2024 will mark the end of a three-year pandemic occupancy recovery, paving the way for 2025 to be a year focused on proactive initiatives, efficiency developments, and a forward-looking approach.

This article is a segment of NIC Analytics’ construction deep dive series, featuring (1) an analysis that highlights the increasing construction durations in senior housing, and (2) an exploration of construction cycles and regional dynamics within the senior housing sector.

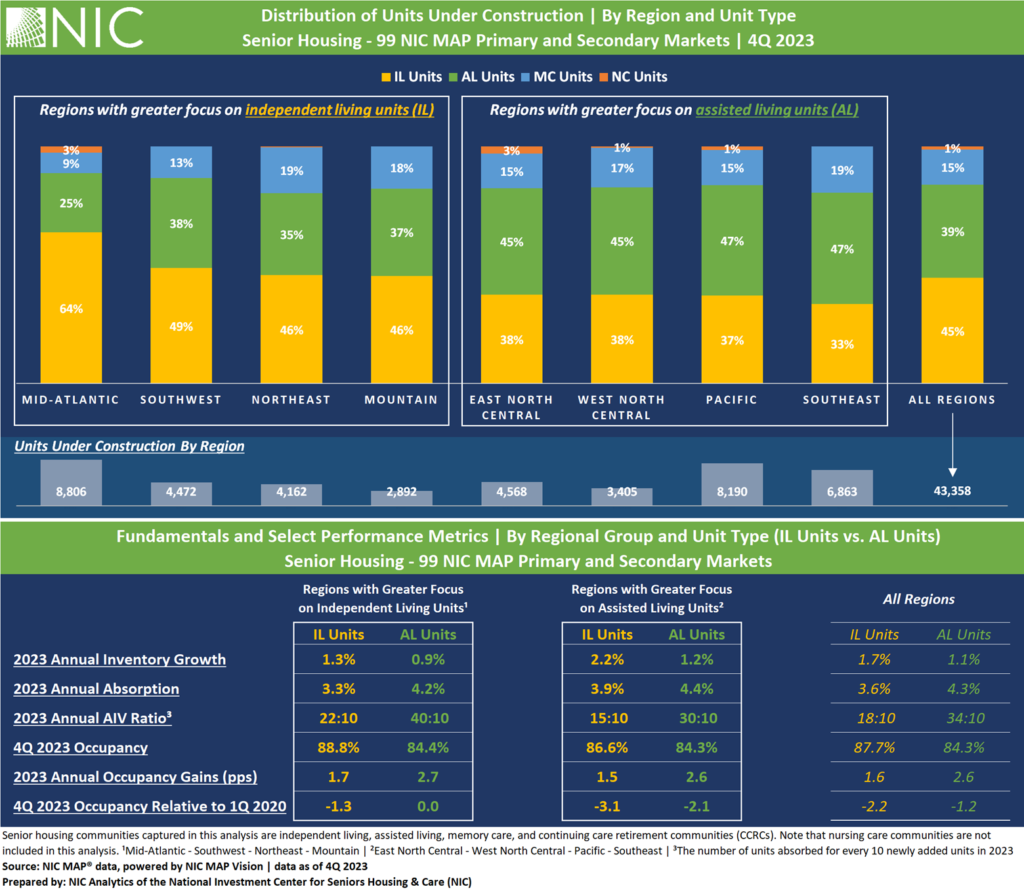

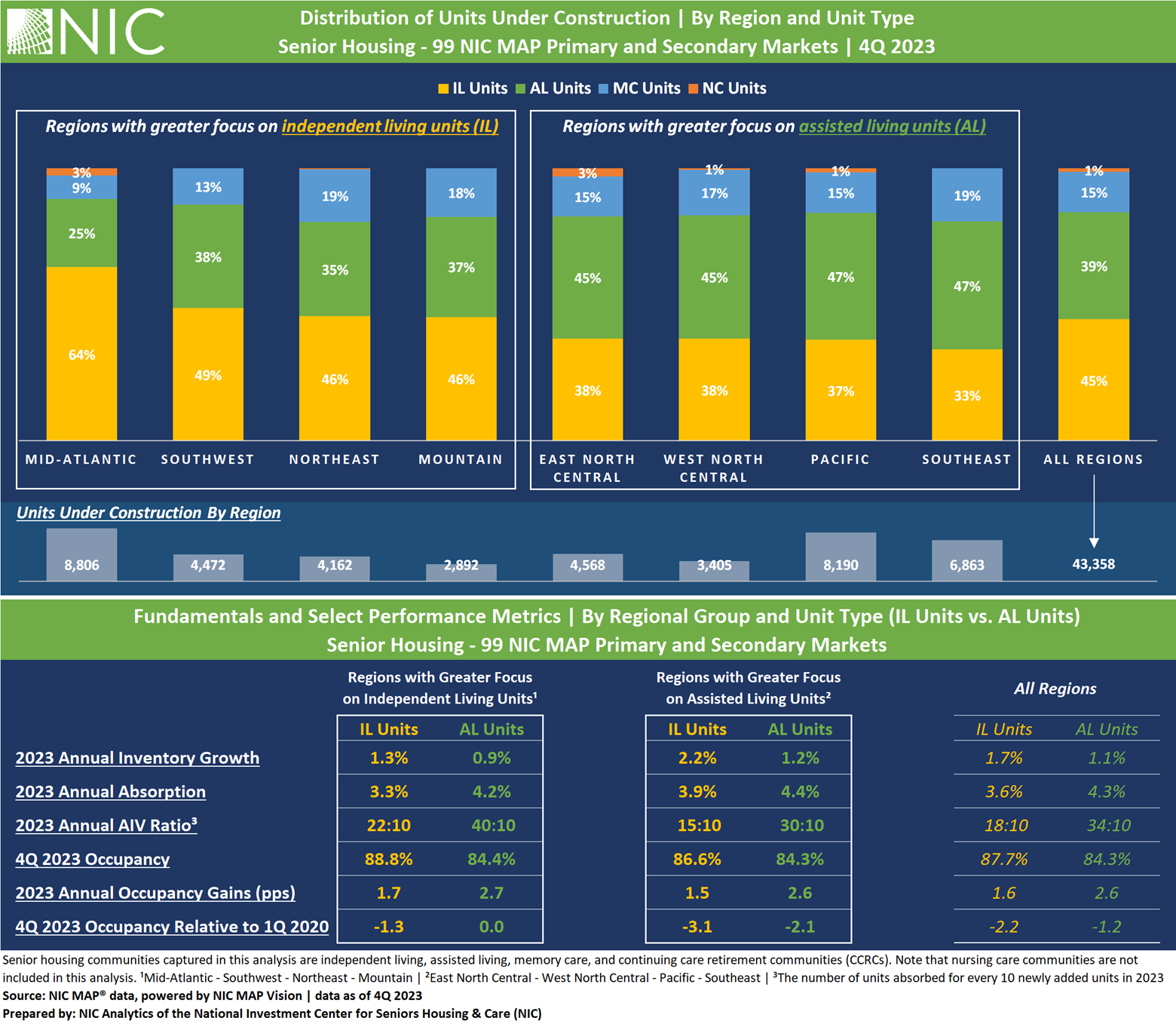

In this concluding segment of the series, NIC Analytics examines key takeaways from the distribution of units (independent living, assisted living, memory care, and nursing care) under construction in senior housing across U.S. regions. The focus is on analyzing fundamentals and select performance metrics in two sets of regions, each employing distinct construction strategies, particularly from a unit type mix perspective.

As we wrap up this series, we invite your perspective on the future trajectory of senior housing construction. Please share your insights by participating in the poll question at the end of this article.

The goal of this construction-focused series is to offer a forward-looking perspective, highlighting opportunities and challenges, indicating areas where the industry anticipates future demand for senior housing unit types, and providing roadmaps to guide future developments.

Distribution of units under construction, market fundamentals, and select performance metrics by region and unit type.

Optimal growth involves striking a harmonious balance in unit types. The exhibit below illustrates the diversity in regional construction strategies, with some regions prioritizing independent living, while others place more focus on assisted living to meet higher acuity care needs of older adults.

The prominence of memory care units across various regions highlights the importance of specialized care and units for older adults with cognitive impairments. Addressing the needs of this growing demographic will not only be a necessity, but also a strategic differentiator.

The data also reveals a notable scarcity of new nursing care units within senior housing properties in all regions. This persistent trend in recent years highlights the growing recognition of senior housing and nursing care as distinct product types, each with unique fundamentals, operations, and investment strategies.

Regions with greater focus on independent living units:

The Mid-Atlantic, Southwest, Northeast, and the Mountain regions share a common trend with more focus on independent living units. The Mid-Atlantic region stands out with a notable concentration in independent living units, accounting for 64% of the total units under construction in the region.

Regions with greater focus on assisted living units:

With 47% of units under construction dedicated to assisted living, the Pacific and the Southeast demonstrate more focus on assisted living units, followed by the East North Central and the West North Central with 45% of units under construction allocated to assisted living.

While each of these distinct regional groups anticipates different projected needs based on the current construction pipeline, the fundamentals and select performance metrics revealed a similar pattern.

In 2023, independent living units within both groups showed relatively higher inventory growth compared to assisted living units. However, assisted living units demonstrated a higher annual absorption rate than independent living units. As a result, the AIV (absorption-to-inventory) ratio for independent living units was lower than that of assisted living, indicating a relatively higher velocity of turning new assisted living units into occupied units.

In terms of occupancy gains in 2023, assisted living units within both regional groups experienced higher growth compared to independent living units. Additionally, occupancy rates for assisted living units are approaching recovery. In fact, the occupancy rate for assisted living units within the select regions with a greater focus on independent units under construction has returned to pre-pandemic first quarter 2020 levels, although independent living units still maintain relatively higher occupancy rates.

The recent surge in demand for assisted living, consistently higher in recent years, is likely indicative of a new normal rather than a pent-up demand. Given this sustained pace of demand growth and relatively moderate inventory growth, assisted living is expected to continue closing the occupancy gap with independent living throughout 2024 and likely beyond.

Looking at these trends across both regional groups prompts a key question: which regions are poised to strike a balanced mix of unit types for optimal growth, effectively meeting the needs of both current residents within the continuum and prospective residents? While in some circumstances, units can be converted, efficiency developments are important for achieving optimal growth needed to maximize performance.

In the context of senior housing construction, efficiency developments are measured by how well the senior housing sector delivers the right product to the right prospective residents when they need it, and involves streamlining construction processes and timelines, optimizing resource allocation, and finding the right unit mix balance to enhance outcomes in terms of cost-effectiveness, quality vs. affordability, and supply vs. demand in senior housing.

In conclusion, 2024 will mark the end of the pandemic recovery at least from an overall occupancy standpoint and construction pace perspective. However, achieving a uniform recovery is unlikely, with some properties, markets, and regions expected to continue facing challenges.

When trends apply broadly, they tend to normalize. Challenges stemming from capital market conditions, higher interest rates, and demanding lending environments are likely to persist, although these are not exclusive to the senior housing sector. Senior housing providers who adeptly navigate these general macro trends and focus on the industry’s specific micro trends will achieve outlier performance in the future – an attainable feat within this transitioning sector from a “value sector” to a “growth sector.”

As background, with anticipating trends and needs becoming the standard for success in the industry, NIC Analytics is embracing more of a forward-looking approach. In future publications, NIC Analytics will introduce its forward-looking AIV ratio alongside the actual AIV ratio, providing an additional metric for assessing the future dynamics of supply and demand.

___

Polling Question:

Considering the greater focus on independent living unit construction in certain regions, do you think this trend will continue or shift in 2024?