Average seniors housing price per unit reaches over $200,000 for first time.

There was no shortage of activity in the U.S. seniors housing and care transactions market in 2019. The story of abundant liquidity continued throughout the year with the number of closed transactions reaching a time-series high going back to 2008. Indeed, there was no sign of reduced interest from investors and the transaction market continued to show significant activity once again which, barring any economic or capital market shocks, is most likely to continue into 2020.

Seniors housing and care closed transactions volume in 2019 registered $15.7 billion, which includes $11.1 billion in seniors housing, and $4.7 billion in nursing care. The total volume was up nearly 6% compared with 2018 volume of $14.9 billion. However, the yearly comparison differs when looking at the sectors separately as seniors housing dollar volume was up and nursing care volume was down compared to 2018. Seniors housing saw a 19% increase in volume from $9.3 billion in 2018, and nursing care volume was down 17% from $5.6 billion last year.

For closed transactions, the yearly count reached a time-series record going back to 2008. The number of deals closed in 2019 totaled 617, which was up 15% from the 535 closed in 2018, and up 22% from the 505 transactions closed in 2017. This new record of transactions closed is another indicator of the high level of interest from investors, especially the private buyers in the market.

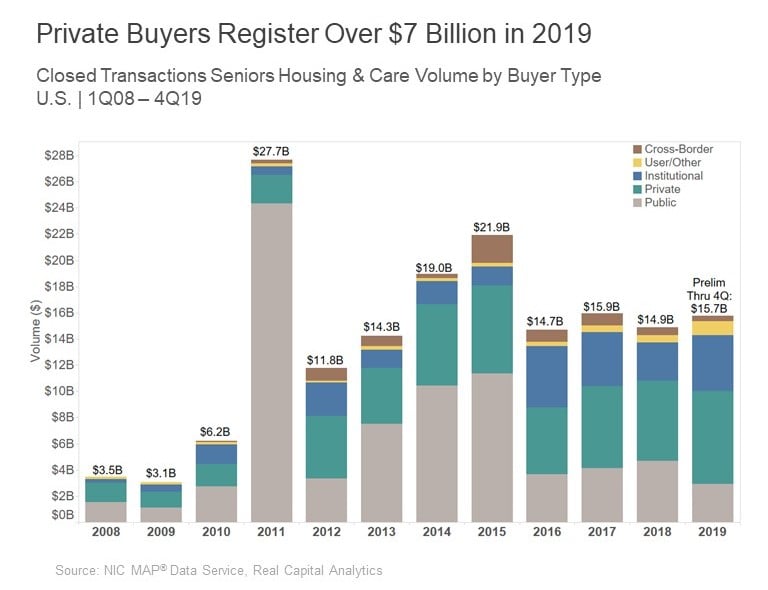

In the bar chart below, note that the private buyer has been consistent in terms of closed transaction dollar volume over the past three years, ranging from $6.1 billion in 2018 to $7.1 billion closed in 2019. This buyer type registered a solid year in 2017 as well with $6.3 billion in closed transactions. The private buyer represented almost half of the dollar volume in 2019 with 45% of closed volume, up from the 41% share of volume in 2018. The 2019 private buyer volume was up 16% from 2018 and 13% from 2017.

Not many significant-sized transactions, for example over $500 million, were tallied. But many transactions closed for smaller portfolios and single properties within the private buyer category, which can include owner/operators, family offices, and other private partnerships whose primary focus is operating, developing, and/or investing in real estate.

Seniors Housing and Care Pricing

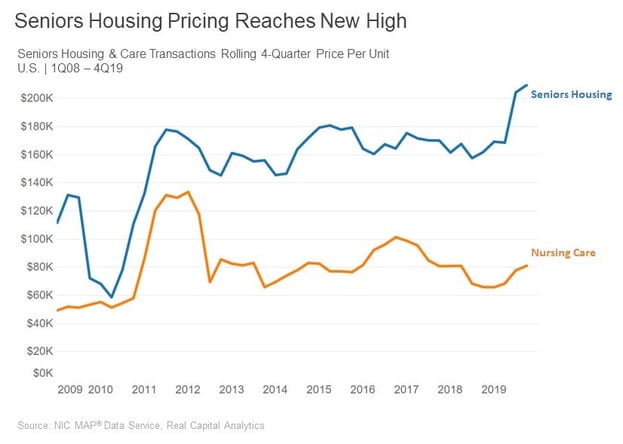

Seniors housing pricing had been trading in a range capped at the $180,000 mark since 2015. But in the second half of 2019 that changed as the third quarter of 2019 saw a price per unit over $200,000 for the first time in the time-series since 2008. In the fourth quarter, price per unit increased 2.6% from $204,300 to finish 2019 at $209,600.

The blue colored line at the top of the graph below shows the uptick as 2019 closed. On a year-over-year comparison, seniors housing price per unit was up significantly as it increased 29.5% from $161,800 in the fourth quarter of 2018. Also, worth noting is that from its low point, in 2010 of $58,500, price per unit is up over 250%.

In terms of nursing care pricing, represented by the orange line on the bottom, the story is much the same for increases in 2019. The price per bed is now back above $80,000 for the first time since the second quarter of 2018 when pricing took its latest downturn. Price per bed increased in the fourth quarter 2019 by 4.3% from $77,800 in the third quarter to end 2019 at $81,100. On a year-over-year comparison, nursing care price per bed was up 23% from $65,900 in the fourth quarter of 2018. From its low point in 2009 of $48,700, pricing per bed is up only 65%, which underscores the volatility in nursing care, as seen in the line graph below, especially in 2011.

In summary, pricing in both seniors housing and nursing care have seen a very positive upswing in 2019, based arguably on the stabilization of fundamentals for both, especially on the occupancy front. Labor continues to be a challenge for both, but absent a significant shock in 2020, for example a significant increase in interest rates or an economic downturn, we expect the fundamentals to continue to stabilize which should bode well for pricing. Of course, capital availability is a key driver as well, though that seems plentiful for now.

About Bill Kauffman

Senior Principal Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

Connect with Bill Kauffman

Read More by Bill Kauffman