The NIC Analytics team presented findings during a webinar with NIC MAP Vision clients on April 11 to review key senior housing data trends during the first quarter of 2024.

NIC Analytics utilized a relatively new webinar format in which the second half featured a deep dive on a special topic. In April’s webinar, David Fasano, Managing Director with Berkadia, discussed the transaction and capital markets environment in senior housing with Lisa McCracken, NIC’s Head of Research & Analytics. NIC hopes attendees enjoyed the new webinar format and welcomes any comments or suggestions.

Key takeaways from the first quarter data included the following:

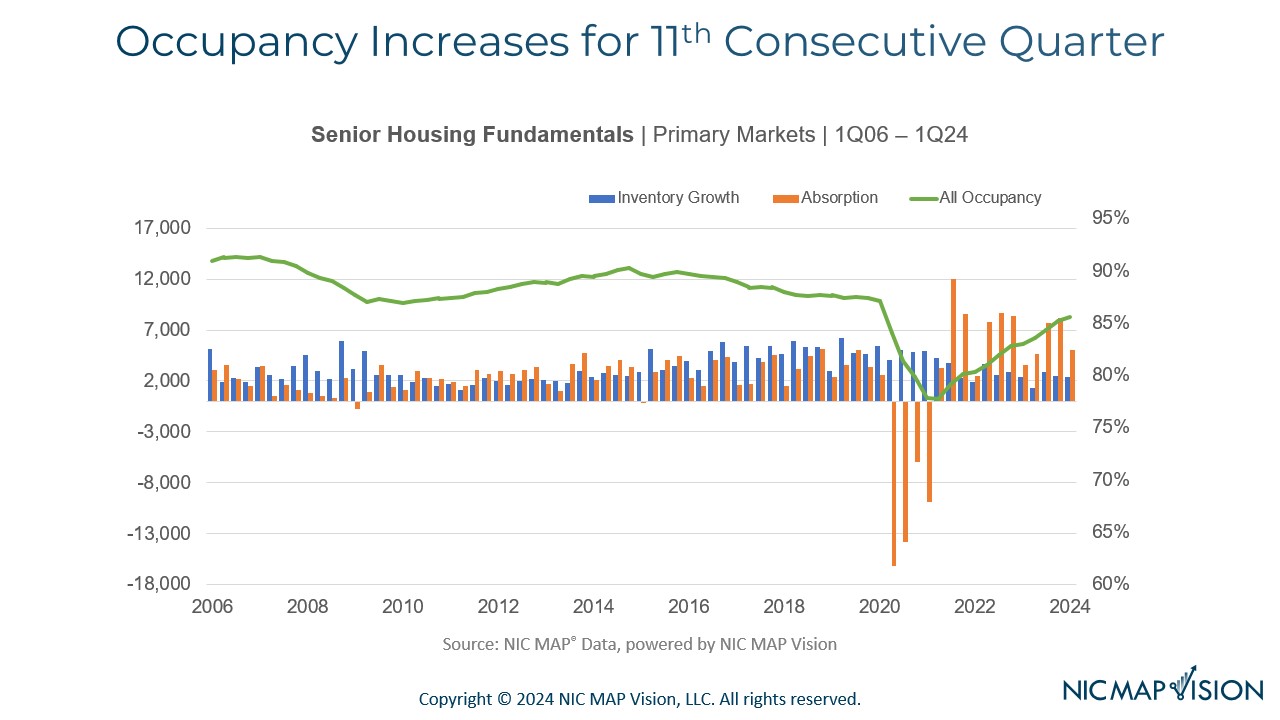

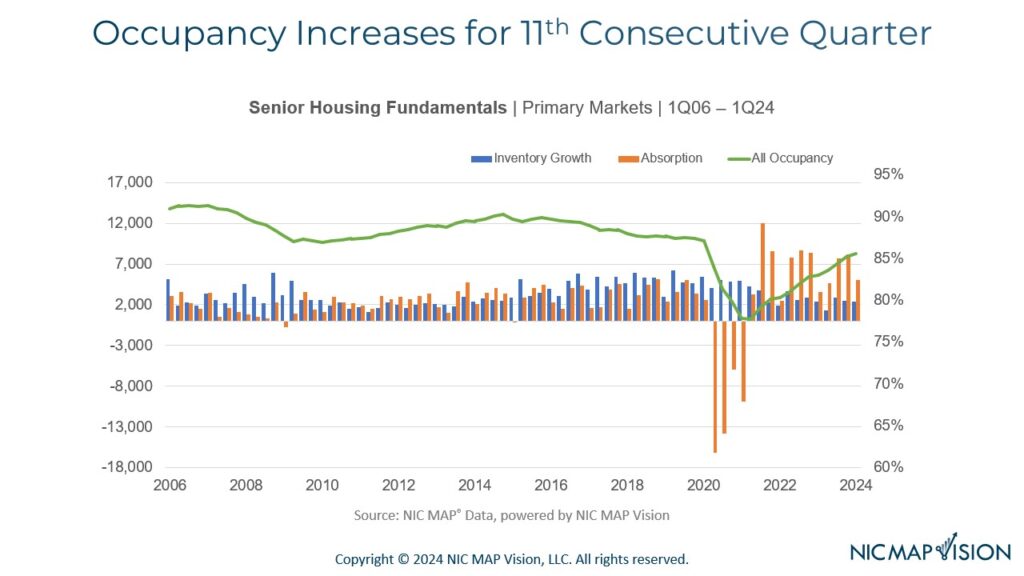

Takeaway #1: Occupancy Increased for the 11th Consecutive Quarter

- The occupancy rate for the 31 NIC MAP Primary Markets rose 0.5 percentage points to 85.6% in the first quarter. This marked the eleventh consecutive quarter of occupancy gains.

- Occupancy is only 1.5 percentage points below its prior peak of 87.1% in the first quarter of 2020.

- Robust demand coupled with moderate levels of new supply have driven occupancy gains, and at this current pace, senior housing occupancy rates are on track to recover to pre-pandemic levels in the second half of 2024.

Takeaway #2: Occupied Units Continue Climbing to Record Highs

- The total number of occupied senior housing units in the Primary Markets set another high in the first quarter, rising to more than 603,000 units. This was 34,400 units higher than the pre-pandemic first quarter of 2020 level.

- This trend is similar for the Secondary Markets and shows that today more older adults than ever before are residents in senior housing properties.

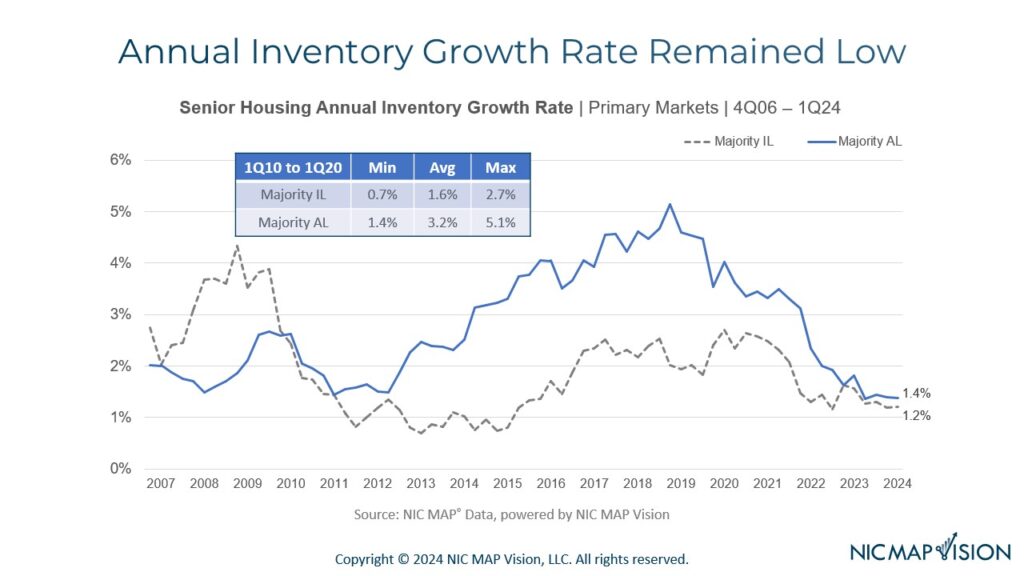

Takeaway #3: Annual Inventory Growth Rate Remained Low

- Inventory growth rates were steady compared to the fourth quarter of 2023, with assisted living at 1.4% and independent living at 1.2% year-over-year.

- Overall, inventory growth has trended down from 2019 rates.

Takeaway #4: Senior Housing Units Under Construction Least Since 2015

- The number of senior housing units under construction in the Primary Markets continued to decline and stood at less than 30,000 units in the first quarter of 2024, which was the lowest level in nearly 10 years.

- By property type, majority independent living properties and majority assisted living properties each comprised roughly half of the construction under way.

- As a share of existing assisted living inventory, units under construction totaled 4.4%, well below its peak of 10.2% in 2017.

- For independent living, units under construction totaled 4.0% of existing inventory, down from its peak of 6.6% in mid-2019.