A NIC report developed to provide timely insights from owners and C-suite operators and executives on the pulse of seniors housing and skilled nursing sectors.

NIC’s weekly Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time where market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

This Wave 8 survey sample includes responses collected May 25-June 7, 2020 from owners and executives of 150 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Join other operators in the sector and participate in the next wave.

In an effort to balance the time commitment of operators responding to our surveys while simultaneously continuing to provide transparency through the delivery of timely and informative data during the COVID-19 pandemic, NIC is separating the existing Executive Survey Insights into two alternating surveys:

- Executive Survey Insights: Market Fundamentals – Researches the impact of COVID-19 on occupancy rates, move-in and move-out rates, development pipelines, staffing, and supports for frontline community employees and staff.

- Executive Survey Insights: COVID-19 – Provides insights into how COVID-19 penetration differs across care segments from both a cumulative and in-place perspective.

Surveys will be distributed on a staggered, every other week basis and the analysis of the survey responses will be made public on our website in the NIC Notes blog. Responses from both surveys will continue to be shared with survey participants in advance of public release. Additionally, the historical Executive Survey Insights can be accessed on the NIC COVID-19 Resource Center.

Wave 8 Summary of Insights and Findings

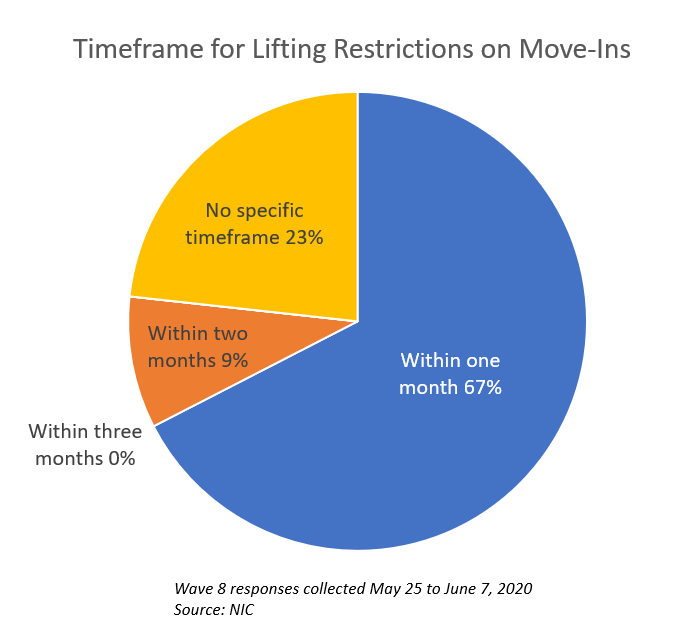

The pace of move-ins and move-outs improved across all segments, resulting in a smaller share of organizations reporting month-over-month and week-over-week declines in occupancy than in prior waves of the survey. Of those with bans on move-ins, either self-imposed or government-imposed, two of every three organizations anticipate lifting restrictions on move-ins within one month, while approximately one in four specified no time frame.

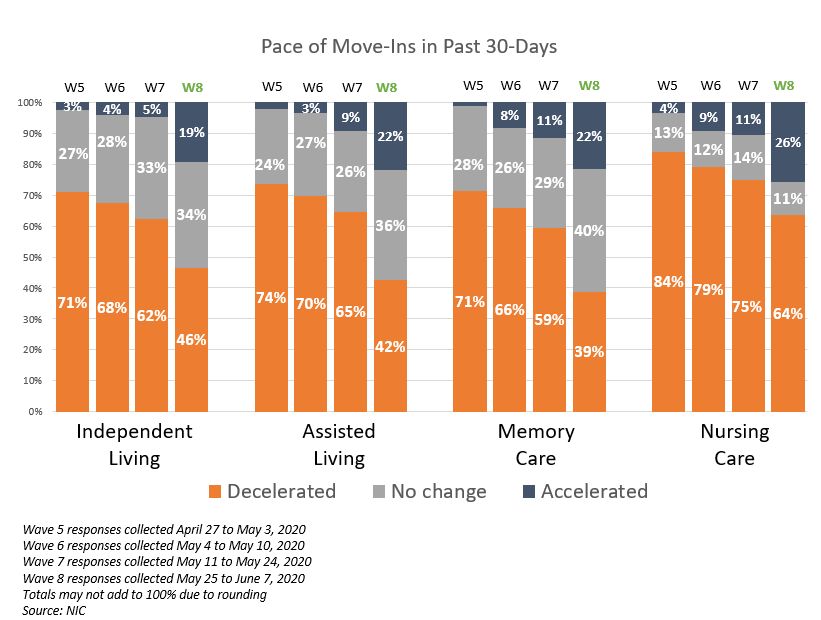

- While most organizations continue to report a deceleration in move-ins in the past 30-days, in Wave 8 of the survey, the shares of organizations reporting deceleration is the lowest—across each of the care segments—since the first two waves of the survey (data collected March 24-31 and April 1-12). Furthermore, the shares of organizations reporting an acceleration in move-ins was the most of any wave to date.

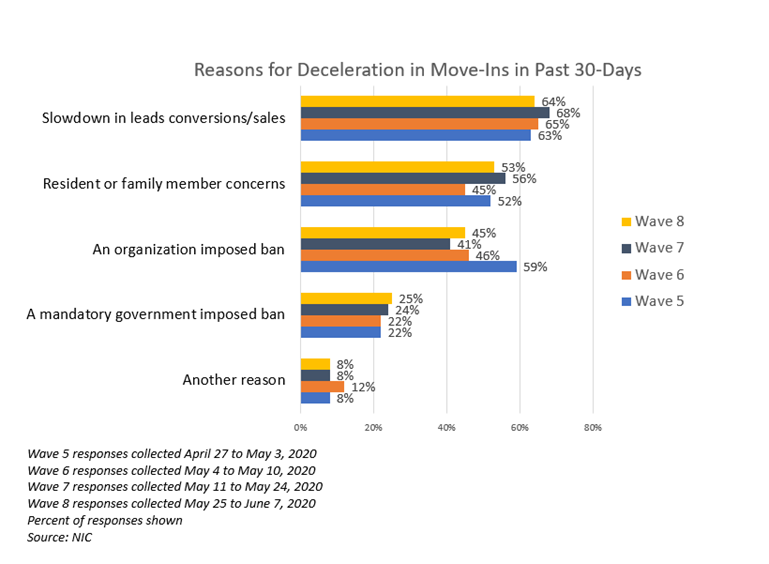

- Reasons cited for a deceleration in move-ins continue primarily to be slow leads conversions/sales resulting in difficulty replacing residents who have passed away or moved out. However, about 15% fewer organizations cite an organization-imposed ban on move-ins in Wave 8 compared to Wave 5, as all states have begun to loosen social and economic restrictions. About one-half of respondents continue to cite resident or family member concerns about moving in. Others continue to note fewer hospital referrals or elective surgeries that bring in residents for rehabilitation and therapy.

- Fewer organizations saw a month-over-month decrease in occupancy compared to earlier survey waves. Additionally, the shares of organizations reporting an increase in occupancy from the prior month increased to the highest since the first two waves of the survey (between 14% and 25% in Wave 8). Respondents with independent living, assisted living, and memory care segment units report slightly higher shares of stable or improving occupancy rates from a week ago.

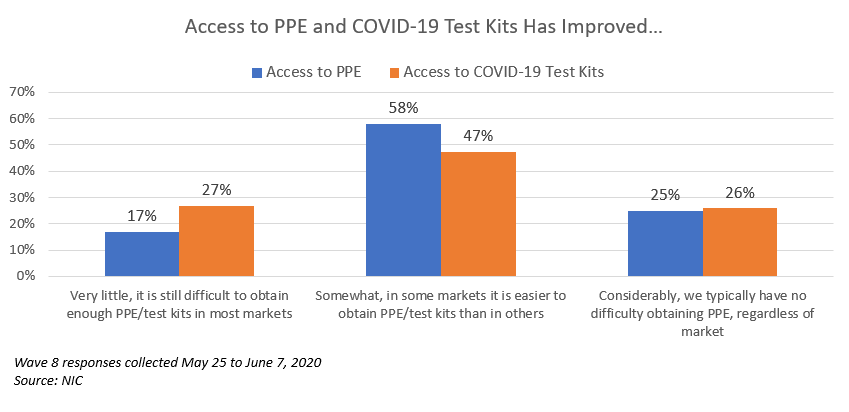

- Approximately one in four organizations indicated that both access to PPE and access to COVID-19 testing kits has improved considerably, while 58% indicated it has improved somewhat for PPE and 47% for test kits. Roughly one in four organizations report that it is still difficult to obtain enough testing kits.

Wave 8 Summary Demographics

- Responses were collected May 25-June 7, 2020 from owners and executives of 150 seniors housing and skilled nursing operators from across the nation.

- Two-thirds of respondents were exclusively for-profit providers (66%), about one-quarter (27%) were exclusively nonprofit providers, and 7% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 53% of the sample. Operators with 11 to 25 properties make up 25% while operators with 26 properties or more make up 22% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 81% of the organizations operate seniors housing properties (IL, AL, MC), 34% operate nursing care properties, and 28% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

- The shares of organizations reporting a deceleration in move-ins in the past 30-days is the lowest, across each of the care segments, since the first two waves of the survey (data collected March 24-31 and April 1-12), while the share of organizations reporting an acceleration is the highest.

- In Wave 8 of the survey, between 39% to 46% of organizations reporting on their independent living, assisted living and memory care segments, and 64% of organizations with nursing care beds indicated that the pace of move-ins decelerated in the past 30-days—a continuing trend in improvement.

- Additionally, approximately 20% of organizations with independent living, assisted living, and memory care segments and about one-quarter of organizations with nursing care beds saw an acceleration in move-ins in the past 30-days.

Reasons for Deceleration in Move-Ins

Respondents were asked: “The deceleration in move-ins is due to…”

- Significantly fewer respondents in recent surveys cited an organization-imposed ban on settling new residents into their communities than in earlier waves (45% in Wave 8 versus 59% in Wave 5).

- In Wave 8 of the survey—in similar proportions to the prior three waves—roughly two-thirds of respondents attribute a deceleration in move-ins to a slowdown in leads conversions/sales. Around one-half of organizations cite resident or family member concerns, and about one-quarter cite a mandatory government-imposed ban. Others cite fewer hospital referrals and elective surgeries that bring residents in for rehabilitation and therapy.

When Organizations Will Lift Restrictions on Move-Ins

Respondents that reported having an organization-wide ban or mandatory government-imposed ban were asked: “My organization anticipates lifting restrictions on settling new residents into some or all of our communities…”

- In Wave 8, two of every three organizations anticipate lifting restrictions on move-ins within one month, while approximately one in four specified no timeframe.

Move-Outs

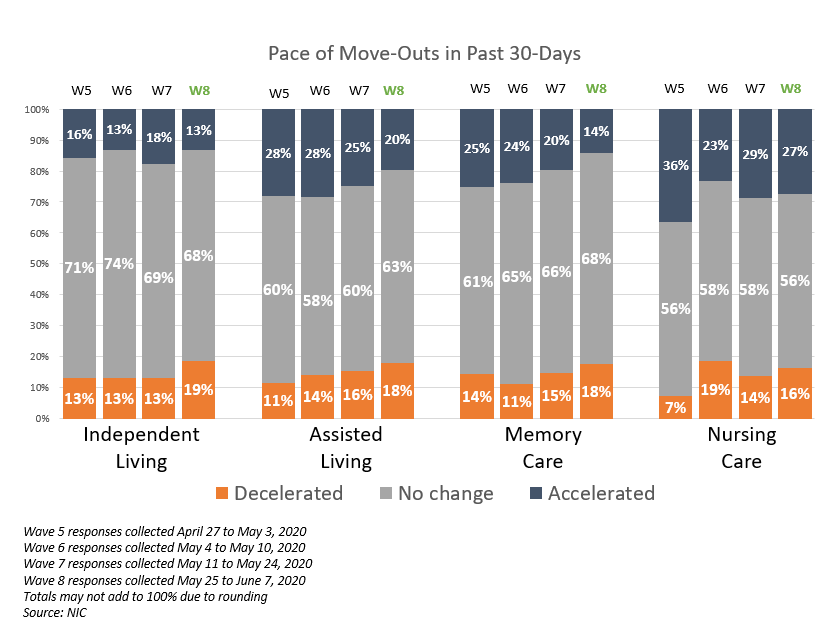

- Between 63% and 68% of organizations reporting on their independent living, assisted living, and memory care units in Wave 8 saw no change in move-outs in the past 30-days, similar to Wave 7, while approximated 20% reported decelerations.

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

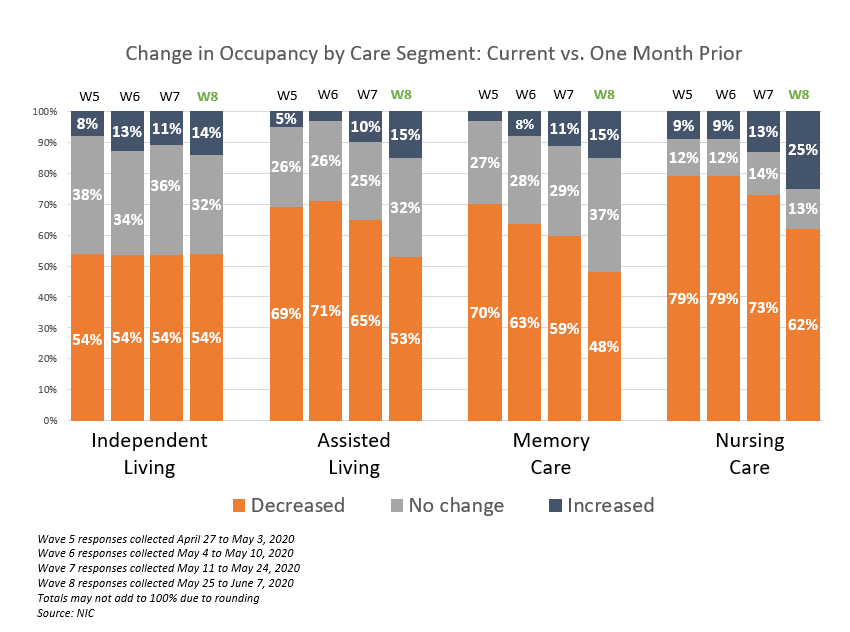

- Approximately one-half of organizations reporting on their independent living, assisted living, and memory care units in Wave 8 of the survey—across their respective portfolios of properties—experienced a decrease in occupancy from the prior month, while roughly one-third report no change (32% to 37%).

- Notably, one in four organizations with nursing care beds reported an increase in occupancy from the prior month, and 14%-15% of organizations with independent living, assisted living units or memory care units report an increase in occupancy in the past month. This was the highest since earlier waves of the survey.

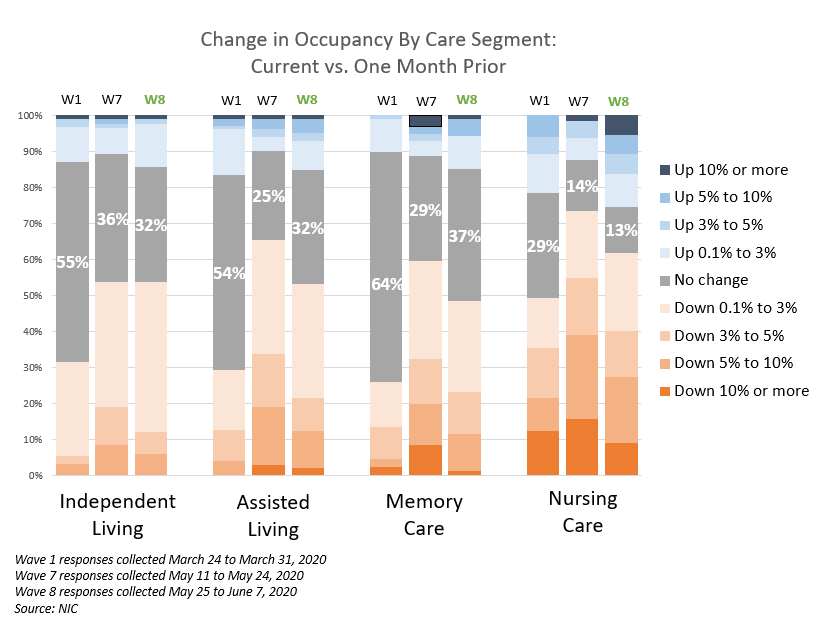

- The chart below breaks out the rates of change in occupancy by care segment with greater granularity, comparing the current timeframe (Wave 8 data collected between May 25 to June 7), to the prior survey (Wave 7 data collected between May 11 and May 24), and earlier in the pandemic at the start of this survey when the majority of independent living, assisted living and memory care segments had yet to report major changes in current occupancy compared to one month prior (Wave 1 data collected between March 24 and March 31).

- As shown in the chart, near the beginning of the pandemic (Wave 1), the share of operators that reported month-over-month occupancy rate declines increased as the pandemic progressed. More recently in Wave 8, the share reporting downward changes in occupancy has declined for all segments but independent living. The majority of those reporting occupancy declines in independent living reported declines between 0.1% and 3.0%.

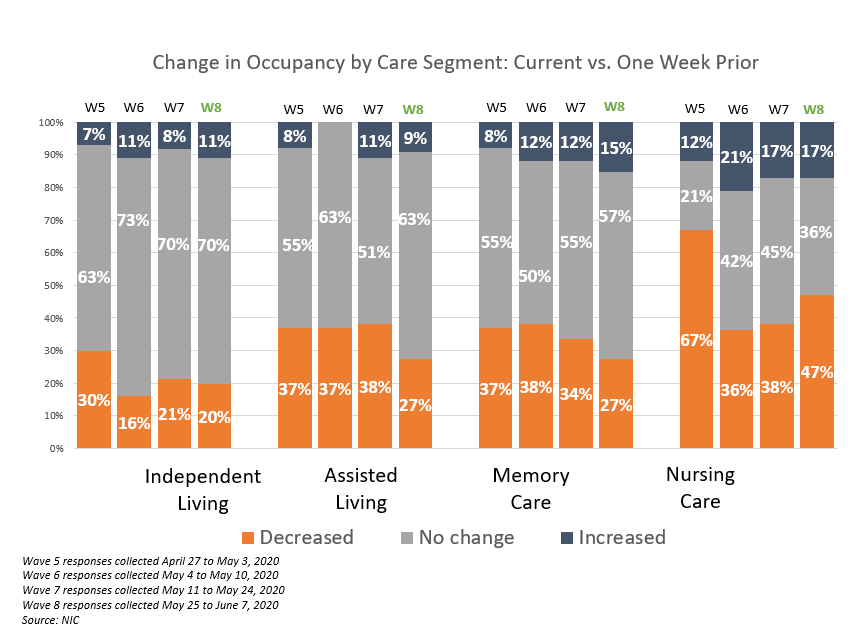

- Regarding the change in occupancy from one week ago, respondents with independent living units consistently report the fewest declines in occupancy from one week earlier while assisted living and memory care saw fewer organizations reporting declines (27%, respectively) than in prior surveys.

- Most organizations with independent living, assisted living and memory care segment units note no change (57% to 70%); however, slightly higher shares of organizations with independent living and memory care segment units report an increase in occupancy from one week ago. Organizations reporting on nursing care beds reported the highest share of higher occupancy rates from the prior week (17%), the same as in Wave 7.

Improvement in Access to PPE and COVID-19 Testing Kits

Respondents were asked: “Considering access to PPE (personal protective equipment) and COVID-19 testing kits, my organization has experienced that access has improved…”

- Approximately one in four organizations responding to this inquiry indicated that both access to PPE and access to COVID-19 testing kits has improved considerably, while 58% indicated it has improved somewhat for PPE and 47% for test kits. Roughly one in four organizations report that it is still difficult to obtain enough test kits.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. NIC also thanks both ASHA and Argentum for their support in encouraging participation in the Executive Survey Insights: COVID-19 survey. The results of our joint efforts to provide timely and informative data to the market in this challenging time have been significant and noteworthy.

The Executive Survey Insights: COVID-19 survey is now open. To respond to the survey, please click here.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the current Executive Survey, please send a message to insight@nic.org to be added to the email distribution list.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck