NIC Analytics released the 1Q 2023 NIC Lending Trends Report today. The quarterly report, available complimentary to NIC constituents, includes data trends over six years for senior housing and nursing care construction loans, mini-perm/bridge loans, and permanent loans, from 3Q 2016 through 1Q 2023.

Takeaways from the 1Q 2023 NIC Lending Trends Report

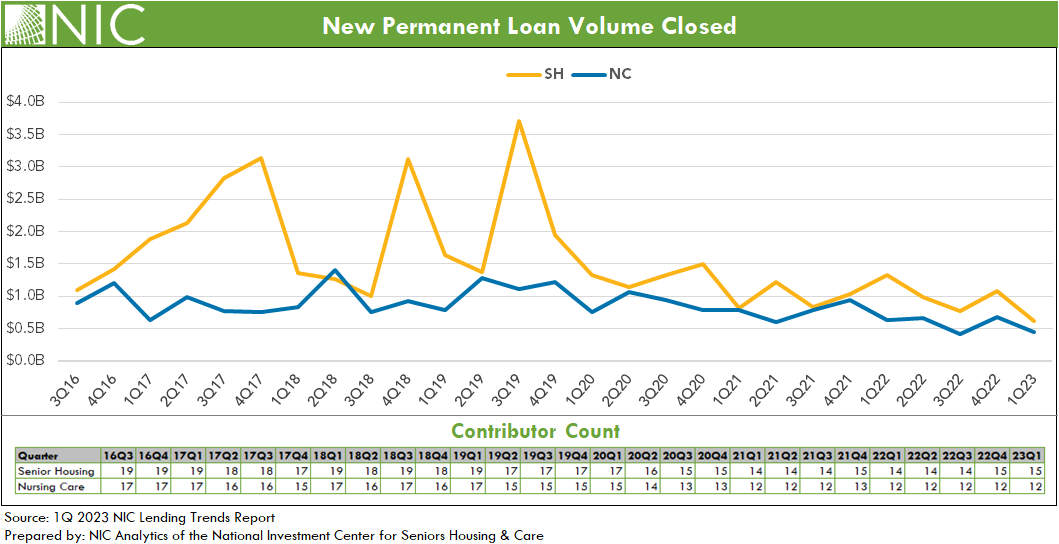

The issuance of new permanent debt reached a time series low for senior housing and a near record low for nursing care as well. The marked decline in permanent financing reflects tightening lending standards, widening spreads (i.e., the amount charged over the risk-free rate to compensate for risk), and lower loan proceeds. Credit conditions have changed dramatically because of the Federal Reserve’s efforts to slow economic growth to stem inflation through a series of interest rate hikes since March 2022.

The issuance of mini-perm/bridge debt for senior housing fell nearly 50% in the first quarter of 2023 from late 2022 levels. Mini-perm/bridge loan issuance was largely unchanged for nursing care and remained relatively low and on par with pre-pandemic levels. Heightened activity in the fourth quarter for senior housing bridge financing showed some borrowers’ preference for financing structures that offer flexibility – i.e., short-term loans over permanent ones for certain deals.

New construction loan closings for senior housing remained notably weak in the first quarter of 2023 compared to historical standards, with only two other periods in the time series matching this low level — the third quarter of 2022 and the first quarter of 2021. Issuance of construction debt for nursing care was virtually non-existent for the lenders sampled in the NIC Lending Trends Report. This aligns with the observed pattern of limited debt financing for new nursing care property construction since NIC began data collection in 2016. In fact, there has been limited development of new nursing care properties for several years.

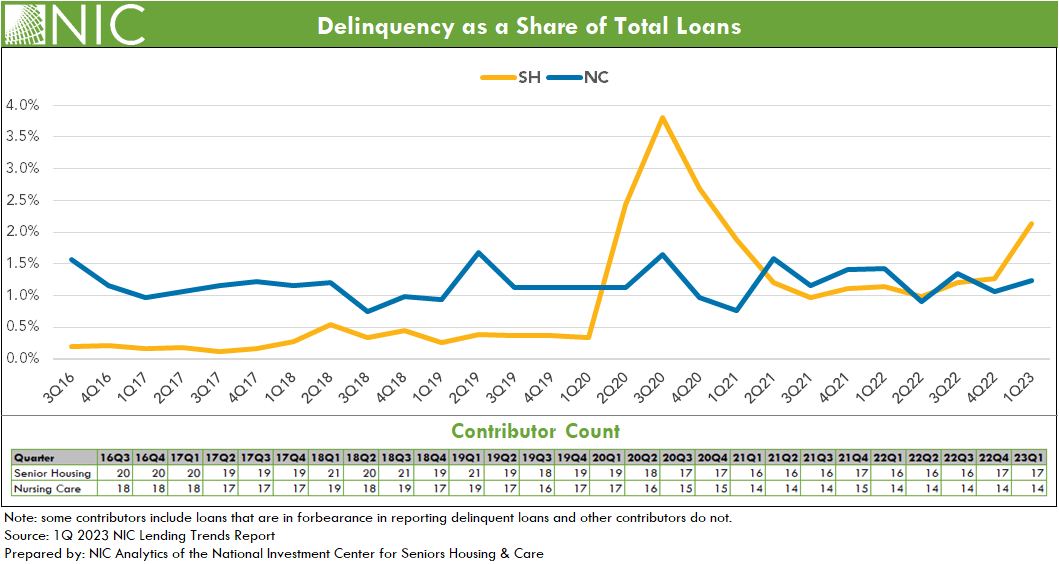

The total balance of senior housing delinquent loans saw a notable increase, though still lower than the high levels seen in the third quarter of 2020. Delinquencies in senior housing in the first quarter 2023 rose by 68.9%, while those in nursing care climbed by 16.0% from the prior quarter. Delinquencies as a share of total loans rose to 2.1% for senior housing, up from 1.3% in the fourth quarter of 2022. For nursing care, the delinquency rate edged up to 1.2%. Note that loans in forbearance are reported in the delinquent loan data for some debt providers. Also of note, some foreclosures were reported for the sample in first quarter 2023 for both senior housing and nursing care.

As background, the lending environment has tightened sharply in the past 16 months. The Federal Reserve raised interest rates by another 0.50 percentage points (pps) to 5.00% in the first quarter of 2023 (+0.25pps in February 2023 and +0.25pps in March 2023), up from 0% in March 2022 in an effort to tame inflation. Since June 2022, the annual inflation rate in the U.S. has continued to slow, decelerating for a ninth consecutive month to 5.0% in March 2023, down 4.1pps from the highs seen in June 2022 (9.1%). Meanwhile, senior housing construction starts remained relatively low in the first quarter of 2023, and the number of senior housing units under construction in the 31 NIC MAP Primary Markets remained near its lowest level since 2015, according to data released by NIC MAP Vision.

Looking ahead, these trends will likely persist in 2023. The broader economic landscape, characterized by relatively high interest rates and inflation, will continue to influence the senior housing and nursing care lending environment. This could result in further tightening of lending standards and an ongoing preference for short-term loans over permanent ones. The caution surrounding new construction financing and the elevated delinquency rates may also persist. However, the resilience and adaptability of this sector have been demonstrated time and again, and it will be interesting to monitor how these challenges are navigated moving forward. As always, understanding and responding to these trends will be critical for lenders, borrowers, and other stakeholders in the senior housing and nursing care sector.

From the Field: 1Q 2023 Survey Comments

In this release, we reached out to our network of contributors, engaging them with key questions about the lending environment for senior housing and nursing care. We sought to understand their strategies in response to changing capital market conditions, their lending patterns with respect to existing versus new clients, and any notable trends they observed in the market in the first quarter of 2023.

In the face of changing capital market conditions in the first quarter 2023, the responses indicated that lenders are responding to these changing conditions by focusing on strong sponsorship and strong credits. This trend reflects a reaction to a jump in the SOFR and 10-year Treasury rates, lower loan-to-value (LTV) ratios, tighter spreads, leaner proceeds, and higher equity requirements.

The first quarter of 2023 also saw a focus on long-term relationships with many lenders extending loans predominantly to existing clients. Limited transactions were completed with new clients. New financing requests mainly consisted of acquisition projects requiring substantial turnaround or lengthy runways, thus directing attention towards short-term bridge loans that can exit successfully within 18 to 24 months. Nonetheless, the number of new clients onboarded was relatively fewer due to tightened lending standards driven by higher interest rates.

The first quarter of 2023 continued to signal a cautious lending climate, with a significant slowdown in construction requests. Opportunities, however, have arisen for funds looking to acquire underperforming assets at discounted rates.

Note that this survey does not fully reflect the immediate disruption to the banking system following the failures of Silvergate, Silicon Valley Bank, and Signature Bank and the sale of First Republic Bank to JP Morgan Chase.

Download the complimentary 1Q 2023 NIC Lending Trends Report for full details on these and other trends in senior housing and skilled nursing lending.

Note: These data are not to be interpreted as a census of all senior housing and skilled nursing lending activity in the U.S., but rather reflect lending activity from participants included in the survey sample only.

The 2Q2023 NIC Lending Trends Report is scheduled for release in mid-November 2023.

Interested in participating? The NIC Lending Trends Report helps NIC Analytics to deliver on NIC’s mission to enable access and choice by further enhancing transparency of capital market trends in the senior housing and care sectors. We very much appreciate our data contributors. This report would not be possible without them.

If you would like to participate and contribute your data, please contact us at analytics@nic.org. As a courtesy for providing data, data contributors receive this report early before publication on the website. The information provided as part of the survey will be kept strictly confidential. Individual answers will be combined with the answers of all other respondents. Data acquired from this survey will only be reported in the aggregate, and therefore, the resulting aggregated data will not be attributed to you or your company upon distribution.