“The pace of move-ins continued to be sluggish in Wave 17 with more survey respondents reporting declines in occupancy rates than increases in occupancy for each of the four care segments. Fewer organizations cited stronger resident demand as a factor influencing the pace of move-ins. Comments by survey respondents added color to the key survey findings: several leaders of their organizations cited rising COVID-19 cases among residents and staff in some properties resulting in stress in containing outbreaks and maintaining staffing levels amid wage growth and hazard pay challenges. While some operators were eagerly anticipating the arrival of the vaccine, others expressed frustration with new slowdowns in the turnaround times for receiving COVID-19 lab test results.”

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change. This Wave 17 survey includes responses collected November 30-December 13, 2020 from owners and executives of 80 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 17 Summary of Insights and Findings

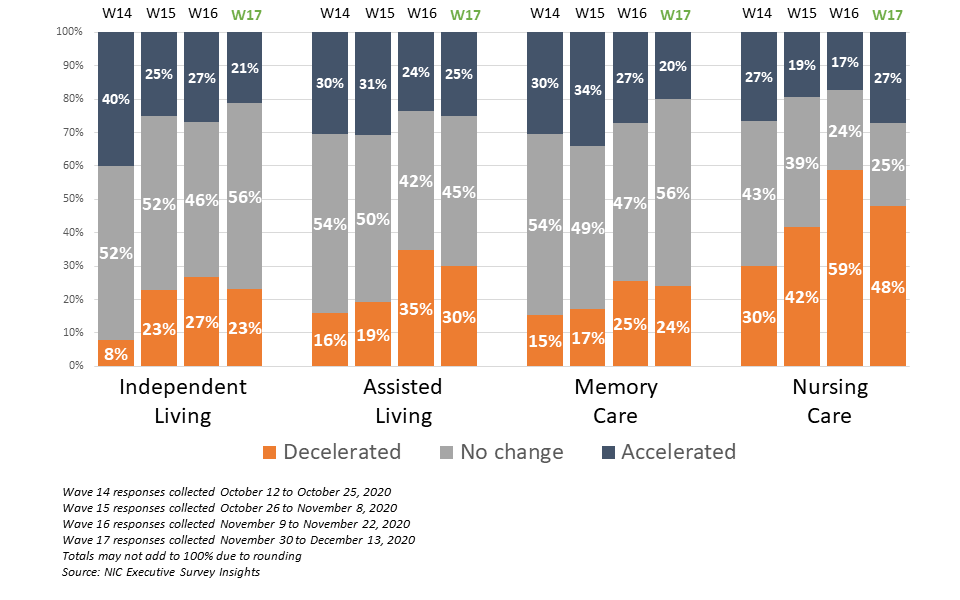

- In Wave 17, reports of decelerations in the pace of move-ins slightly outpaced accelerations in independent living, assisted living and memory care, and continued to significantly outpace accelerations in move-ins in the nursing care segment since Wave 14 surveyed in mid-October. The shares of organizations reporting an acceleration in the pace of move-ins in the past 30-days for the independent living, assisted living and memory care segments remained at or around their lowest levels since Wave 8 (surveyed late-May to early-June).

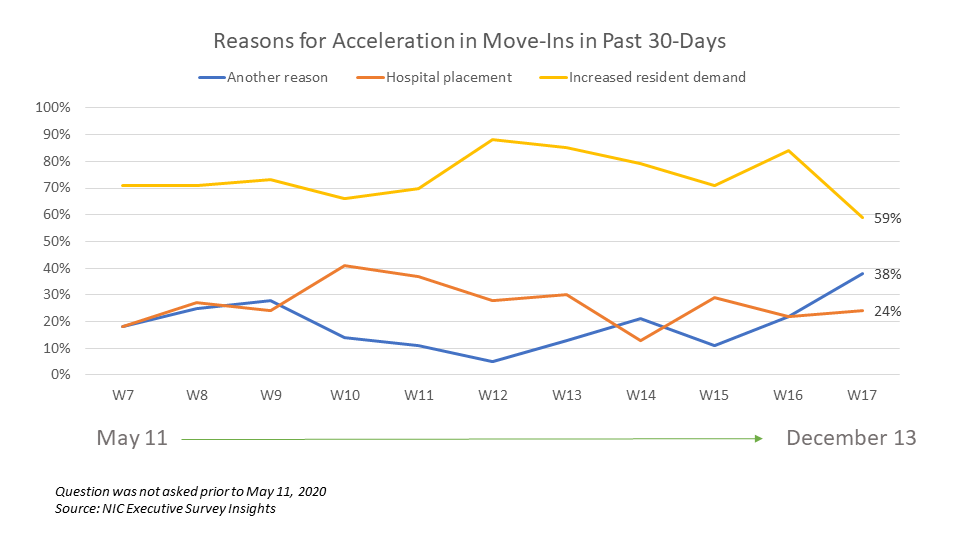

- The shares of organizations citing increased resident demand as a reason for acceleration in the pace of move-ins (59%) was at the lowest level in the survey time series, falling from a recent high of 84% in Wave 16. Hospital placement cited as a reason for acceleration in the pace of move-ins (24%) continued to lag the survey time series high of 41% reached in Wave 10, surveyed in late July. The percentage of respondents citing “another reason” for acceleration in the pace of move-ins has risen to 38%. Comments from respondents included reasons such as rent concessions and incentives, residents transferring from different levels of care, more needs-based admissions, and residents and families becoming comfortable with COVID-19 infection mitigation and visitation protocols.

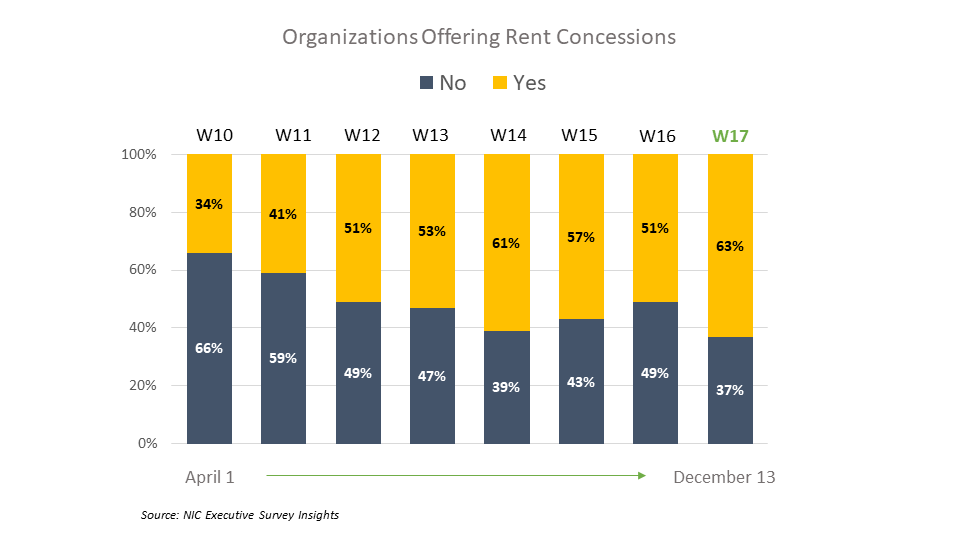

- NOI is continuing to be pressured as more organizations in the Wave 17 survey sample were offering rent concessions, paying staff overtime hours, and using agency or temp staff to backfill staffing shortages. Organizations offering rent concessions (63%) is up from 51% in Wave 16, and nine out of ten organizations (87%) were paying overtime wages. Staffing is a growing challenge. One respondent noted that with the surge of recent COVID-19 cases and the resulting second wave of infections, their organization is experiencing distress in finding labor at “double-time wages.” Others addressed the issue of financial tension in the context of occupancy challenges indicating that fewer move-ins coupled with attrition and transfers to higher levels of care is putting pressure on business operations.

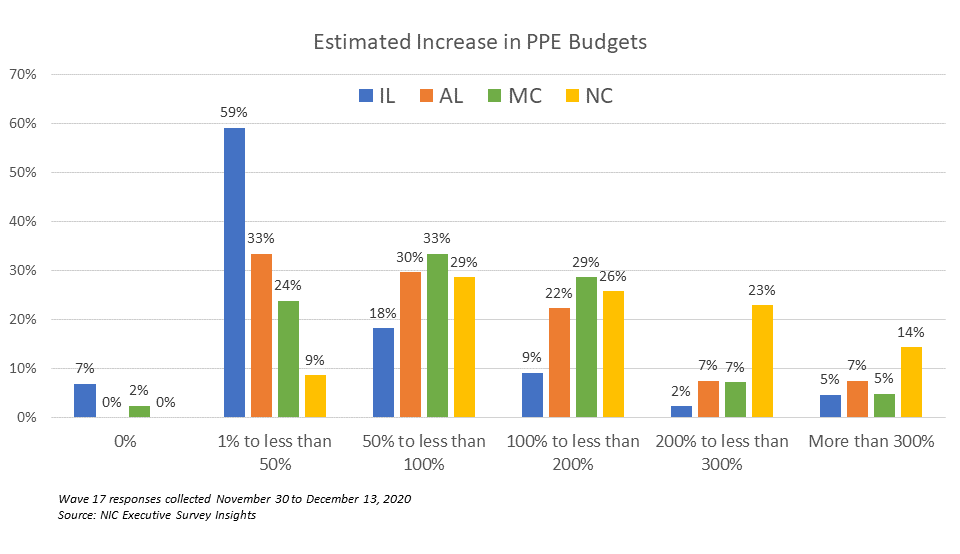

- About two-thirds of organizations (65%) noted they are experiencing challenges obtaining PPE due to high demand/competition (36%) and/or restrictions on allocation (29%). One-third (33%) reported budgetary constraints in paying for PPE.

- Higher levels of care segments (assisted living, memory care and nursing care) reported increases in PPE budgets commensurate with growing levels of care. Additionally, organizations with the largest portfolios of properties were more likely to report significantly higher PPE budget increases than single-site operators.

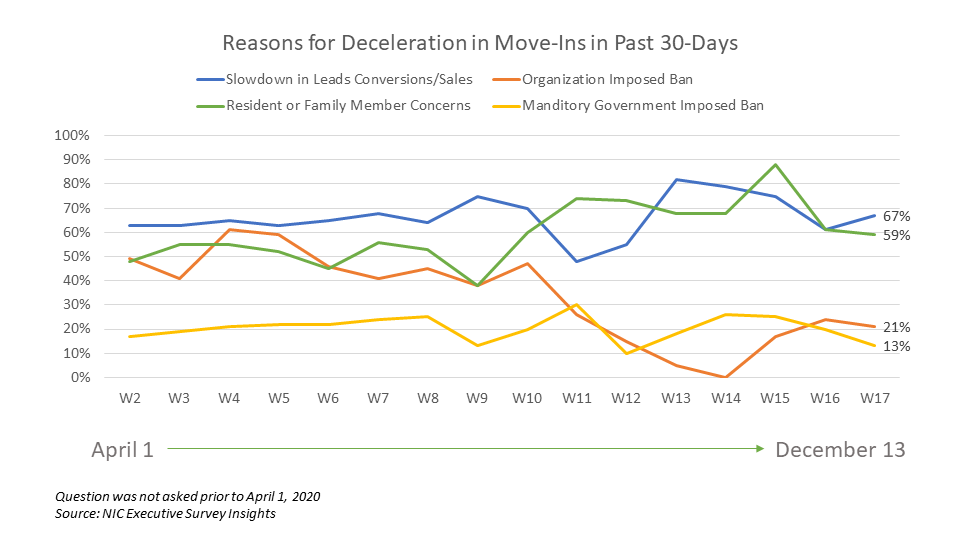

- Despite surging COVID-19 cases across the country, only about one in five organizations (21%) reported a self-imposed ban as a reason for deceleration in the pace of move-ins in Wave 17. At this point in the pandemic, two-thirds of organizations were neither increasing nor easing move-in restrictions in some or all geographies. The share of organizations increasing move-in restrictions in Wave 17 (22%) rose slightly since Wave 15 surveyed in late October (19%).

- Slowdown in leads conversions/sales and/or resident or family member concerns cited as reasons for decelerations in the pace of in move-ins in the past 30-days were either up or down slightly from Wave 16 (67% and 59%, respectively).

- Approximately one-quarter of respondents (26%) indicated that their organizations had a backlog of residents waiting to move in. This is down from a high of 34% reached in Wave 16 and similar to levels last observed in Waves 12 through 15 surveyed mid-September to late-October/early November.

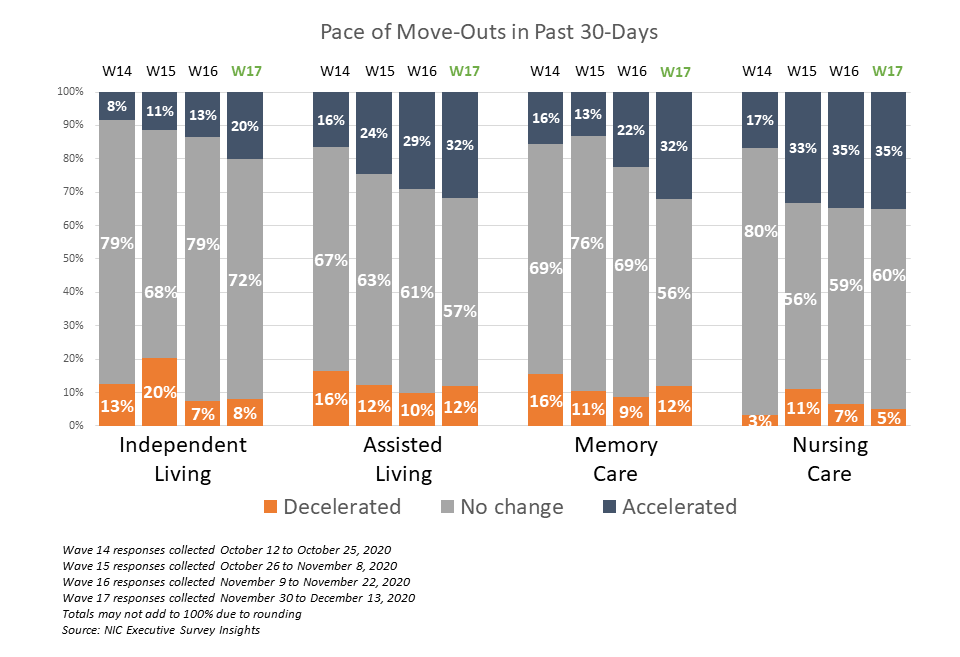

- A growing share of those organizations that responded to the Wave 17 Survey reported an acceleration in the pace of move-outs for each of the care segments except nursing care—which remains at levels last seen in the surveys from the month of April (Waves 2-5). Notably, the shares of organizations with assisted living and/or memory care units reporting acceleration in the pace of move-outs in the past 30-days is at the highest levels reported in the survey time series (32%, respectively).

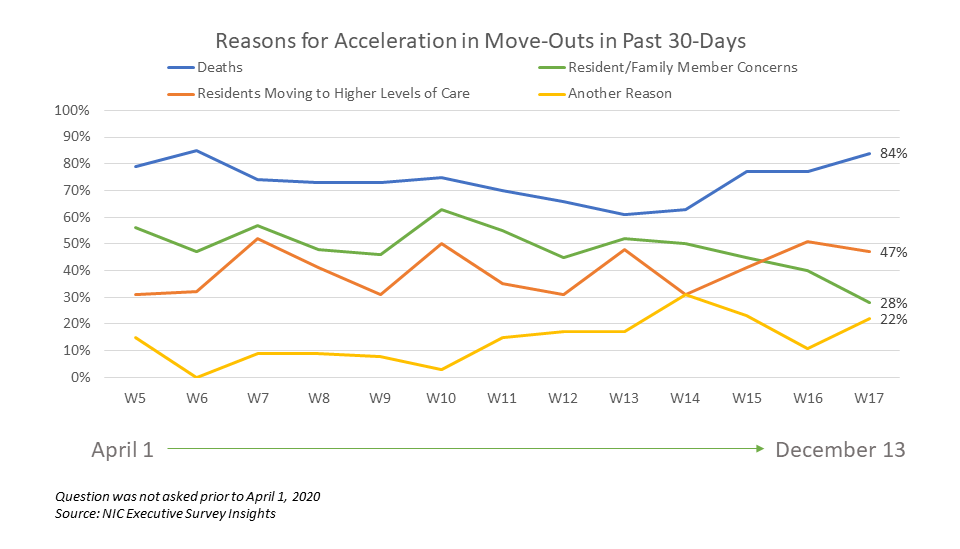

- As shown in the chart below, resident deaths (unspecified reason) continued to be cited most frequently as a reason for acceleration in the pace of move-outs in the last 30-days (84%). This is up from 61% in Wave 13 and similar to the peak of 85% reached in Wave 6 surveyed in early-May. Comments by respondents citing “another reason,” included COVID-19 (unspecified), COVID-19 deaths, and residents transferring to other levels of care.

- Presumably as a result of better and safer visitation protocols and more acceptance, resident or family member concerns cited as a reason for acceleration in the pace of move-outs (28%) was down from 40% in Wave 16 and is at the lowest level in the survey time series.

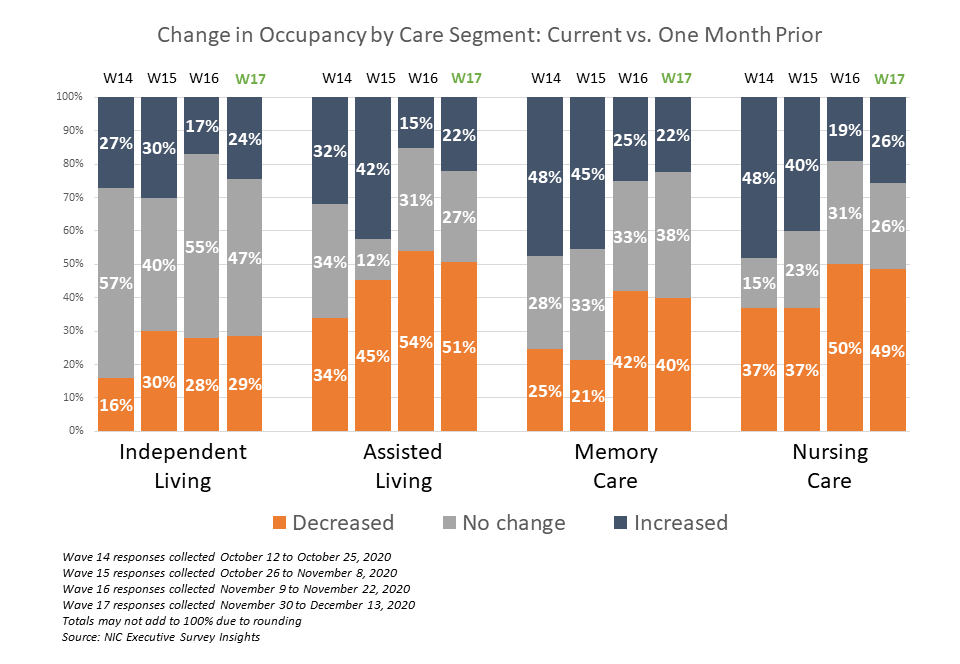

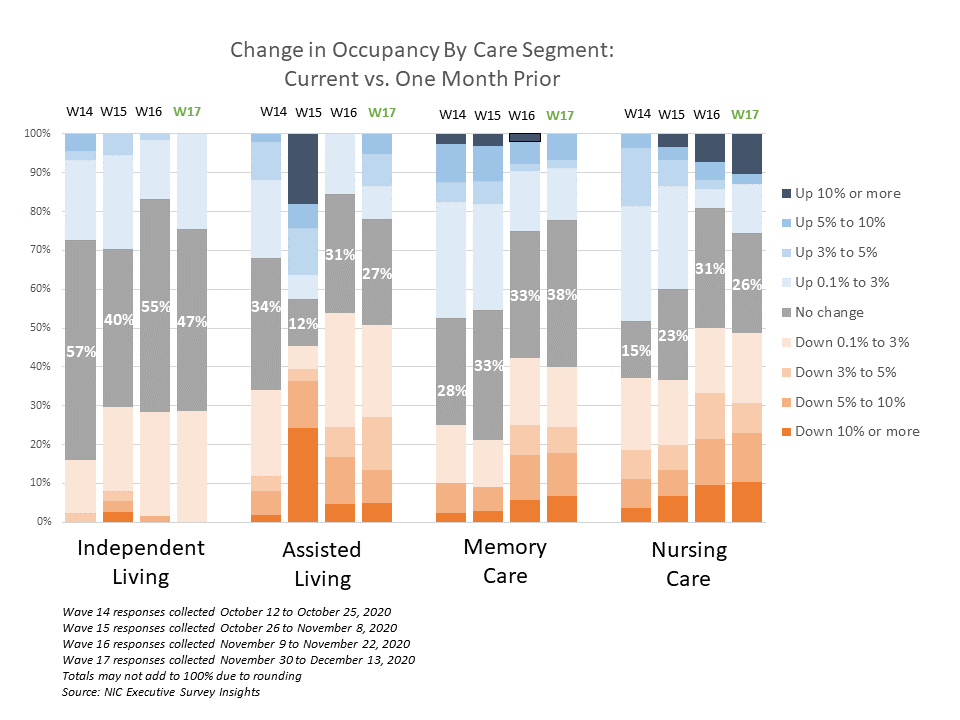

- For each of the care segments, the shares of organizations reporting downward changes in occupancy in the past 30 days outpaced those reporting upward changes. One survey respondent mentioned that November was the first month in which their organization saw a net occupancy increase since February—but the last week of November and the first week of December also had the highest positive COVID-19 tests in their communities among residents and associates. Compared to Wave 16, the percentage of organizations reporting month-over-month declines in occupancy rates remained at similar levels. Between 40% and 51% of organizations with assisted living units, memory care units and/or nursing care beds reported downward changes in occupancy in the past 30-days.

- The chart above illustrates that In Wave 17, 51% of operators with assisted living units noted declines in occupancy rates. The chart below describes the degree of those occupancy rate changes. The blue and orange-hued stacked bars correspond to the solid bars in the chart above indicating the degree of change by the saturation of color. For the assisted living care segment, one in four organizations (27%) reported occupancy drops of more than three percentage points, while another one in four (24%) reported occupancy declines between 0.1 and three percentage points.

- The independent living segment saw the least occupancy rate change: just under one-third (29%) reported a decline in occupancy of less than three percentage points, and one-quarter (24%) reported an increase of no more than three percentage points.

- The nursing care segment saw the largest changes (downward and upward) in occupancy rates—ten percentage points or more, respectively. One half (49%) reported a decline in occupancy in Wave 17.

- Consistent with the findings of the Wave 16 survey, organizations with nursing care and/or memory care segments reported more week-over-week occupancy declines than those organization with other care segments (31% and 29%, respectively). However, nursing care also saw the highest week-over-week increase in occupancy rates in recent waves of the survey (28%).

- In Wave 17, one-half of respondents received their COVID-19 test results within 2 days, however it is taking 3 or more days to receive test results for the other half of respondents (48%). Although frustration with turnaround times was expressed in the survey comments with some fearing the impact of delays could result in difficulty mitigating infection control before effective isolation can be accomplished, given the swell in coronavirus cases across the country, these findings were relatively unchanged since Wave 14 surveyed mid-October.

- Nearly nine out of ten respondents (87%) indicated their organizations have increased the use of telehealth/virtual appointments since the beginning of the pandemic.

Wave 17 Survey Demographics

- Responses were collected November 30 – December 13, 2020 from owners and executives of 80 seniors housing and skilled nursing operators from across the nation. Just under half of respondents are exclusively for-profit or nonprofit providers (46% and 44%, respectively), and 10% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 64% of the sample. Operators with 11 to 25 properties make up 20% of the sample, while operators with 26 properties or more make up 16% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 78% of the organizations operate seniors housing properties (IL, AL, MC), 35% operate nursing care properties, and 38% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By providing real-time insights to the longest running pulse of the industry survey you can help ensure the narrative on the seniors housing and care sector is accurate. By demonstrating transparency, you can help build trust.

“…a closely watched Covid-19-related weekly survey of…operators

conducted by the National Investment Center for Seniors Housing & Care…”

The Wall Street Journal | June 30, 2020

The Wave 18 survey is available and takes just 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck