This blog post provides a NIC Analytics review of data that highlights and quantifies the number one issue facing operators of skilled nursing facilities: staffing shortages. Labor shortages are particularly acute for nursing staff and aides who are often the hands-on workers with direct and intimate relationships with residents and patients. Staffing has generally been a challenge for the sector but since the onset of the pandemic staffing shortages have become pervasive across the industry.

Some have called the current skilled nursing labor shortage the worst the sector has ever seen, and many are worried it will intensify. To be fair, many sectors of the economy are experiencing significant labor shortages for a multitude of reasons such as a reduced pandemic-related labor force, worker fear of catching or spreading COVID-19, childcare and elder care responsibilities, and generous pandemic-related unemployment insurance benefits (many of which have recently rolled off). There is some debate about the causes of labor shortages across the country, but one thing that is certain is many sectors of the economy are being impacted in ways that are creating major operational hurdles.

Skilled nursing facilities (SNFs) face an all too familiar dilemma in competing with other industries in retaining and recruiting workers to provide care for high acuity residents. Further, the industry is challenged with maintaining operating margins due to very low occupancy rates, elevated operating expenses, and the often-inadequate Medicaid payment rates in many states.

Staffing shortages are a critical part of the much bigger story of today’s aging society. In 2020, the American population over 75 was estimated to be 23 million, according to the Bureau of Labor Statistics (BLS). By 2025, this figure will rise to 29 million (up 26% from 2020 levels), and by 2030, this figure will rise to 34 million (up 48% from 2020 levels). At the same time, other broad demographic trends suggest labor force challenges as older adults reach retirement and as they are not fully replaced by younger experienced workers.

According to the Demographic Drought Report released by EMSI, a leading provider of labor market data, “the US labor force participation rate (LFPR), which measures people working or actively seeking work, has dropped to lows we haven’t seen since the recession of the mid-1970s.” The report also highlighted the mass exodus of baby boomers and the lowest birth rates in U.S. history. Notably, the number of baby-boomer retirees increased by over a million in 2020, and the national birth rate hit a 35-year low in 2019. These demographic trends suggest a tightening labor market ahead, and that a large and growing labor pool of essential workers are needed today and in the foreseeable future.

What healthcare workers are in high need and have the biggest shortages within the skilled nursing sector?

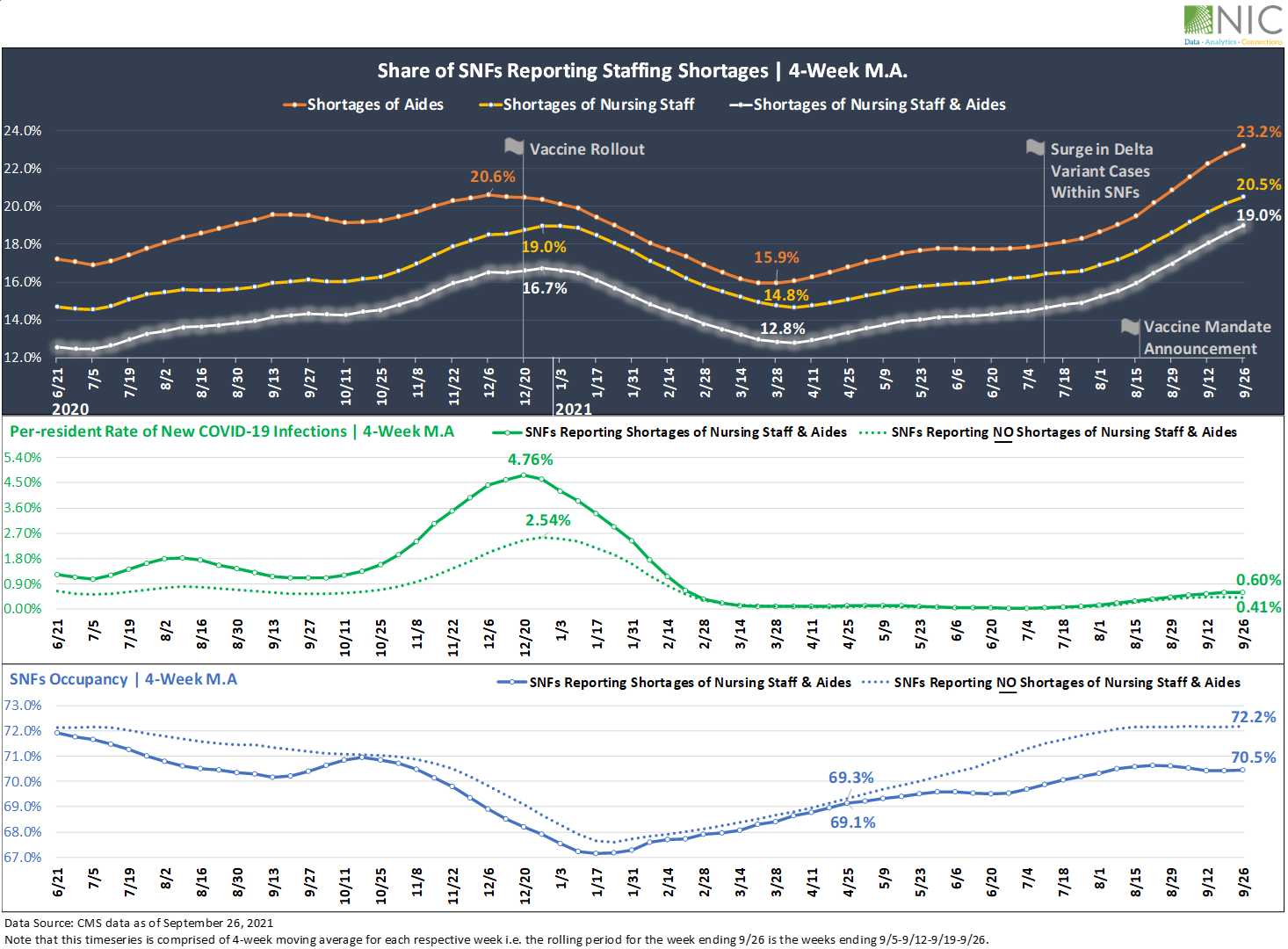

Exhibit 1 below depicts the share of skilled nursing facilities reporting shortages of nursing staff and aides since CMS began reporting this data in May 2020. The highest shortages of staff reported by SNFs have been among aides and nursing staff. Further, nursing staff and aides represent the largest share of all SNF staff. Indeed, according to the BLS Employment & Wage report compiled by NIC MAP®, powered by NIC MAP Vision, nursing staff and healthcare support occupations, including aides, represent over 60% of all staff within the skilled nursing sector.

Following the launch of the long term care vaccination program in December 2020, the share of SNFs reporting shortages of hands on essential workers started trending down and reached a low level of 15.9% for aides in March 2021, 14.8% for nursing staff and 12.8% for both nursing staff and aides. Since then, the proportion of SNFS reporting shortages began to rise again as move-ins and occupancy rates increased, although these percentages remained below the high levels seen in December 2020 prior to the vaccine rollout (20.6% for aides, 19.0% for nursing staff and 16.7% for both nursing staff and aides).

Unfortunately, a surge in COVID-19 delta variant cases within U.S. skilled nursing facilities in July 2021 as well as the recent vaccine mandate announcement in August 2021 exacerbated shortages of on-hand essential workers. By the end of September 2021, 23.2% of SNFs reported shortages of aides (up 7.3 percentage points from March 2021 levels), 20.5% reported shortages of nursing staff (up 5.7pps over the same period), and 19.0% reported shortages of both nursing staff and aides (up 6.2pps since March 2021). These are the highest levels seen since May 2020.

What impacts do shortages of nursing staff and aides have on SNF residents, SNF performance and the recovery of the sector as a whole?

Staffing shortages have likely not hit the peak yet and may get worse in the next few months. Indeed, a recent survey by the American Health Care Association and National Center of Assisted Living (AHCA/NCAL) shows nearly all the nursing homes participating in the survey are currently asking staff to work overtime or extra shifts and more than half are limiting new admissions due to staffing shortages. The survey also highlights that 78% of the nursing homes surveyed admitted to being concerned about having to close their facility due to workforce challenges.

The ripple effect on residents and the performance of SNFs is even more profound. Since CMS began reporting data in May 2020, skilled nursing facilities experiencing shortages of both nursing staff and aides have been reporting relatively higher per-resident rates of new COVID-19 infections and lower occupancy rates compared with SNFs reporting no shortages of these hands-on essential workers.

Notably, in December 2020 and prior to the vaccine rollout, infection rates peaked at 4.76% on a 4-week moving average (476 in 10,000 residents tested positive) for SNFs reporting shortages of nursing staff and aides, nearly double that of SNFs reporting NO shortages of hands-on essential workers (2.54%, equivalent to 254 in 10,000 residents tested positive). This suggests that shortages of staff translate into lower staff-to-resident ratios and consequently increase “one-to-many” interactions between available staff and residents. These “one-to-many” interactions could lead to higher virus transmission among residents.

The occupancy chart featured in Exhibit 1 below shows that SNFs reporting shortages of hands-on essential workers (in this case, defined as nursing staff and aides) have also had somewhat lower occupancy rates compared with SNFs reporting no staffing shortages since May 2020.

The widening gap in the last four months is something to watch going forward. By the end of September 2021, as staffing shortages intensified, the occupancy rate for SNFs reporting shortages of nursing staff and aides was 70.5% (4-week moving average, based on CMS data), 1.7pps below the occupancy rate for SNFs reporting no shortages (72.2%). Back in April 2021 when staffing shortages and virus cases within SNFs were relatively low, the occupancy rate for SNFs reporting shortages was 69.1%, only 0.2pps below the occupancy rate for SNFs reporting no shortages (69.3%).

The recovery in demand in the last few months is promising but staffing shortages could slow down the occupancy recovery for the sector and limit the improvement for SNFs experiencing staffing shortages.

Exhibit 1 – Staffing shortages vs. per-resident rate of new COVID-19 infections and occupancy

Staffing shortages and the impact on vaccination rates

The effects of staffing shortages continue across vaccination rates, which have been relatively low among nursing staff and extremely low among aides. In September 2021, 67.2% of all healthcare workers had been fully vaccinated, up 8.7pps from 58.5% in June 2021. Vaccination coverage has certainly improved in the last three months, but the disparity in vaccination rates among healthcare workers in SNFs has been dragging down the overall vaccination rate among staff and could be leading to higher virus transmission among residents.

Exhibit 2 below shows that the highest rate of fully vaccinated staff was among licensed independent practitioners at 88.6%, followed by therapist employees (77.1%), and other healthcare personnel (72.6%). However, vaccination rates among aides are still lagging, with only 57.2% of aides having been fully vaccinated, 11pps below the vaccination rate of nursing staff (68.2%) and 10pps below the overall staff vaccination rate of 67.2%, and even below the vaccination rate of all healthcare workers recorded three months ago in June 2021 (58.5%).

Staggering as this disparity in vaccination rates among SNFs healthcare workers is, none of this comes as a particular surprise. Aides and nursing staff represent the largest number of workers within the skilled nursing sector, and both have the highest shortages and most likely the highest turnover and churn rate. Recent studies have shown high turnover and churn rate among staff at nursing homes.

Skilled nursing facilities keep recruiting and losing these critical workers. In addition to the time and effort of recruiting and training these -hands on essential workers who interact directly with patients, a higher turnover rate is likely having a significant impact on operational costs, productivity, and infection control protocols to prevent virus transmission among residents.

Exhibit 2 – Vaccination rates among SNFs workers

-png.png)

