“Positive signals are palpable in Wave 22 results, which reveal upward shifts in organizations reporting acceleration in move-ins and occupancy increases across each of the care segments in the past 30 days. Data compiled in NIC’s Skilled Nursing COVID-19 Tracker clearly illustrates that COVID-19 cases in skilled nursing communities are now falling at a faster pace compared to the U.S. since the launch dates of the Pfizer and Moderna vaccines in long-term care settings, and more organizations with memory care units and/or nursing care beds reported increases in occupancy than decreases since prior to the fall surge of the coronavirus. The Wave 23 survey, currently collecting data, will explore when operators expect their occupancy rates to return to pre-pandemic levels."

–Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space as market conditions continue to change. This Wave 22 survey includes responses collected February 8 to February 21, 2021 from owners and executives of 67 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights. Additionally, the full range of time series data for each wave of the survey by care segment for move-ins, move-outs and occupancy rate changes can be found HERE.

Wave 22 Summary of Insights and Findings

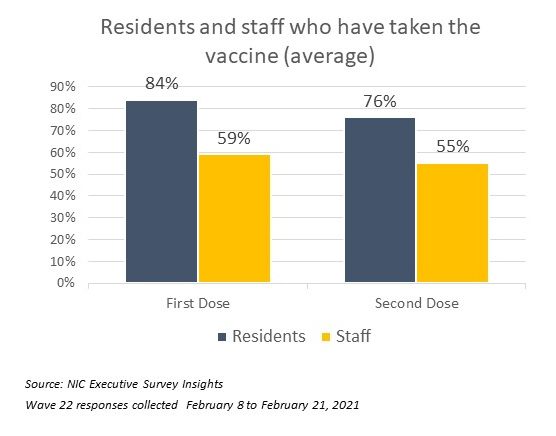

- According to Wave 22 seniors housing and care survey respondents, roughly 80% of residents and 60% of staff of their respective properties—including all care segments across their portfolios–have received the first dose of the COVID-19 vaccine on average, and about 75% of residents and 55% of staff have received the second dose.

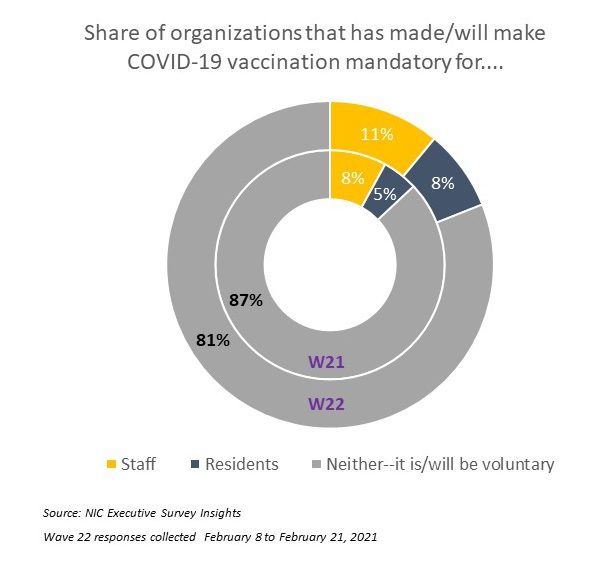

- The majority of organizations surveyed have not made the COVID-19 vaccine mandatory for residents and/or staff (81%). Whether or not the vaccine remains voluntary will continue to be monitored in Wave 23 of the survey, which asks how likely organizations will be to consider making the COVID-19 vaccine mandatory for staff members.

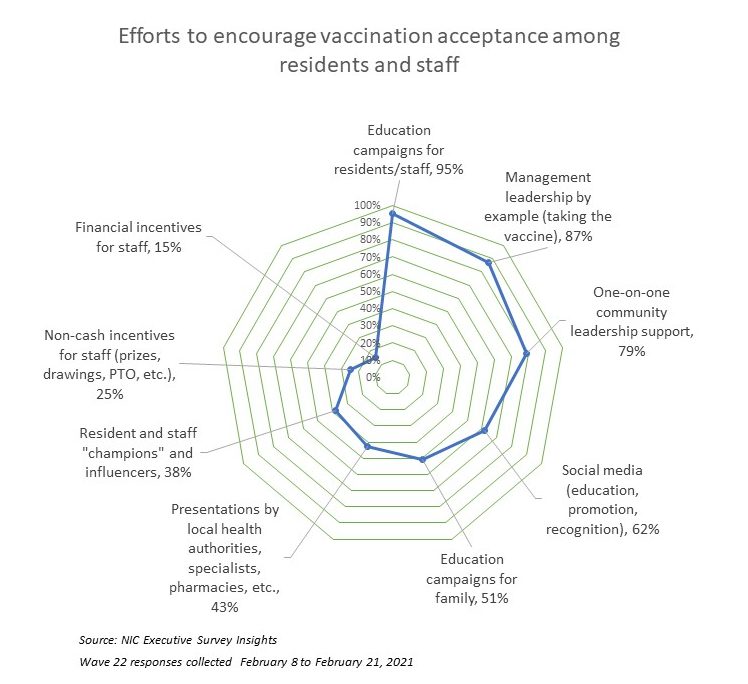

- Roughly nine out of ten respondents in the Wave 22 survey indicated that educating and motivating staff to take the vaccine was a challenge. To smooth the way, operators are implementing a variety of strategies to encourage and improve vaccine acceptance. In addition to education/communication campaigns for residents and staff (95%), community and corporate leadership have stepped up and publicly taken the vaccine themselves (87%) and have been personally available with one-on-one support for staff who have questions and concerns (79%). Few respondent organizations have incentivized staff to take the vaccine with financial benefits (15%).

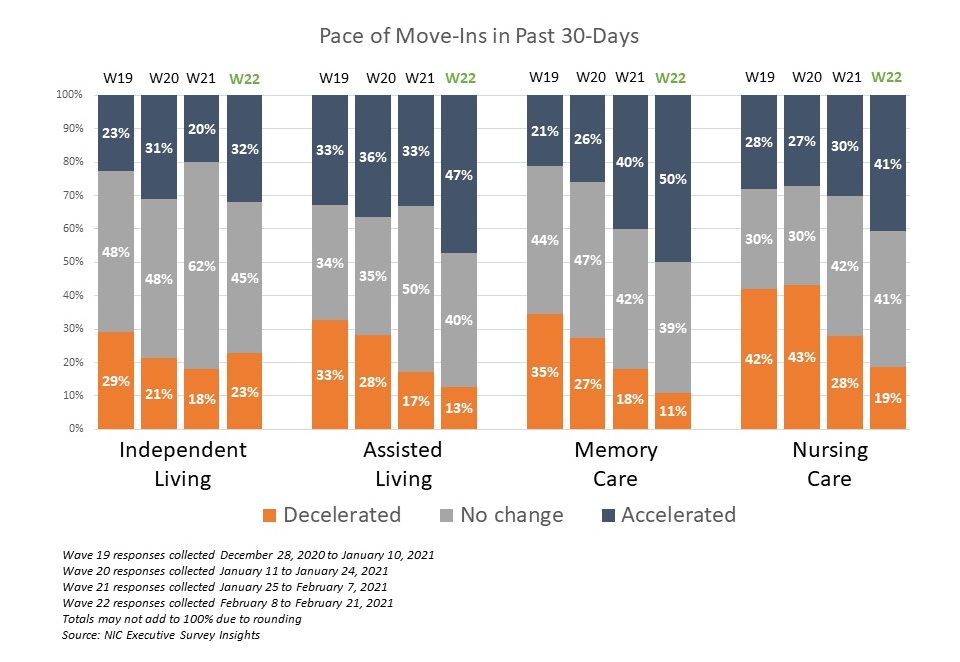

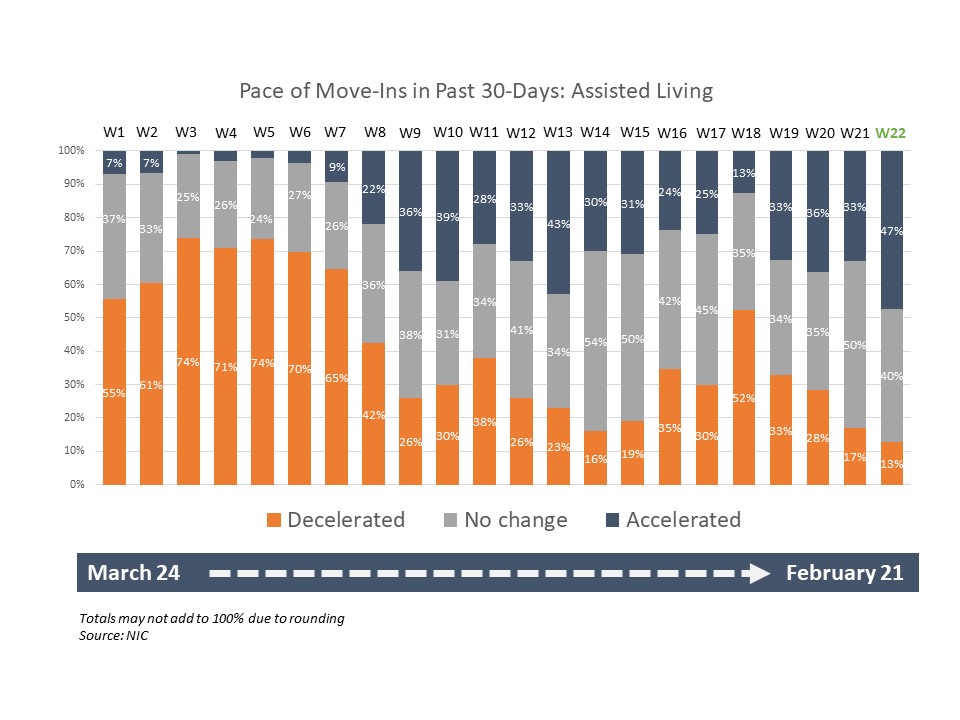

- In Wave 22, the shares of organizations reporting acceleration in the pace of move-ins is higher than those organizations reporting deceleration for each of the care segments. Furthermore, organizations reporting deceleration in the pace of move-ins has shrunk in the memory care, assisted living and nursing care segments over the past three waves of the survey.

- Looking specifically at the assisted living care segment, nearly half of organizations with assisted living units in their portfolios of properties (47%) noted acceleration in the pace of move-ins—the highest in the survey to date. The fewest (13%) noted deceleration in the pace of move-ins in the past 30-days. Wave 22 survey respondents reporting of acceleration in move-ins for the memory care segment is essentially equal to the high reached in the Wave 12 survey (50% and 51%, respectively), reflecting operator experiences in mid- to late-August. It is interesting to note that the pace of move-ins for the independent living care segment has not changed much since the Fall surge of the coronavirus.

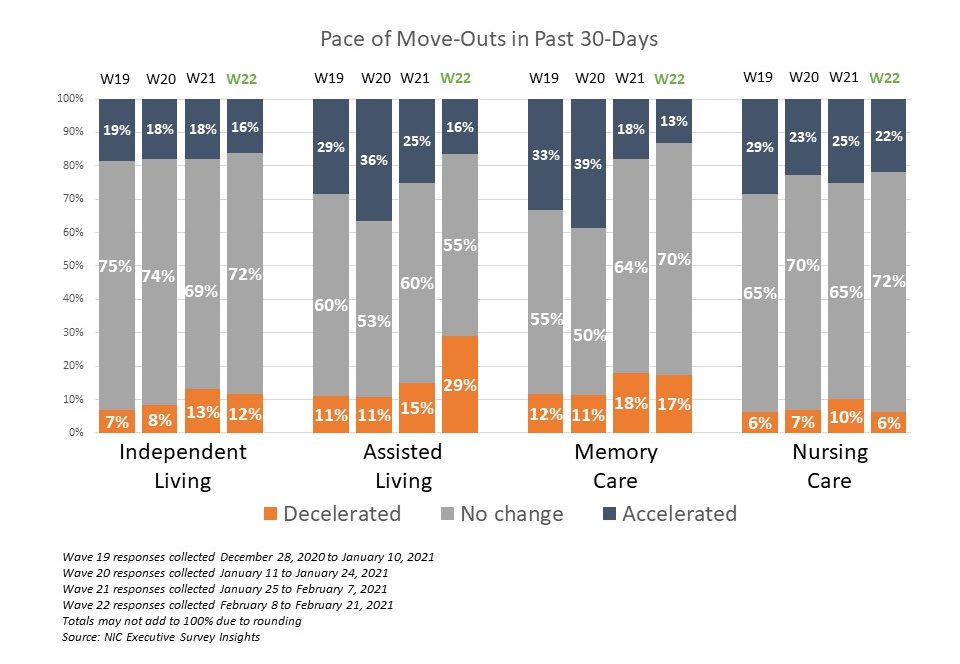

- One in five respondents in Wave 22 noted that their organizations had a backlog of residents waiting to move in (20%)—similar to the prior survey, which was lower than at any other time since the question was first asked in late July. Possible reasons may include the previously mentioned, recent increase in the pace of move-ins across each of the care segments taking up some of the slack in pent-up demand, typical seasonality experienced during the winter months, and potentially less turnover of inventory in some properties as the pace of move-outs slowed in the Wave 22 survey. Between 78% and 87% of organizations noted no change or deceleration in the pace of move-outs for each of the care segments, and roughly one-third with assisted living units noted the pace of move-outs decelerated in the past 30-days.

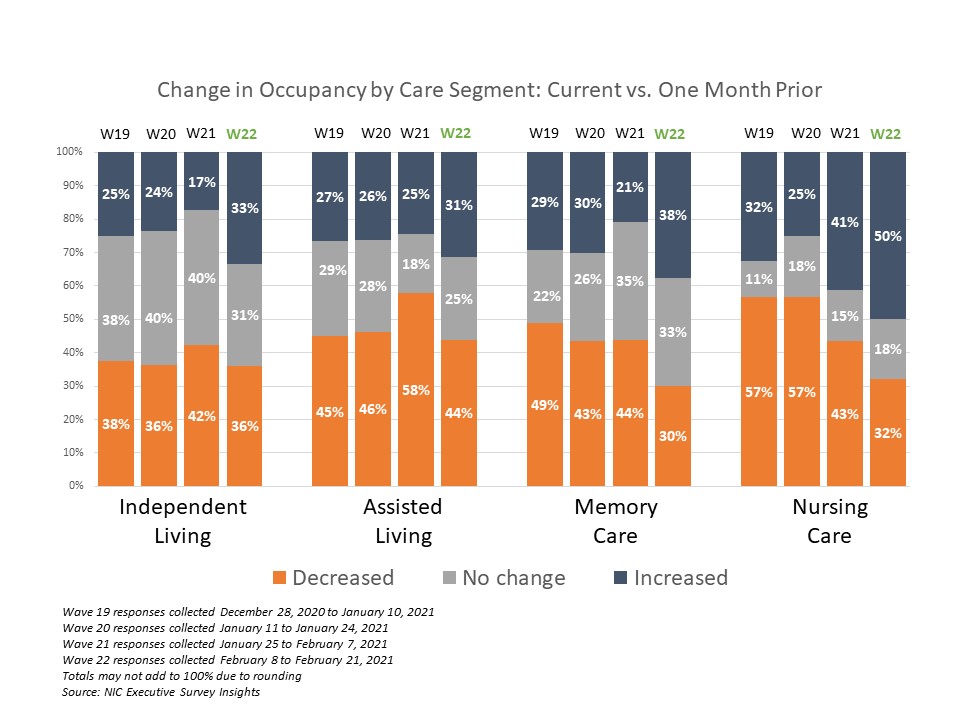

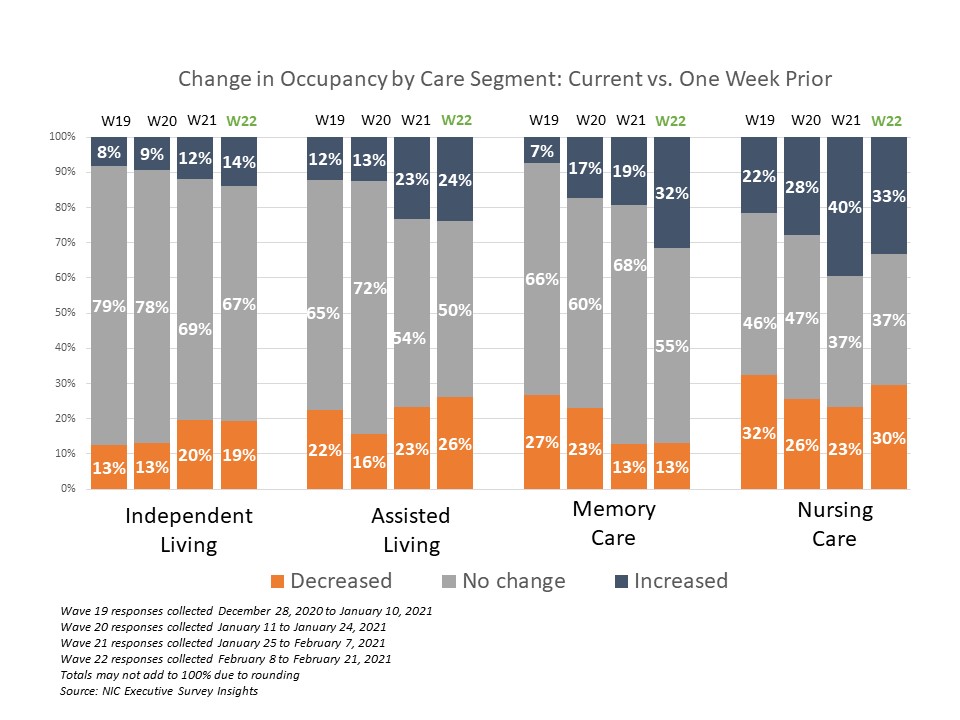

- The Wave 22 survey data shows an upward shift in the shares of organizations reporting increased occupancy across each of the care segments since the prior survey, and more organizations with memory care units and/or nursing care beds reported increases in occupancy than decreases. The shares of organizations with independent living and assisted living units with declining occupancy in the past 30-days (across their portfolios of properties) continued to exceed those reporting rising occupancy.

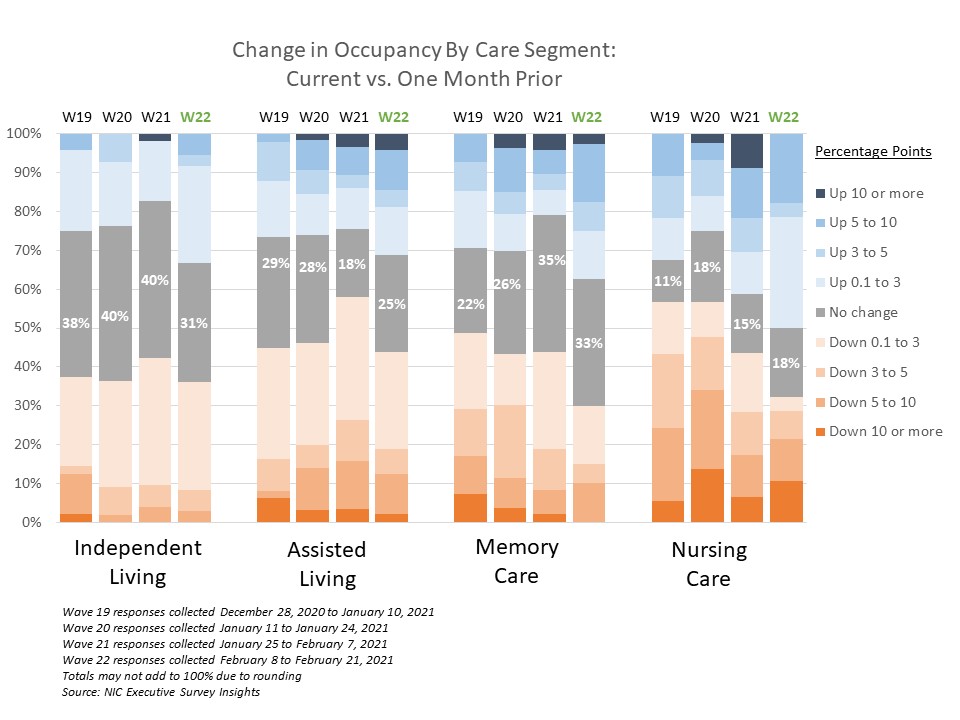

- The chart above shows that in Wave 22, 50% of organizations with nursing care beds reported increasing occupancy rates in the past 30-days. However, as shown in the chart below, the majority of the increases were relatively small. The chart below describes the degree of those occupancy rate changes and illustrates that more organizations with nursing care beds in Wave 22 reported smaller increases than in the prior three waves of the survey. (The blue and orange-hued stacked bars correspond to the solid bars in the chart above indicating the degree of change by the saturation of color.) In the Wave 22 survey, 30% of respondents with nursing care beds reported occupancy increases of 0.1 to 3 three percentage points.

- One-third of organizations with memory care units and/or nursing care beds (32% and 33%, respectively), and one-quarter of organizations with assisted living units (24%) reported a week-over-week increase in occupancy. That said, similar shares of organizations with nursing care beds and/or assisted living units also saw decreases (30% and 26%, respectively).

Wave 22 Survey Demographics

- Responses were collected between February 8 and February 21, 2021 from owners and executives of 67 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise two-thirds of the sample (66%). Operators with 11 to 25 properties make up 18% of the sample, while operators with 26 properties or more make up 16% of the sample.

- Just over one-half of respondents are exclusively for-profit providers (57%), one-quarter (26%) are nonprofit providers, and 16% operate both for-profit and nonprofit seniors housing and care organizations.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 74% of the organizations operate seniors housing properties (IL, AL, MC), 31% operate nursing care properties, and 28% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By demonstrating transparency, you can help build trust. The survey results and analysis are frequently referenced in media reports on the sector including in McKnight’s publications, Mortgage Professional America Magazine, Senior Housing News, Multi-Housing News, Provider Magazine, and other industry-watching media outlets. The surveys’ findings have also been mentioned in stories by Kaiser Health News, CNN, the Wall Street Journal, and other major news outlets across the U.S.

The Wave 23 survey is available and takes 5-10 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck