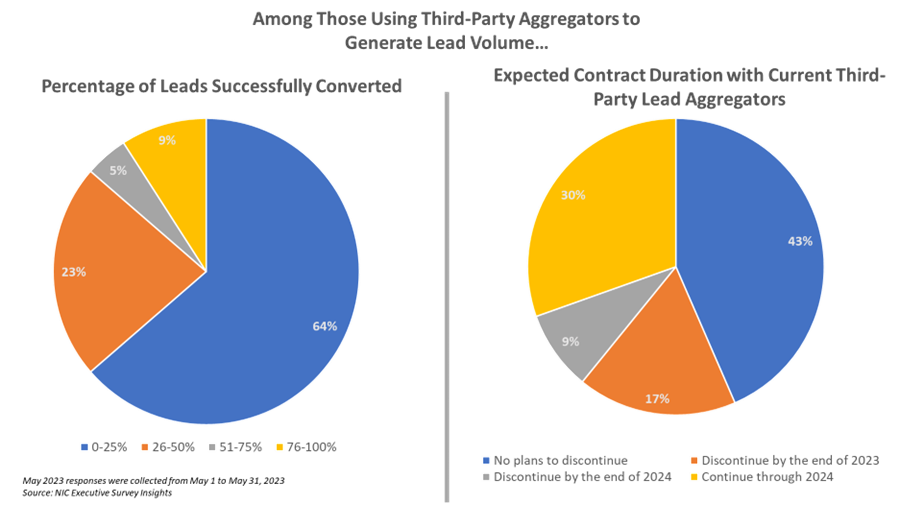

“A new series of questions in the May 2023 survey, suggested by April 2023 ESI survey participants, asked about the utilization of third-party referral aggregators. Of respondents who are currently using third-party aggregators, almost two-thirds (64%) successfully convert less than 25% of the third-party generated leads. Just under one-quarter of respondents (23%) successfully convert between 26% and 50% of the third-party generated leads. Less than one-sixth of respondents successfully convert more than 50% of third-party generated leads, with just under one-tenth converting more than 75%.

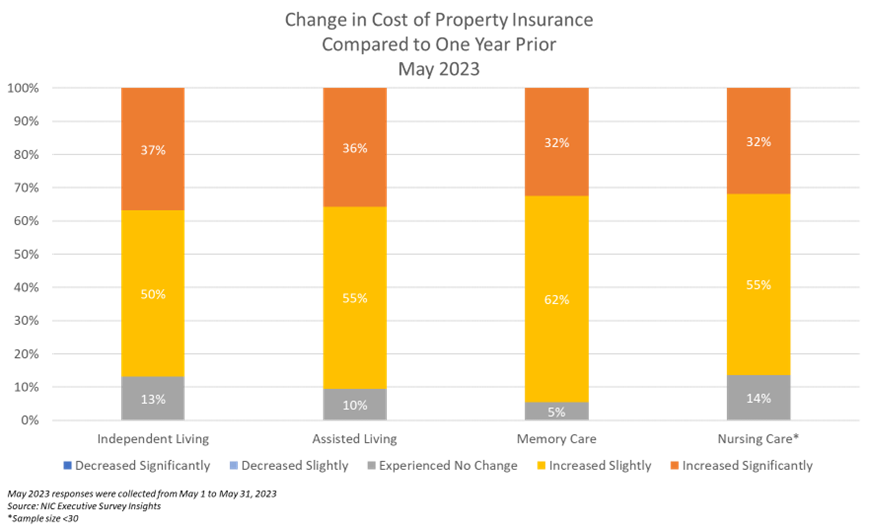

When asked to compare the cost of their property insurance currently to one year prior, between 86% and 95% of operators across all care segments – independent living, assisted living, memory care, and nursing care – reported it to have increased (either significantly or slightly). More than one-third of independent living (37%) and assisted living (36%) operators report the change in the cost of their property insurance to have increased significantly, followed by memory care (32%) and nursing care (32%).”

–Ryan Brooks, Senior Principal, NIC

These Executive Survey Insights, May 2023 results include responses from May 1 to May 31, 2023, from owners and executives of 47 small, medium, and large senior housing and skilled nursing operators across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. The number of properties owned or operated by survey respondents in the May 2023 Executive Survey Insights (ESI) ranges from one to as many as 275. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

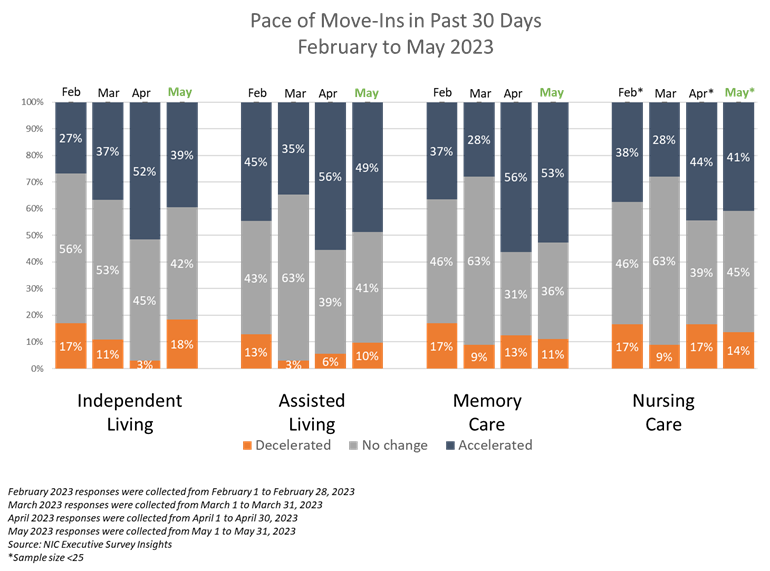

In the May 2023 ESI, approximately one-half of memory care (53%) and assisted living (49%) operators, and two-fifths of nursing care (41%) and independent living (39%) operators report an acceleration in the pace of move-ins in the past 30 days. This represents a decrease in the share of operators reporting an acceleration in the pace of move-ins across all care segments. The slowdown was greatest for independent living and assisted living operators, while memory care and nursing care operators reported only a slight decrease of three percentage points.

When asked what they attributed the deceleration in move-ins to, a slowdown in leads conversions or sales was the most common response (71%), followed by potential residents’ fear of rising unemployment or unstable economy (14%), and an increase in community pricing (7%).

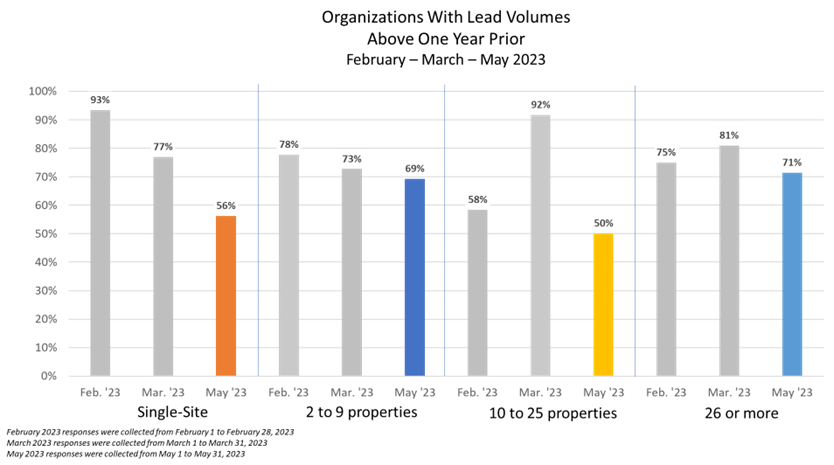

May 2023 ESI respondents were asked if lead volumes were above the prior year. With a slowdown in the pace of move-ins being reported across all care segments, lead volumes are an important indicator to watch with regards to occupancy recovery and stabilization. As shown above, in May, organizations reporting lead volumes that are above one year prior were down compared to the two most recent times this question was asked – in February and March 2023.

Single-site operators and operators with between two and nine properties have experienced three consecutive decreases in reported lead volumes, while operators with 10-25 properties and those with more than 26 properties experience more volatility. Despite the decreases in lead volume, most respondents are still reporting higher lead volumes than one year prior.

A new series of questions in the May 2023 survey, suggested by April 2023 ESI survey participants, asked about the utilization of third-party referral aggregators (Caring.com, A Place for Mom, etc.). Just over one-half (51%) of operators report currently using these types of referral aggregators.

Of respondents who are currently using third-party aggregators, the May 2023 ESI asked about the percentage of leads which are successfully converted as well as the expected duration of their relationship with their current third-party aggregator. With regard to the rate of successful lead conversion, just under one-tenth convert more than 75% of the third-party generated leads, less than one-sixth successfully convert more than 50%, and just under one-quarter of respondents (23%) successfully convert between 26% and 50% of their third-party generated leads. Almost two-thirds of respondents (64%) successfully convert less than 25% of the third-party generated leads.

When asked about the expected duration of third-party aggregator contracts, most respondents (43%) have no current plans to discontinue the relationship, while just under-one third anticipate their third-party aggregator contracts will remain in place through 2024. One-sixth of respondents (17%) expect to discontinue their third-party aggregator contract before the end of 2023 and slightly less than one-tenth of respondents (9%) expect to discontinue their contract before the end of 2024.

The most cited challenge facing operators – reported by more than 80% of respondents in the May 2023 ESI – is rising operator expenses, and responses to questions on property and professional liability insurance emphasize the sentiment.

When asked to compare the cost of their property insurance currently to one year prior, between 86% and 95% of operators across all care segments – independent living, assisted living, memory care, and nursing care – reported it to have increased (either significantly or slightly). More than one-third of independent living (37%) and assisted living (36%) operators report the change in the cost of their property insurance to have increased significantly, followed by memory care (32%) and nursing care (32%). No owners or operators reported a decrease in the cost of property insurance.

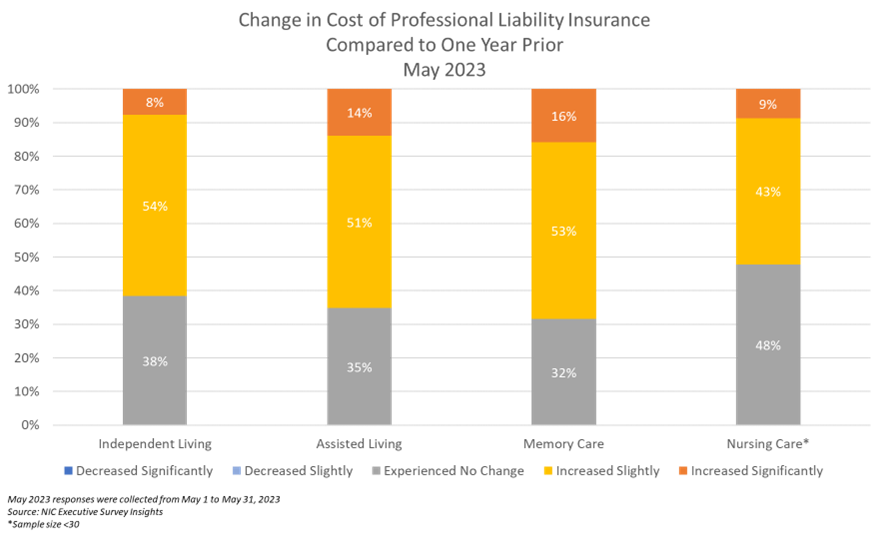

Professional liability insurance has also increased compared to one year prior. When asked to compare the cost of their professional liability insurance to one year prior, two-thirds of memory care (68%) and assisted living (65%) operators report the change in cost to have either increased significantly or increased slightly, followed by three-fifths of independent living operators (62%), and one-half of nursing care operators (52%). No owners or operators reported a decrease in the cost of professional liability insurance.

May 2023 Survey Demographics

- Responses were collected between May 1 and May 31, 2023, from owners and executives of 47 senior housing and skilled nursing operators across the nation.

- Owners/operators with 1 to 10 properties comprise roughly two-thirds of the sample (64%). Operators with 11 to 25 properties account for one-fifth of the sample (19%), and operators with 26 properties or more account for the remaining one-sixth (17%) of respondents.

- More than one-half of respondents are exclusively for-profit providers (57%), one-third operate not-for-profit seniors housing and care properties (34%), and 9% operate both.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, more than three-quarters (83%) of the organizations operate seniors housing properties (IL, AL, MC), 21% operate nursing care properties, and 36% operate CCRCs – also known as life plan communities.

The June 2023 ESI survey is currently open and will be collecting responses through June 30, 2023. If you are an owner or C-suite executive of senior housing and care and would like an invitation to participate in the survey, please contact Ryan Brooks at rbrooks@nic.org to be added to the list of recipients.

NIC wishes to extend a heartfelt thank you to the owners and operators who have contributed to this survey over the past three years. It is remarkable that we have now completed more than 50 waves of surveys. We have surveyed through numerous challenges — COVID-19, threats of a looming recession, labor shortages, inflation, and rising expenses — many of which still persist. As we continue to navigate through these challenges, your input and real-time insights help ensure the narrative on the senior housing and care sector is accurate. By demonstrating transparency, you build trust. Thank you.