In tune with NIC’s mission of educating the market on the opportunities and challenges of investing in seniors housing and care properties, The NIC Investment Guide: Investing in Seniors Housing & Care Properties, serves as a primer on the senior housing and care sector.

The Sixth Edition of the NIC Investment Guide, based on year-end 2019 time-series data, serves as a benchmark to the sector prior to the COVID-19 pandemic. Takeaways from this edition include:

- The investment-grade senior housing and care market is estimated to have a nationwide inventory of nearly 24,500 properties inclusive of more than 3.0 million units, and its overall market value is estimated at $474.5 billion.

- The market value estimate is based on an average $210,000 price per unit for senior housing properties and an average $81,000 price per bed for nursing care properties.

- The largest owner category of senior housing and care properties are private for-profit entities with ownership of 55.4% ($2 billion) of units in senior housing properties and 67.2% ($78.6 billion) of units in nursing care properties. Publicly traded REITs own 11.6% ($41.4 billion) of units in senior housing properties and 6.5% ($7.5 billion) of units in nursing care properties.

The technical chapters of the NIC Investment Guide include a detailed description of each senior housing and care community type. The community type descriptions incorporate resident profiles, supply data, industry operating structures, operating economics, and current trends. The Guide also discusses underwriting criteria, the development and construction of new properties and the acquisition of existing properties, debt and equity sources, and valuations, returns, and loan performance.

As in prior editions, the Sixth Edition features a chapter on Emerging Trends and Observations written by members of NIC’s Future Leaders Council (FLC). Drawing upon the acumen of industry participants to make observations and discuss emerging trends for which contemporaneous, empirical data may not be available, the topics put forth are forward-looking considering operating strategies, capital markets, joint venture preferences, labor shortages and the rising costs of labor, fragmented senior housing regulation, provider partnerships, and the growing market share for Managed Care, just to name a few. It also includes detailed appendices related to alternative housing and services, active adult communities, factors affecting demand, trends in technology, risks and mitigating factors, and the collaboration between housing and healthcare.

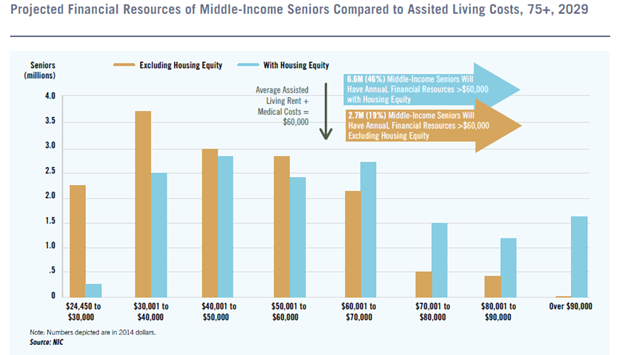

The large and growing middle market is also addressed. In 2019, The Forgotten Middle: Middle Market Seniors Housing Study was completed with results of the analysis published as a manuscript in Health Affairs. The study defined the middle-income cohort as people aged 75 and older who do not qualify for government assistance for senior housing—such as Medicaid—but are not wealthy enough to afford traditional private pay, market-rate senior housing for a meaningful amount of time. As shown below, the study determined that 54% of middle-income seniors will not have sufficient financial resources to cover projected average annual costs of approximately $60,000 for assisted living rent and other out-of-pocket medical costs by 2029.

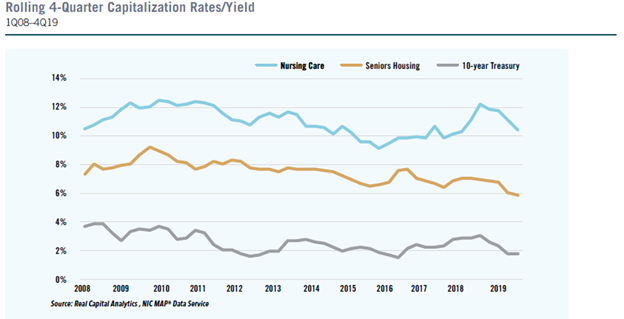

Additionally, through NIC’s strategic alliance with Real Capital Analytics, the NIC Investment Guide provides pricing and volume metrics on closed sales transactions of senior housing and care properties throughout the U.S. for the prior 10 years, and cap rates by property type. When comparing valuations among different senior housing property types, the use of cap rates and price per unit (PPU) are common measures. As shown by the exhibit below, development cap rates have historically been 250-500 basis points higher than those of existing properties, although recently those spreads have narrowed.

A reflection of NIC’s mission to provide data, analytics, and connections, all of which advance the access and choice of seniors housing and care for America’s elders, examples such as these and more are widely accessible through NIC’s Investment Guide. The Executive Summary of the NIC Investment Guide is available free of charge as a PDF download from nic.org. The full NIC Investment Guide, Sixth Edition is available both as a PDF file priced at $50 per copy and as a print publication priced at $100 per copy. Both can be found at store.nic.org.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck