NIC Analytics released the 3Q 2023 NIC Lending Trends Report today. The complimentary quarterly report includes data trends over seven years for senior housing and nursing care construction loans, mini-perm/bridge loans, and permanent loans from 3Q 2016 through 3Q 2023.

Third Quarter 2023 and Beyond: Market Forces Recap

The Federal Reserve nudged rates higher by another 0.25 percentage points (pps) in July 2023, bringing the federal funds rate to a target range of 5.25% – 5.50%. This was the eleventh rate hike since March 2022. Concurrently, the consumer price index (CPI), has decelerated since June 2022, reaching 3.0% in June 2023 before rebounding to 3.7% in August and September of 2023.

Despite a noted easing of inflation in the past year, the Federal Reserve acknowledged its persistent elevation. Since July 2023, the Federal Reserve held rates steady for four consecutive meetings, including the most recent one in January 2024. The omission of any mention of further rate hikes in the Federal Reserve’s statement suggests a more balanced outlook regarding the risks associated with reaching its employment and inflation targets. However, the central bank remains vigilant about adjusting monetary policy as needed to address emerging risks.

Looking ahead, the expectation is for any potential rate cuts to occur gradually, involving SMALL incremental adjustments. The goal is to recalibrate and align interest rates with inflation to support overall economic health and mitigate inflationary pressures or deflationary risks.

Escalating loan expenses due to higher interest rates are impacting senior housing property assets, creating challenges for many and distress in certain others. The sector anticipates billions of dollars maturing this year. While some may endure the repercussions of high interest rates, more stability is anticipated in 2025 for those that can weather the current conditions, with an expected improvement in capital market conditions, occupancy, and NOI outlook.

The lending environment for senior housing and nursing care in the third quarter of 2023, although tighter compared to 2020, showed relatively similar conditions to the second quarter 2023 with some adjustments from both borrowers and lenders.

Takeaways from the 3Q 2023 NIC Lending Trends Report

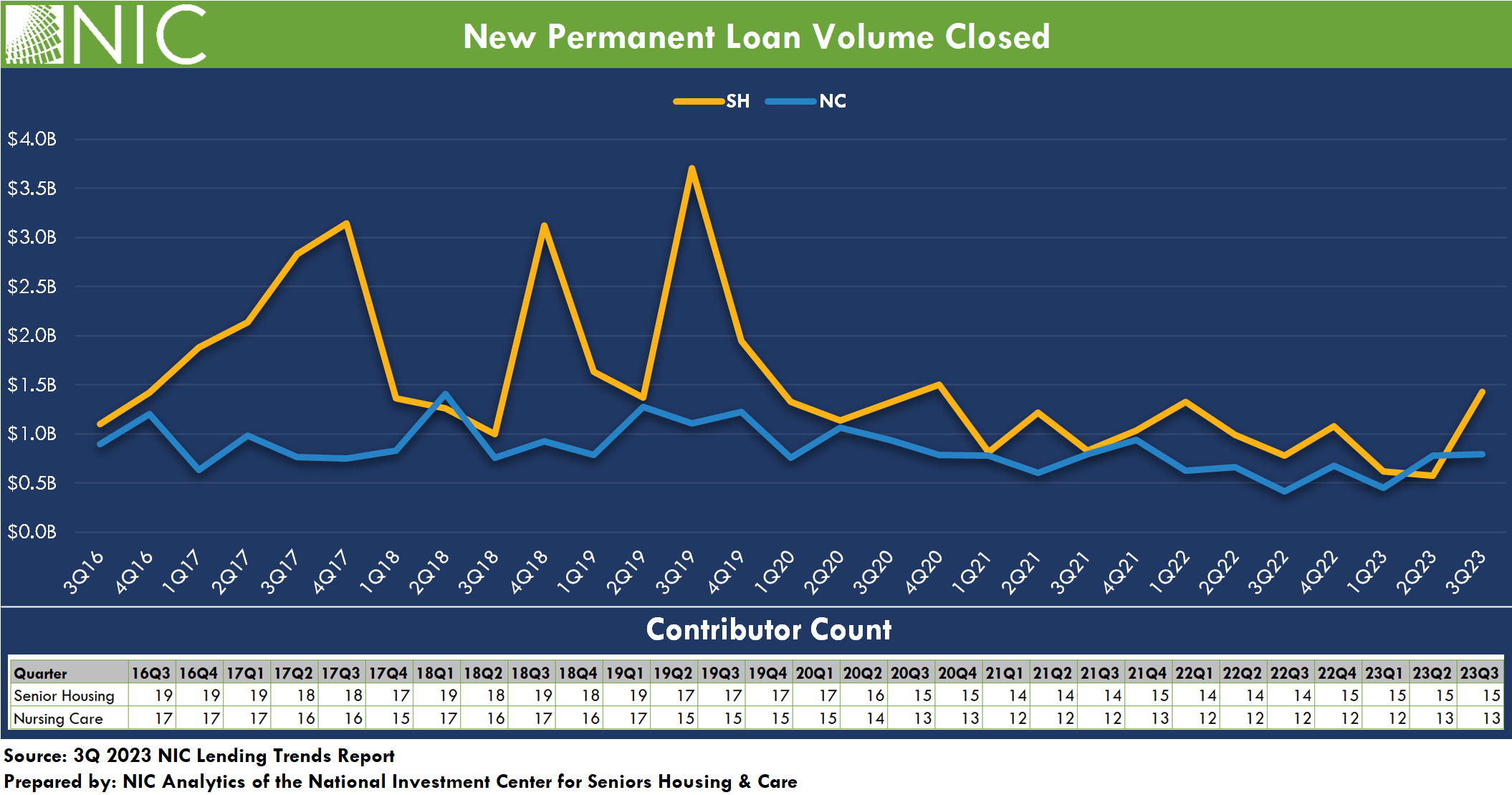

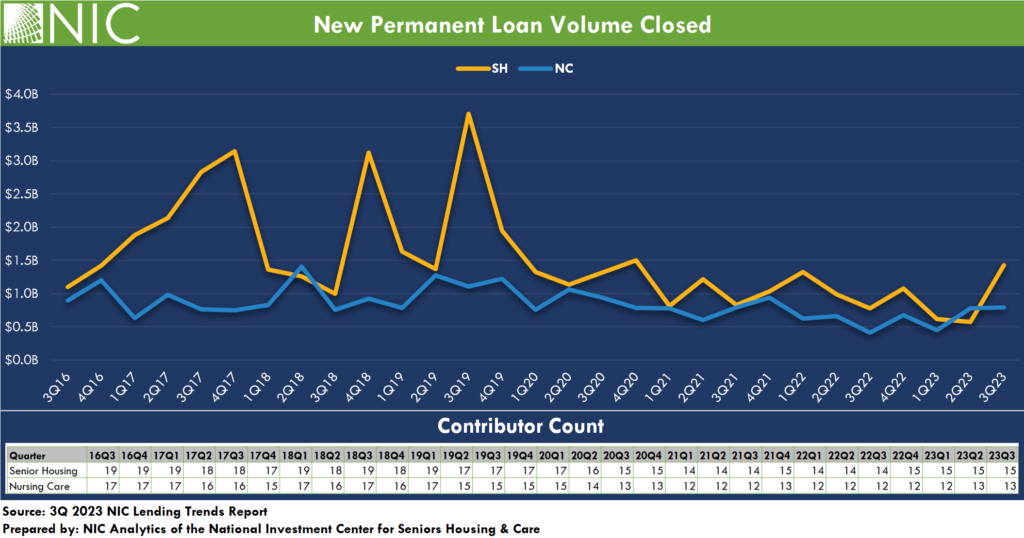

The issuance of new permanent debt for senior housing increased during the third quarter 2023. For the sample of lenders in the NIC Lending Trends Report, the volume of new permanent loans closed for senior housing surged to $1.43B, marking a 150% increase from the prior quarter. This increase suggests that some lenders and borrowers are likely adjusting to changing capital market and credit conditions and locking in long-term interest rates. However, the levels remained relatively low compared to the high volumes observed pre-2020.

The decline in mini-perm/bridge debt issuance for senior housing persisted and reached time-series low, reflecting a further 46% decrease from the prior quarter and 87% from late 2022 levels. Similarly, nursing care mini-perm/bridge loan closings, while slightly higher than those in senior housing for the past two consecutive quarters, remained relatively low and on par with pre-pandemic levels. Borrowers continue to adjust to the prevailing “higher for longer” mindset, anticipating sustained rates without a potential decline in the near future. While short-term debt options are limited, those available often come with increased costs and additional credit enhancements e.g., the need for more equity or a repayment guaranty.

New construction loan closings for senior housing subdued to weak levels and hit a new low within the time series in the third quarter of 2023. This is evident in construction starts which remained relatively feeble in the third quarter of 2023, and the number of senior housing units under construction in the 31 NIC MAP Primary Markets which remained near its lowest level since 2015, according to data released by NIC MAP Vision.

This notable decline suggests a trend of diminishing confidence in a quick construction market correction. Despite this, the consensus points towards mid- or late-2024 as the most likely period for senior housing construction starts to reach their lowest point.

As for nursing care, the issuance of construction debt was virtually non-existent for the lenders sampled in the Lending Trends Report. This aligns with the observed pattern of limited debt financing for new nursing care property construction since NIC began data collection in 2016.

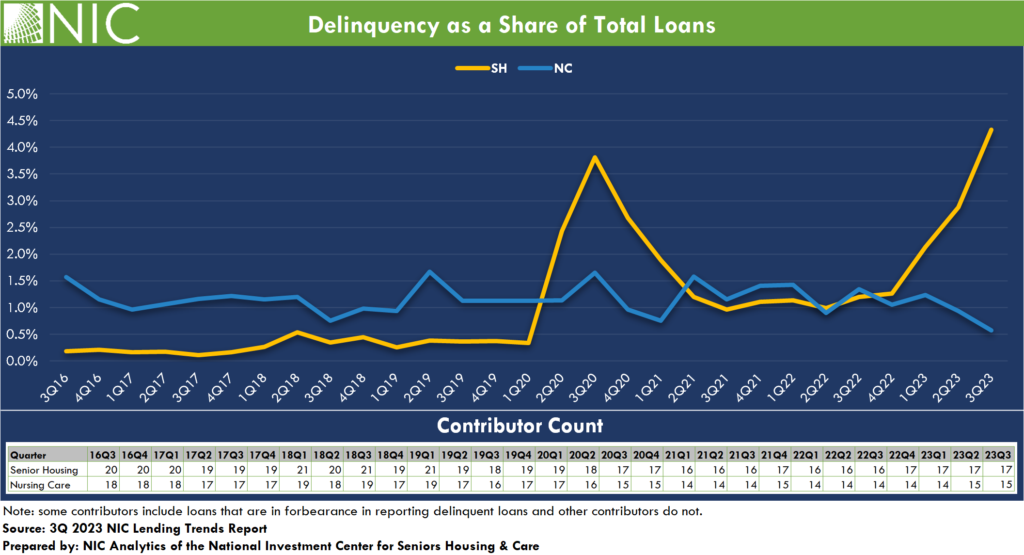

The total balance of delinquent loans for senior housing saw a notable increase to time-series high. Delinquencies in senior housing rose by 50% in the third quarter 2023 while those in nursing care declined by 38% from the prior quarter. Delinquencies as a share of total loans rose to 4.3% for senior housing, up from 2.9% in the second quarter of 2023 and 1.3% in late 2022. For nursing care, the delinquency rate edged down to 0.6% from 1.1% in late 2022. Note that loans in forbearance are reported in the delinquent loan data for some debt providers. Also of note, foreclosures were reported for the sample in third quarter 2023 for both senior housing and nursing care, $20.2M and $14M, respectively.

From the Field: 3Q 2023 Survey Comments

For the past three quarters, NIC Analytics has reached out to our network of lender data contributors to this report, asking them questions about the lending environment for senior housing and nursing care. We are asking about their strategies in response to changing capital market conditions, lending patterns with respect to existing versus new clients, and any notable trends they are observing in the market.

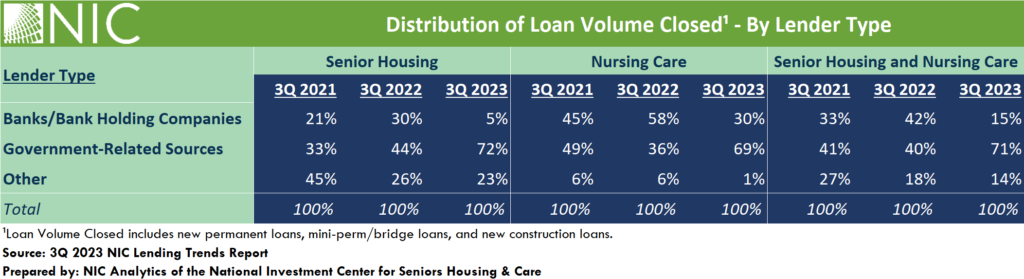

In the face of changing capital market conditions, the responses in the third quarter 2023 were diverse. Approximately two-thirds reported tightening lending standards, but credit requirements aligned with the first half of 2023, while a third maintained base credit standards but focused on strong sponsorship and credits opportunities due to reduced credit availability from banks. As the exhibit below shows, over the past three years, there has been a decline in the share of loan volume closed by banks and other lenders, juxtaposed with a rise in the share of loan volume closed by government-related sources (based on this sample of lenders captured by NIC).

The third quarter of 2023 also prompted greater focus on long-term relationships with many lenders extending loans predominantly to existing clients, acknowledging persisting challenges posed by rising short-term and long-term interest rates, staffing issues, slow census recovery in some cases, and inflationary increases in operating costs. Although some lenders onboarded new clients despite tightened lending standards.

Additionally, lenders noted that many properties displayed improved three-month NOI over 12-month NOI, but the surge in interest rates and cap rate trends sometime offsets potential loan proceeds. Further, the impact of higher interest rates caused some loans to become debt service constrained and resulted in adjustments to requested loan amounts to meet minimum DSCR requirements.

In conclusion, the third quarter “from the field” survey reflects the adaptability of senior housing and nursing care lenders and borrowers to new economic realities in the face of shifting market conditions. The industry grapples with a balancing act – tightening standards to navigate challenges while seeking opportunities to position themselves for the road ahead.

Download the complimentary 3Q 2023 NIC Lending Trends Report for full details on these and other trends in senior housing and skilled nursing lending.

Note: These data are not to be interpreted as a census of all senior housing and skilled nursing lending activity in the U.S., but rather reflect lending activity from participants included in the survey sample only.

The 4Q 2023 NIC Lending Trends Report is scheduled for release in mid-May 2024.

Interested in participating? The NIC Lending Trends Report helps NIC Analytics to deliver on NIC’s mission to enable access and choice by further enhancing transparency of capital market trends in the senior housing and care sectors. We very much appreciate our data contributors. This report would not be possible without them.

If you would like to participate and contribute your data, please contact us at analytics@nic.org. As a courtesy for providing data, data contributors receive this report ahead of its publication on the website. The information provided as part of the survey will be kept strictly confidential. Individual answers will be combined with the answers of all other respondents. Data acquired from this survey will only be reported in the aggregate, and therefore, the resulting aggregated data will not be attributed to you or your company upon distribution.