Shortages of nursing staff and aides vary by state

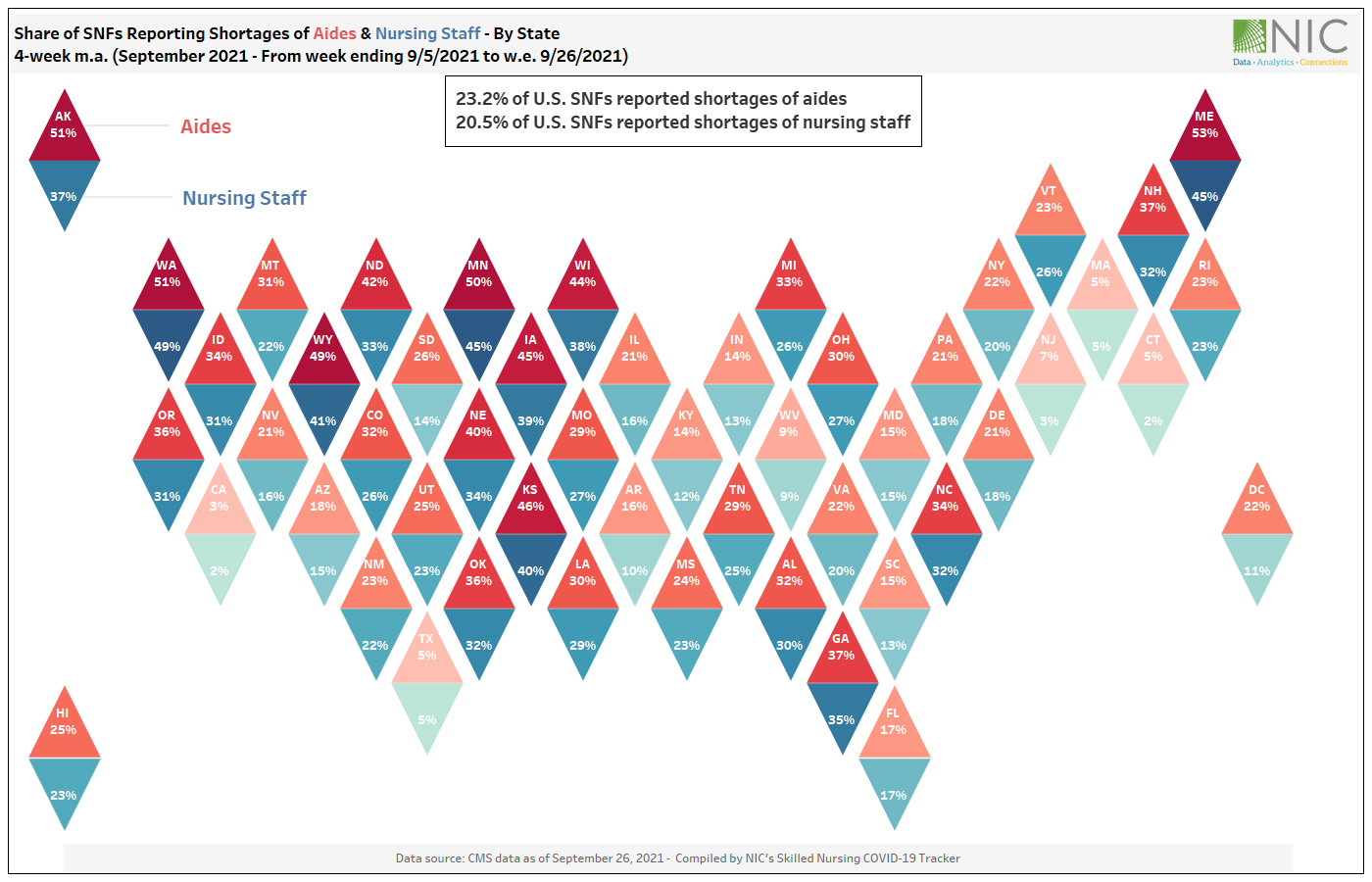

Exhibit 3 below shows that shortages of nursing staff and aides vary by state. In September 2021, over 40% of SNFs reported to be experiencing shortages of both nursing staff and aides across several states, including Maine, Kansas, Wyoming, and Minnesota.

While the majority of states are currently experiencing high staffing shortages, there are some states where staffing shortages have been comparatively very low among both nursing staff and aides. These states include California, Texas, Connecticut, New Jersey, and Massachusetts. Some of these states may have access to a larger labor pool. However, having access to a large labor pool doesn’t necessarily mean high retention rates among hands on essential workers (aides and nursing staff). Retention seems to be a real challenge facing all SNFs, regardless of labor availability.

Staff availability and retention may become the leading factors in identifying a competitive market or property for senior housing and skilled nursing constituents, and key attributes for residents in choosing between facilities.

Exhibit 3 – Share of SNFs reporting shortages of aides vs. nursing staff – By state

In this NIC analysis, we examined what group of workers and roles are in high needs and have the largest labor shortages within skilled nursing facilities, and the impact that shortages of these essential workers (aides and nursing staff) have on SNF residents, SNF performance, and the recovery of the skilled nursing sector.

Forthcoming analysis will examine what’s driving labor shortages among these critical and essential workers. and explore potential solutions and limitations to address this major issue.

About Omar Zahraoui and Bill Kauffman

Omar Zahraoui, Principal at the National Investment Center for Seniors Housing & Care (NIC), is a senior housing research professional with expertise in providing quantitative analysis and insights on seniors housing & care market data; building new products and reporting capabilities, including dashboards and proformas for clients and internal stakeholders; and implementing new processes and data solutions. Prior to his current role, Omar worked as a data analyst, at Calpine Corporation, supporting the development of new-business strategy initiatives, analyzing sales and financial data, and developing statistical modeling of consumers’ behaviors to drive business performance. Omar holds a Bachelor’s degree in Business Administration with concentrations in Finance and Management, a Master in Corporate Finance from IAE Lyon School of Management at Jean Moulin Lyon III University in France, and a Master of Science in Management Information Systems and Data Analytics from Pace University.

Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

Connect with Omar Zahraoui and Bill Kauffman

Read More by Omar Zahraoui and Bill Kauffman