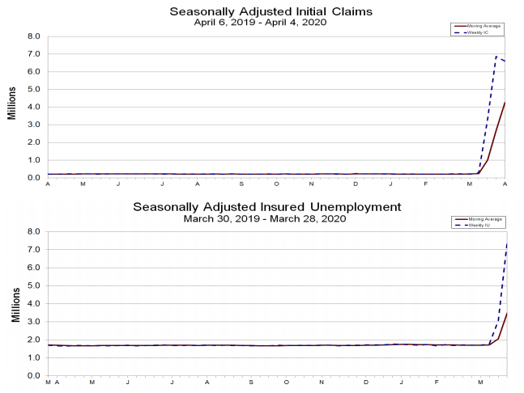

The Department of Labor reported that 6,606,000 Americans filed for unemployment insurance benefits in the week ending April 4, 2020 as the COVID-19 pandemic caused businesses to reduce or furlough their workforces. This was a very slight decline of 261,000 from the previous week’s upwardly revised record high level of 6,868,000. The speed and scale of the job losses is unprecedented. In the past three weeks, more than 16 million people have filed claims. At its worse during the Great Recession, there were 665,000 first-time claims filed in the week ended March 28, 2009. That was second only to the week ended October 2, 1982, when 695,000 first-time claims were filed.

Continuing claims for regular benefits, which are reported with an extra week’s lag, rose 4.4 million to 7.5 million.

The largest increases in initial claims for the week ending March 28 were in California, New York, Michigan, Florida, Georgia Texas and New Jersey.

This week’s increase in unemployment claims marks the third consecutive week of surging jobless claims and provides a window into the magnitude of the economic downturn into which we are solidly moving. Economists from a Wall Street Journal survey now project a spike in the jobless rate to 13% by June from its 50 year low of 3.5% as recently as February. In March, the rate had already increased to 4.4%. This same group of economists predict that real GDP will contract at an annual rate of 25% in the second quarter. In March, the expectation had been a decline of merely 0.1%. For the full year of 2020, GDP is projected to decline by 4.9%. In 2019 it grew by 2.3%.

In response to the expected sharp slowdown in the economy, the President signed into law a $2 trillion economic stimulus rescue package that broadly expands unemployment benefits. Independent contractors and self-employed individuals are now eligible, at least in some cases. More fiscal stimulus packages are expected to be enacted in the coming months to further blunt the economic fallout of the COVID-19 pandemic.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace