Managed Medicare revenue mix at 8.2%

NIC MAP® Data Service released its latest Skilled Nursing Monthly Report on October 29, 2020, which includes key monthly data points from January 2012 through August 2020.

Here are some key takeaways from the report:

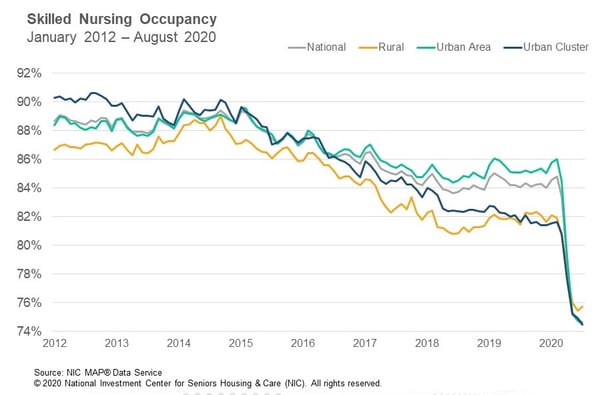

- The trend of declining occupancy rates for skilled nursing continued in the month of August due to the on-going impacts of COVID-19. The downward pressure on occupancy has been significant since the pandemic, with another 81 basis point drop from July to August to a new low of 73.8%. This represents a 9.6 percentage points drop in just the five months since March (83.4%) and a 10.9 percentage point decline since February. On a year-over-year basis, the occupancy rate is down 10.5 percentage points from August 2019. The occupancy trend was consistent across geographies as both urban and rural areas decreased from July to August ending at 73.7% and 75.1%, respectively.

- Patient day mix across all four payor types, i.e., Medicare, managed Medicare, Medicaid and Private, trended differently as Medicare and managed Medicare increased from July to April but Medicaid and Private decreased. This suggests the weakness in occupancy from July to August may be due to Medicaid admissions and/or patient days.

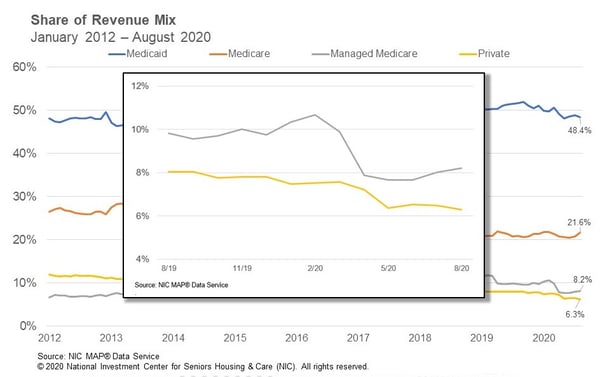

- Medicare patient day mix increased 40 basis points from 12.1% in July to 12.5% in August. Since March, it is up 114 basis points and since last year, it is up 125 basis points from 11.2%. In addition, Medicare revenue mix increased 87 basis points from July to August, increasing from 20.8% to 21.6%. The combination of the overall decline in occupancy and the increase in Medicare patient day mix and revenue mix suggests that the waiver of the 3-Day Rule imposed by the Centers for Medicare and Medicaid Services (CMS) is having a positive impact on Medicare days. Meanwhile, Medicare revenue per patient day (RPPD) declined 0.3% from July to August, ending at $549. It has now decreased 1.1% from June after an initial increase during the earlier periods of the pandemic as skilled nursing properties were likely receiving more Medicare RPPD because of additional reimbursement due to COVID-19 positive patients requiring isolation.

- Managed Medicare admissions have seemingly stabilized after decreasing significantly during the pandemic. Its patient day mix increased 14 basis points from July ending August at 5.9% and up 40 basis points since April. In addition, managed Medicare revenue mix is up 21 basis points from July ending August at 8.2% and up 34 basis points since April. The current stabilization in patient day and revenue mix is at the same time managed Medicare revenue per patient day (RPPD) is decreasing. RPPD decreased from $449 in July to $447 in August and is down 1.1% since February. The latest decrease in August suggests the downtrend in RPPD may be continuing after initial reimbursement stability from insurance companies during the earlier pandemic days. Although some stabilization occurred in August, managed Medicare revenue mix is down 168 basis points since March and down 246 basis points since February when it was 10.7%.

- Medicaid revenue mix declined 46 basis points from 48.8% in July to 48.4% in August. Medicaid revenue mix has declined 222 basis points since March when the mix was 50.6%. Furthermore, it has decreased 324 basis points from August 2019. Medicaid patient days likely decreased as well, due to lower overall admissions during the pandemic thus far and some Medicaid patients converted to Medicare because of the waiver of the 3-Day Rule. Meanwhile, the increases in Medicaid RPPD seen at the onset of the pandemic have slowed. Medicaid RPPD is up 0.4% since April but has increased 2.5% since March when initial increases in reimbursement from states helped skilled nursing properties related to the number of COVD-19 cases at properties. RPPD was flat from July to August at $233.

To get more trends from the latest data you can download the Skilled Nursing Monthly Report. There is no charge for this report.

The report provides aggregate data at the national level from a sampling of skilled nursing operators with multiple properties in the United States. NIC continues to grow its database of participating operators in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form here.

About Bill Kauffman

Senior Principal Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

Connect with Bill Kauffman

Read More by Bill Kauffman