A NIC report developed to provide timely insights from owners and C-suite operators and executives on the pulse of seniors housing and skilled nursing sectors.

NIC’s weekly Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time where market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

This week’s sample (Wave 6) includes responses collected May 4 - May 10, 2020 from owners and executives of 100 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center under "Executive Survey Insights."

This report also features two weeks of COVID-19 seniors housing and care incidence data collected April 27 - May 10 (Waves 5 and 6 combined) as reported by a subset of survey-takers.

Summary of Insights and Findings

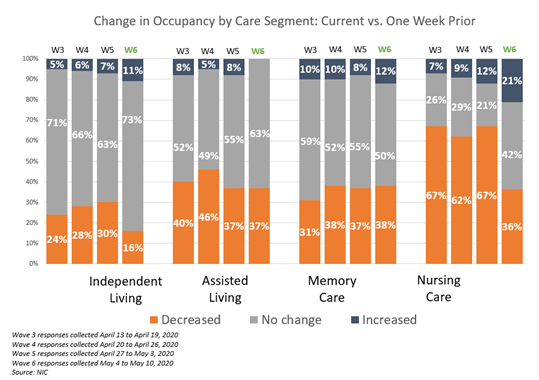

While more data is needed to observe definitive turning points in occupancy rate trend data there are signs of potential improvements in occupancy patterns in the survey’s week-over-week data. In Wave 6, 21% of the respondents reporting on nursing care indicated that occupancy rates had started to increase, the most since the survey started. That said, 36% of respondents do continue to report declines in occupancy for skilled nursing from the prior week, although that is down from 67% in Wave 5. Respondents with independent living and memory care segment units also report slightly higher shares of improving occupancy rates from a week prior.

Other potentially positive signals include a slightly lower percentage of operators reporting decelerations of move-ins in Wave 6 relative to Wave 5—although the majority of organizations across all care segments did still report that move-ins decelerated in the past 30-days. Additionally, the percentage of respondents citing an organization-imposed ban on move-ins decreased from 59% in Wave 5 to 46% in Wave 6, and fewer respondents cited resident or family member concerns about moving residents in or out of communities.

- Regarding the change in occupancy from one week ago, the independent living and nursing care segments reported the most improvement from prior waves of the survey. The nursing care segment had the largest increase in the share of organizations reporting higher occupancy rates from the prior week (21%).

- The share of organizations reporting a deceleration in move-ins with regard to their nursing care segments in Wave 6 of the survey is lower compared to Wave 5 and Wave 3. Of note, 19% of organizations with nursing care beds report a deceleration in move-outs in the past 30-days in Wave 6, compared to 7% in Wave 5. Furthermore, under a quarter note an acceleration in move-outs, compared to around one-third in the prior three waves of the survey.

- The share of organizations reporting an acceleration in the pace of move-outs for the assisted living and memory care segments remain comparable to Wave 5 (around one-quarter), but higher than earlier waves of the survey. While the assisted living care segment saw a slight increase in the share of organizations experiencing a deceleration of move-outs compared to Wave 5, the memory care segment reported a slightly lower share.

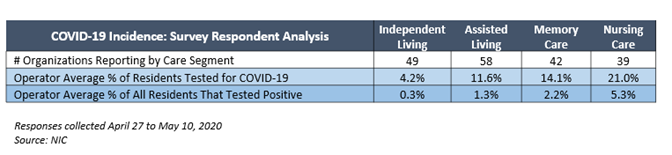

- For the data collected between April 27 and May 10, 2020 (Waves 5 and 6 of the survey combined), a subset of seniors housing and care executives, answering on behalf of their organizations, provided the number of residents that were tested for COVID-19 and the number of residents tested positive by care segment.

- The operator average for the percentage of residents tested for COVID-19 by care segment rose with acuity level and ranged from 4.2% for independent living, 11.6% for assisted living, 14.1% for memory care and 21.0% for nursing care. The operator average of all residents with a lab-confirmed positive test for COVID-19 ranged from 0.3% for independent living, 1.3% for assisted living, 2.2% for memory care and 5.3% for nursing care. More detail can be found in the Key Survey Results section of this report.

