The Labor Department reported that nonfarm payrolls rose by 1.4 million in August and that the unemployment rate fell to 8.4% from 10.2%. This suggests that the employment recovery from the unprecedented COVID-related drop in March and April continues to reverse course. Eleven million jobs have now been recovered during the May to August period. Nonetheless, the level of payrolls remains about 12 million below where it was in February.

The 1.4 million job gain in August was smaller than in the prior three months, but was significant, nonetheless. The change in total nonfarm payroll employment for June was revised down by 10,000 from a gain of 4.791 million to 4.781 million and the change for July was revised down by 29,000 from 1.763 million to 1.734 million. Combined, 39,000 jobs were subtracted to the original estimates. Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors. Market expectations had been for a gain of 1.350 million.

August hiring was helped by the employment of 238,000 temporary field workers for the 2020 Census. Census hiring could rise further in September before slipping later in the year as those positions are no longer needed. However, other sectors also saw impressive gains, with retail adding 249,000 jobs, leisure and hospitality, 174,000 jobs and professional and business services up 200,000 positions. In July, leisure and hospitality sectors had added 621,000 jobs as COVID-related jobs come back.

Health care added 75,000 jobs in August, with gains in offices of physician, dentists, hospitals, and home health care services. Job losses continued in nursing and residential care facilities.

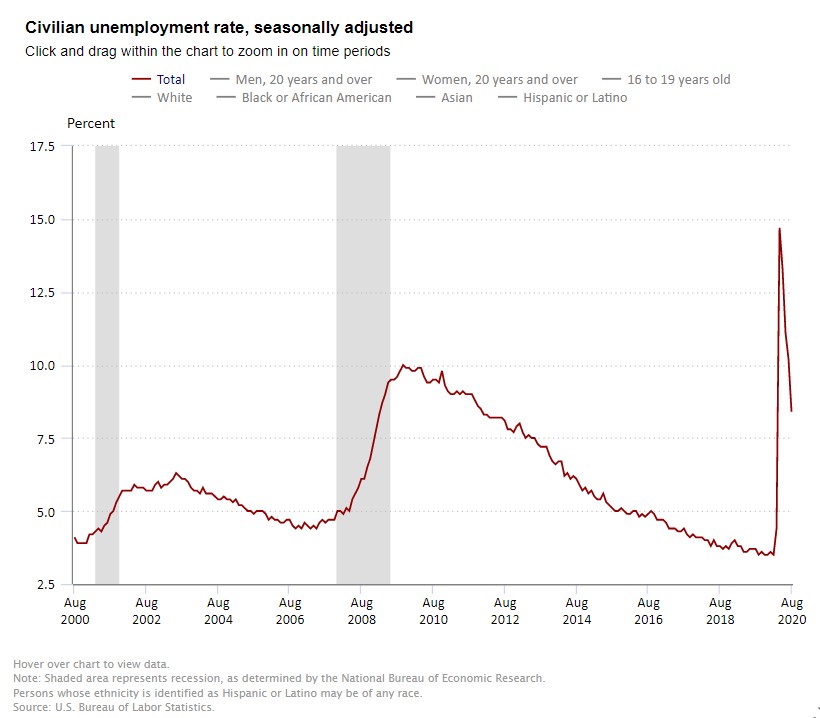

The 1.8 percentage point drop in the August unemployment rate to 8.4% was good news and driven by a 3.8 million person increase in the household measure of employment and occurred despite an increase in the labor forces of nearly 1 million. The increase in the labor force in turn may be the result of the expiration of jobless benefits at the start of the month which pushed some workers back into the labor force. At 8.4%, however, the unemployment rate is still quite elevated by historic standards and significantly higher than the 50-year low of 3.5% in February.

The number of permanent job losses rose 534,000 in August to 3.2 million from 2.9 million, a figure that suggests difficult time for a number of Americans. Moreover, more than 29 million workers remain on government assistance and the number of unemployed remain 5 million above where it was pre-pandemic.

Among major worker groups, the unemployment rate fell in August for adult men to 8.0%, adult women to 8.4% and teenagers to 16.1%.

The underemployment rate or the U-6 jobless rate fell to 14.2% in August from 16.4% in July. This figure includes those who have quit looking for a job because they are discouraged about their prospects and people working part-time but desiring a full work week. In the previous 2008/2009 recession, this rate peaked at 17.2%.

Average hourly earnings for all employees on private nonfarm payrolls rose by $0.11 in August to $29.47, a gain of 4.7% from a year earlier.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work increased 0.3 percentage point in August to 61.7%.

While the August improvement is welcome news, the labor market continues to be strained and the recent spike in the virus across many states could hamper further gains. Indeed, some states are backtracking plans to reopen as coronavirus infections are rising again.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace