The Labor Department reported that nonfarm payrolls rose by 1.8 million in July and that the unemployment rate fell to 10.2%. This suggests that the employment recovery from the unprecedented COVID-related drop in March and April continues to reverse course, although the pace of recovery appears to be slowing. The 1.8 million job gain in July was less than the increases of 4.8 million in June and 2.7 million in May. Combined, 9.3 million jobs were generated in May, June and July, recouping some of the 22.2 million jobs lost in March and April. Nevertheless, the July level of employment was lower than its February level by 12.9 million positions or by 8.4%.

While the July improvement is welcome news, the labor market continues to be strained and the recent spike in the virus across many states could hamper further gains. Indeed, some states are backtracking plans to reopen as coronavirus infections are rising again.

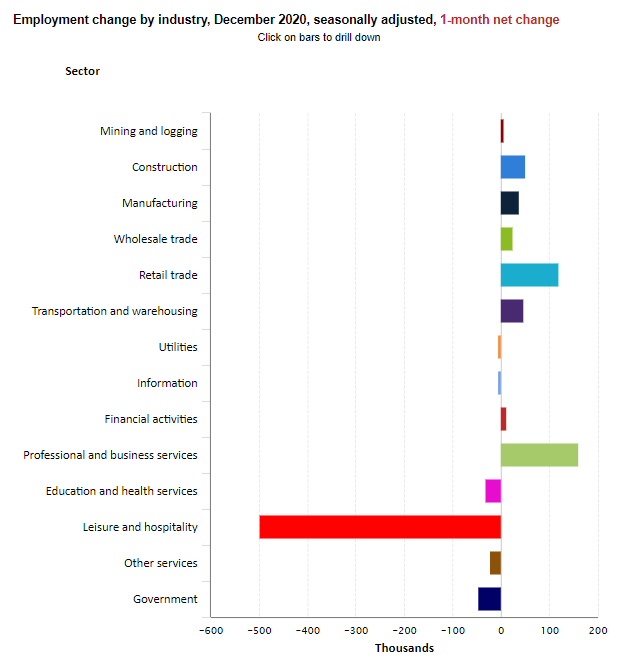

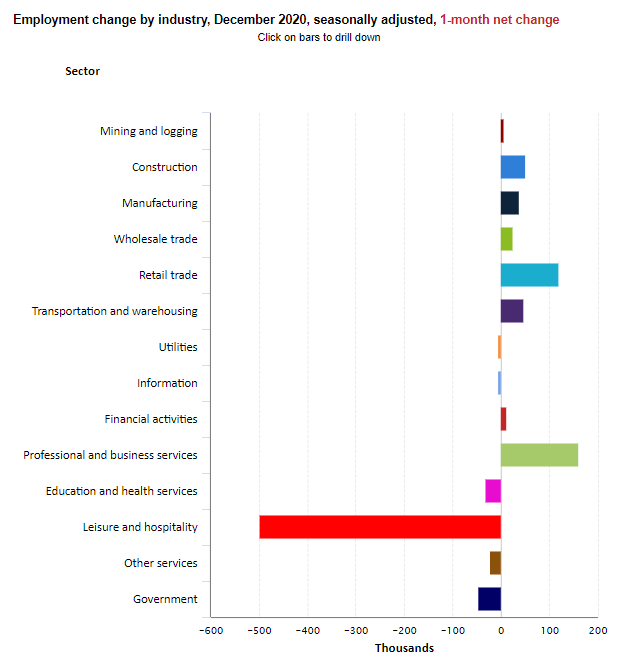

The largest July job increases occurred in the leisure and hospitality sectors, which added 592,000 jobs. This accounted for about one-third of the job gains. Health care added 126,000 jobs in July but is still down by 797,000 jobs since February. July job gains in health care occurred in offices of dentists and physicians, hospitals, and home health care services. Job losses continued in nursing and residential care facilities (-28,000).

The July unemployment rate of 10.2% was down 0.9 percentage point from June but is still quite elevated by historic standards and significantly higher than the 50-year low of 3.5% in February. The number of unemployed persons fell by 1.4 million to 16.3 million. Despite this decline, total unemployed persons are still 10.6 million more than in February.

Among major worker groups, the unemployment rate fell in July for adult men to 9.4%, adult women to 10.5% and teenagers to 19.3%. Among the unemployed, those who were jobless less than 5 weeks increased by 364,000 to 3.2 million in July and the number of persons jobless 15 to 26 weeks rose by 4.6 million to 6.5 million.

The underemployment rate or the U-6 jobless rate fell to 16.5% in July from 18.0% in June. This figure includes those who have quit looking for a job because they are discouraged about their prospects and people working part-time but desiring a full work week. In the previous 2008/2009 recession, this rate peaked at 17.2%.

The change in total nonfarm payroll employment for May was revised up by 26,000 from a gain of 2.699 million to 2.725 million and the change for June was revised own by 9,000 from 4.800 million to 4.791 million. Combined, 17,000 jobs were added to the original estimates. Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors. Market expectations had been for a gain of 1.480 million.

Average hourly earnings for all employees on private nonfarm payrolls rose by $0.07 in July to $29.39, a gain of 4.8% from a year earlier.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work was little changed in July from June at 61.4%.

Separately, the Department of Labor reported yesterday that the number of new applications for jobless benefits fell to the lowest level since March, though remained historically high at 1.2 million new applications.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace