In last week's NIC Notes, we shared three highlights from the October NIC MAP® Data Service webinar on key seniors housing data trends during the third quarter of 2019. Two additional key takeaways are detailed below.

Takeaway #1: Increase in seniors housing occupancy from an 8-year low.

Takeaway #2: Slight increase in assisted living occupancy.

Takeaway #3: Slowing of assisted living units under construction.

Takeaway #4: Wage growth continued to exceed rent growth.

- Since 2017, same-store asking rent growth for assisted living has been decelerating and this pattern continued in the third quarter when annual rent growth slipped back to 2.3% from 3.8% in late 2016, and from 2.8% one year ago. This can be seen on the orange line below.

- For independent living, the pattern is not as consistent and, in the third quarter, annual asking rent growth was 3.0%.

- Compared with the growth of average hourly earnings for assisted living in the second quarter, which increased by a very strong 5.9% from year-earlier levels, asking rent growth has been lagging. Based on anecdotal comments from operators, the BLS estimate of 5.9% seems to be more accurate than past readings of the upward pressure they have been experiencing for wage growth.

- For many operators, labor expenses amount to 60% of their expenses so this is taking a toll on their ability to maintain and grow NOI.

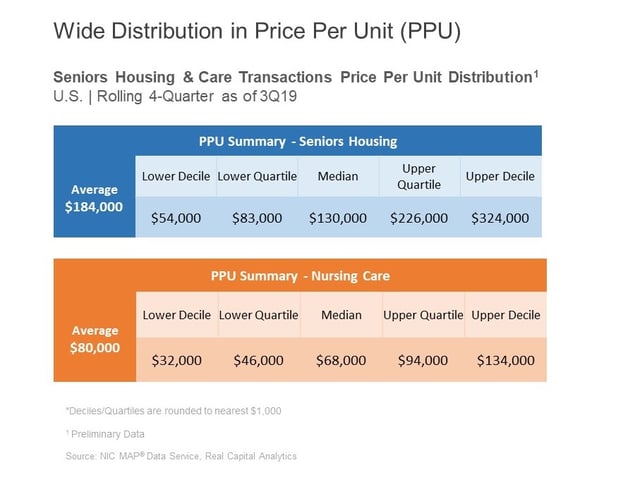

Key Takeaway #5: Wide distribution in price per unit (PPU).

- The chart below represents a snapshot of the pricing distribution of seniors housing and skilled nursing properties as of the third quarter of 2019.

- For perspective, the average price per unit for seniors housing was $184,000, which represents an increase of 9.2% from the second quarter when it came in at $168,500. Compared to a year ago, the price per unit increased 17%.

- There is a wide range of pricing, however, as this chart shows, with the upper decile at $324,000.

- For skilled nursing the upper decile is $200,000 lower at $134,000.

###

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace