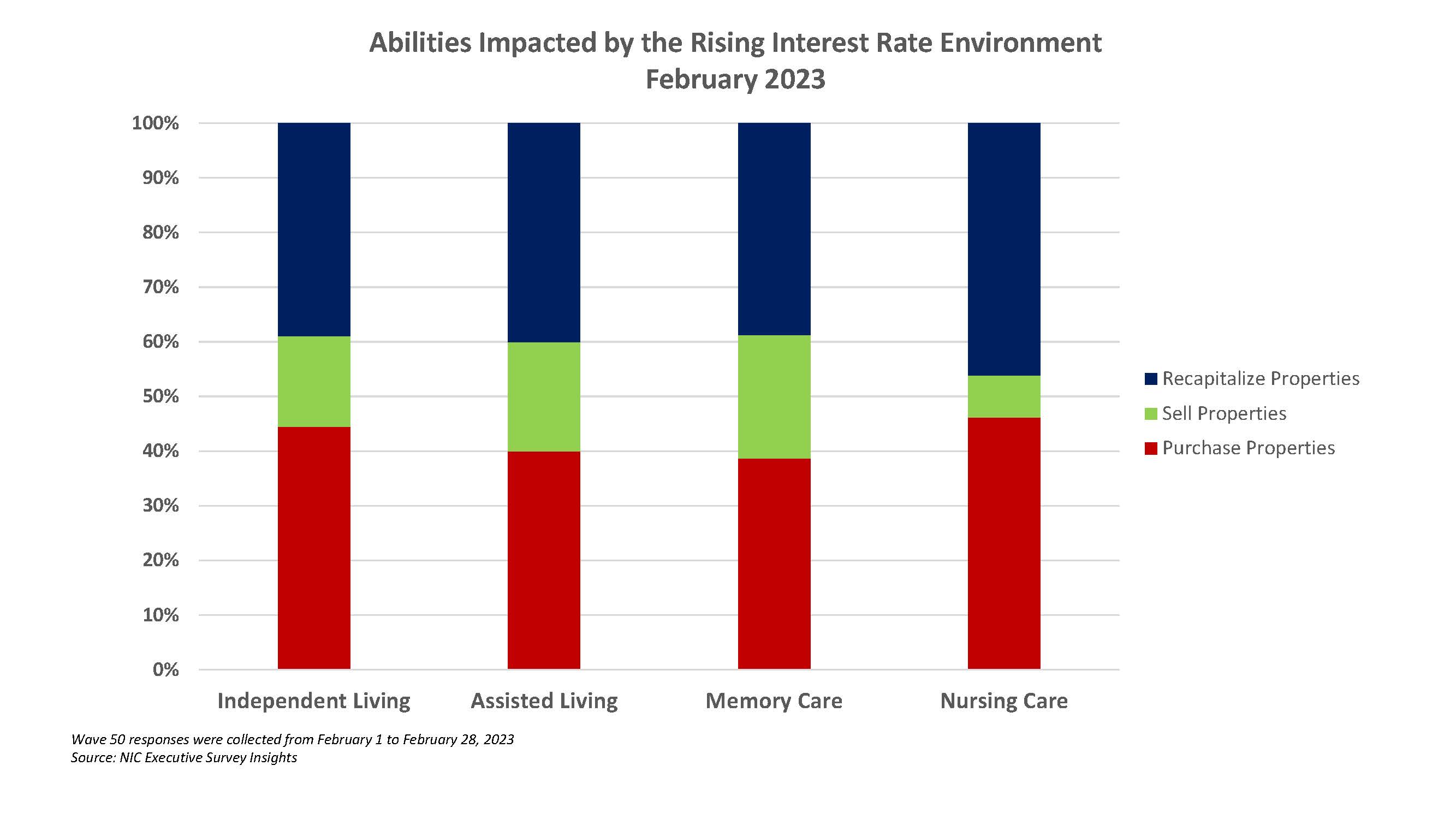

“In a new question to the ESI, respondents were asked what areas have been impacted by the rising interest rate environment. Purchasing properties was the area most reported to be affected by rising interest rates, followed by the ability to recapitalize properties. Across all care segments, one in twelve operators (8%) indicate that their abilities to purchase, sell, and recapitalize properties have all been impacted by the rising interest rate environment.

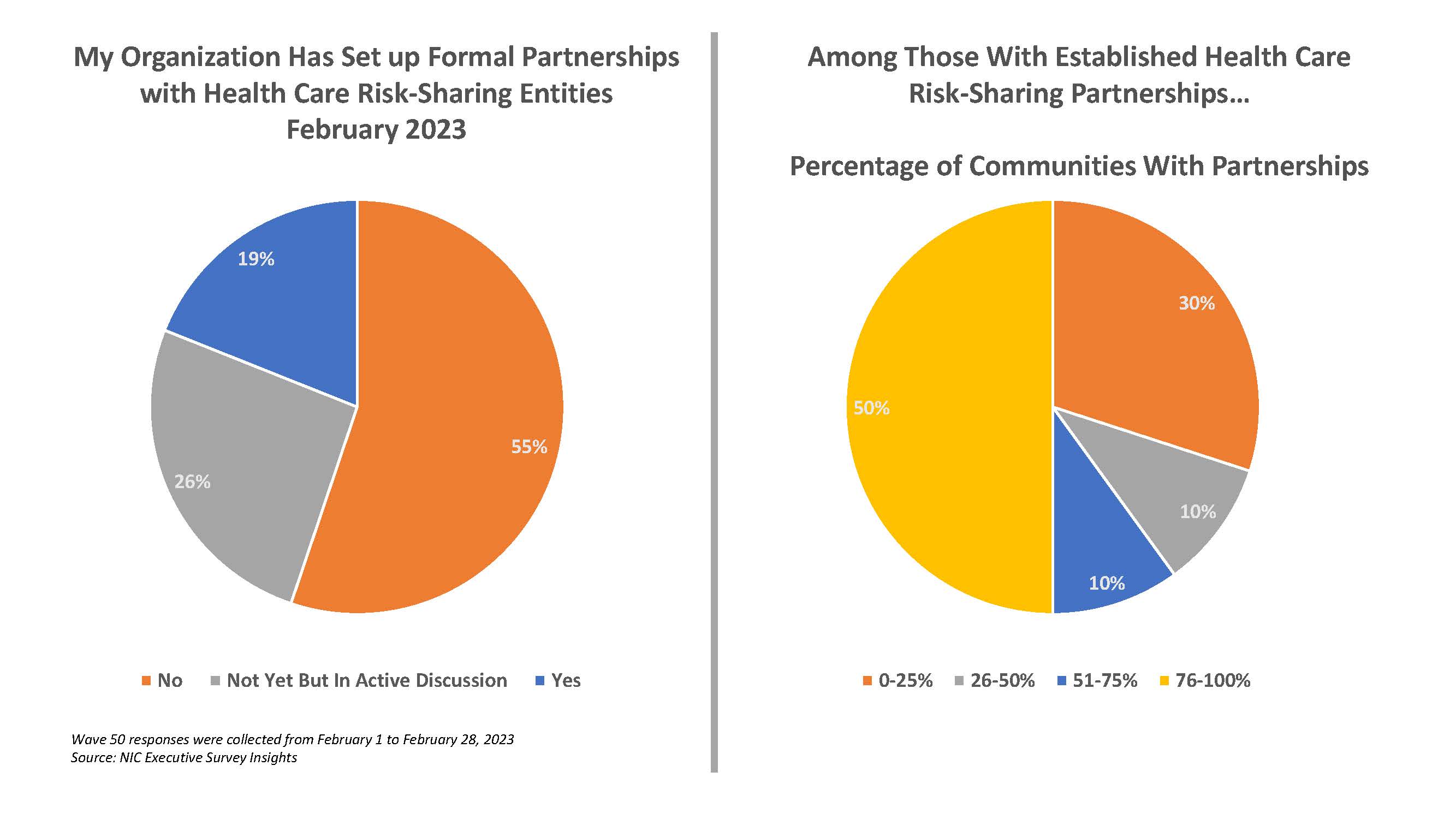

Respondents were also asked if their organization has set up formal partnerships with health care risk-sharing entities, such as accountable care organizations (ACOs) or Medicare Advantage (MA) plans. Four out of five respondents (81%) indicate that their organization does not have formal health care partnerships established, however a portion of this group (26%) also indicate that their organization is in active discussions to establish these types of partnerships. Only one in five (19%) responding organizations have formal partnerships with health care risk-sharing entities.”

--Ryan Brooks, Senior Principal, NIC

This ESI survey includes responses from February 1, 2023, to February 28, 2023, from owners and executives of 58 small, medium, and large senior housing and skilled nursing operators across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

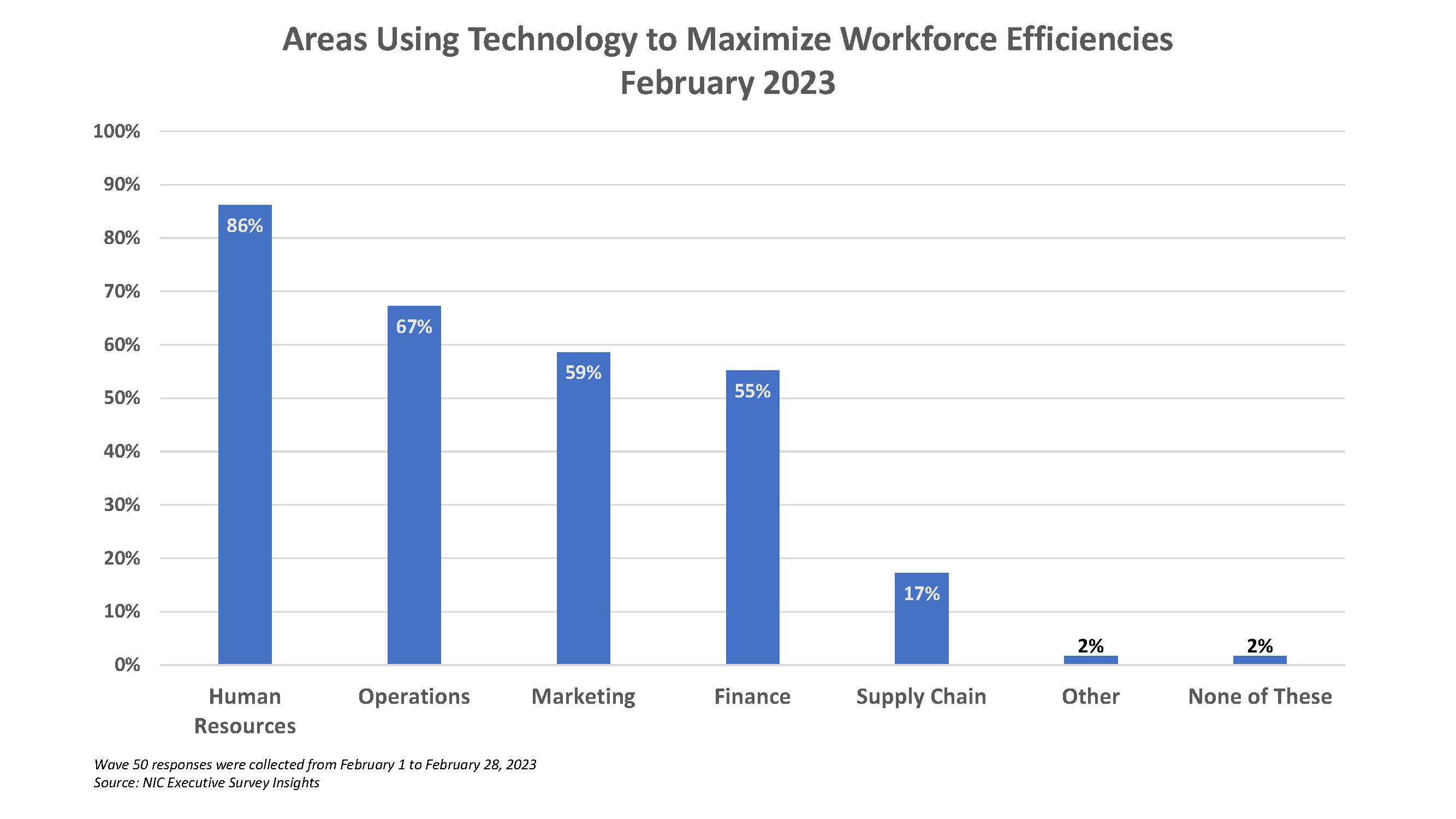

In the February 2023 survey, respondents were asked in what areas their organization is using technology to maximize the efficiencies of the existing workforce. The most common area where technology is being deployed to maximize workforce efficiencies is in Human Resources. Categories of technological deployment within Human Resources include recruiting, staff onboarding, staff training, and employee retention. Almost nine of ten respondents (86%) reported using technology to improve efficiencies in Human Resources, followed by two-thirds (67%) deploying technology in Operations, and more than half deploying technology in Marketing (59%) and Finance (55%). Only one out of every six respondents reported using technology to improve workforce efficiency in the area of Supply Chain, however.

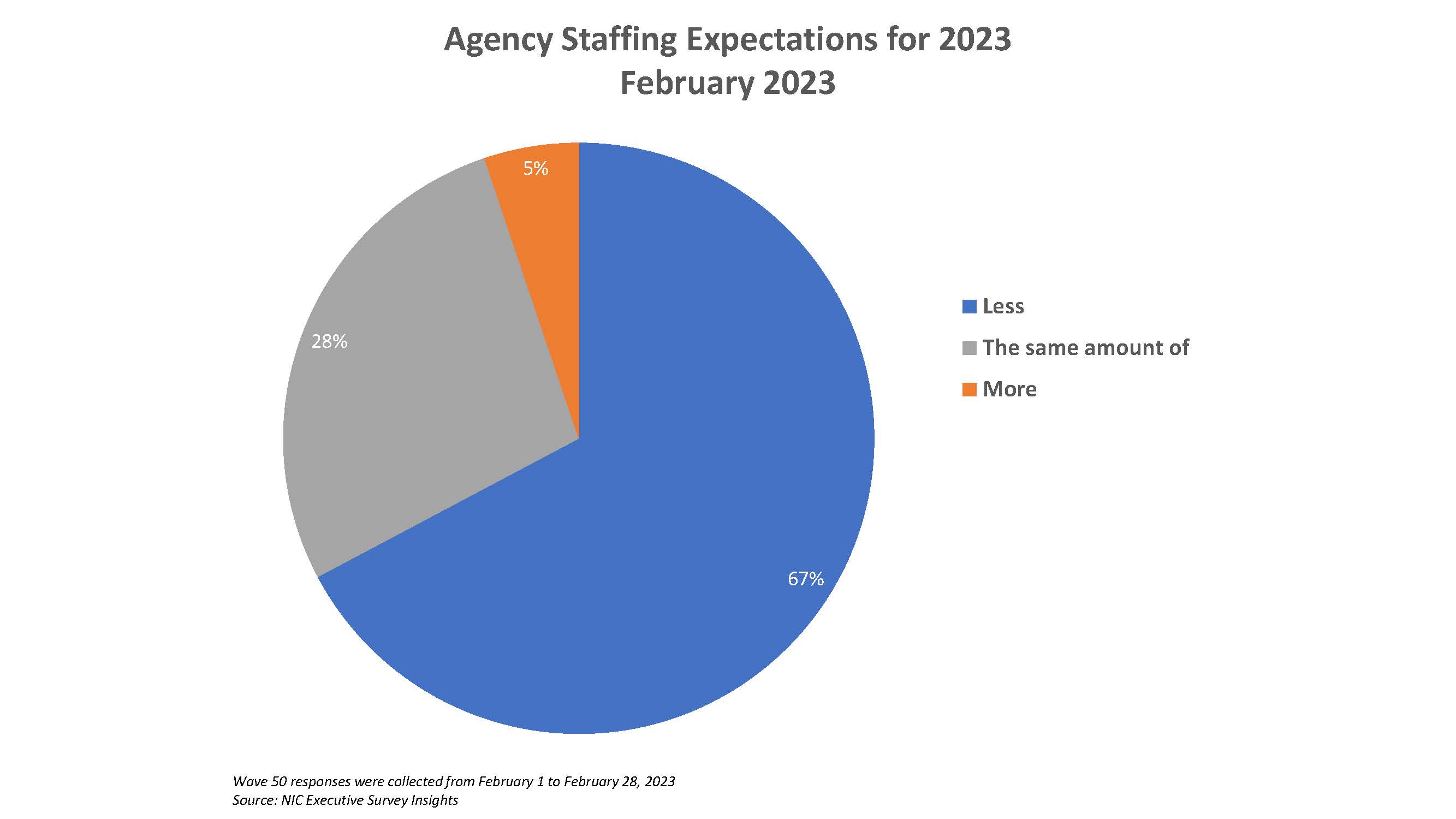

With the area of Human Resources experiencing a high degree of technological implementation to improve workforce efficiencies, it may not come as a surprise that operators are expressing some optimism with regards to their agency staff utilization in 2023. Two-thirds (67%) of responding operators expect to use less agency labor in 2023 when compared to 2022. Almost one-third (28%) anticipate using the same amount of agency labor, and only 5% expect to require more agency utilization than last year.

