According to estimates derived from an analysis released by NIC Analytics in 2022, approximately one in nine Americans aged 65 and older, totaling 6.5 million individuals, are affected by Alzheimer’s or other dementias. The analysis further indicated that the prevalence increased with age, with higher ratios observed in older age cohorts. By projecting the findings to 2030, NIC Analytics estimated that around 8.2 million Americans will be living with Alzheimer’s or other forms of dementia just seven years from now. These estimates highlight the importance of providing tailored and innovative care and support to meet the growing demand for specialized memory care services.

In this article, we explore the memory care sector - a senior housing segment that is specifically designed for residents with Alzheimer’s or other forms of dementia - in terms of its market fundamentals within the combined 99 NIC MAP® Primary and Secondary Markets. The article provides an overview of supply and demand dynamics, occupancy rates across properties and different types of campuses, compared with the broader senior housing property segment types (i.e., independent living and assisted living segments). Note that memory care in this article uses the segment type designation from NIC MAP Vision, meaning that the data used in this analysis are memory care units that can be located at any type of property.

Fundamentals of the Memory Care Segment − 99 NIC MAP Primary & Secondary Markets

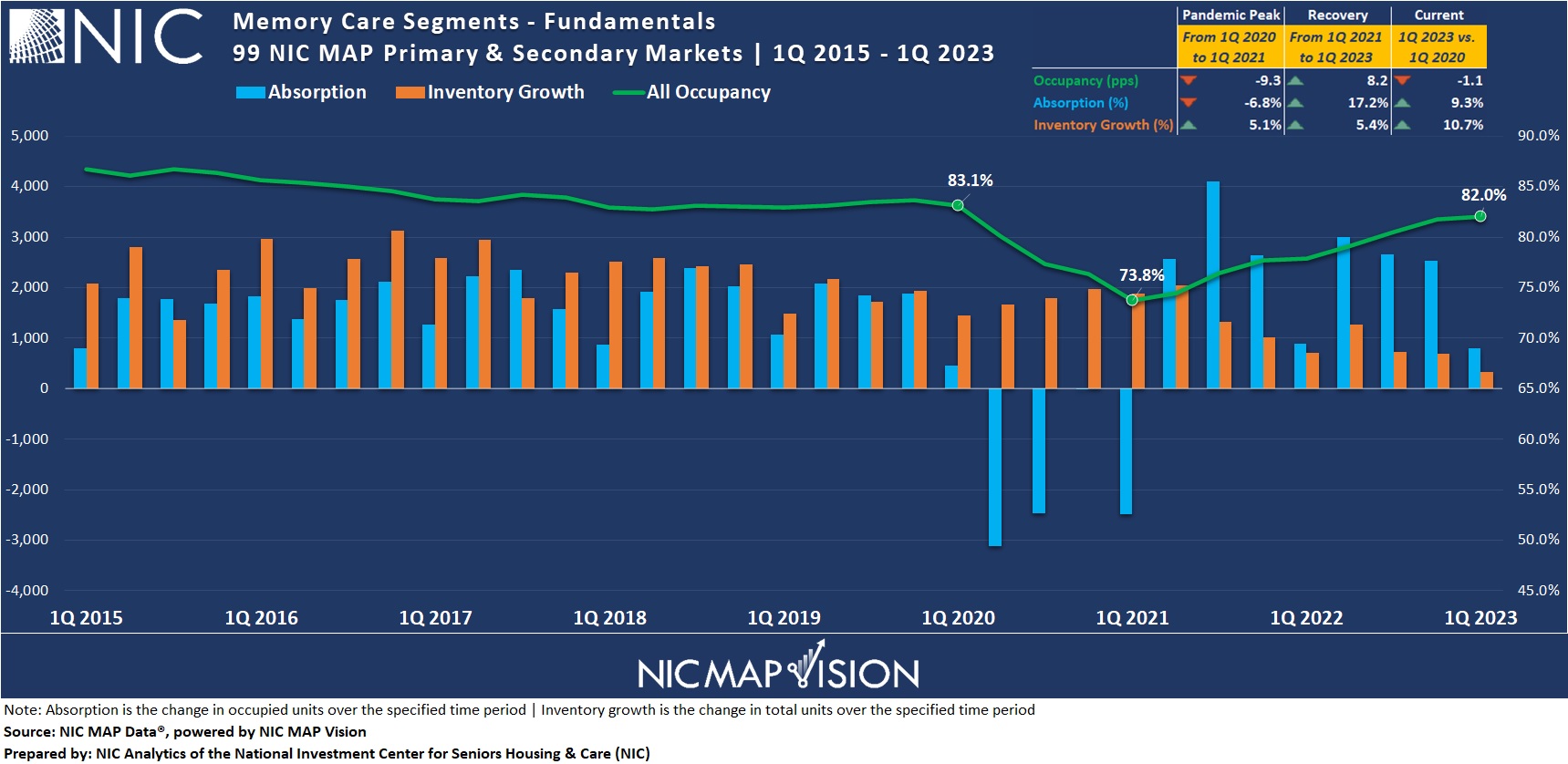

Supply Dynamics. Historically, memory care segments have reported higher rates of inventory growth compared with independent living and assisted living segments. Notably, over the period from first quarter of 2015 to first quarter of 2020, the five-year period prior to the pandemic, inventory for memory care segments in the 99 Primary and Secondary Markets increased by over 46%, averaging 1.9% growth on a quarterly basis. As of the first quarter of 2020, roughly one in three existing memory care units had been developed over the span of five years. By comparison and over the same five-year period, inventory for independent living and assisted living segments grew by 10.9% and 18.0%, respectively.

Although at a slightly slower pace, supply dynamics for memory care segments since the first quarter of 2020 have remained strong and elevated compared with independent living and assisted living segments. Inventory for memory care segments in the Primary and Secondary Markets grew by 10.7%, from 143,826 units in the first quarter 2020 to 159,229 in the first quarter 2023, averaging 0.9% growth on a quarterly basis, while the inventory of both the independent living and assisted living segments have grown by 6.5% and 5.6%, respectively, over the same period, averaging 0.5% growth quarter-over-quarter (i.e., half that of memory care segments).

Demand Dynamics. Similarly, memory care segments in the 99 Primary and Secondary Markets experienced notable demand growth ahead of the pandemic. In fact, over the five-year period prior to the pandemic, occupied stock for memory care segments increased by 40.2% (from first quarter 2015 to first quarter 2020). This pace of demand growth far exceeded that of independent living segments (9.7%) and assisted living segments (12.8%) over that same five-year period.

During the peak of the pandemic, occupied stock across memory care segments in the 99 Primary and Secondary Markets fell by 6.8% as more than 8,000 units on net were placed back on the market from first quarter of 2020 to first quarter of 2021. On a relative scale and over the same period, this occupied stock decline was larger than across independent living segments (which fell by 5.1%) but not as large as across assisted living segments (which fell 9.8%). As background, the recently released COVID-19 study conducted by NORC at the University of Chicago, through a grant from NIC, showed that the average mortality rate was the least in independent living and comparable to its corresponding county’s mortality rate, while average mortality rate for assisted living was slightly higher but notably not as high as for memory care or nursing care.

Since then and after eight consecutive quarters (two years) of strong and relatively consistent demand momentum, occupied stock across memory care segments within the 99 Primary and Secondary markets has fully recovered after having increased by 17.2% from the pandemic lows; that’s equivalent to roughly 19,200 units that have been occupied over the period from the first quarter of 2021 to the first quarter of 2023. Remarkably, memory care was the first care segment that has exceeded pre-pandemic occupied stock levels and is now up 9.3% or 11,109 occupied units over its level during the first quarter of 2020. Comparatively, first quarter 2023 occupied stock for independent living and assisted living segments are 2.0% and 1.4% above their respective first quarter 2020 levels, equivalent to 7,701 and 5,256 occupied units, respectively.

Occupancy Rate Recovery. The occupancy rate for memory care segments within the 99 Primary and Secondary Markets recorded the second largest decline across senior housing segments and fell by 9.3 percentage points following the onset of the pandemic, from 83.1% in the first quarter of 2020 to 73.8% in the first quarter of 2021. Over this same period except for nursing care segments, the largest decline was recorded in the assisted living segments (down 10.5 percentage points to 75.1%), and the smallest decline was registered in independent living segments (down 6.6% to 83.4%).

From the lows in first quarter 2021, occupancy for memory care segments has been recovering relatively quickly and gained 8.2 percentage points to reach 82.0% in the first quarter of 2023. That places it only 1.1 percentage points below its pre-pandemic level of 83.1%. Occupancy for independent living and assisted living segments recovered 3.0 and 7.1 percentage points, respectively, from their pandemic-related lows, but both segments still have the most room to make up with a gap of 3.8 percentage points from the pre-pandemic level (90.0%) for independent living segments, and a gap of 3.4 percentage points from pre-pandemic level (85.6%) for assisted living segments.

Exhibit 1 – Memory Care Segments - Fundamentals

Memory Care Segments – Occupancy Recovery by Campus Type

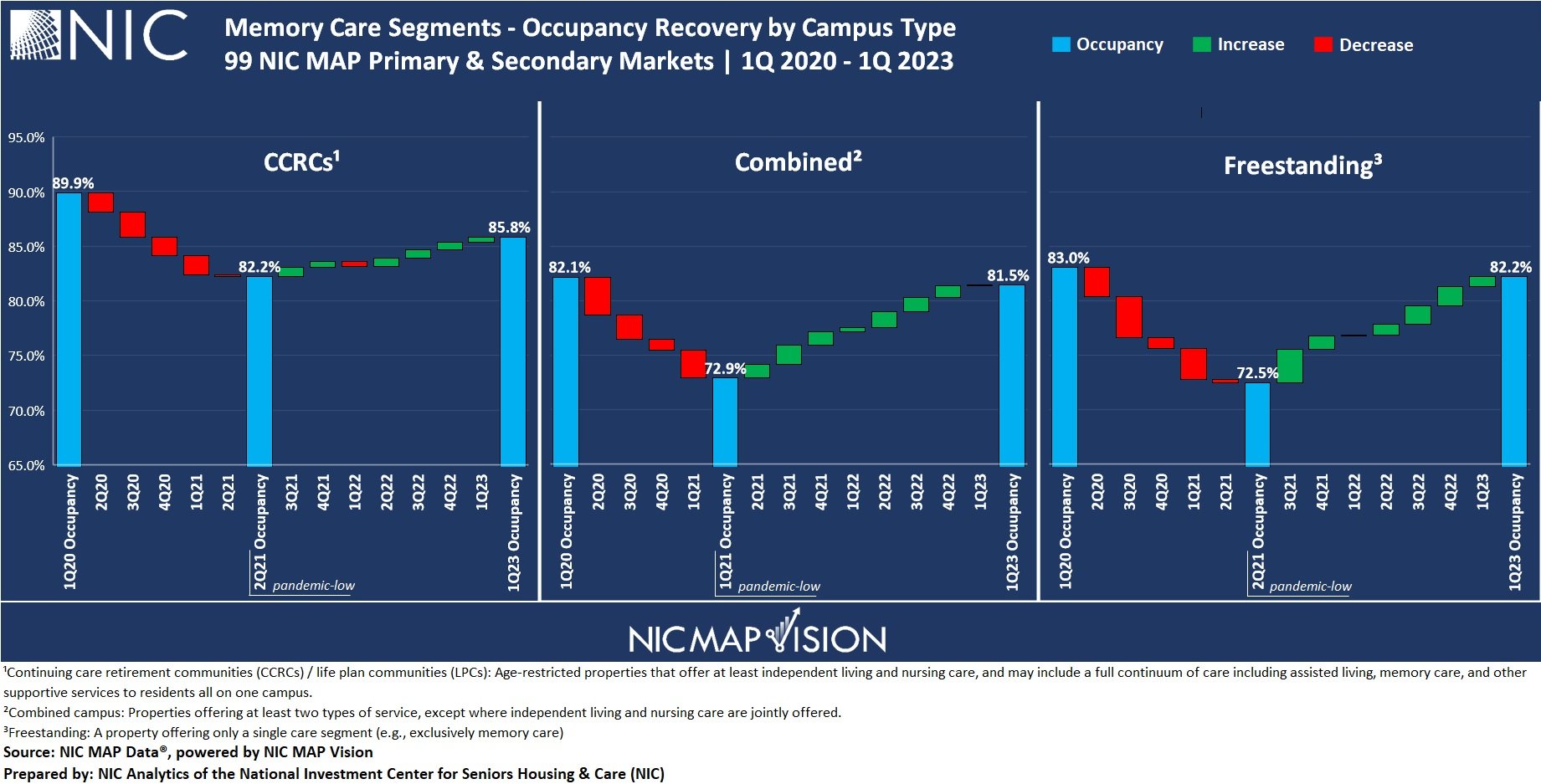

In the first quarter of 2023, there were about 5,500 properties within the 99 combined NIC MAP Primary and Secondary Markets offering memory care services. Among these properties, 15% were freestanding – (i.e., offering memory care as the singular level of care), 74% were combined properties offering at least two types of service, except where independent living and nursing care are jointly offered, which comprised the remaining 11% that were continuing care retirement communities (CCRCs) offering at least independent living and nursing care and may include a full continuum of care including assisted living, memory care, and other supportive services to residents all on one campus. Across these 5,500 properties in the 99 Primary and Secondary Markets, approximately 85% are for-profit and 15% are not-for-profit properties.

As these statistics show, memory care is frequently offered in combined properties. Generally, these properties’ main concentration is the assisted living care segment, with a dedicated secured wing or floor for memory care. While the freestanding memory care model had seen a significant increase in inventory prior to 2020, this trend has since shifted. The freestanding memory care model has experienced a notable slowdown in development following the onset of the pandemic.

Exhibit 3 below shows that memory care segments within CCRCs had the highest occupancy (85.8%) in the first quarter of 2023, followed by memory care segments within freestanding and combined properties (82.2% and 81.5%, respectively). Freestanding memory care properties experienced the largest occupancy decline during the height of the pandemic, but in terms of occupancy improvements from pandemic-related lows, memory care segments within freestanding and combined properties have been recovering relatively fast, both within less than one percentage point of reaching first quarter 2020 levels.

Exhibit 2 – Memory Care Segments – Occupancy Recovery by Campus Type

Memory Care Segments – Occupancy Distribution “Same Store”

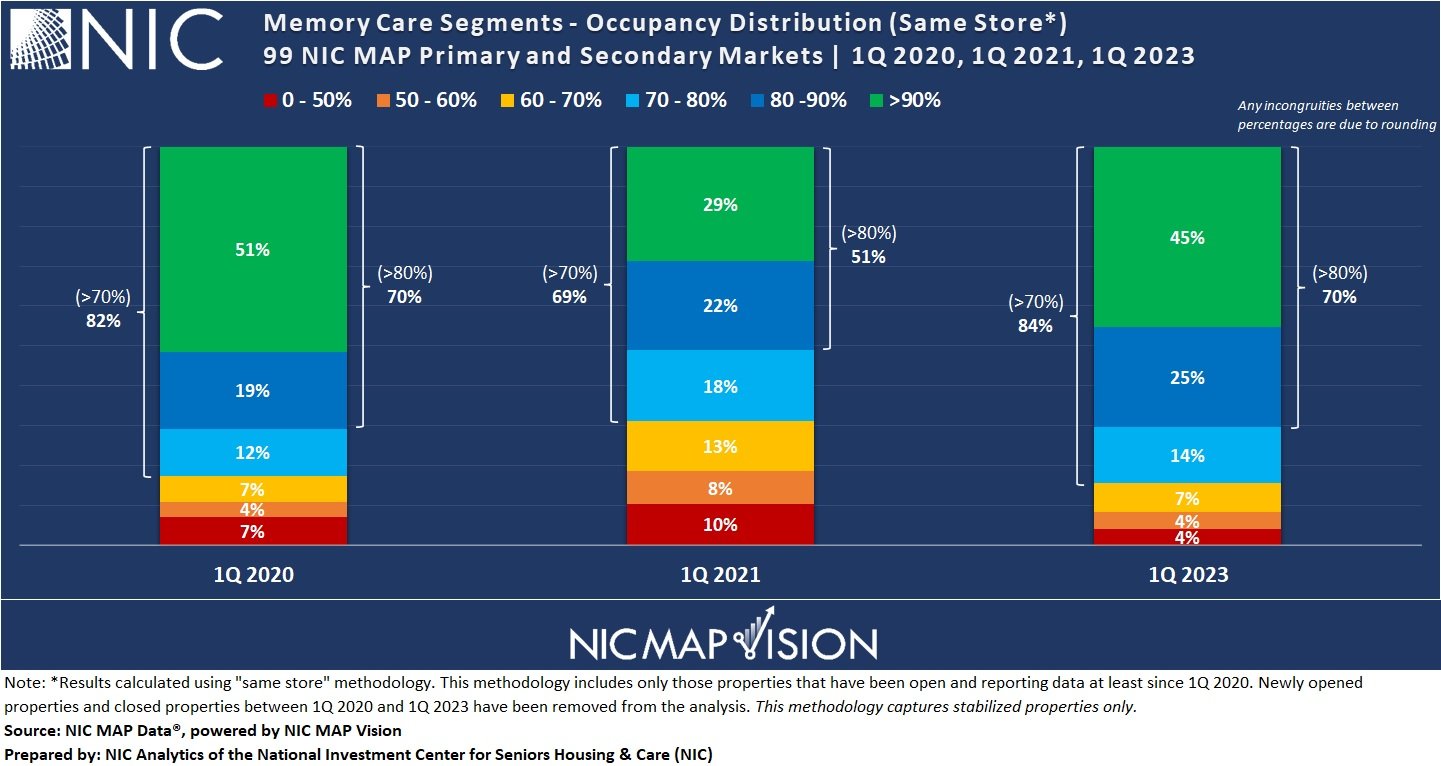

Exhibit 3 below examines the occupancy distribution for memory care segments using same-store methodology to include only those properties that have been open and reporting data at least since 1Q 2020 (4,770 properties in the 99 NIC MAP Primary and Secondary Markets). Newly opened properties and closed properties between 1Q 2020 and 1Q 2023 have been removed from the analysis. In other words, this methodology captures stabilized properties only.

In the first quarter of 2020, more than 50% of memory care segments in the Primary and Secondary markets had occupancy rates above 90%. At the worst of the pandemic, this figure fell to 29%, and as of today, it has increased to 45%. Further, 70% of properties had occupancy rates of 80% or higher in the pre-pandemic period, while 82% of properties had occupancy rates of 70% or higher during that time. However, during the peak of the pandemic in the first quarter of 2021, these figures experienced a notable decline.

Fast forward to the first quarter of 2023, the memory care segments of 70% of properties have achieved occupancy rates of 80% or higher, matching the pre-pandemic levels of the first quarter of 2020. Additionally, an impressive 84% of properties now have occupancy rates of 70% or higher for memory care, surpassing the share recorded in the first quarter of 2020 (82%).

To put it simply, there are nearly as many units of memory care within the segment categorization with occupancy rates above 90% as before the pandemic began, that is roughly half. This is also the case for units with 80% or higher occupancy rates, i.e., 70% of units. Conversely, there are 30% with an occupancy rate below 80%, the same as in the pre-pandemic period. At the worst of the COVID crisis, this had risen to 49%.

Exhibit 3 – Memory Care Segments – Occupancy Distribution “Same Store”

In conclusion, the dynamics and notable recovery of the memory care trends suggest strong fundamentals for the sector. However, understanding individual markets’ supply and demand trends, including labor supply and availability, is essential for senior housing stakeholders seeking to provide the best care and support for high acuity residents in memory care settings, optimize asset allocation, improve a portfolio’s performance, or for those who are planning a new memory care development project.

The data featured in this article is available at the market level. To learn more about NIC MAP Vision data and about accessing the data, schedule a meeting with a product expert.

About Omar Zahraoui

Omar Zahraoui, Principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing research professional with expertise in providing quantitative analysis and insights on seniors housing & care market data; building new products and reporting capabilities, including dashboards and proformas for clients and internal stakeholders; and implementing new processes and data solutions. Prior to his current role, Zahraoui worked as a data analyst, at Calpine Corporation, supporting the development of new-business strategy initiatives, analyzing sales and financial data, and developing statistical modeling of consumers’ behaviors to drive business performance. Zahraoui holds a Bachelor’s degree in Business Administration with concentrations in Finance and Management, a Master in Corporate Finance from IAE Lyon School of Management at Jean Moulin Lyon III University in France, and a Master of Science in Management Information Systems and Data Analytics from Pace University.

Connect with Omar Zahraoui

Read More by Omar Zahraoui