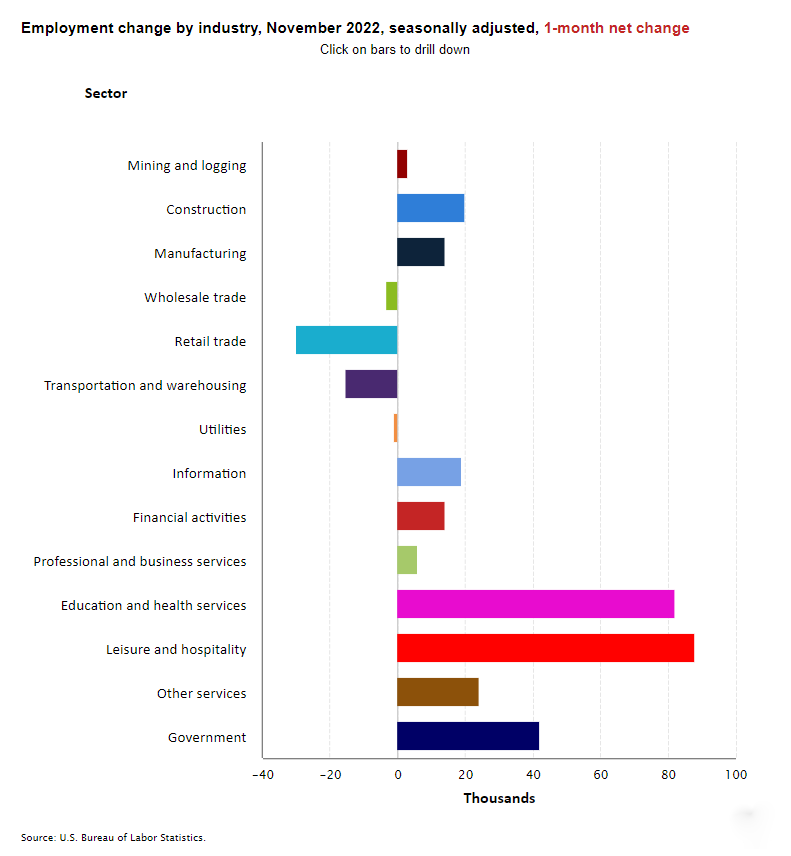

The U.S. Bureau of Labor Statistics reported that nonfarm payrolls rose by 263,000 in November 2022 and the unemployment rate remained steady at 3.7%. The November increase was roughly the same as average growth over the prior three months (282,000), but well below the year-to-date average of 392,000 and the monthly average of 562,000 seen in 2021, and higher than the average monthly gains of 164,000 seen in 2019. Market expectations had called for a gain of 200,000 jobs. Revisions subtracted 23,000 positions to total payrolls in the previous two months. The monthly gain paints an image of a still growing, but slowing, labor market.

Today’s labor report will add further impetus to the Fed’s policy conviction of increasing interest rates. It is looking for the job market to slow significantly and for the inflation rate to be tempered before it will adjust its aggressive stance on monetary policy. In a statement this past Wednesday, Federal Reserve Chair Jay Powell indicated that the central bank is likely to raise the fed funds rate further, but by a lesser 50 basis points at its upcoming December meeting, down from 75 basis points in the last four rate hikes. Indeed, the Federal Reserve raised short-term interest rates for the sixth time this year on November 2nd. That marked the fourth consecutive 0.75 percentage point increase and followed earlier increases in 2022 of lesser amounts. The latest increase pushed the Fed Funds rate to a range of 3.75% to 4.00%, up from 0% at the beginning of the year. The rapid rise in interest rates is the most aggressive pace of monetary policy tightening since the early 1980s and is in response to inflation which remains uncomfortably high.

Employment in health care rose by 45,000 in November and has increased by an average of 47,000 per month in 2022 compared with 9,000 in 2021. Employment in nursing care facilities grew by 2,800 jobs from last month and 23,500 from year-earlier levels and stood at 1,369,500 positions. Separately, and despite headlines about job losses in tech sectors, the information sector added 19,000 jobs.

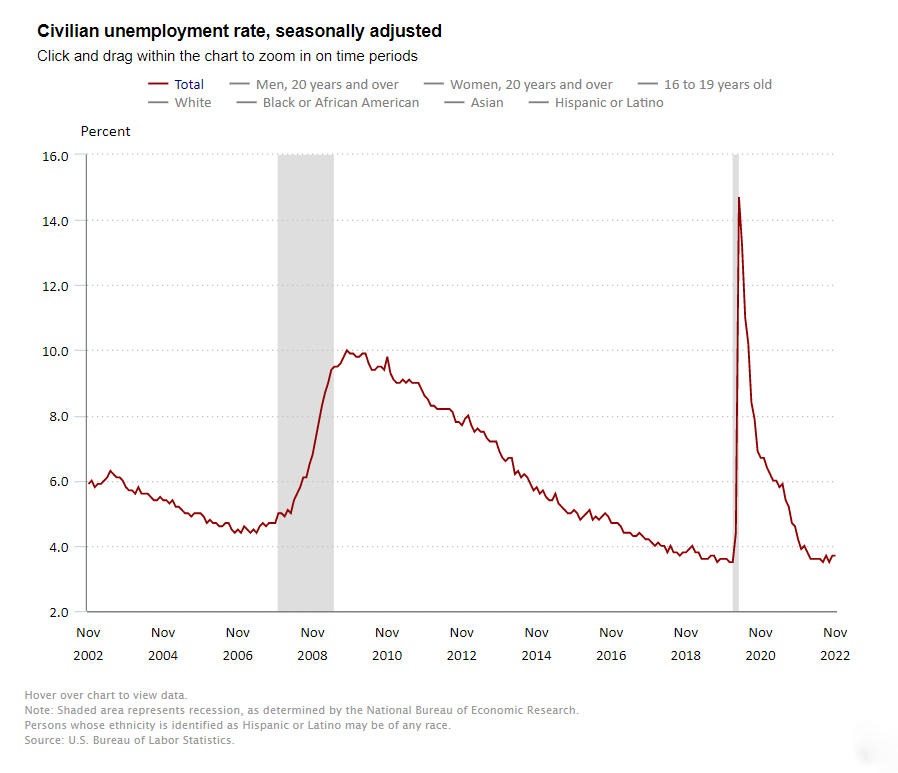

In the household survey conducted by the BLS, the jobless rate was unchanged from October and stood at 3.7% in November. In September, the jobless rate had once again fallen to its pre-pandemic level of 3.5% seen in February 2020. Both months’ unemployment rates are well below the 14.7% peak seen in April 2020. The underemployment rate was 6.7% in November, up from 6.8% in October.

Among the major worker groups, the October unemployment rates were 3.3% for adult women, adult men (3.4%), teenagers (11.3%), Whites (3.2%), Hispanics (3.9%), Blacks (5.7%), and Asians (2.7%).

Average hourly earnings for all employees on private nonfarm payrolls rose by $0.18 in November to $32.82. This was a gain of 5.1% from year-earlier levels, lower than the upwardly revised gain of 6.8% seen in October.

The labor force participation rate slipped back to 62.1% in November from 62.2% in October and was below the February 2020 level of 63.4%.

Earlier this week, the BLS released the results of its October Job Openings and Labor Turnover Survey (JOLTS report) that showed the number of job openings fell by 353,000 positions to a seasonally adjusted 10.3 million. That was below the peak of 11.9 million in March, but still well above their pre-pandemic level in early 2020 when it averaged 7.0 million. This means that there are roughly 1.7 open positions for every person looking for work in September, down from 1.9 in September, but much higher than 1.2 in 2019. The hirings rate fell to 6.0 million, the lowest level since January 2021 and the quits fell for the second month in a row to 4.0 million, the lowest level since May 2021.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace