The National Council of Real Estate Investment Fiduciaries (NCREIF) recently released investment return performance indicators for the primary commercial real estate sectors, including seniors housing. The results for seniors housing are summarized in this blog post. The performance measurements reflect the returns of 124 seniors housing properties, valued at $6.5 billion in the third quarter. As recently as the second quarter of 2018, the value of seniors housing properties reported into NCREIF was $1 billion less, at $5.4 billion with 110 properties reported. While limited in scope, the data reflects the return performance of investment managers who manage or own institutional real estate with a market value of at least $50 million held in a fiduciary setting.

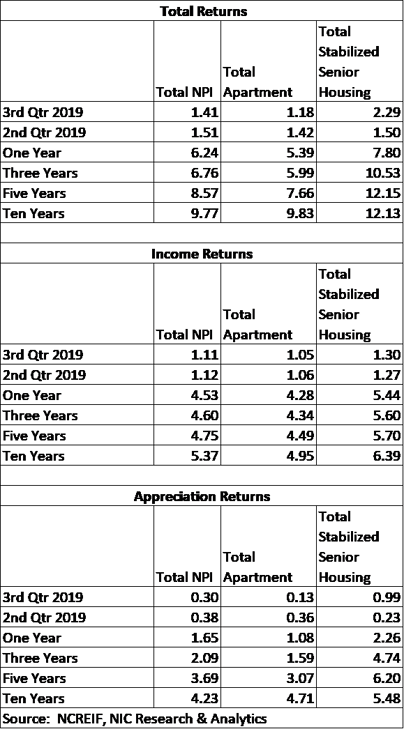

Seniors Housing Capital Returns Outpace NPI. The total investment return for institutional investors as measured by the 124 properties that reported data to NCREIF in the third quarter of 2019 was 2.29%, composed of a 1.30% income return and a 0.99% capital (appreciation) return. The positive appreciation return indicates that the seniors housing properties in the NCREIF data set continue to increase in value after deducting for capital expenditures. The total return for this quarter was slightly ahead of the average quarterly return over the past four quarters, which was 1.89%. The quarterly total seniors housing return compared favorably with the 1.18% rate for apartments and 1.41% rate for the total NPI. The quarterly appreciation return for seniors housing was particularly strong compared with the NPI and apartments and was 0.99%, compared with 0.30% and 0.13%, respectively. Note that these figures reflect unleveraged returns.

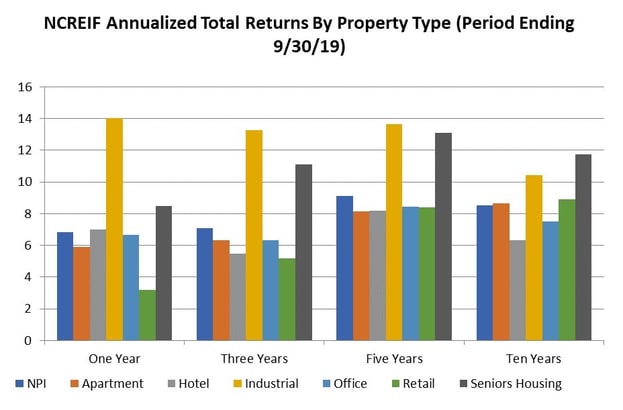

The annual total return through the third quarter of 2019 was 7.80%, exceeding the NCREIF Property Index (NPI) result of 6.24% and the apartment return of 5.39%. However, at 13.64%, industrial total returns significantly outpaced seniors housing. Industrial continues to benefit from e-commerce which has increased demand for last-mile warehouse space. Despite the relatively strong showing for seniors housing, the total annual return has been trending down since mid-2014 when it peaked at 20.37%. This pattern can also be seen in the broader index and reflects where we are in the cycle.

Cap Rate Compression. Based on NCREIF data, the value-weighted cap rate for seniors housing averaged 5.1% in the third quarter, near the mean for the year, but down from the average 5.4% rate seen in 2018 and 5.8% in 2017. Since 2017, cap rate compression has not been as significant for the overall NPI nor apartments. The risk premium is nearly one percentage point higher than for apartments (4.2% cap rate) and 78 basis points for the NPI (4.3% cap rate).

See NCREIF Real Estate Performance Report Quarterly Highlight.

About Beth Mace

Beth Burnham Mace is a special advisor to the National Investment Center for Seniors Housing & Care (NIC) focused exclusively on monitoring and reporting changes in capital markets impacting senior housing and care investments and operations. Mace served as Chief Economist and Director of Research and Analytics during her nine-year tenure on NIC’s leadership team. Before joining the NIC staff in 2014, Mace served on the NIC Board of Directors and chaired its Research Committee. She was also a director at AEW Capital Management and worked in the AEW Research Group for 17 years. Prior to joining AEW, Mace spent 10 years at Standard & Poor’s DRI/McGraw-Hill as director of its Regional Information Service. She also worked as a regional economist at Crocker Bank, and for the National Commission on Air Quality, the Brookings Institution, and Boston Edison. Mace is currently a member of the Institutional Real Estate Americas Editorial Advisory Board. In 2020, Mace was inducted into the McKnight’s Women of Distinction Hall of Honor. In 2014, she was appointed a fellow at the Homer Hoyt Institute and was awarded the title of a “Woman of Influence” in commercial real estate by Real Estate Forum Magazine and Globe Street. Mace earned an undergraduate degree from Mount Holyoke College and a master’s degree from the University of California. She also earned a Certified Business Economist™ designation from the National Association of Business Economists.

Connect with Beth Mace

Read More by Beth Mace