Technology applications in the Operations area include voice-enabled rooms, electronic medical records, and medication distribution. Applications within the Marketing area include virtual tours and customer relationship management while applications within the Finance area include accounting and procurement practices.

In a new question to the ESI, respondents were asked what areas have been impacted by the rising interest rate environment. Purchasing properties was the area most reported to be affected by rising interest rates, followed by the ability to recapitalize properties. Across all care segments, just under one in ten operators (8%) indicate that their abilities to purchase, sell, and recapitalize properties have all been impacted by the rising interest rate environment.

Respondents were also asked to specify in what ways those areas have been affected. Responses include an increased cost of capital, increased difficulty reaching good financing terms, and the increased cost of debt leading to wider bid-ask spreads that put both sellers and potential recapitalization partners on the sidelines.

When asked about other challenges currently facing their organization, rising operator expenses was cited as the most common (26%), followed by staff turnover (24%), and attracting community and caregiving staff (23%). Less commonly cited challenges include low occupancy rates (10%), new competition (6%), and the 2023 recession (6%).

In the February survey, respondents were asked if their organization has set up formal partnerships with health care risk-sharing entities, such as accountable care organizations (ACOs) or Medicare Advantage (MA) plans. Four out of five respondents (81%) indicate that their organization does not have formal health care partnerships established, however a portion of this group (26%) also indicate that their organization is in active discussions to establish these types of partnerships. Only one in five (19%) responding organizations have formal partnerships with health care risk-sharing entities.

Among organizations who do currently have these formal partnerships established, responses show that the programs are not always implemented in every community. One-third (30%) of operators report these partnerships are established in up to 25% of their communities. One-tenth of operators indicate these programs are implemented in between 26-50% and another one-tenth indicate they are implemented in between 51-75% of their communities. The remaining half of responses have implemented these programs in between 76-100% of their communities.

February 2023 Survey Demographics

- Responses were collected between February 1, 2023, and February 28, 2023, from owners and executives of 58 senior housing and skilled nursing operators across the nation.

- Owners/operators with 1 to 10 properties comprise more than one-half of the sample (60%). Operators with 11 to 25 properties account for one-fifth (19%) and operators with 26 properties or account for another one-fifth (21%).

- Two-thirds of respondents are exclusively for-profit providers (64%), one-third operate not-for-profit seniors housing and care properties (31%), and 5% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, three-quarters (74%) of the organizations operate seniors housing properties (IL, AL, MC), 21% operate nursing care properties, and 28% operate CCRCs – also known as life plan communities.

The March 2023 ESI survey is currently open and will be collecting responses through March 31, 2023. If you are an owner or C-suite executive of seniors housing and care and would like an invitation to participate in the survey, please contact Ryan Brooks at rbrooks@nic.org to be added to the list of recipients.

NIC wishes to extend a heartfelt thank you to the owners and operators who have contributed to this survey over the past three years. It is remarkable that we have now completed more than 50 waves. We have surveyed through numerous challenges -- COVID-19, threats of a looming recession, labor shortages, inflation, and rising expenses -- many of which persist. As we continue to navigate these challenges, your input and real-time insights help ensure the narrative on the senior housing and care sector is accurate. By demonstrating transparency, you build trust.

About Ryan Brooks

Senior Principal Ryan Brooks works with the research team in providing research, analysis, and contributions in the areas of healthcare collaboration and partnerships, telemedicine implementation, EHR optimization, and value-based care transition. Prior to joining NIC, he served as Clinical Administrator for multiple service lines within the Johns Hopkins Health System, where he focused on patient throughput strategies, regulatory compliance, and lean deployment throughout the organization. Brooks received his Bachelor’s in Health Services Administration from James Madison University and his Master’s in Business Administration from the University of Maryland.

Connect with Ryan Brooks

Read More by Ryan Brooks