Wave 6 Survey Demographics

- Responses were collected May 4 - May 10, 2020 from owners and executives of 100 seniors housing and skilled nursing operators from across the nation.

- Nearly two-thirds of respondents were exclusively for-profit providers (60%), about one-third (31%) were exclusively nonprofit providers, and 9% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 56% of the sample. Operators with 11 to 25 properties make up 26% while operators with 26 properties or more make up 18% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 84% of the organizations operate seniors housing properties (IL, AL, MC), 26% operate nursing care properties, and 31% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Pace of Move-Ins and Move-Outs

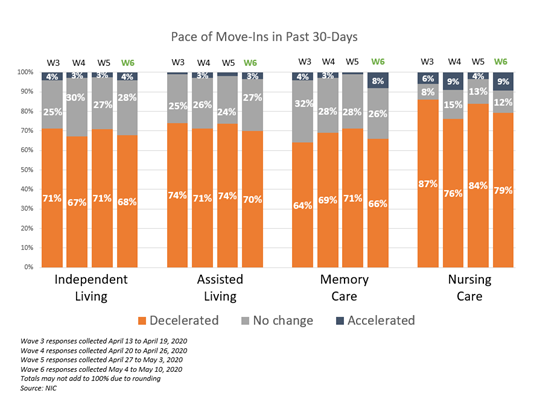

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

- In Wave 6 of the survey, between 66% and 70% of organizations reporting on their independent living, assisted living and memory care segments indicated that the pace of move-ins decelerated. However, between 26% and 28% report no change in the pace of move-ins for these care segments.

- Most of the organizations reporting on their nursing care segments in Wave 6 of the survey note a deceleration in move-ins (79%); however, the share is lower compared to Wave 5 (84%) and Wave 3 (87%).

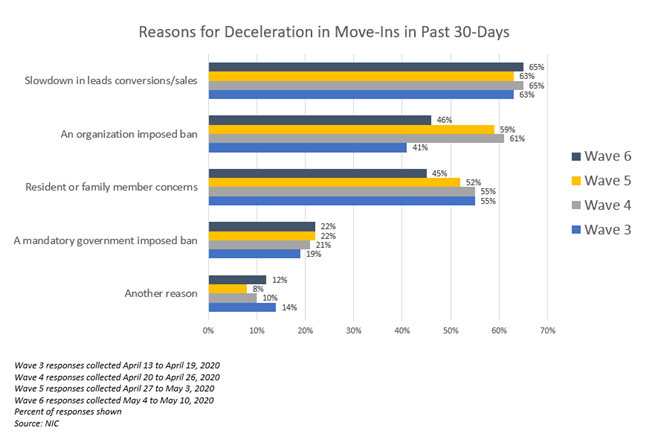

Reasons for Deceleration in Move-Ins

Respondents were asked: “The deceleration in move-ins is due to…”

- The most common reason cited for deceleration in move-ins continues to be slowdowns in leads conversions/sales due to moratoriums of moving residents into communities to mitigate COVID-19 contagion among residents and the staff members who care for them.

- Fewer respondents in Wave 6 cited an organization-imposed ban on settling new residents into their communities (46%) compared to the prior two waves (59% and 61%, respectively). Additionally, fewer organizations in Wave 6 cited resident or family member concerns (45%) than in the prior three waves of the survey.

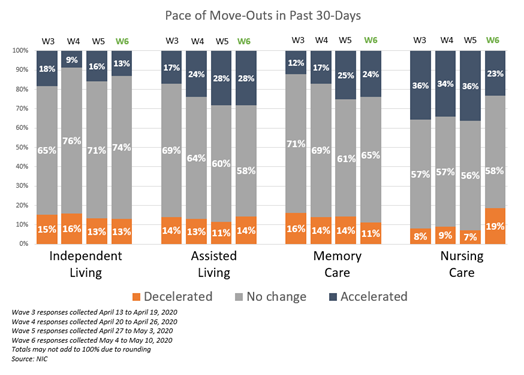

Move-Outs

- Between 58% and 74% of organizations reporting on their independent living, assisted living and memory care units saw no change in move-outs in the past 30-days. The share of organizations with independent living units reporting no change in move-outs has remained between 76% and 71% since Wave 4.

- The share of organizations reporting an acceleration in move-outs in the past 30-days for the assisted living and memory care segments remained comparable to Wave 5 (28% and 24%), but higher than Waves 4 and 3. The assisted living care segment, however, saw a slight increase in the share of organizations experiencing a deceleration of move-outs (14%) compared to Wave 5 (11%), while a slightly greater share with memory care units saw a slight decrease (from 14% to 11%).

- Until Wave 6, the pace of move-outs reported for the nursing care segment had been consistent across waves of the survey with around one-third of organizations with nursing care beds reporting an acceleration in move-outs. However, the pace of move-outs in Wave 6 slowed with under a quarter of survey respondents experiencing an acceleration in move-outs. Further, 19% of organizations with nursing care beds report a deceleration in move-outs in Wave 6 compared to 7% in Wave 5.

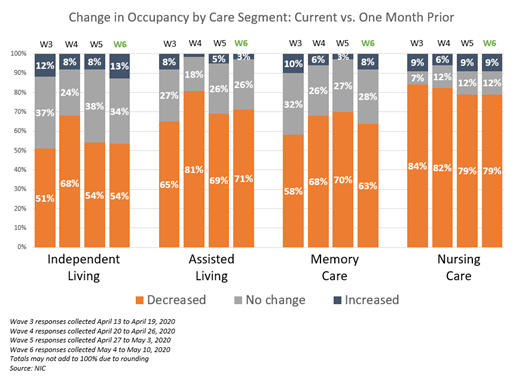

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

- In similar proportions to Wave 5, approximately one-half to more than two-thirds (54% to 71%) of organizations reporting on their independent living and assisted living segment units, and 79% of organizations reporting on their nursing care beds in Wave 6 of the survey—across their respective portfolios of properties—experienced a decrease in occupancy from the prior month.

- The share of organizations with memory care units reporting a decline in occupancy rates fell from 70% in Wave 5 to 63% in Wave 6, and more than one third (36%) noted either no change or an increase in occupancy from the prior month.

- The independent living segment saw the highest share of organizations reporting an increase in occupancy from one month prior (13%).

- The percent of organizations reporting nursing care segment occupancy declines in Wave 6 was equal to Wave 5 (79%) and down slightly from 84% in Wave 3.

- Regarding the change in occupancy from one week ago, the independent living and nursing care segments reported the most improvement from prior waves of the survey. In Wave 6, 84% of organizations with independent living units and 63% of organizations with nursing care beds saw no change or an increase in occupancy rates.

- The nursing care segment had the largest increase in share of organizations reporting higher occupancy rates from the prior week (21%). More organizations with assisted living units note no change in occupancy rates from the prior week than in previous waves of the study (63%).

Incidence of COVID-19 Among Survey Respondents

For the data collected between April 27 and May 10, 2020 (Waves 5 and 6 combined), seniors housing and care executives, answering on behalf of their organizations, provided the number of residents that were tested for COVID-19 and the number of residents that tested positive by care segment.

- The COVID-19 incidence data is a self-reported, non-validated sampling of seniors housing and care owners and operator executives for the two-week timeframe. It is important to note that this sample is not a statistical representation of COVID-19 incidence in seniors housing and care, in general.

- As shown in the table, in this sample of survey respondents, the percentage of residents that were tested for COVID-19 by care segment rose with acuity level and the operator average percent of residents tested ranged from 4.2% for independent living, 11.6% for assisted living, 14.1% for memory care and 21.0% for nursing care. The operator average percent of all residents that had a lab-confirmed positive test for COVID-19 ranged from 0.3% for independent living, 1.3% for assisted living, 2.2% for memory care and 5.3% for nursing care.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. Your support helps provide both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the current Executive Survey, please click here for the current online questionnaire.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck