A NIC report developed to provide timely insights from owners and C-suite operators and executives on the pulse of seniors housing and skilled nursing sectors.

NIC’s weekly Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time where market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

This week’s sample (Wave 7) includes responses collected May 11-May 24, 2020 from owners and executives of 155 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Join other operators in the sector and participate in the next wave.

Summary of Insights and Findings

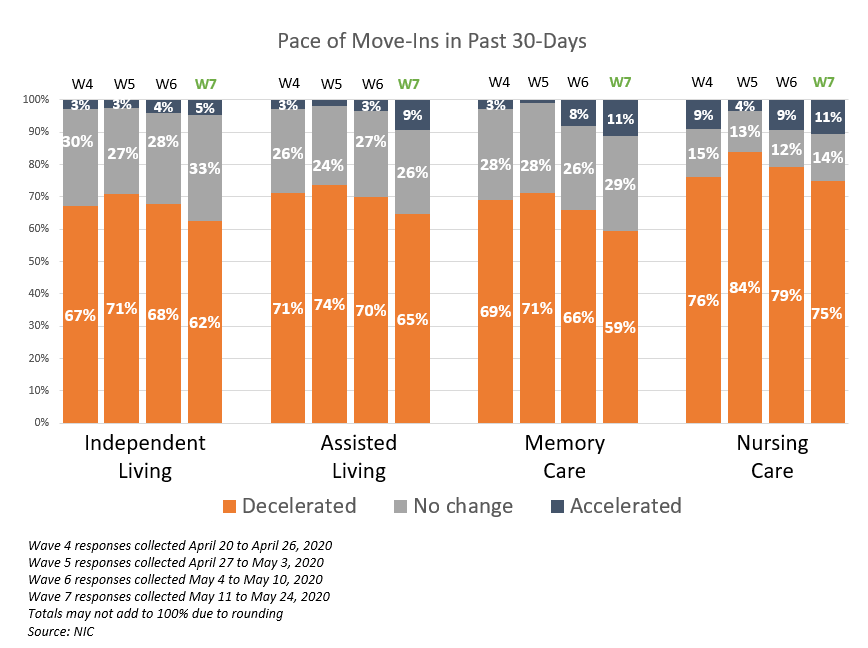

While most organizations continue to report a deceleration in move-ins in the past 30-days, in Wave 7 of the survey, the shares of organizations reporting deceleration is the lowest—across each of the care segments—since the first two waves of the survey (data collected March 24-31 and April 1-12).

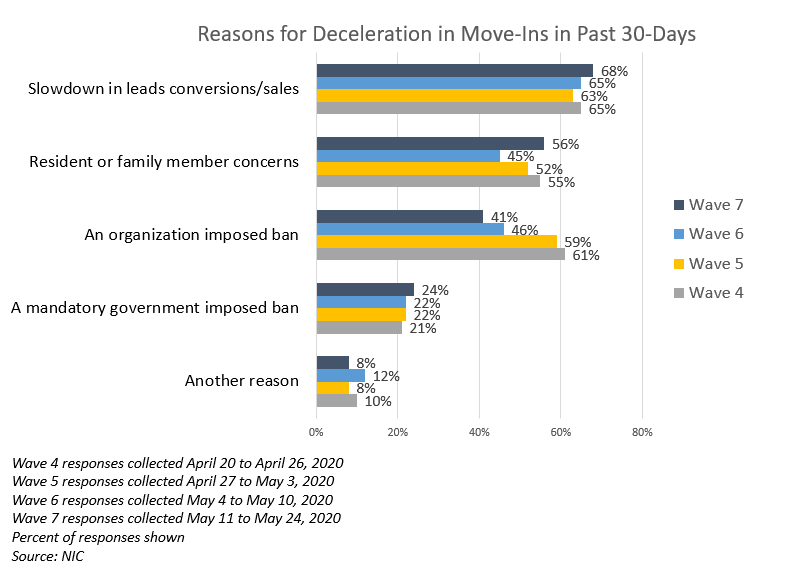

Reasons cited for a deceleration in move-ins continue to primarily be slow leads conversions/sales resulting in difficulty replacing residents who have passed away or moved out; however, about 20% fewer organizations cite an organization-imposed ban on move-ins in Wave 7 compared to Wave 4, as all of the states in the country have begun to loosen social and economic restrictions. About one-half of respondents continue to cite resident or family member concerns about moving in. Others note fewer hospital referrals and elective surgeries, and general concerns about the economy.

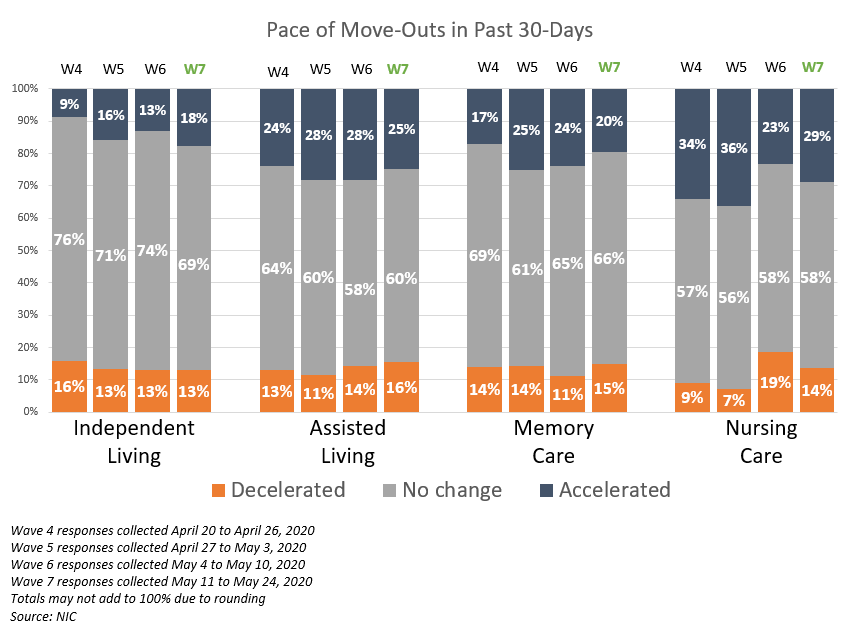

Most organizations continue to report no change in the pace of move-outs in the past 30-days. Of those that did experience an acceleration in the pace of move-outs, reasons cited include a growing percentage of residents transferring to higher levels of care. Other respondents cited nonspecific resident deaths and hospitalizations, resident or family member concerns and normal discharges.

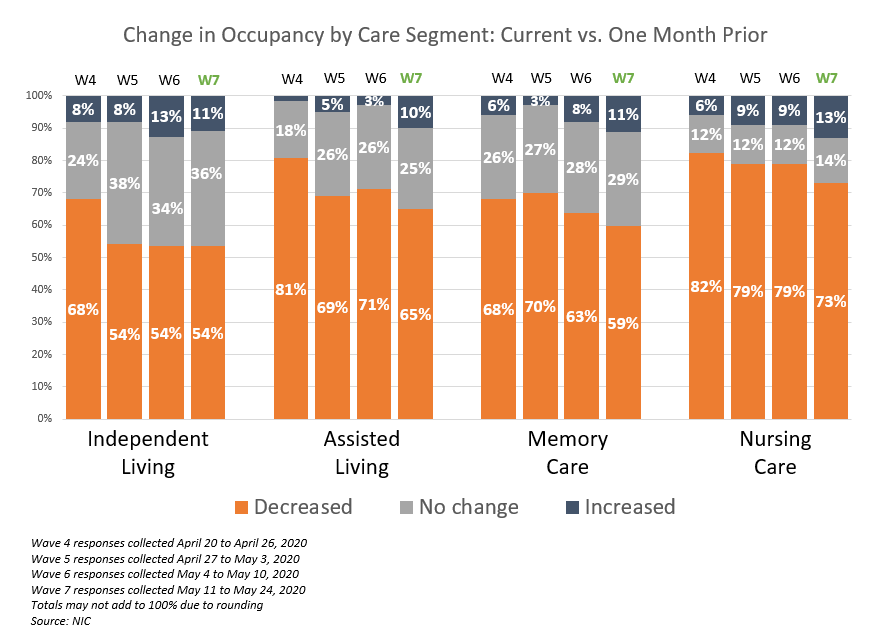

Fewer organizations saw a decrease in occupancy compared to earlier survey waves. Respondents with assisted living and memory care segment units report slightly higher shares of stable or improving occupancy rates from a week ago. And, just over one-third of the organizations reporting on their nursing care segments, in two consecutive waves of the survey, note occupancy rate declines from one week prior (38% and 36%)—significantly lower than in Waves 5 and 4 (67% and 62%).

The percentage of residents that were tested for COVID-19 by care segment rose with acuity level. The operator average share of residents tested by segment ranged from 2.1% for independent living, 13.5% for assisted living, 18.2% for memory care and 24.0% for nursing care. These rates of testing are higher than the previous time frame, with the exception of the independent living segment.

Wave 7 Survey Demographics

-

- Responses were collected May 11-May 24, 2020 from owners and executives of 155 seniors housing and skilled nursing operators from across the nation.

- More than one half of respondents were exclusively for-profit providers (57%), about one-third (32%) were exclusively nonprofit providers, and 11% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 58% of the sample. Operators with 11 to 25 properties make up 23% while operators with 26 properties or more make up 19% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 77% of the organizations operate seniors housing properties (IL, AL, MC), 36% operate nursing care properties, and 33% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

-

- In Wave 7 of the survey, between 65% and 59% of organizations reporting on their independent living, assisted living and memory care segments, and 75% of organizations with nursing care beds indicated that the pace of move-ins decelerated in the past 30-days.

- The shares of organizations reporting a deceleration in move-ins in the past 30-days is the lowest, across each of the care segments, since the first two waves of the survey (data collected March 24-31 and April 1-12).

- Approximately 40% of organizations with memory care and/or independent living segments and about one-third and one-quarter of organizations with assisted living units and/or nursing care beds saw no change or an acceleration in move-ins in the past 30-days.

Reasons for Deceleration in Move-Ins

Respondents were asked: “The deceleration in move-ins is due to…”

-

- Significantly fewer respondents in Waves 7 and 6 cited an organization-imposed ban on settling new residents into their communities than in Waves 5 and 4 (41% and 46% vs. 59% and 61%, respectively).

- In Wave 7 of the survey, in similar proportions to the prior three waves, roughly two-thirds of respondents attribute a deceleration in move-ins to a slowdown in leads conversions/sales. Around one-half of organizations cite resident or family member concerns, and about one-quarter cite a mandatory government-imposed ban. Others cite fewer hospital referrals, elective surgeries and general concerns about the economy.

Move-Outs

- Between 60% and 69% of organizations reporting on their independent living, assisted living and memory care units in Wave 7 saw no change in move-outs in the past 30-days.

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

-

- Approximately one-half to about two-thirds (54% to 65%) of organizations reporting on their independent living, assisted living and memory care units in Wave 7 of the survey—across their respective portfolios of properties—experienced a decrease in occupancy from the prior month, however roughly one-quarter to one-third report no change (25% to 36%).

- Notably fewer organizations with assisted living units and/or nursing care beds report a decrease in occupancy in the past month compared to Wave 4 (65% vs. 81% and 73% vs. 82%, respectively).

- The independent living and memory care segments also saw fewer organizations reporting a decrease in occupancy rates compared to earlier waves of the survey. The share of independent living organizations reporting a decrease in occupancy in the past month fell from 68% in Wave 4 to 54% in Waves 5, 6 and 7. Additionally, fewer organizations with memory care units in Wave 7 than in Wave 5 note declining occupancy rates (59% vs. 70%).

-

-

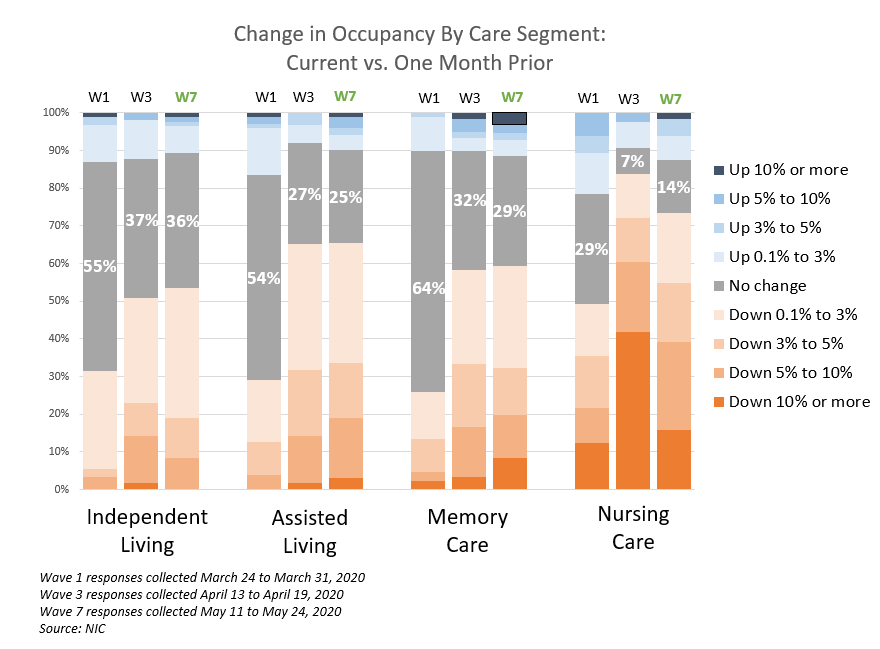

- The chart below breaks out the rates of change in occupancy by care segment with greater granularity, comparing the current timeframe (Wave 7 data collected between May 11 and May 24), the middle of the pandemic (Wave 3 data collected between April 13 and April 19), and earlier in the pandemic at the start of this survey when the majority of independent living, assisted living and memory care segments had yet to report major changes in current occupancy compared to one month prior (Wave 1 data collected between March 24 and March 31).

- As shown in the chart, near the beginning of the pandemic (Wave 1), the share of operators that reported month over month occupancy rates declines increased as the pandemic progressed into Waves 3, and most recently, Wave 7.

- Shares of organizations reporting a decrease in occupancy in the past 30-days in Wave 7 and Wave 3 are similar for independent living, assisted living and memory care, but slightly more organizations in Wave 7 report both wider declines and improvements in occupancy for the memory care segment than in prior waves of the survey. Fewer organizations with nursing care beds in Wave 7 report significant downward changes in occupancy compared to one-month prior than in Wave 3.

-

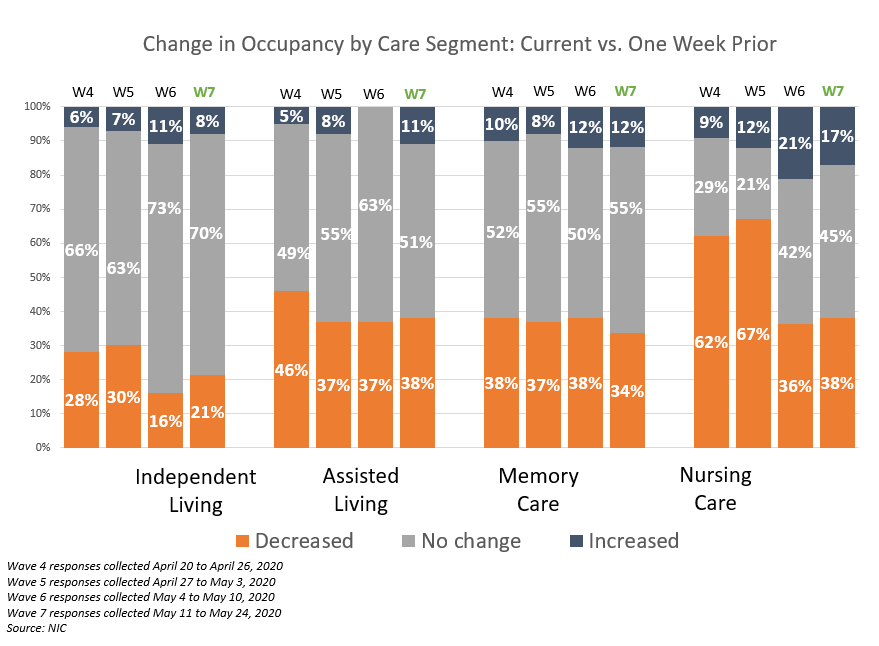

- Regarding the change in occupancy from one week ago, respondents with independent living units consistently report the fewest declines in occupancy from one week earlier while nursing care, assisted living and memory care have been generally consistent with around 36% of respondents reporting decelerations in occupancy from the prior week for the last two waves; these are all below Wave 4 percentages, however.

- Most organizations with independent living, assisted living and memory care segment units note no change (51% to 70%); however, slightly higher shares of organizations with assisted living and memory care segment units report no change or an increase in occupancy from one week ago.

- Just over one-third of the organizations reporting on their nursing care segments in Waves 7 and 6 of the survey note occupancy rate declines from one week prior (38% and 36%)—significantly lower than in Waves 5 and 4 (67% and 62%). Greater shares report no change or an increase from the week prior in Waves 7 and 6.

Incidence of COVID-19 Among Survey Respondents

Data was collected between May 11 and May 24 (Wave 7) and April 27 and May 10, 2020 (Waves 5 and 6 combined).

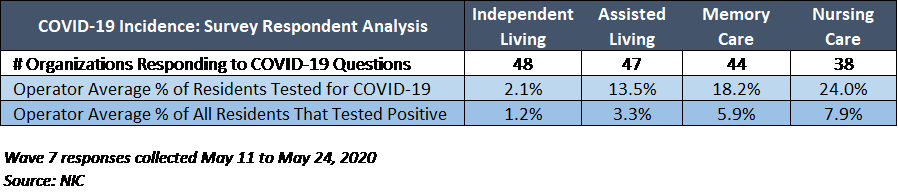

Answering on behalf of their organizations, seniors housing and care owners and executives provided the COVID-19 incidence data shown below. The data represents a subsample of the total respondents that answered the COVID-19 questions fully, is self-reported and non-validated, and should not be considered a statistical representation of COVID-19 incidence in seniors housing and care, in general.

-

- Considering the Wave 7 subsample of survey respondents, the percentage of residents that were tested for COVID-19 by care segment rose with acuity level. The operator average percent of residents tested by segment ranged from about 2.1% for independent living, 13.5% for assisted living, 18.2% for memory care and 24.0% for nursing care. These rates of testing are higher than the previous time frame, with the exception of the independent living segment.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. Your support helps provide both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the current Executive Survey, please click here for the current online questionnaire.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck