NIC MAP® Data Service clients attended a webinar in mid-October on the key seniors housing data trends during the third quarter of 2019. Three key takeaways are shared below. We’ll share additional key learnings from the data in the next NIC Notes.

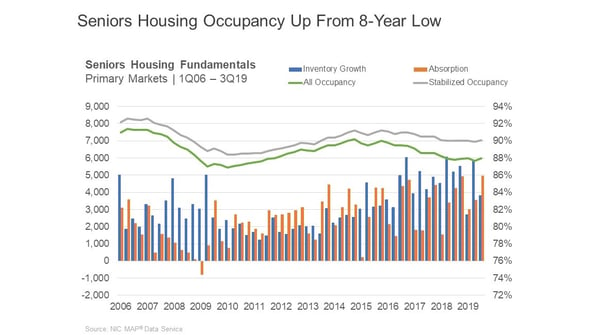

Takeaway #1: Seniors housing occupancy increased from an 8-year low.

- During the third quarter, seniors housing net absorption totaled 4,977 units for the NIC MAP® Primary 31 markets, the greatest number of units absorbed on a net basis in a single quarter since NIC began reporting the data in 2006.

- At the same time, the quarterly change in the number of units added to inventory slowed to 3,832 units, the second fewest units added to the stock since mid-2016.

- Combined, these factors supported a 30-basis point (bp) increase in all occupancy to 88.0% in the third quarter from 87.7% in the second quarter when it had fallen to its lowest level in 8 years. The all occupancy rate for seniors housing, which includes properties still in lease up, is shown by the green line in the chart below.

- This placed all occupancy 1.1 percentage points above its cyclical low (of 86.9%) reached during the first quarter of 2010 and 2.2 percentage points below its most recent high (of 90.2%) in the fourth quarter of 2014.

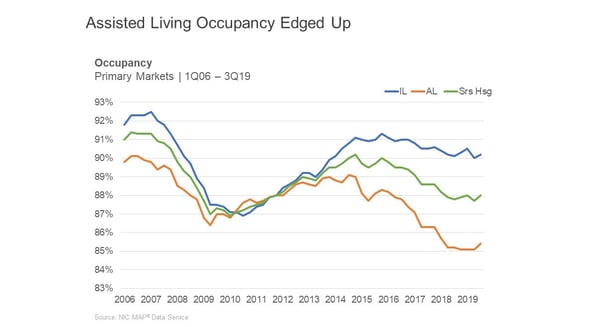

Takeaway #2: Third-quarter assisted living occupancy edged up.

- As shown on the chart below, distinct differences in occupancy performance between independent living and assisted living are evident. As of the third quarter, there was a 490bp difference in occupancy rates.

- In the third quarter, assisted living occupancy moved off its record low rate of 85.1% for the past three quarters to 85.4%, as relatively robust demand outpaced new inventory growth. Indeed, net absorption totaled 3,128 units in the third quarter, the most of any quarter except the Q4 2018.

- The occupancy rate for independent living inched up 20bps to 90.2% in the third quarter, 10bps higher than year-earlier levels, but below the rate earlier in 2019.

Takeaway #3: Assisted living units under construction slowed.

- Construction as a share of inventory for majority assisted living properties decelerated in the third quarter and equaled 7.3% or 22,000 units. This includes all properties under construction from start to completion. This was the lowest rate since 2015 and down from a peak of 10% in late 2017.

- The same pattern is not yet evident in independent living as the graph below shows. In the third quarter, construction as a share of inventory totaled 6.2%, where it has been hovering for the past year.

Stay tuned to NIC Notes for additional highlights from third quarter 2019 data trends.

###

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace