Today, ATI Advisory released a research paper, commissioned by NIC, that is a resource for skilled nursing stakeholders, including policymakers. The COVID-19 pandemic reminded our country of the persistent weaknesses of the long-term care system and NIC believes that a study providing the facts — both past and present — would be of tremendous value to stakeholders and is aligned with NIC’s mission of providing access and choice. In addition, with 10,000 people a day turning 65 and living longer with multiple chronic conditions, the time is now to set forth the facts to enable the country to move forward and improve the system.

The paper includes

- an overview of the nursing home industry,

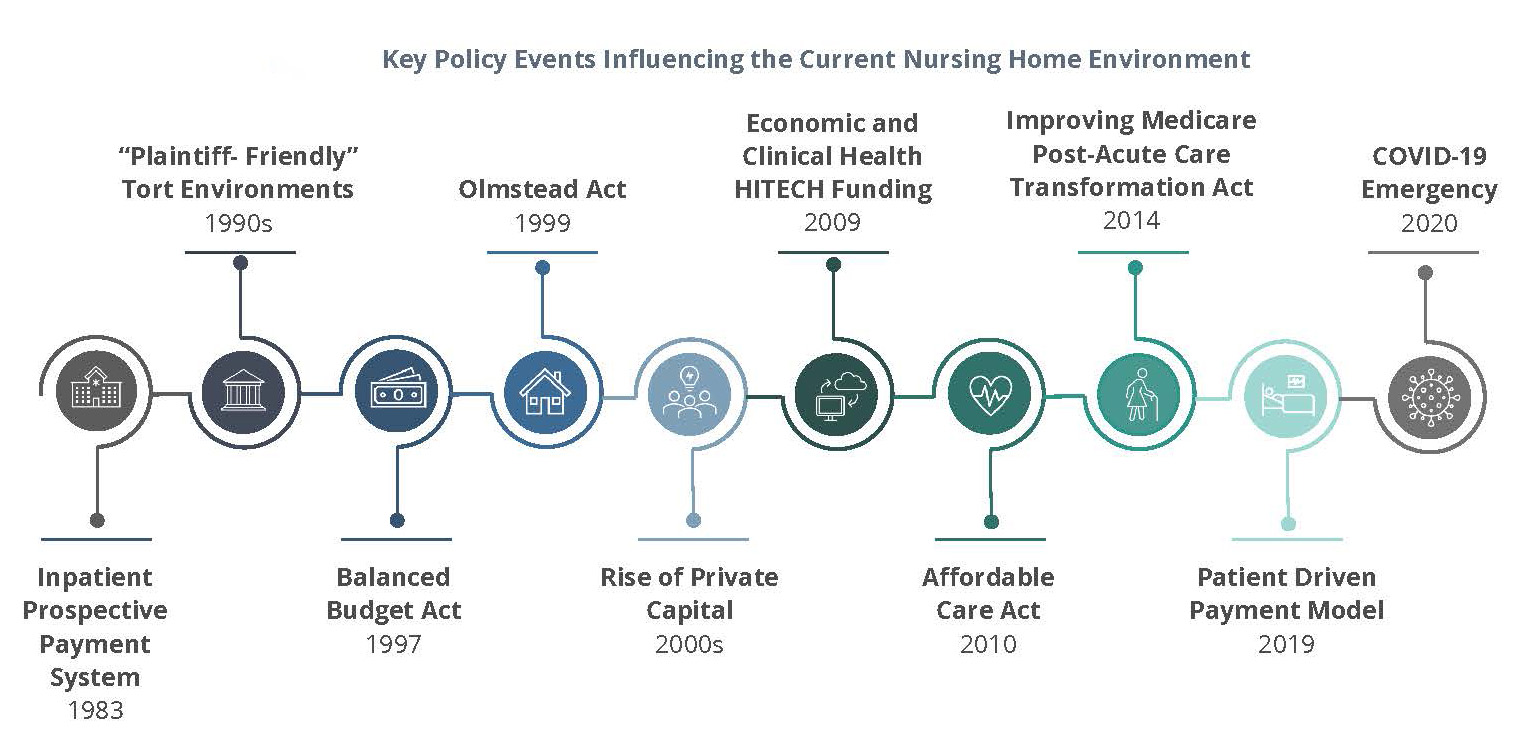

- a summary of policy events that have shaped the current environment,

- a closer look at nursing home capital market dynamics, and

- key opportunities for policymakers to consider in their approach to nursing home reform.

These sections of the paper are meant to collectively inform the policy decision making process, regarding the factors to consider when making policy.

These sections of the paper are meant to collectively inform the policy decision making process, regarding the factors to consider when making policy.

The current nursing home industry is struggling as it is increasingly serving a more complex patient population, facing a continuing staffing crisis which could become more difficult with new staffing mandates, and continuing to struggle with reimbursement as a result of growing Medicare Advantage penetration and value-based payment models.

A main takeaway from the paper is, given the current state of the industry, the current public-private partnership for skilled nursing facilities is failing. To meet the long-term care and housing needs of extremely frail older adults, America needs a modern and high-functioning skilled nursing industry. The government alone cannot meet the needs of this population and without reinventing the public-private partnership, federal and state governments will fail in meeting the needs of the extremely frail population who require 24-hour care. Partnerships to meet the capital funding needs of the skilled nursing sector must be rethought and restructured to better serve patients and the staff that care for them.

In order for public-private partnerships to succeed, the system needs to encourage much-needed innovation that would improve facilities and their operations for patients and staff. The policy changes over many years have resulted in operators seeking alternative sources of capital. For example, Medicaid reimbursement rates are no longer required to cover the cost of providing care, causing SNFs in many states to rely on higher reimbursement from Medicare patients to subsidize Medicaid shortfalls. Furthermore, within the current system it is not encouraged for private capital sources to invest in modernization of existing infrastructure or operational improvements that would drive quality care for patients by supporting frontline staff.

Visit our website to download the paper in its entirety, including the executive summary.